Macroeconomics II Lecture notes (4) on: Dynamic macroeconomic ...

Macroeconomics II Lecture notes (4) on: Dynamic macroeconomic ...

Macroeconomics II Lecture notes (4) on: Dynamic macroeconomic ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

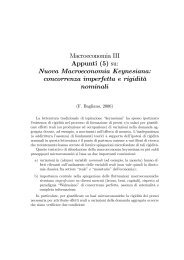

<str<strong>on</strong>g>Macroec<strong>on</strong>omics</str<strong>on</strong>g> <str<strong>on</strong>g>II</str<strong>on</strong>g><str<strong>on</strong>g>Lecture</str<strong>on</strong>g> <str<strong>on</strong>g>notes</str<strong>on</strong>g> (4) <strong>on</strong>:<strong>Dynamic</strong> macroec<strong>on</strong>omic models ofreal-financial interacti<strong>on</strong>s(F. Bagliano, 2012)The rati<strong>on</strong>al expectati<strong>on</strong>s hypothesis has been introduced in many macroec<strong>on</strong>omicmodels, even outside the framework of the new classical macroec<strong>on</strong>omics,to investigate the interacti<strong>on</strong>s between asset prices and real activity. These <str<strong>on</strong>g>notes</str<strong>on</strong>g>outlinetwodynamicmodelsthatfocus<strong>on</strong>thedeterminantsofstockpricesandexchange rate fluctuati<strong>on</strong>s, and their effects <strong>on</strong> the real ec<strong>on</strong>omy.1. The stock market in a dynamic IS-LM model (Blanchard1981)This secti<strong>on</strong> describes a simplified versi<strong>on</strong> of the dynamic IS − LM model inBlanchard (1981), that extends this elementary macroec<strong>on</strong>omic scheme al<strong>on</strong>g twodimensi<strong>on</strong>s: (i) by c<strong>on</strong>sidering dynamics, and (ii) by enlarging the set of financialmarkets bey<strong>on</strong>d the traditi<strong>on</strong>al "m<strong>on</strong>ey" and "b<strong>on</strong>ds". In the model below, thelatter extensi<strong>on</strong> is limited to the stock market. Stock prices have a forward-lookingnature, since they incorporate agents’ expectati<strong>on</strong>s <strong>on</strong> the future course of theec<strong>on</strong>omy (particularly <strong>on</strong> the determinants of stock market returns: dividends,future stock prices, and interest rates). 1 The changes in stock prices (and, inextended versi<strong>on</strong>s of the model, in the prices of other financial assets such as l<strong>on</strong>gtermb<strong>on</strong>ds) highlight the role of expectati<strong>on</strong>s as driving forces of real variables1 In the model, absent any stochastic element, the rati<strong>on</strong>al expectati<strong>on</strong>s hypothesis coincideswith perfect foresight.

dynamics and as determinants of the effects of ec<strong>on</strong>omic (fiscal and m<strong>on</strong>etary)policies.The main features of Blanchard’s model are:• the ec<strong>on</strong>omy is closed, and, as in the static versi<strong>on</strong> of the IS − LM model,the goods price is exogenously fixed and c<strong>on</strong>stant;• private investments (a comp<strong>on</strong>ent of aggregate demand) depend positively<strong>on</strong> the ratio of the market value of the productive capital owned by firms toits replacement cost: this ratio is known as Tobin’s q;• in the model, q is interpreted as the market valuati<strong>on</strong> of firms’ capital stock.Such valuati<strong>on</strong> is incorporated into the level of stock prices: an increase instock prices signals that the market attributes a higher value to the capitalstock (relative to its replacement cost), thereby inducing firms to increaseinvestment and enlarge the existing capital stock.Formally, the aggregate demand side of the model is represented by equati<strong>on</strong>sdescribing goods demand and the equilibrium <strong>on</strong> financial asset markets (m<strong>on</strong>ey,b<strong>on</strong>ds, and stocks), and the supply side, with fixed prices, is given by a functi<strong>on</strong>capturing the dynamic adjustment of output to excess demand or excess supply inthe goods market. In the following, time t is measured by a c<strong>on</strong>tinuous variable,and all variables (with the excepti<strong>on</strong> of the price level p) are functi<strong>on</strong>s of time.1.1. Aggregate demandThe aggregate demand for goods, y D (t), is given by the following linear functi<strong>on</strong>:y D (t) =αq(t)+cy(t)+g(t) α>0 , 0

