You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

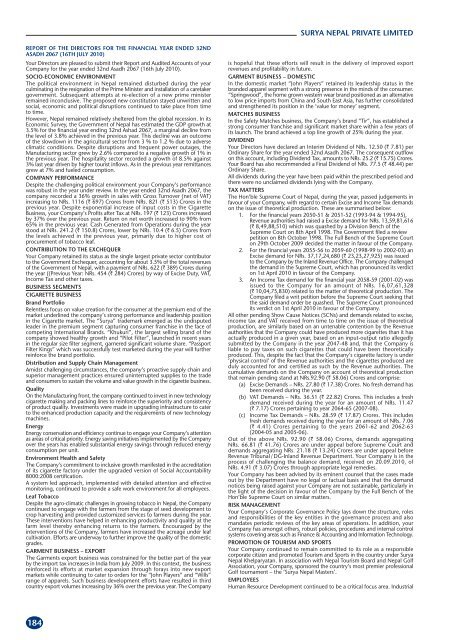

<strong>SURYA</strong> <strong>NEPAL</strong> <strong>PRIVATE</strong> <strong>LIMITED</strong>PROFIT AND LOSS ACCOUNT FOR THE YEAR ENDED 32ND ASADH 2067 (16TH JULY 2010)Figures in NRs. Figures in ` Figures in NRs. Figures in `For the year ended For the year ended For the year ended For the year ended32nd Asadh 2067 32nd Asadh 2067 31st Asadh 2066 31st Asadh 2066Schedule (16th July 2010) (16th July 2010) (15th July 2009) (15th July 2009)Gross Revenue 11 11,15,51,95,592 6,97,19,97,245 8,21,33,92,623 5,13,33,70,389Less: Duties 12 3,87,87,93,937 2,42,42,46,211 2,83,91,04,742 1,77,44,40,464Net Sales 7,27,64,01,655 4,54,77,51,034 5,37,42,87,881 3,35,89,29,925Raw Materials Consumed, etc. 13 2,92,35,79,313 1,82,72,37,071 2,04,89,11,992 1,28,05,69,995Cost of Sales 2,92,35,79,313 1,82,72,37,071 2,04,89,11,992 1,28,05,69,995Gross Profit 4,35,28,22,342 2,72,05,13,963 3,32,53,75,889 2,07,83,59,930Other Income 14 10,12,62,733 6,32,89,208 11,73,63,861 7,33,52,413Total 4,45,40,85,075 2,78,38,03,171 3,44,27,39,750 2,15,17,12,343Manufacturing, Admin, Selling Expenses etc. 15 1,06,37,93,136 66,48,70,709 98,31,17,616 61,44,48,509Provision For Employees’ Bonus 27,24,88,766 17,03,05,479 20,04,53,876 12,52,83,673Operating Profit 3,11,78,03,173 1,94,86,26,983 2,25,91,68,258 1,41,19,80,161Depreciation 22,44,55,190 14,02,84,494 13,79,83,391 8,62,39,619Loss on Fixed Assets sold / discarded (Net) 1,07,03,671 66,89,794 5,93,867 3,71,167Profit before Taxation 2,88,26,44,312 1,80,16,52,695 2,12,05,91,000 1,32,53,69,375Provision for Taxation 16 90,82,98,132 56,76,86,332 67,97,38,016 42,48,36,260Profit after Taxation 1,97,43,46,180 1,23,39,66,363 1,44,08,52,984 90,05,33,115Transferred from General Reserve — — 65,08,79,260 40,67,99,538Available for Appropriation 1,97,43,46,180 1,23,39,66,363 2,09,17,32,244 1,30,73,32,653AppropriationProvision For Employees’ Housing 15,77,56,654 9,85,97,909 11,60,52,244 7,25,32,653Interim Dividend 25,20,00,000 15,75,00,000 10,08,00,000 6,30,00,000Second Interim Dividend — — 1,14,91,20,000 71,82,00,000Proposed Final Dividend 1,56,24,00,000 97,65,00,000 72,57,60,000 45,36,00,000Balance Carried Over to Balance Sheet 21,89,526 13,68,454 — —1,97,43,46,180 1,23,39,66,363 2,09,17,32,244 1,30,73,32,653Notes to the Accounts and Contingent Liabilities 17The schedules referred to above form an integral part of the Profit & Loss Account.This is the Profit & Loss Account referred to in our Report of even date.Subhraketan Mitra Sanjiv Keshava Saurya SJB Rana K N Grant Y C DeveshwarFinancial Controller Managing Director Alternate Director Director ChairmanS R Pandey A K Mukerji B B Chatterjee Nem Lal Amatya Partha MitraDirector Director Director Partner PartnerN. Amatya & Co. Lovelock & LewesDate: 18th Aswin 2067 (4th October 2010) Chartered Accountants Chartered Accountants187

<strong>SURYA</strong> <strong>NEPAL</strong> <strong>PRIVATE</strong> <strong>LIMITED</strong>SCHEDULES TO THE ACCOUNTS (Contd.)SCHEDULE 17 - NOTES TO THE ACCOUNTS1. Significant Accounting Policiesi) ConventionThese financial statements have been prepared in accordance with applicable AccountingStandards in Nepal and generally accepted accounting principles. A summary of significantaccounting policies, which have been applied consistently, is set out below. The financialstatements have also been prepared in accordance with the relevant presentationalrequirements of the Company Act, 2063 of Nepal.ii) Basis of AccountingThese financial statements have been prepared in accordance with the historical costconvention modified by revaluation of certain freehold land as detailed in (iii) below. Thepreparation of the accounts requires management to make estimates and assumptionsthat affect the reported amounts of revenues, expenses, assets and liabilities at the dateof the financial statements. The