Avner Oil - Annual Report 2011 - Delek Energy Systems

Avner Oil - Annual Report 2011 - Delek Energy Systems

Avner Oil - Annual Report 2011 - Delek Energy Systems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

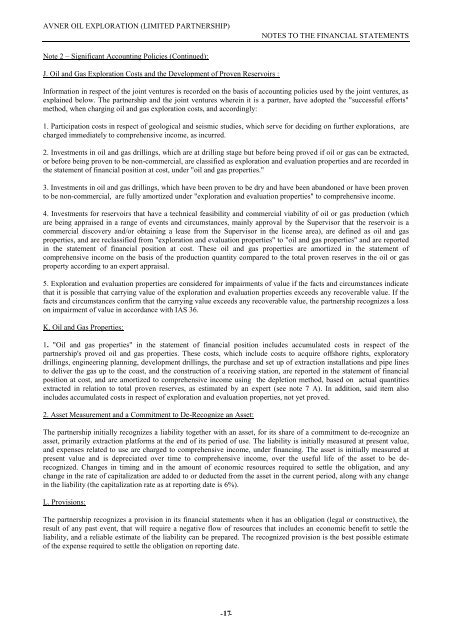

AVNER OIL EXPLORATION (LIMITED PARTNERSHIP)NOTES TO THE FINANCIAL STATEMENTSNote 2 – Significant Accounting Policies (Continued):J. <strong>Oil</strong> and Gas Exploration Costs and the Development of Proven Reservoirs :Information in respect of the joint ventures is recorded on the basis of accounting policies used by the joint ventures, asexplained below. The partnership and the joint ventures wherein it is a partner, have adopted the "successful efforts"method, when charging oil and gas exploration costs, and accordingly:1. Participation costs in respect of geological and seismic studies, which serve for deciding on further explorations, arecharged immediately to comprehensive income, as incurred.2. Investments in oil and gas drillings, which are at drilling stage but before being proved if oil or gas can be extracted,or before being proven to be non-commercial, are classified as exploration and evaluation properties and are recorded inthe statement of financial position at cost, under "oil and gas properties."3. Investments in oil and gas drillings, which have been proven to be dry and have been abandoned or have been provento be non-commercial, are fully amortized under "exploration and evaluation properties" to comprehensive income.4. Investments for reservoirs that have a technical feasibility and commercial viability of oil or gas production (whichare being appraised in a range of events and circumstances, mainly approval by the Supervisor that the reservoir is acommercial discovery and/or obtaining a lease from the Supervisor in the license area), are defined as oil and gasproperties, and are reclassified from "exploration and evaluation properties" to "oil and gas properties" and are reportedin the statement of financial position at cost. These oil and gas properties are amortized in the statement ofcomprehensive income on the basis of the production quantity compared to the total proven reserves in the oil or gasproperty according to an expert appraisal.5. Exploration and evaluation properties are considered for impairments of value if the facts and circumstances indicatethat it is possible that carrying value of the exploration and evaluation properties exceeds any recoverable value. If thefacts and circumstances confirm that the carrying value exceeds any recoverable value, the partnership recognizes a losson impairment of value in accordance with IAS 36.K. <strong>Oil</strong> and Gas Properties:1. "<strong>Oil</strong> and gas properties" in the statement of financial position includes accumulated costs in respect of thepartnership's proved oil and gas properties. These costs, which include costs to acquire offshore rights, exploratorydrillings, engineering planning, development drillings, the purchase and set up of extraction installations and pipe linesto deliver the gas up to the coast, and the construction of a receiving station, are reported in the statement of financialposition at cost, and are amortized to comprehensive income using the depletion method, based on actual quantitiesextracted in relation to total proven reserves, as estimated by an expert (see note 7 A). In addition, said item alsoincludes accumulated costs in respect of exploration and evaluation properties, not yet proved.2. Asset Measurement and a Commitment to De-Recognize an Asset:The partnership initially recognizes a liability together with an asset, for its share of a commitment to de-recognize anasset, primarily extraction platforms at the end of its period of use. The liability is initially measured at present value,and expenses related to use are charged to comprehensive income, under financing. The asset is initially measured atpresent value and is depreciated over time to comprehensive income, over the useful life of the asset to be derecognized.Changes in timing and in the amount of economic resources required to settle the obligation, and anychange in the rate of capitalization are added to or deducted from the asset in the current period, along with any changein the liability (the capitalization rate as at reporting date is 6%).L. Provisions:The partnership recognizes a provision in its financial statements when it has an obligation (legal or constructive), theresult of any past event, that will require a negative flow of resources that includes an economic benefit to settle theliability, and a reliable estimate of the liability can be prepared. The recognized provision is the best possible estimateof the expense required to settle the obligation on reporting date.-01-