markets is given by two equilibrium c<strong>on</strong>diti<strong>on</strong>s. On the m<strong>on</strong>ey market, equilibriumis described by a standard LM curve:m(t)= h 0 + h 1 y(t) − h 2 r(t) (1.2)pwhere real m<strong>on</strong>ey supply (nominal m<strong>on</strong>ey m(t) -used as the m<strong>on</strong>etary policyinstrument, perfectly c<strong>on</strong>trolled by the central bank- divided by the exogenousprice level p) is equal to m<strong>on</strong>ey demand, that depends positively <strong>on</strong> output (fortransacti<strong>on</strong> motives: purchases of goods and payments to productive inputs) andnegatively <strong>on</strong> the interest rate <strong>on</strong> short-term b<strong>on</strong>ds r(t). 2 For analytical c<strong>on</strong>venience,we assume that the short-term b<strong>on</strong>ds have "instantaneous" (infinitesimal)maturity. Thus, the rate of return obtained <strong>on</strong> those b<strong>on</strong>ds coincides with theinterest rate r with no additi<strong>on</strong>al capital gain (or loss) comp<strong>on</strong>ent due to changesin the market price of b<strong>on</strong>ds.Short-term b<strong>on</strong>ds and stocks are seen as perfect substitutes in investors’ portfolios:therefore, their rates of return must be equal in equilibrium. Investors’arbitrage operati<strong>on</strong>s <strong>on</strong> the two financial markets ensures that any return differentialsis immediately eliminated, restoring at any time t the following equilibriumc<strong>on</strong>diti<strong>on</strong> (known as a "no-arbitrage c<strong>on</strong>diti<strong>on</strong>"):π(t)q(t) + ˙q(t) = r(t) (1.3)q(t)wheretheleft-handsideisthe(instantaneous) rate of return <strong>on</strong> stocks, made upof dividends paid to shareholders π(t) (and, by assumpti<strong>on</strong>, equal to firms’ profits)and by the capital gain (or loss) due to stock price changes. Such changes arecaptured by ˙q(t) ≡ dq(t) ,wherethedotoverq de<str<strong>on</strong>g>notes</str<strong>on</strong>g> the time derivative: ˙q(t) > 0dtis a capital gain, whereas ˙q(t) < 0 a capital loss. 3 The no-arbitrage c<strong>on</strong>diti<strong>on</strong> (1.3)imposes equality in each moment in time between the rate of return <strong>on</strong> stocks andthe short-term interest rate r(t). 42 The assumpti<strong>on</strong> of fixed prices implies a zero expected inflati<strong>on</strong> rate. Therefore, there is n<strong>on</strong>eed to distinguish between the nominal and the real interest rates.3 The absence of stochastic elements in the model allows to equate the expected capital gain˙q e (t) (that should enter the definiti<strong>on</strong> of the rate of return <strong>on</strong> stocks in (1.3)) with the realizedcapital gain ˙q(t). In the absence of uncertainty, the rati<strong>on</strong>al expectati<strong>on</strong>s hypothesis coincideswith perfect foresight: the expected and realized changes in shock prices are equal.4 In the original versi<strong>on</strong> of the model (Blanchard 1981), also l<strong>on</strong>g-term b<strong>on</strong>ds are introduced.In this case, a sec<strong>on</strong>d no-arbitrage c<strong>on</strong>diti<strong>on</strong> would be necessary to ensure that the return <strong>on</strong>those b<strong>on</strong>ds (made up of two elements -interest payments and price changes- as for stocks) isequal to the short-term rate r(t).3

Finally, profits (entirely paid out as dividends to shareholders) are positivelyrelated to output:π(t) =a 0 + a 1 y(t) (1.4)1.2. Aggregate supplyOn the supply-side of the ec<strong>on</strong>omy, with fixed prices, the output level adjuststo clear the goods market. The evoluti<strong>on</strong> of output over time is given by thefollowing dynamic (differential) equati<strong>on</strong>:ẏ(t) =β (y D (t) − y(t)) β>0 (1.5)where ẏ ≡ dy(t) is the (instantaneous) change of output in resp<strong>on</strong>se to the excessdtdemand for goods, y D (t) − y(t): when aggregate demand y D (t) is higher thancurrent output y(t), firms meet goods demand by decumulating inventories andincreasing producti<strong>on</strong> <strong>on</strong>ly gradually over time. Therefore, changes in inventoriesensure c<strong>on</strong>tinuous clearing of the goods market, whereas output reacts <strong>on</strong>ly graduallyto excess demand (or excess supply) <strong>on</strong> the market. Under this assumpti<strong>on</strong><strong>on</strong> dynamic adjustment, output y(t) has the nature of a "predetermined"variable:it cannot show instantaneous (i.e. "discrete") adjustments in resp<strong>on</strong>se to changesin market demand c<strong>on</strong>diti<strong>on</strong>s. 51.3. Steady-state equilibrium and dynamicsThe two differential equati<strong>on</strong>s (1.3) e (1.5) describe the time dynamics of stockprices q(t) and output y(t). In a steady-state equilibrium both variables do notchange over time: ˙q(t) =ẏ(t) =0.Off the steady-state equilibrium, q(t) and y(t)5 Formally, the differential equati<strong>on</strong> (1.5) can be solved to express the level of output in anygiven instant T as a functi<strong>on</strong> of goods demand. In the case of (1.5), the negative coefficient<strong>on</strong> y(t) (−β) guaranteesthatabackward-looking soluti<strong>on</strong> (making output depend <strong>on</strong>ly <strong>on</strong> pastdemand levels) is stable. It is then possible to express output at T as a weighted average of allpast demand levels:Z Ty(T )= y D (t) β e −β(T −t) dt ,−∞with values of y D (t) in the distant past having decreasing weights. The weights sum to <strong>on</strong>e:R T−∞ β e−β(T −t) dt =1. Therefore, in each moment in time, output is determined by the wholepast goods demand history. A current excess demand can <strong>on</strong>ly trigger a gradual adjustment overtime, and cannot determine an immediate adjustment leading instantaneously to the equalitybetween producti<strong>on</strong> and demand: y(t) =y D (t).4