key estimates and assumptions are set out in theaccounting policies below, together with the related notes to the accounts.The most significant items include:a) The estimation of and accounting for retirement benefit costs. The determinationof the carrying value of assets and liabilities, as well as the charge for the year,involves judgements made in conjunction with independent actuaries. These involveestimates about uncertain future events including life expectancy of members,attrition rate, salary increases as well as discount rates.b) The estimation of provisions for taxation, which are subject to uncertain futureevents, may extend over several years and so the amount and/or timing may differfrom current assumptions. The accounting policy for taxation is disclosed belowin point no. (xiv) including the recognised deferred tax assets and liabilities.iii) Fixed AssetsFreehold land acquired up to 17.12.2043 (31.03.1987) was revalued and the resultantincrease in the value of such land was credited to Capital Reserve. Subsequent acquisitionof the above asset and the other assets are stated at cost of acquisition inclusive of inwardfreight, duties and taxes and incidental expenses related to acquisition.Depreciation on fixed assets has been provided on straight-line basis at the rates prescribedby the erstwhile Income Tax (First Amendment) Rules, 2039. The said rates have furtherbeen increased by 33 1/3 % as allowed by the Industrial Enterprises Act, 2049. Additionaldepreciation arising from a change in estimated useful life of assets is charged againstrevenue.Impairment loss, if any, ascertained as per Nepal Accounting Standard – 18 “Impairmentof Assets” issued by Institute of Chartered Accountants of Nepal, is recognised.iv)InventoriesInventories are valued at cost or net realisable value whichever is lower. The cost iscalculated on weighted average method. Cost comprises expenditure incurred in thenormal course of business in bringing such inventories to its location and includes, whereapplicable, appropriate overheads based on normal level of activity.Obsolete, slow moving and defective inventories are identified at the time of physicalverification and where necessary provision is made for such inventories.v) InvestmentsLong Term Investments are valued at cost. Provision is made where there is a permanentfall in the valuation of such Investments.vi)vii)viii)SalesNet sales are stated after deducting taxes, duties and sticker charges from invoiced valueof goods sold.Investment IncomeIncome from investments is accounted for on an accrual basis, inclusive of related taxdeducted at source.Foreign Exchange TransactionForeign Exchange transactions are recorded at the exchange rate prevailing on the dateof transactions or where applicable at the exchange rate covered by forward contracts.Gains/Losses arising out of fluctuations in the exchange rates are recognised in the Profitand Loss in the period in which they arise. Differences between the forward exchangerates and the exchange rates at the date of transactions are recognised as income orexpense over the life of the contracts. Profit / loss arising on cancellation or renewal offorward exchange contracts is recognised as income / expense for the period. Gains /losses in the Profit and Loss Account on foreign exchange rate fluctuations relating tomonetary items are accounted for at the year end.ix) Lease RentalsOperating lease rental are charged to the profit and loss account as incurred.x) Retirement Benefits(a)(b)(c)GratuityLiability for gratuity benefits payable to the employees is actuarially determinedat the year end and provided for.Provident FundRegular monthly contributions are made to Provident Funds, which are chargedagainst revenue.Leave Encashment and Other Retirement BenefitsLeave encashment and other retirement benefits, wherever applicable, are determinedon the basis of actuarial valuation