rhode island tax news - Rhode Island Division of Taxation - RI.gov

rhode island tax news - Rhode Island Division of Taxation - RI.gov

rhode island tax news - Rhode Island Division of Taxation - RI.gov

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

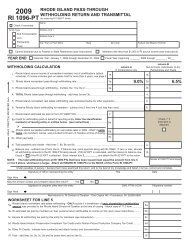

A NEWSLETTER FOR TAXPAYERS AND PRACTITIONERSPAGE 5TAX DIVISION MAILS FORM 1099-G, 1099-INThe <strong>Rhode</strong> <strong>Island</strong> <strong>Division</strong><strong>of</strong> <strong>Taxation</strong> in TJanuary finished mailing theForm 1099-G and the Form1099-INT. The forms arehelpful to <strong>tax</strong>payers – and<strong>tax</strong> pr<strong>of</strong>essionals – as theyprepare returns this season.Form 1099-GIn general, the Form 1099-G shows how much <strong>of</strong> a<strong>Rhode</strong> <strong>Island</strong> income <strong>tax</strong>refund a <strong>tax</strong>payer received in2011. The amount is shownin the form’s Box 2, “State orLocal Income Tax Refunds,Credits, or Offsets.” Altogether,the Tax <strong>Division</strong>ended up sending out187,805 Forms 1099-G. (Part<strong>of</strong> a standard Form 1099-G isreproduced below.)Form 1099-INTAlso in January, the Tax<strong>Division</strong> finished mailing theForm 1099-INT. It showshow much interest a <strong>tax</strong>payerreceived in 2011 ontheir <strong>Rhode</strong> <strong>Island</strong> income<strong>tax</strong>refunds. Overall, theagency ended up sendingout 4,157 Forms 1099-INT.If you received either orboth forms in the mail,keep in mind that neither isa bill. They’re simply documentsto use in preparingyour returns. See Tax <strong>Division</strong>FAQs for more details.Tax TipCheck out the <strong>Rhode</strong><strong>Island</strong> <strong>Division</strong> <strong>of</strong> <strong>Taxation</strong>’swebsite to learnmore about two <strong>of</strong>fersfor preparing and filingyour federal and state<strong>tax</strong> returns online at nocharge.ESTIMATED TAX COUPONS SET FOR MAILING FOR 2012The Tax <strong>Division</strong> has finalizedthe form many <strong>tax</strong>payersuse to make quarterly estimatedpayments <strong>of</strong> personalincome <strong>tax</strong>.Thus, in early 2012, theagency plans to mail about40,000 copies <strong>of</strong> the 2012Form <strong>RI</strong>-1040ES, “<strong>Rhode</strong><strong>Island</strong> Resident and NonresidentEstimated Payment Coupons.”Taxpayers use the couponsto make quarterly estimatedpayments, and the couponsserve as a handy reminder.A helpful toolWhat’s more, each couponpacket also has a table onwhich you can keep a record<strong>of</strong> your payments. That canbe a helpful tool when itcomes time to filing yourannual income <strong>tax</strong> return.After all, it may not be easy inApril to recall with precisionthe payments you madenearly a year before.Download copyIf you haven’t received yourcopy <strong>of</strong> the coupons yet, anddon’t want to wait, you maydownload a copy from theTax <strong>Division</strong> website.