change over time according to their dynamic equati<strong>on</strong>s; moreover, in each momentin time, the m<strong>on</strong>ey market is in equilibrium, satisfying (1.2), and aggregatedemand and firms’ profits are at the levels given by (1.1) and (1.4).How the ec<strong>on</strong>omy works can be illustrated graphically by means of the stati<strong>on</strong>aryequati<strong>on</strong>s (or "stati<strong>on</strong>ary loci") for y(t) and q(t), capturing the relati<strong>on</strong>shipsthat hold between output and stock when we impose ẏ(t) =0and ˙q(t) =0respectively<strong>on</strong> (1.5) and (1.3). The relati<strong>on</strong>ships so obtained can then be plotted<strong>on</strong> a (q, y) plane.Let us start by imposing ẏ(t) = 0 in (1.5). Using the aggregate demandequati<strong>on</strong> (1.1) to substitute out y D (t), we get the following relati<strong>on</strong>ship betweenoutput and stock prices:y(t) =α1 − c q(t)+ 1 g(t) (1.6)1 − cFor a given value of the fiscal measure g(t), equati<strong>on</strong> (1.6) describes all the combinati<strong>on</strong>sof output y(t) and stock prices q(t) that ensure equality between goodsdemand and supply. The positive coefficient <strong>on</strong> q(t) means that a higher valueof q(t), by increasing private investment, stimulates aggregate spending, and anincrease in producti<strong>on</strong> y(t) is necessary to restore the stati<strong>on</strong>ary equilibrium <strong>on</strong>thegoodsmarket(asituati<strong>on</strong>inwhichfirms do not have to decumulate inventoriesto meet goods demand, and output is c<strong>on</strong>stant over time). The relati<strong>on</strong> (1.6),plotted in Figure 1(a), is the equivalent of the IS schedule in a more traditi<strong>on</strong>alIS − LM model, linking negatively the interest rate to output. For each level ofoutput, there exists a unique value of q(t), given by (1.6), for which output equalsaggregate spending. Higher values of q(t) determine larger investment flows anda corresp<strong>on</strong>ding excess demand for goods, y D (t) >y(t); accordingtothedynamicequati<strong>on</strong> (1.5), output starts to increase, gradually adjusting to the higher demand:ẏ(t) > 0. This output adjustment occurs at all points above the ẏ(t) =0curve (or "locus"), and is graphically depicted by the arrows pointing to the right(note that, since we are dealing with the dynamics of output <strong>on</strong>ly, keeping q(t)c<strong>on</strong>stant, the arrows are horiz<strong>on</strong>tal). Symmetrically, at all points below (1.6),there is excess supply of goods (y D (t)

where the last equality is obtained using (1.4) and (1.2) to substitute out π(t) andr(t). (1.7) shows the combinati<strong>on</strong>s of y(t) and q(t) for which the m<strong>on</strong>ey marketis in equilibrium and the returns <strong>on</strong> stocks and b<strong>on</strong>ds are equal without the needfor capital gains or losses (i.e. with c<strong>on</strong>stant share prices, ˙q(t) =0). The signof this relati<strong>on</strong>ship is not uniquely determined: as output increases, profits anddividends increase, raising q(t); also the interest rate r(t), atwhichfutureprofitsare discounted, increases, with a depressing effect<strong>on</strong>stockprices. Theslopeofthe ˙q(t) =0locus then depends <strong>on</strong> the relative strength of those two effects; inwhat follows we assume that the "interest rate effect" dominates, and c<strong>on</strong>sequentlydraw a downward-sloping stati<strong>on</strong>ary locus for q(t) in Figure 1(b); this assumpti<strong>on</strong>corresp<strong>on</strong>ds to the "bad news" case in Blanchard (1981). 6 Thedynamicsofq(t)out of its stati<strong>on</strong>ary locus are governed by the no-arbitrage c<strong>on</strong>diti<strong>on</strong> (1.3). Foreach level of output (that uniquely determines dividends and the interest ratefrom (1.4) and (1.2), <strong>on</strong>ly the value of q(t) <strong>on</strong> the stati<strong>on</strong>ary locus is such that˙q(t) =0. Higher values of q(t) (as in points above the curve) reduce the dividendcomp<strong>on</strong>ent of the rate of return <strong>on</strong> shares, and a capital gain, implying ˙q(t) > 0,is needed to fulfil the no-arbitrage c<strong>on</strong>diti<strong>on</strong> between shares and b<strong>on</strong>ds: q(t)willthen move upwards, as shown by the arrows in the figure(notethat,sincewearedealing with the dynamics of share prices <strong>on</strong>ly, keeping y(t) c<strong>on</strong>stant, the arrowsare vertical). Symmetrically, at all points below the ˙q(t) =0curve, capital lossesare needed to equate returns, and therefore ˙q(t) < 0.6 Formally, the negative slope of the stati<strong>on</strong>ary locus for q(t) depends <strong>on</strong> the following c<strong>on</strong>diti<strong>on</strong>s<strong>on</strong> parameters:dqdy ¯ < 0 ⇔ a 1

Figure 1A complete graphical descripti<strong>on</strong> of the joint dynamic behavior of q(t) andy(t) is obtained by superimposing the two pictures in Figure 1, getting the phasediagram showninFigure2.Theuniquesteady state equilibrium of the system isfound at the point where the two stati<strong>on</strong>ary loci given by (1.6) and (1.7) cross, andoutput and stock prices are c<strong>on</strong>stant over time. The arrows of moti<strong>on</strong> describe, foreach regi<strong>on</strong> of the diagram, the joint effect of the dynamics of y(t) and q(t) already(separately) analyzed in Figure 1. In the regi<strong>on</strong>s above and below the steadystate equilibrium, the dynamics follow divergent paths, with y(t) and q(t) eitherincreasing towards infinitely large values (in the upper regi<strong>on</strong>, with arrows pointingright and upwards), or decreasing towards ec<strong>on</strong>omically n<strong>on</strong>sensical (negative)values (in the lower regi<strong>on</strong>, with arrows pointing left and downwards). Thosepaths, not c<strong>on</strong>verging to the steady-state equilibrium, are hardly interpretablefrom the ec<strong>on</strong>omic point of view. Moreover, also trajectories starting from theleft and right regi<strong>on</strong>s in Figure 2 may not lead the system towards the steadystateequilibrium; this happens when the dynamic paths cross the ẏ(t) =0locus(vertically) or the ˙q(t) =0locus (horiz<strong>on</strong>tally), and then, instead of pointingtowards the steady state, proceed in the regi<strong>on</strong>s where arrows point away from it.Two such paths are shown in Figure 2, starting from points B and C.In the figure, however, a pair of dynamic paths is drawn that start from points7