at the year end and provided for.xi) BonusBonus is provided as per the provisions of the Bonus Act, 2030.xii) Employees’ HousingEmployees’ Housing is provided as per the provisions of Labour Act, 2048.xiii) Cash and Cash EquivalentsCash and cash equivalents represent cash and cheques on hand and balance in bankaccounts.xiv)xv)Tax on IncomeProvision for current tax is made on profit for the period covered by the financialstatements with reference to the provisions of Income Tax Act, 2058.Deferred Tax is recognised and provided for on timing differences between taxableincome and accounting income subject to consideration of prudence.Deferred tax assets are not recognised unless there is virtual certainty that there will besufficient future taxable income available to realise such assets.Deferred tax is determined using the tax rates that have been enacted or substantivelyenacted by the balance sheet date and are expected to apply when the related deferredtax asset is realised or deferred tax liability is settled.DividendFinal Dividend is provided for as proposed by the Directors, pending approval at theAnnual General Meeting. Interim dividend is provided for as declared by the Board ofDirectors and confirmed at the Annual General Meeting.2. Notes to the AccountsA. For the year ended 32nd Asadh 2067, the Board of Directors of the Company at itsmeeting held on 18th Aswin 2067 (4th October 2010) have:a) declared interim dividend of NRs. 12.50 (` 7.81) per share andb) recommended final dividend of NRs. 77.50 (` 48.44) per share.B. Claims against the Company not acknowledged as debts:a) Demands raised by Revenue Authorities on theoretical production of cigarettes:The Company has been receiving Show Cause Notices (SCNs) and demands fromExcise, Income Tax and VAT authorities. The basis of all these SCNs and demandsis an untenable contention by the Revenue authorities that the Company couldhave produced more cigarettes than it has actually produced in a given year, byapplying an input-output ratio allegedly submitted by the Company in the year2047-48 and, that, the Company is liable to pay taxes on such cigarettes that couldhave been theoretically produced and sold. This, despite the fact that the Company’scigarette factory is under ‘physical control’ of the Revenue authorities and cigarettesproduced are duly accounted for and certified as such by the Revenue authorities.It may be pointed out that such levy of taxes on such theoretical production ofcigarettes has absolutely no basis in law.The Hon’ble Supreme Court of Nepal has, during the year, passed judgements infavour of your Company, with regard to certain Excise and Income Tax demandson the issue of theoretical production. These are summarised below:(i) Excise Related:1. For the financial years 2050-51 & 2051-52 (1993-94 & 1994-95),Revenue authorities had raised a Excise demand for NRs. 13,59,81,616(` 8,49,88,510), which was quashed by a Division Bench of the SupremeCourt on 8th April 1998. Government filed a review petition on 8thOctober 1998. The Full Bench of the Supreme Court on 29th October2009 decided the matter in favour of the Company. Our counselappearing in the matter has opined that this verdict will add substantialstrength to the Company’s case in all other matters relating to the issueof theoretical production.2. An Excise demand dated 12th July 2005 for NRs. 37,17,24,680(` 23,23,27,925) for the financial years 2055-56 to 2059-60 (1998-99to 2002-03) was issued to the Company by the Inland Revenue Office.On 21st September 2006 the Company challenged the demand in theSupreme Court, which on 1st April 2010, has decided the matter infavour of the Company.(ii) Income Tax Related:An Income Tax demand dated 13th October 2006 for the financial year2058-59 (2001-02) was issued to the Company for an amount ofNRs. 