rhode island tax news - Rhode Island Division of Taxation - RI.gov

rhode island tax news - Rhode Island Division of Taxation - RI.gov

rhode island tax news - Rhode Island Division of Taxation - RI.gov

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

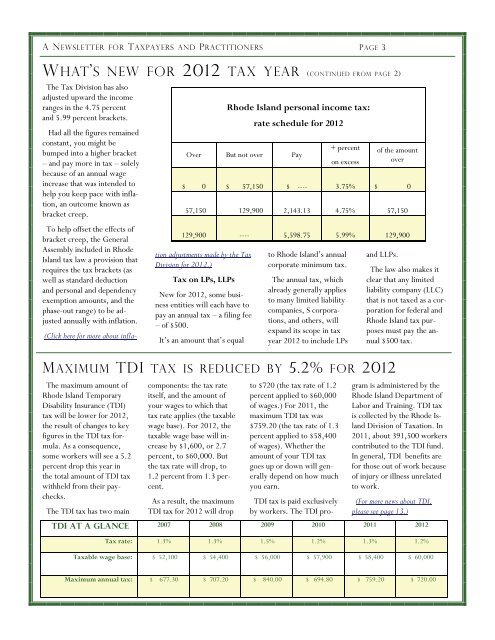

A NEWSLETTER FOR TAXPAYERS AND PRACTITIONERSPAGE 3WHAT’S NEW FOR 2012 TAX YEAR (CONTINUED FROM PAGE 2)The Tax <strong>Division</strong> has alsoadjusted upward the incomeranges in the 4.75 percentand 5.99 percent brackets.Had all the figures remainedconstant, you might bebumped into a higher bracket– and pay more in <strong>tax</strong> – solelybecause <strong>of</strong> an annual wageincrease that was intended tohelp you keep pace with inflation,an outcome known asFIDUCIARY bracket creep. UPDATE:To help <strong>of</strong>fset the effects <strong>of</strong>bracket creep, the GeneralAssembly included in <strong>Rhode</strong><strong>Island</strong> <strong>tax</strong> law a provision thatrequires the <strong>tax</strong> brackets (aswell as standard deductionand personal and dependencyexemption amounts, and thephase-out range) to be adjustedannually with inflation.(Click here for more about inflationadjustments made by the Tax<strong>Division</strong> for 2012.)Tax on LPs, LLPsNew for 2012, some businessentities will each have topay an annual <strong>tax</strong> – a filing fee– <strong>of</strong> $500.It’s an amount that’s equal<strong>Rhode</strong> <strong>Island</strong> personal income <strong>tax</strong>:rate schedule for 2012Over But not over Pay+ percenton excessto <strong>Rhode</strong> <strong>Island</strong>’s annualcorporate minimum <strong>tax</strong>.The annual <strong>tax</strong>, whichalready generally appliesto many limited liabilitycompanies, S corporations,and others, willexpand its scope in <strong>tax</strong>year 2012 to include LPs<strong>of</strong> the amountover$ 0 $ 57,150 $ ---- 3.75% $ 057,150 129,900 2,143.13 4.75% 57,150129,900 ---- 5,598.75 5.99% 129,900MAXIMUM TDI TAX IS REDUCED BY 5.2% FOR 2012The maximum amount <strong>of</strong><strong>Rhode</strong> <strong>Island</strong> TemporaryDisability Insurance (TDI)<strong>tax</strong> will be lower for 2012,the result <strong>of</strong> changes to keyfigures in the TDI <strong>tax</strong> formula.As a consequence,some workers will see a 5.2percent drop this year inthe total amount <strong>of</strong> TDI <strong>tax</strong>withheld from their paychecks.The TDI <strong>tax</strong> has two maincomponents: the <strong>tax</strong> rateitself, and the amount <strong>of</strong>your wages to which that<strong>tax</strong> rate applies (the <strong>tax</strong>ablewage base). For 2012, the<strong>tax</strong>able wage base will increaseby $1,600, or 2.7percent, to $60,000. Butthe <strong>tax</strong> rate will drop, to1.2 percent from 1.3 percent.As a result, the maximumTDI <strong>tax</strong> for 2012 will dropto $720 (the <strong>tax</strong> rate <strong>of</strong> 1.2percent applied to $60,000<strong>of</strong> wages.) For 2011, themaximum TDI <strong>tax</strong> was$759.20 (the <strong>tax</strong> rate <strong>of</strong> 1.3percent applied to $58,400<strong>of</strong> wages). Whether theamount <strong>of</strong> your TDI <strong>tax</strong>goes up or down will generallydepend on how muchyou earn.TDI <strong>tax</strong> is paid exclusivelyby workers. The TDI pro-and LLPs.The law also makes itclear that any limitedliability company (LLC)that is not <strong>tax</strong>ed as a corporationfor federal and<strong>Rhode</strong> <strong>Island</strong> <strong>tax</strong> purposesmust pay the annual$500 <strong>tax</strong>.gram is administered by the<strong>Rhode</strong> <strong>Island</strong> Department <strong>of</strong>Labor and Training. TDI <strong>tax</strong>is collected by the <strong>Rhode</strong> <strong>Island</strong><strong>Division</strong> <strong>of</strong> <strong>Taxation</strong>. In2011, about 391,500 workerscontributed to the TDI fund.In general, TDI benefits arefor those out <strong>of</strong> work because<strong>of</strong> injury or illness unrelatedto work.(For more <strong>news</strong> about TDI,please see page 13.)TDI at a glance 2007 2008 2009 2010 2011 2012Tax rate: 1.3% 1.3% 1.5% 1.2% 1.3% 1.2%Taxable wage base: $ 52,100 $ 54,400 $ 56,000 $ 57,900 $ 58,400 $ 60,000Maximum annual <strong>tax</strong>: $ 677.30 $ 707.20 $ 840.00 $ 694.80 $ 759.20 $ 720.00