to the left and right of the steady state and c<strong>on</strong>tinue towards it, at graduallydecreasing speed, 7 without ever meeting the system’s stati<strong>on</strong>ari loci. All pointsal<strong>on</strong>g such path are compatible with c<strong>on</strong>vergence towards the steady state, andtogether form the saddlepath of the dynamic system. For any given level of output,<strong>on</strong>ly <strong>on</strong>e level of stock prices puts the system <strong>on</strong> a trajectory c<strong>on</strong>verging to thesteady state. For example, given the output level y 0 lower than steady-stateoutput, <strong>on</strong>ly the level of share prices corresp<strong>on</strong>ding to point A in Figure 2 allowsthe system to travel al<strong>on</strong>g a path leading to the steady state.All other values ofq(t), such as those corresp<strong>on</strong>ding to points B and C in the figure, would put theec<strong>on</strong>omy <strong>on</strong> an "explosive" path, gradually diverging from the steady state atan increasing speed.. 8 In what follows, for reas<strong>on</strong>s of ec<strong>on</strong>omic interpretability,we will focus attenti<strong>on</strong> <strong>on</strong>ly <strong>on</strong> "stable" trajectories, c<strong>on</strong>verging to the uniquesteady-state equilibrium of the system.7 From the law of moti<strong>on</strong> of y(t) given by (1.5), the output change over time is larger thelarger is the excess demand for goods y D (t) − y(t), which is gradually reduced al<strong>on</strong>g the pathapproaching the steady state. Similarly, from the dynamic equati<strong>on</strong> for q(t) (1.3), the changein stock prices is larger the bigger is the diference between the interest rate and the dividendcomp<strong>on</strong>ent of share returns r(t)− π(t)q(t), that again gradually decreases al<strong>on</strong>g the c<strong>on</strong>verging path.8 Formally, the dynamic properties of y(t) and q(t) off their stati<strong>on</strong>ary loci, and the relativeslopes of the ẏ(t) =0and ˙q(t) =0curves ensure the uniqueness of the saddlepath c<strong>on</strong>vergingto the steady state.8

Figure 2To rati<strong>on</strong>alize the negative slope of the saddlepath, let us c<strong>on</strong>sider again pointA in the figure, where output y 0 is lower than its steady-state level. The associatedlevel of stock prices <strong>on</strong> the saddlepath is higher than the value of q(t) <strong>on</strong> thestati<strong>on</strong>ary locus ẏ(t) =0corresp<strong>on</strong>ding to y(t) =y 0 . Therefore, there is excessdemand for goods owing to a high level of investment, and output graduallyincreases towards its steady-state value. As y(t) increases, the demand for m<strong>on</strong>eyincreases as well, and, with a given m<strong>on</strong>ey supply, the interest rate r(t) rises.The level of stock prices q(t) is affected by the future behavior of both output(through higher profits and therefore dividends) and the interest rate. The firsteffect pushes q(t) upwards, whereas the "interest rate effect" <strong>on</strong> share prices (sincefuture dividends are discounted at higher interest rates) is negative.Under ourmaintained assumpti<strong>on</strong> that the latter effect dominates, q(t) then declines overtime towards its steady-state value.Formally, the behavior of share prices in any instant of time t 0 can be obtainedby solving forward the differential equati<strong>on</strong> (1.3), yielding the value of q(t 0 ) as the9

present discounted value of future dividends: 9q(t 0 )=Z ∞t 0π(t) e − tt 0r(s) ds dt (1.8)Over time, q(t) changes for two reas<strong>on</strong>s: <strong>on</strong> the <strong>on</strong>e hand, stock prices are positivelyaffected by the increase in dividends (resulting from higher output),; <strong>on</strong> theother, higher interest rates increase the discount factor applied to future dividends(given, in c<strong>on</strong>tinuous time, by the negative exp<strong>on</strong>ential functi<strong>on</strong> e − ttr(s) ds 0 ), withanegativeeffect <strong>on</strong> q(t).Using the dynamic model of the ec<strong>on</strong>omy developed above, we can study theeffects of macroec<strong>on</strong>omic policies <strong>on</strong> output, share prices, and the interest rate.The dynamic adjustment of output and share prices, governed by the two dynamicequati<strong>on</strong>s (1.5) and (1.3), have fundamentally different features. As menti<strong>on</strong>edpreviously, output, being a predetermined variable, reacts <strong>on</strong>ly gradually to theexcess demand for goods. Instead, with agents forming expectati<strong>on</strong>s rati<strong>on</strong>ally,stock prices are a forward-looking variable, immediately reacting to changes inexpected future interest rates and output levels over the whole infinite horiz<strong>on</strong>;therefore, q(t) can display instantaneous, or discrete, adjustments ("jumps") inthe face of events or news that change the expected future path of interest ratesand output, for example as a c<strong>on</strong>sequence of the implementati<strong>on</strong> (or even theannouncement) of m<strong>on</strong>etary and fiscal policy measures.1.4. The effects of macroec<strong>on</strong>omic policiesSince agents, endowed with rati<strong>on</strong>al expectati<strong>on</strong>s, use all available informati<strong>on</strong> toform expectati<strong>on</strong>s <strong>on</strong> the future course of the relevant macroec<strong>on</strong>omic variables,whether the policy measures under study are unexpected or previously anticipated,and permanent or transitory, are features of crucial importance in theevaluati<strong>on</strong> of their effects <strong>on</strong> the system’s dynamic adjustment to a new steadystate equilibrium. In this secti<strong>on</strong> we derive the dynamic resp<strong>on</strong>se of output, shareprices, and the interest rate to m<strong>on</strong>etary and fiscal policy acti<strong>on</strong>s.9 In solving the equati<strong>on</strong>, the "transversality c<strong>on</strong>diti<strong>on</strong>" tlimt→∞ π(t)e− t r(s)ds 0 =0is imposed, thereby ensuring c<strong>on</strong>vergence to the steady state.10