16,07,61,328 (` 10,04,75,830) related to the matter of theoreticalproduction. On 7th November 2006, the Company filed a writ petitionbefore the Supreme Court seeking that the said demand order bequashed. The Supreme Court, on 1st April 2010, has decided the matterin favour of the Company.Following is the status on other demands issued to the Company on the same matterwhich are based on similar untenable contention by the Revenue authorities:(i) Excise Demand for NRs. 27,80,26,266 (` 17,37,66,416)1. A demand letter dated 22nd February 2008 was issued to the Companyby the Inland Revenue Office, Simra, Bara. The demand ofNRs. 14,95,15,509 (` 9,34,47,193) by way of Excise duty, relate to thefinancial years 2060-61 to 2062-63 (2003-04 to 2005-06). The Companyfiled a writ petition in the Supreme Court on 1st April 2008 requestingthat the said demand order be quashed and orders issued such thatthe tax demanded not be collected. The Supreme Court admitted thepetition on 2nd April 2008 and directed issue of Show Cause Noticesto the respondents, and the hearing on the matter is pending.2. A demand letter dated 30th November 2008 was issued to the Companyby the Inland Revenue Office, Simra, Bara. The demand of NRs.12,85,10,757 (` 8,03,19,223) by way of Excise duty, relate to thefinancial year 2063-64 (2006-07). The Company had filed a writ petitionin the Supreme Court on 31st December 2008 requesting that the saiddemand order be quashed and orders issued such that the tax demandednot be collected. The Supreme Court admitted the petition on 6thJanuary 2009 and directed issue of Show Cause Notices to therespondents, and the hearing on the matter is pending.(ii) VAT Demand for NRs. 36,50,65,785 (` 22,81,66,116)1. A demand letter dated 7th August 2006 for the financial year 2058-59(2001-02) was issued to the Company by the Large Taxpayers Office,Kathmandu. Of a total demand of NRs. 7,54,63,766 (` 4,71,64,854),the basis of a demand for NRs. 7,54,51,113 (` 4,71,56,946) is theoreticalproduction. An administrative review petition on the Value Added Taxmatter was filed before the Director General on 1st September 2006,and the matter is pending.2. A demand letter dated 8th August 2007 was issued to the Companyby the Large Taxpayers Office, Lalitpur, for the financial year 2059-60(2002-03). The total demand is for NRs. 5,72,38,860 (` 3,57,74,288)and the basis of demand is theoretical production. The Company hasfiled a writ petition in the Supreme Court on 11th September 2007requesting that the said demand order be quashed and orders issuedsuch that the tax demanded not be collected. The Supreme Courtadmitted the petition on 12th September 2007 and directed issue ofShow Cause Notices to the respondents, and the hearing on the matteris pending.3. A demand letter dated 5th August 2008 was issued to the Companyby the Large Taxpayers Office, Lalitpur, for the financial year 2060-61(2003-04). Of a total demand of NRs. 1,13,28,199 (` 70,80,124), thebasis of a demand for NRs. 1,07,18,107 (` 66,98,817) is theoreticalproduction. The Company has filed a writ petition in the Supreme Courton 1st September 2008 requesting that the said demand order bequashed and orders issued such that the tax demanded not be collected.The Supreme Court admitted the petition on 5th September 2008 anddirected issue of Show Cause Notices to the respondents and the hearingon the matter is pending.4. A demand letter dated 10th July 2009 was issued to the Company bythe Large Taxpayers Office, Lalitpur, for the financial years2061-62 to 2063-64 (2004-05 to 2006-07). The total demand is for193

