alabama's working families and the broken promise of economic ...

alabama's working families and the broken promise of economic ...

alabama's working families and the broken promise of economic ...

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

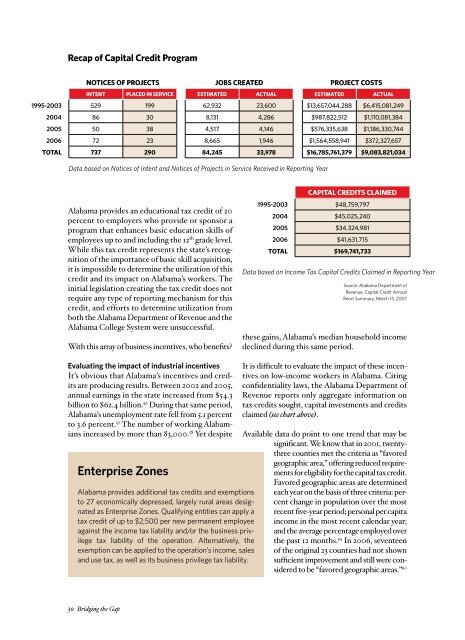

Recap <strong>of</strong> Capital Credit ProgramNOTICES OF PROJECTSINTENT PLACED IN SERVICE1995-2003 529 1992004 86 302005 50 382006 72 23TOTAL 737 290JOBS CREATEDESTIMATEDACTUAL62,932 23,6008,131 4,2864,517 4,1468,665 1,94684,245 33,978PROJECT COSTSESTIMATEDACTUAL$13,657,044,288 $6,415,081,249$987,822,512 $1,110,081,384$576,335,638 $1,186,330,744$1,564,558,941 $372,327,657$16,785,761,379 $9,083,821,034Data based on Notices <strong>of</strong> Intent <strong>and</strong> Notices <strong>of</strong> Projects in Service Received in Reporting YearAlabama provides an educational tax credit <strong>of</strong> 20percent to employers who provide or sponsor aprogram that enhances basic education skills <strong>of</strong>employees up to <strong>and</strong> including <strong>the</strong> 12 th grade level.While this tax credit represents <strong>the</strong> state’s recognition<strong>of</strong> <strong>the</strong> importance <strong>of</strong> basic skill acquisition,it is impossible to determine <strong>the</strong> utilization <strong>of</strong> thiscredit <strong>and</strong> its impact on Alabama’s workers. Theinitial legislation creating <strong>the</strong> tax credit does notrequire any type <strong>of</strong> reporting mechanism for thiscredit, <strong>and</strong> efforts to determine utilization fromboth <strong>the</strong> Alabama Department <strong>of</strong> Revenue <strong>and</strong> <strong>the</strong>Alabama College System were unsuccessful.With this array <strong>of</strong> business incentives, who benefits?CAPITAL CREDITS CLAIMED1995-2003 $48,759,7972004 $45,025,2402005 $34,324,9812006 $41,631,715TOTAL $169,741,733Data based on Income Tax Capital Credits Claimed in Reporting YearSource: Alabama Department <strong>of</strong>Revenue, Capital Credit AnnualReort Summary, March 15, 2007<strong>the</strong>se gains, Alabama’s median household incomedeclined during this same period.Evaluating <strong>the</strong> impact <strong>of</strong> industrial incentivesIt’s obvious that Alabama’s incentives <strong>and</strong> creditsare producing results. Between 2002 <strong>and</strong> 2005,annual earnings in <strong>the</strong> state increased from $54.3billion to $62.4 billion. 56 During that same period,Alabama’s unemployment rate fell from 5.1 percentto 3.6 percent. 57 The number <strong>of</strong> <strong>working</strong> Alabamiansincreased by more than 83,000. 58 Yet despiteEnterprise ZonesAlabama provides additional tax credits <strong>and</strong> exemptionsto 27 <strong>economic</strong>ally depressed, largely rural areas designatedas Enterprise Zones. Qualifying entities can apply atax credit <strong>of</strong> up to $2,500 per new permanent employeeagainst <strong>the</strong> income tax liability <strong>and</strong>/or <strong>the</strong> business privilegetax liability <strong>of</strong> <strong>the</strong> operation. Alternatively, <strong>the</strong>exemption can be applied to <strong>the</strong> operation’s income, sales<strong>and</strong> use tax, as well as its business privilege tax liability.It is difficult to evaluate <strong>the</strong> impact <strong>of</strong> <strong>the</strong>se incentiveson low-income workers in Alabama. Citingconfidentiality laws, <strong>the</strong> Alabama Department <strong>of</strong>Revenue reports only aggregate information ontax credits sought, capital investments <strong>and</strong> creditsclaimed (see chart above).Available data do point to one trend that may besignificant. We know that in 2001, twentythreecounties met <strong>the</strong> criteria as “favoredgeographic area,” <strong>of</strong>fering reduced requirementsfor eligibility for <strong>the</strong> capital tax credit.Favored geographic areas are determinedeach year on <strong>the</strong> basis <strong>of</strong> three criteria: percentchange in population over <strong>the</strong> mostrecent five-year period; personal per capitaincome in <strong>the</strong> most recent calendar year;<strong>and</strong> <strong>the</strong> average percentage employed over<strong>the</strong> past 12 months. 59 In 2006, seventeen<strong>of</strong> <strong>the</strong> original 23 counties had not shownsufficient improvement <strong>and</strong> still were consideredto be “favored geographic areas.” 6030 Bridging <strong>the</strong> Gap