1.4.1. M<strong>on</strong>etary policyLet us c<strong>on</strong>sider a m<strong>on</strong>etary policy restricti<strong>on</strong>, implemented at time t 0 by means ofa permanent reducti<strong>on</strong> of the quantity of m<strong>on</strong>ey m; suchreducti<strong>on</strong>isunexpectedby agents. Up to t 0 the ec<strong>on</strong>omy is in a steady-state equilibrium at point A inFigure 3(a). To pin down the new steady state equilibrium, with a lower quantityof m<strong>on</strong>ey m, we note that a reducti<strong>on</strong> of the m<strong>on</strong>ey stock leaves the positi<strong>on</strong> of10the ẏ(t) =0curve unchanged, while shifting the ˙q(t) =0locus downwards.The new steady-state equilibrium is then determined at point C in the figure: inthe l<strong>on</strong>g run, a m<strong>on</strong>etary restricti<strong>on</strong> causes output and share prices to decline;moreover, as in the static IS − LM model, a m<strong>on</strong>etary restricti<strong>on</strong> increases theinterest rate.Figure 3(1) shows also the unique dynamic adjustment path c<strong>on</strong>verging to thenew steady state al<strong>on</strong>g the saddlepath. At t 0 , when m<strong>on</strong>ey supply is reduced,with output still at the initial equilibrium level y(t 0 ), the interest rate r increasesto clear the m<strong>on</strong>ey market, according to (1.2). To restore the no-arbitrage c<strong>on</strong>diti<strong>on</strong>between b<strong>on</strong>ds and stocks, share prices decrease at t 0 (point B), reachingthe saddlepath c<strong>on</strong>verging to the new equilibrium. From t 0 <strong>on</strong>wards, the dynamicadjustment follows the saddlepath (from B to C), with output declining and increasingshare prices. A level of q(t 0 ) lower than the initial equilibrium reducesinvestment and the aggregate goods demand, triggering a gradual decline in output.Also the interest rate, after the increase in t 0 in the face of the m<strong>on</strong>ey supplyreducti<strong>on</strong>, starts decreasing, due to the lower demand for m<strong>on</strong>ey. The dynamicpaths of all variables are displayed in Figure 3(b).The dynamic adjustment of share prices can be rati<strong>on</strong>alized in terms of thebehavior of output (and therefore of profits and dividends) and the interest rate.With rati<strong>on</strong>al, forward-looking agents, when the unexpected m<strong>on</strong>etary restricti<strong>on</strong>takes place at t 0 , share prices immediately incorporate the future course of y(t)(and therefore π(t)) andr(t). At t 0 agents understand that, from then <strong>on</strong>, theinterest rate will always be higher than in the initial equilibrium, and outputand dividends will always be lower. Both effects c<strong>on</strong>tribute to lower the levelof stock prices q(t 0 ) needed to equate returns. As shown by (1.8), lower futureprofits and higher future interest rates both determine a lower level of q at the very10 Formally, from (1.7), we have∂q∂m¯ > 0˙q=0whereas m does not enter the stati<strong>on</strong>ary locus ẏ(t) =0(1.6).11

moment of the m<strong>on</strong>etary policy restricti<strong>on</strong> (point B). On the subsequent dynamicpath (al<strong>on</strong>g the saddlepath from B to C), even though output and dividends aredecreasing, the effect of declining interest rates dominates, making share prices toincrease towards their new steady-state level. Al<strong>on</strong>g this path, ˙q(t) > 0: capitalgains ensure the equality of the rates of return <strong>on</strong> b<strong>on</strong>ds and stocks.In this model, the effects of a restrictive m<strong>on</strong>etary policy are characterized not<strong>on</strong>ly in the l<strong>on</strong>g run (increase of the interest rate, decrease of share prices andoutput), but also in the adjustment dynamics of all the variables, that in somecases display a change in their directi<strong>on</strong> of moti<strong>on</strong>. In fact, both share prices andthe interest rate show an impact resp<strong>on</strong>se to the m<strong>on</strong>etary restricti<strong>on</strong> which leadstheir values at t 0 respectively below and above the final steady-state equilibriumlevels. Afterwards, together with the gradual output decline, we observe decreasinginterest rates and increasing share prices, a behavior that could be hardlyexplained in the absence of agents forming rati<strong>on</strong>al expectati<strong>on</strong>sFigure 312