<strong>SURYA</strong> <strong>NEPAL</strong> <strong>PRIVATE</strong> <strong>LIMITED</strong>SCHEDULES TO THE ACCOUNTS (Contd.)SCHEDULE 17 - NOTES TO THE ACCOUNTS (Contd.)NRs. 10,69,66,056 (` 6,68,53,785) and the basis of demand is theoreticalproduction. The Company has filed a writ petition in the Supreme Courton 7th August 2009 requesting that the said demand order be quashedand orders issued such that the tax demanded not be collected. TheSupreme Court admitted the petition on 9th August 2009 and directedissue of Show Cause Notices to the respondents and the hearing onthe matter is pending.5. A demand letter dated 14th May 2010 was issued to the Company bythe Large Taxpayers Office, Lalitpur, for the financial year 2064-65(2007-08) for NRs. 11,46,91,649 (` 7,16,82,280) the basis of which istheoretical production. An administrative review petition on the ValueAdded Tax matter was filed before the Director General on 11th July2010, and the matter is pending.(iii) Income Tax Demand for NRs. 28,58,68,507 (` 17,86,67,817)1. A demand letter dated 12th August 2007, for the financial year 2059-60 (2002-03) was issued to the Company by the Large Taxpayers Office,Lalitpur, on 14th August 2007 for a sum of NRs. 19,60,92,971(` 12,25,58,107) on theoretical production. The Company has filed awrit petition in the Supreme Court on 11th September 2007 requestingthat the said demand order be quashed and orders issued such thatthe tax demanded not be collected. The Supreme Court admitted thepetition on 12th September 2007, and the hearing on the matter ispending.2. A demand letter dated 15th September 2008 for the financial year2060-61 (2003-04) was issued to the Company by the Large TaxpayersOffice, Lalitpur. Of a total demand of NRs. 2,25,36,944 (` 1,40,85,590)the basis of the demand for NRs. 1,91,39,653 (` 1,19,62,283) is ontheoretical production.The Company has filed a writ petition in the Supreme Court on 7thDecember 2008 seeking that the said demand order be quashed andorders issued such that the tax demanded not be collected. The SupremeCourt admitted the petition on 8th December 2008 and hearing onthe matter is pending.3. A demand letter dated 16th October 2009 for the financial year 2061-62 (2004-05) was issued to the Company by the Large Taxpayers Office,Lalitpur. Out of a total demand of NRs. 2,26,26,609 (` 1,41,41,631),the basis of the demand for NRs. 2,15,65,409 (` 1,34,78,381) is ontheoretical production. The Company has filed an administrative reviewpetition before the Director General, Inland Revenue Department on18th December 2009. However, the Director General without dealingwith the issues raised by the Company, summarily dismissed the petitionby an order dated 2nd March 2010. The Company thereafter filed anappeal before the Revenue Tribunal, on 17th June 2010, and the matteris pending.4. A demand letter dated 16th September 2010 for the financial year2062-63 (2005-06) was issued to the Company by the Large TaxpayersOffice, Lalitpur. Out of a total demand of NRs. 4,92,55,186(` 3,07,84,491), the basis of the demand for NRs. 4,90,70,474(` 3,06,69,046) is on theoretical production. The Company, inconsultation with its counsel, is in the process of challenging it throughappropriate legal remedies.The Management considers that all the demands listed above have nolegal or factual basis. Accordingly, the Management is of the view thatthere is no liability that is likely to arise, particularly in the light of thedecision in favour of the Company by the Full Bench of the HoníbleSupreme Court.b) Other demands raised on account of,1. Income Taxes for various assessment years amounting to NRs.10,32,83,725 (` 6,45,52,328) {(2065-66 - NRs. 10,32,83,725(` 6,45,52,328)} (net of provision made for the above assessment years)against which the Company has filed appeals with the appropriateauthorities.2. Value Added Tax matters under dispute, pertaining to financial years2055-56 to 2057-58, amounting to NRs. 31,00,750 (` 19,37,969){(2065-66 - NRs. 31,00,750 (` 19,37,969))}, which are under appeal.C. In the matter related to theoretical production, a Show Cause Notice dated 19thJanuary 2010 was issued by the Inland Revenue Office seeking reasons as to whya demand of NRs. 19,65,37,807 (` 12,28,36,129) by way of Excise Duty shouldnot be raised on the Company