ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

ISN'T IT RICH? - American Business Media

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

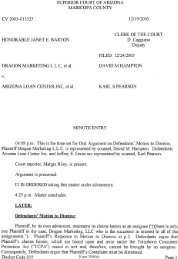

When it comes to eDiscovery less is MORE:DEALS IN BRIEF / M&ATechnically SpeakingLast year was a good one for M&A in the technology sector, which saw 137 deals of $100 millionor more worth a total of $106 billion, according to Dealogic. Those figures easily outpacedthe previous three years, and the activity was spread across a variety of market segments.Competition between Apple Inc. and Google Inc. for patents related to smartphones led to a bidding war in a bankruptcyauction for 6,000 patents and patent applications owned by Nortel Networks Inc. [Big Deals, September 2011]. Apple teamedwith EMC Corporation, Microsoft Corporation, Research in Motion Limited, and Sony Corporation to win the assets with a$4.5 billion bid. Google responded seven weeks later by agreeing to pay $12.5 billion in cash for Motorola Mobility Holdings,Inc. [Big Deals, October 2011].The year’s largest software deal came on August 17, when Hewlett-Packard Company agreed to buy Autonomy Corporationplc for $10.8 billion in cash [Big Deals, October 2011]. Texas Instruments Incorporated struck the year’s largest chipdeal when it agreed to pay $6.5 billion in cash for industry rival National Semiconductor Corporation on April 4 [Deals inBrief, June 2011], and on September 12 Broadcom Corporation agreed to pay $3.7 billion in cash for rival semiconductormanufacturer NetLogic Microsystems, Inc. [Big Deals, November 2011]. We feature another chip merger in this month’sDeals in Brief column.In the cloud computing space, Oracle Corporation agreed on October 24 to pay $1.5 billion for RightNow Technologies,Inc., a Web-based provider of customer service software [Big Deals, January]. Oracle’s business software rival SAP AGhopes to increase its presence in the cloud with the purchase of SuccessFactors, Inc., which is the other deal in this month’scolumn. SuccessFactors used Gordon Davidson and Jeffrey Vetter at Fenwick & West, who landed a much bigger prize onFebruary 1: a spot as issuer’s counsel on the planned IPO of Facebook, Inc., one of the most eagerly awaited debuts ever ona U.S. exchange.—David Marcus10 efficientPredictive Coding from RecommindmoreLam ResearchNovellusLam Research Corporation agreed to pay$3.3 billion in stock for rival semiconductormanufacturer Novellus Systems, Inc.,after the stock market’s close on December14. The deal came at a 28 percentpremium to Novellus’s closing price thatday. The parties hope to close the deal inthe second quarter of 2012 pending approvalsfrom regulators and both sets ofshareholders.LAM RESEARCH CORPORATION(FREMONT, CALIFORNIA)Jones Day: Timothy Hoxie andDaniel Mitz.NOVELLUS SYSTEMS, INC. (SAN JOSE)Morrison & Foerster: Brandon Parrisand Robert Townsend.SAPSuccessFactorsSAP AG agreed to pay $3.4 billion in cashfor cloud-based employee managementsoftware company SuccessFactors, Inc.,on December 3. The German softwarecompany will pay $40 per SuccessFactorsshare, a 52 percent premium to the target’sDecember 2 closing price. The companieshope to close the deal in the first quarterpending approvals from regulators andSuccessFactors shareholders.SAP AG (WALLDORF, GERMANY)Allen & Overy: Peter Harwich, Hans-Christoph Ihrig, and Jennifer Kwong.Jones Day: Daniel Mitz.SUCCESSFACTORS, INC. (SAN MATEO, CALIFORNIA)Fenwick & West: Gordon Davidsonand Jeffrey Vetter.Morrison & Foerster: Intellectual property:Tessa Schwartz.RECOMMINDTHE NEXT-BEST SYSTEM(and up to 50x more efficient than other approaches)presents:Register TODAY!Call 212.457.7905Email: register@almevents.comwww.americanlawyer.com/businessRecommind’s Axcelerate eDiscovery with patentedPredictive Coding is the clear winner in the eDiscovery race.May 1-2, 2012 | The Harvard Club | New York, NYLearn more at www.predictivecoding.com/efficiency