1.4.2. Fiscal policySuppose that at time t 0 a future fiscal restricti<strong>on</strong> is announced, tobeimplementedat time t 1 >t 0 : public spending, that is initially c<strong>on</strong>stant at g 0 , will be decreasedto g 1 < g 0 at t 1 and will then remain permanently at this lower level. Theinformati<strong>on</strong><strong>on</strong>thepermanent nature of the fiscal restricti<strong>on</strong> is included in thepolicy announcement.The effects of this anticipated fiscal restricti<strong>on</strong> <strong>on</strong> the steady state levels ofoutput and the interest rate are immediately clear from a c<strong>on</strong>venti<strong>on</strong>al IS − LM(static) model: in the new steady state both y and r will be lower. Both changesaffect the new steady-state level of q: lower output and dividends depress stockprices, whereas a lower interest rate raises q. Again, the latter effect is assumed todominate, leading to an increase of the steady-state value of q. Only the positi<strong>on</strong>of the stati<strong>on</strong>ary locus for output, ẏ(t) =0,isaffected by changes in g: att 1 (theimplementati<strong>on</strong> date of the fiscal policy measure), this curve shifts upwards al<strong>on</strong>gan unchanged ˙q(t) =0schedule, leading to a higher q and a lower y in steadystate, as shown by point D in Figure 4(a).In order to characterize the dynamics of the system, we note that, from timet 1 <strong>on</strong>wards, no further change in the exogenous variables occurs: to c<strong>on</strong>verge tothe steady state, the ec<strong>on</strong>omy must then be <strong>on</strong> the saddlepath portrayed in thediagram. Accordingly, from t 1 <strong>on</strong>wards, al<strong>on</strong>g the saddlepath from C to D in thefigure, output decreases (since the lower public spending causes aggregate demandto fall below current producti<strong>on</strong>) and q increases (due to the dominant effect ofthe decreasing interest rate).What happens from the fiscal policy announcement at t 0 to its delayed implementati<strong>on</strong>at t 1 ?Att 0 , when the future policy becomes known, agents in the stockmarket anticipate lower future interest rates (they also foresee lower dividends butthis effect is relatively weak); c<strong>on</strong>sequently, they immediately shift their porfoliostowards shares, bidding up their price. Then, at the announcement date, withoutput and the interest rate still at their initial steady state levels, q increases, asat point B in the figure. The ensuing dynamics from t 0 up to the implementati<strong>on</strong>date t 1 follow the equati<strong>on</strong>s of moti<strong>on</strong> in (1.5) and (1.3) referred to the initialsteady state (i.e. the unchanged ˙q(t) =0locus, and the initial ẏ(t) =0curve).A higher value of q stimulates investment, causing an excess demand for goods;starting from t 0 , then, output gradually increases, and so does the interest rate(due to the increase in m<strong>on</strong>ey demand). The dynamic adjustment of output and qis such that when the fiscal policy is implemented at t 1 (and the stati<strong>on</strong>ary locusẏ(t) =0shifts upwards) the ec<strong>on</strong>omy is exactly <strong>on</strong> the saddlepath (point C) lead-13

ing to the new steady state: aggregate demand falls and output starts decreasingal<strong>on</strong>g with the interest rate, whereas q and investment c<strong>on</strong>tinue to rise. Figure4(b) displays the dynamic adjustment of all relevant variables.Therefore, an apparently “perverse” effect of fiscal policy (an expansi<strong>on</strong> ofinvestment and output following the announcement of a future fiscal restricti<strong>on</strong>)can be explained by the forward-looking nature of stock prices, anticipating futurelower interest rates.Figure 42. Expectati<strong>on</strong>s and exchange rate dynamics (Dornbusch1976)The wide fluctati<strong>on</strong>s of nominal and real exchange rates observed under flexibleexchange rate regimes (perticularly in the 1970s) motivated the analysis of simpledynamic macroec<strong>on</strong>omic models where the exchange rate is determined by equilibriumc<strong>on</strong>diti<strong>on</strong>s <strong>on</strong> financial markets, and agents are endowed with rati<strong>on</strong>alexpectati<strong>on</strong>s. This secti<strong>on</strong> outlines a versi<strong>on</strong> of the most influential model of this14

kind, due to R. Dornbusch (1976), that shows the possibility of an over-reacti<strong>on</strong>oftheexchangeratetounexpectedm<strong>on</strong>etarypolicyacti<strong>on</strong>s(aresultknownasexchange rate overshooting).Themainfeaturesofthemodelarethefollowing:(i) the model describes a relatively "small" open ec<strong>on</strong>omy, under a flexibleexchange rate regime, and with perfect capital mobility;(ii) <strong>on</strong>thefinancial markets (for domestic b<strong>on</strong>ds, denominated in local currency,and foreign b<strong>on</strong>ds, denominated in foreign currency) the uncovered interestrate parity holds, and agents form rati<strong>on</strong>al expectati<strong>on</strong>s <strong>on</strong> the future courseof the exchange rate;(iii) the (perfectly flexible) exchange rate ensures that equilibrium occurs at anyinstant <strong>on</strong> financial markets; <strong>on</strong> the c<strong>on</strong>trary, the goods price level, thoughnot fixed (as in the simple IS − LM scheme and in Blanchard’s model),adjusts <strong>on</strong>ly gradually in resp<strong>on</strong>se to deviati<strong>on</strong>s of output from its "natural"level. Therefore, the nominal rigidity in the model takes the form of a sloweradjustment of the goods price level with respect to the exchange rate.We now specify the structure of the ec<strong>on</strong>omy and show the dynamic resp<strong>on</strong>seof output, the interest rate, and the exchange rate to fiscal and m<strong>on</strong>etary policymeasures.2.1. The structure of the ec<strong>on</strong>omyThe model is set in c<strong>on</strong>tinuous time: therefore, all variables are functi<strong>on</strong>s oftime t (for notati<strong>on</strong>al simplicity, this dependence will not be made explicit in thefollowing equati<strong>on</strong>s). All variables, with the excepti<strong>on</strong> of interest rates, are inlogarithms, and all parameters are positive.In the goods market, output y is determined by aggregate demand accordingto:y = −αr+ β (e + p ∗ − p)+γg (2.1)where demand has three determinants: the nominal interest rate r, therealexchangerate e + p ∗ − p, and government spending g. Since the price level p is notfixed, the inclusi<strong>on</strong> of the nominal instead of the real interest rate (i.e. r − ṗ) asa(negative) demand determinant is allowed <strong>on</strong>ly for the sake of analytical simplicity,without any qualitative change in the model’s c<strong>on</strong>clusi<strong>on</strong>s. The real exchange15