for the financial year 2064-65 (2007-08). TheCompany has filed a writ petition in the Supreme Court on 4th February 2010seeking a stay order on the Department from raising a demand on this matter inview of the favourable decision of the Hon’ble Supreme Court in the matter narratedin paragraph B(a)(i)(1) above. On 7th March 2010, Supreme Court stayed thedemand, pending final disposal.In respect of the above Show Cause Notice, the management is of the view thatthe Company has a strong case on merits and has been advised by eminent counselthat the Show Cause Notice is not sustainable, particularly in the light of the decisionby the Full Bench of the Supreme Court on a similar mannerD. Estimated amount of contracts remaining to be executed on capital accountNRs. 38,94,00,452 (` 24,33,75,283) {(2065-66 NRs. 1,36,12,442 (` 85,07,776))}.E. Payment to Managing Directors:Particulars Year ended Year ended32nd Asadh 2067 31st Asadh 2066(16th July 2010) (15th July 2009)In NRs. In ` In NRs. In `Salary, Bonus etc. (Short Term) 1,31,55,061 82,21,913 1,11,98,602* 69,99,126*Post Employment Benefits** — — — —Total 1,31,55,061 82,21,913 1,11,98,602 69,99,126* Includes NRs. 39,44,756 (` 24,65,473) paid to former Managing Director as per terms and conditions approved by the Shareholders.**Post employment benefits are actuarially determined on overall basis for all employees.F. Miscellaneous Expenses include reimbursement of expenses to statutory auditors amounting to NRs. 68,410 (` 42,756) {(2065-66 – NRs. 2,48,754 (` 1,55,471))}.G. The major components of the Deferred Tax Assets/Liabilities, based on the tax effect of the timing difference are as under:Particulars As at As at31st Asadh 2067 31st Asadh 2066(16th July 2010) (15th July 2009)In NRs. In ` In NRs. In `Deferred Tax AssetOn employees’ separation and retirement 1,08,20,523 67,62,827 1,36,75,628 85,47,268On fiscal allowance on fixed assets 2,22,01,471 1,38,75,919 77,30,612 48,31,632On doubtful advance 12,66,614 7,91,634 9,60,155 6,00,0973,42,88,608 2,14,30,380 2,23,66,395 1,39,78,997Deferred Tax LiabilityOn finished goods 53,01,893 33,13,683 59,16,809 36,98,006Deferred Tax – Net 2,89,86,715 1,81,16,697 1,64,49,586 1,02,80,991H. Explanation of the relationship between tax expenses and accounting profit:Particulars For the Year ended For the Year ended32nd Asadh 2067 31st Asadh 2066(16th July 2010) (15th July 2009)In NRs. In ` In NRs. In `Accounting Profit 2,88,26,44,312 1,80,16,52,695 2,12,05,91,000 1,32,53,69,375Tax at the applicable tax rate 88,00,80,163 55,00,50,102 64,81,82,492 40,51,14,057(Cigarette manufacturing @ 30%,Garments Manufacturing @ 20% andTrading @ 25%)Factors affecting tax charge for the yearEffect of :Unused Tax Losses not recognised 2,72,77,870 1,70,48,668 2,56,08,895 1,60,05,559Expenses not deductible for tax purposes 9,40,099 5,87,562 10,42,934 6,51,834Movement in other timing differences — — 36,96,313 23,10,196Reduction in opening deferred taxes resulting from reduction in tax rate — — 12,07,382 7,54,614Total Tax Expense 90,82,98,132 56,76,86,332 67,97,38,016 42,48,36,260194

<strong>SURYA</strong> <strong>NEPAL</strong> <strong>PRIVATE</strong> <strong>LIMITED</strong>SCHEDULES TO THE ACCOUNTS (Contd.)SCHEDULE 17 - NOTES TO THE ACCOUNTS (Contd.)I. Capital:The Company is not subject to any capital adequacy norms under regulations presentlyin force. Employees Housing Reserve is set aside as required by law. It is the Company’spolicy to maintain a sound capital base that is supportive of the Company’s businessplans . Return on Capital employed is monitored based on Asset Turnover & Profitabilityratio.J. Related party DisclosuresNature of relationship and name of the related parties:1. Holding Company<strong>ITC</strong> Limited, India2. Fellow Subsidiariesa) Srinivasa Resorts Limited, Indiab) Fortune Park Hotels Limited, Indiac) Bay Islands Hotel Limited, Indiad) Russell Credit Limited, India