ate is defined as the ratio of the foreign goods price level c<strong>on</strong>verted into domesticcurrency (that is the nominal exchange rate E times the -exogenously set andc<strong>on</strong>stant- foreign price level P ∗ ) to the domestic price level P :then EP∗ ,inlogsPe + p ∗ − p as in (2.1). Given this definiti<strong>on</strong>, an increase in the real exchange ratecorresp<strong>on</strong>ds to a depreciati<strong>on</strong> of the domestic currency, which stimulates exportsand reduces imports: the overall effect <strong>on</strong> aggregate demand is therefore positive(β >0).On the domestic m<strong>on</strong>ey market, the standard equilibrium c<strong>on</strong>diti<strong>on</strong> betweenm<strong>on</strong>ey demand (determined by output y and the nominal domestic interest rater) and m<strong>on</strong>ey supply holds:m − p = y − hr (2.2)where a unit elasticity of m<strong>on</strong>ey demand to income has been assumed (for simplicity),and −h measures the (semi)elasticity of m<strong>on</strong>ey demand to the interestrate.On the supply side of the ec<strong>on</strong>omy, the price level p chnages gradually overtime in resp<strong>on</strong>se to possible deviati<strong>on</strong>s of current output y from its natural levelȳ, according to the dynamic equati<strong>on</strong>:ṗ = θ (y − ȳ) (2.3)Whencurrentoutputisabove(below)ȳ, the price level increases (decreases) at agradual pace (since the value of θ is finite, 0

plus the expected depreciati<strong>on</strong> of the domestic currency ė e . An interest ratedifferential in favor of domestic b<strong>on</strong>ds (r >r ∗ ) can be c<strong>on</strong>sistent with no arbitrage<strong>on</strong> b<strong>on</strong>d markets <strong>on</strong>ly if a depreciati<strong>on</strong> of the domestic currency is expected(ė e > 0). The opposite occurs, with expected appreciati<strong>on</strong> (ė e < 0), if the interestrate differential favors foreign b<strong>on</strong>ds (r

(i.e. an increase of e) is needed to restore the equality y =ȳ. This explains thepositive slope of the ṗ =0curve. 12Off the stati<strong>on</strong>ary locus, producti<strong>on</strong> is different from natural output. Indeed,at all points above the curve, y > ȳ (because an increase of e for a given pstimulates net exports, whereby increasing output) and the price level increasesover time according to (2.3): ṗ>0, as shown by the horiz<strong>on</strong>tal arrows in Figure5(a). The opposite dynamics occurs at all points below the curve, where y

Figure 6Starting from point A in Figure 6 (where y>ȳ and r

future differentials between domestic and foreign interest rates over the wholeinfinite horiz<strong>on</strong>. Therefore, e can display instantaneous adjustments ("jumps") inthe face of events or news that change the expected future path of interest rates,for example as a c<strong>on</strong>sequence of the implementati<strong>on</strong> (or even the announcement)of m<strong>on</strong>etary and fiscal policy measures.2.4. M<strong>on</strong>etary policyLet us c<strong>on</strong>sider an expansi<strong>on</strong>ary m<strong>on</strong>etary policy, implemented by means of anunexpected permanent increase of the m<strong>on</strong>ey supply m at time t 0 . Up to t 0 theec<strong>on</strong>omy is in a steady-state equilibrium at point A in Figure 7(a). The steadystateproperties of the system studied above ensure that in the l<strong>on</strong>g run m<strong>on</strong>eyneutrality prevails: an increase in m entails an increase in p and e of the samemagnitude. The new steady state equilibrium is at point C in the figure. Theshifts of the stati<strong>on</strong>ary loci caused by the m<strong>on</strong>ey supply increase can be formallyderived from (2.10) and (2.11). We have:de¯ = − α dm¯ṗ=0 βh < 0which implies a downward shift of the ṗ =0locus, 16 andde¯ = 1 dm¯ė=0 β > 0whichimpliesanupwardshiftoftheė =0curve. Then, in the l<strong>on</strong>g run, them<strong>on</strong>etary expansi<strong>on</strong> causes a depreciati<strong>on</strong> of the nominal exchange rate and anincrease of the price level, so that the real exchange rate (e + p ∗ − p) isbroughtback to its initial level.The adjustment towards the final steady state follows the saddlepath shown inFigure 7(a). Al<strong>on</strong>g the path, the nominal exchange rate appreciates (e decreases)and p gradually increases: both effectsmaketherealexchangeratetoappreciateas well. At t 0 , when the unanticipated m<strong>on</strong>etary policy is implemented, the pricelevel does not react (as a predetermined variable, it cannot resp<strong>on</strong>d immediately todeviati<strong>on</strong>s between current producti<strong>on</strong> and natural output), whereas the nominal16 Note that in the case of α =0, the stati<strong>on</strong>ary locus for p has a unitary slope and does notshift in the face of changes in m. Both the initial and the final steady-state equilibria are <strong>on</strong> thesame (unchanged) ṗ =0curve.23

exchange rate e instantaneously adjusts, jumping to point B <strong>on</strong>to the saddlepathc<strong>on</strong>verging to the new steady state. At t 0 , then, a depreciati<strong>on</strong> of the nominal(andreal)exchangerateoccurs,withe reaching a higher level then in the l<strong>on</strong>g-runequilibrium (at C). This (apparently) excessive impact resp<strong>on</strong>se of the exchangerate with respect to its l<strong>on</strong>g-run level is the most notable result of the Dornbusch’smodel, known as exchange rate overshooting.The depreciati<strong>on</strong> of the nominal exchange rate at t 0 in the face of an increasein m<strong>on</strong>ey supply can be rati<strong>on</strong>alized by c<strong>on</strong>sidering what happens <strong>on</strong> the m<strong>on</strong>eymarket. With p still fixed at its initial level, the increase in m determines anincrease in real m<strong>on</strong>ey supply, with a downward pressure <strong>on</strong> the domestic interestrate r. In their portfolio allocati<strong>on</strong> decisi<strong>on</strong>s, investors will then favor foreignb<strong>on</strong>ds, causing a capital outflow and a depreciati<strong>on</strong> of the domestic currency (i.e.an increase in e). The magnitude of this depreciati<strong>on</strong> is such as to restore theno-arbitrage c<strong>on</strong>diti<strong>on</strong> <strong>on</strong> financial markets: with an interest rate differential infavor of foreign b<strong>on</strong>ds (r

References[1] Blanchard O.J. (1981) "Output, the stock market, and the interest rate",American Ec<strong>on</strong>omic Review, 71[2] Dornbusch R. (1976) "Expectati<strong>on</strong>s and exchange rate dynamics", Journal ofPolitical Ec<strong>on</strong>omy, 84[3] Tobin J. (1969) "A general equilibrium approach to m<strong>on</strong>etary theory", Journalof M<strong>on</strong>ey, Credit and Banking, 126

Problems1. (<strong>Dynamic</strong> IS-LM model with the stock market) Suppose that, differentlyfrom the assumpti<strong>on</strong> of Secti<strong>on</strong> 1, stocks and short-term b<strong>on</strong>ds are notperfect substitutes in investors’ portfolios. Now stocks are perceived asriskier than b<strong>on</strong>ds: therefore, investors will be willing to hold stocks <strong>on</strong>ly ifthey are compensated for the higher risk with a rate of return higher thanr. Let this compensati<strong>on</strong>, or "risk premium", be θ 0 > 0 in the ec<strong>on</strong>omy’sinitial steady-state equilibrium.(a) Modify the no-arbitrage c<strong>on</strong>diti<strong>on</strong> (1.3) appropriately in the presenceof the risk premium <strong>on</strong> stocks; derive the new stati<strong>on</strong>ary locus for qand explain how changes in θ may affect the ˙q =0curve;(b) suppose now that at time t 0 an unexpected and permanent reducti<strong>on</strong> ofthe risk premium occurs, from θ 0 to θ 1 (with θ 0 >θ 1 > 0). Derive andexplain the effect of this change in θ <strong>on</strong> the steady-state equilibriumand <strong>on</strong> the dynamic adjustment of output, share prices, and the interestrate.2. (<strong>Dynamic</strong>IS-LMmodelwiththestockmarket) We assumed in Secti<strong>on</strong> 1that the "interest rate effect" dominates <strong>on</strong> the "dividend effect" in determiningstock price changes. Let us now suppose that the "dividend effect"dominates.(a) Give a precise characterizati<strong>on</strong> of the ˙q(t) =0schedule and of thedynamic properties of the system under the new assumpti<strong>on</strong>;(b) analyze the effects of an anticipated permanent fiscal restricti<strong>on</strong> (announcedat t 0 and implemented at t 1 ) and c<strong>on</strong>trast the results withthose reported in Secti<strong>on</strong> 1.3. (Expectati<strong>on</strong>s and exchange rate dynamics) Starting from the Dornbuschmodel of Secti<strong>on</strong> 2, let us now assume that β>1.(a) Under this assumpti<strong>on</strong>, plot the stati<strong>on</strong>ary locus for the exchange rateand explain its slope;(b) draw the phase diagram in this case, and characterize the dynamics ofe and p in the various regi<strong>on</strong>s of the picture; draw the saddlepath anddescribe its ec<strong>on</strong>omics properties;27

(c) analyze the effects of an unexpected, permanent expansi<strong>on</strong>ary m<strong>on</strong>etarypolicy and compare the dynamics of the endogenous variables withthe case presented in Secti<strong>on</strong> 2, explaining the differences.4. (Expectati<strong>on</strong>s and exchange rate dynamics) C<strong>on</strong>sider the following modifiedversi<strong>on</strong> of the Dornbusch model:y D = −αr+ β (e + p ∗ − ¯p) (aggregate demand)m − ¯p = y − hr (m<strong>on</strong>ey market equilibrium )r = r ∗ + ė (uncovered interest rate parity)ẏ = ϕ (y D − y) (output adjustment)where y D de<str<strong>on</strong>g>notes</str<strong>on</strong>g> the aggregate demand for goods. The price level is nowfixed (¯p), as in the IS − LM model, and output gradually adjust over timeto excess demand for (or excess supply of) goods, as in Blanchard (1981).The assumpti<strong>on</strong> of perfect foresight has already been introduced into theuncovered interest rate parity equati<strong>on</strong>.(a) Derive the properties of the steady-state equilibrium of the model, andof the dynamics (the shape of the stati<strong>on</strong>ary loci and of the saddlepathc<strong>on</strong>verging to l<strong>on</strong>g-run equilibrium);(b) what are the dynamic effects of an expansi<strong>on</strong>ary m<strong>on</strong>etary policy (unexpectedand permanent) <strong>on</strong> the interest rate, output, and the exchangerate?28