and its subsidiaryi. Greenacre Holdings Limited, Indiaii. Wimco Limited, India and its subsidiariesPavan Poplar Limited, IndiaPrag Agro Farm Limited, Indiaiii. Technico Pty Limited, Australia and its subsidiariesTechnico ISC Pty. Limited, AustraliaTechnico Agri Sciences Limited, IndiaTechnico Technologies Inc., CanadaTechnico Asia Holdings Pty Limited, Australia and its subsidiaryTechnico Horticultural (Kunming) Co. Limited, Chinae) <strong>ITC</strong> Infotech India Limited, India and its subsidiariesi. <strong>ITC</strong> Infotech Limited, United Kingdomii. <strong>ITC</strong> Infotech (USA), Inc., United States of America and its SubsidiaryPyxis Solutions, LLC, United States of America(became subsidiary with effect from 11.08.2008)f) Wills Corporation Limited, Indiag) Gold Flake Corporation Limited, Indiah) Landbase India Limited, Indiai) BFIL Finance Limited, India and its subsidiaryMRR Trading & Investment Company Limited, Indiaj) King Maker Marketing, Inc., United States of AmericaThe above list does not include:a) <strong>ITC</strong> Global Holdings Pte. Limited, Singapore (under liquidation)i. Hup Hoon Traders Pte. Limited, Singaporeii. AOZT “Hup Hoon”, Moscowiii. Hup Hoon Impex SRL, Romaniab) BFIL Securities Limited (a subsidiary of BFIL Finance Ltd.) which isunder voluntary winding up proceedings.3. Key Management Personnel:Y. C. Deveshwar Chairman & Non-Executive DirectorS. Puri Alternate Director to Y. C. Deveshwar (w.e.f. 22nd March,2010)A. Singh Non-Executive Director (till 21st March, 2010)A. K. Mukerji Non-Executive Director (w.e.f. 17th August, 2009)B. B. Chatterjee Non-Executive DirectorK. N. Grant Non-Executive Director (w.e.f. 22nd March, 2010)P. Chatterjee Non-Executive Director (till 16th August, 2009)S. R. Pandey Non-Executive DirectorS. SJB Rana Non-Executive DirectorSaurya SJB Rana Alternate Director to Mr. S. SJB RanaS. Keshava Managing DirectorDisclosure of transactions between the Company and related parties and the status of outstanding balances as on 16th July, 2010:In NRs. In ` In NRs. In ` In NRs. In ` In NRs. In ` In NRs. In ` In NRs. In `Sale of Goods /Services 9,63,46,535 6,02,16,584 59,820 37,388 22,10,73,693 13,81,71,058Purchase of Goods /Services 1,98,87,64,823 1,24,29,78,014 23,03,064 14,39,415 1,18,74,63,779 74,21,64,862 31,29,830 19,56,144Payment to Managing Director 1,31,55,061 82,21,913 72,53,846 45,33,654Sitting Fees / IncidentalExpenses to Other Directors 98,824 61,765 48,529 30,331Machine Hire Charges 69,19,105 43,24,441 34,79,199 21,74,499Rent Received 12,24,946 7,65,591 51,20,000 32,00,000Dividend Payments 1,16,56,51,200 72,85,32,000 51,54,24,000 32,21,40,000Expenses recovered 91,83,785 57,39,866 12,073 7,546 97,54,500 60,96,563Expenses reimbursed 58,02,919 36,26,824 84,70,386 52,93,991 2,36,848 1,48,030Advances Given (after adjustmentof purchase) 50,22,62,979 31,39,14,362 4,56,037 2,85,023Issue of Bonus Share 99,12,00,000 61,95,00,000Balances as on 16th JulyFor the year endedFor the year ended32nd Asadh, 2067 (16th July, 2010) 31Asadh, 2066 (15th July, 2009)Holding Company Fellow Key Management Holding Company Fellow Key ManagementSubsidiaries Personnel Subsidiaries Personnel— Debtors 3,82,29,509 2,38,93,443 6,33,71,200 3,96,07,000— Advances/Other Receivables 50,46,56,336 31,54,10,210 11,30,246 7,06,404— Creditors / Payables 13,61,82,247 8,51,13,904 5,39,61,944 3,37,26,215 8,41,281 5,25,801K. Figures have been rounded off to the nearest rupee.L. Previous Year’s figures have been regrouped and/or rearranged wherever necessary.Subhraketan Mitra Sanjiv Keshava Saurya SJB Rana K N Grant Y C DeveshwarFinancial Controller Managing Director Alternate Director Director ChairmanS R Pandey A K Mukerji B B Chatterjee Nem Lal Amatya Partha MitraDirector Director Director Partner PartnerN. Amatya & Co. Lovelock & LewesDate: 18th Aswin 2067 (4th October 2010) Chartered Accountants Chartered Accountants195