Avner Oil - Annual Report 2011 - Delek Energy Systems

Avner Oil - Annual Report 2011 - Delek Energy Systems

Avner Oil - Annual Report 2011 - Delek Energy Systems

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

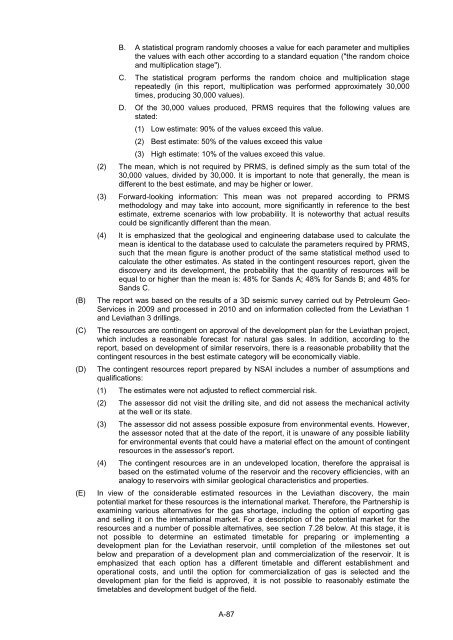

(B)(C)(D)(E)B. A statistical program randomly chooses a value for each parameter and multipliesthe values with each other according to a standard equation ("the random choiceand multiplication stage").C. The statistical program performs the random choice and multiplication stagerepeatedly (in this report, multiplication was performed approximately 30,000times, producing 30,000 values).D. Of the 30,000 values produced, PRMS requires that the following values arestated:(1) Low estimate: 90% of the values exceed this value.(2) Best estimate: 50% of the values exceed this value(3) High estimate: 10% of the values exceed this value.(2) The mean, which is not required by PRMS, is defined simply as the sum total of the30,000 values, divided by 30,000. It is important to note that generally, the mean isdifferent to the best estimate, and may be higher or lower.(3) Forward-looking information: This mean was not prepared according to PRMSmethodology and may take into account, more significantly in reference to the bestestimate, extreme scenarios with low probability. It is noteworthy that actual resultscould be significantly different than the mean.(4) It is emphasized that the geological and engineering database used to calculate themean is identical to the database used to calculate the parameters required by PRMS,such that the mean figure is another product of the same statistical method used tocalculate the other estimates. As stated in the contingent resources report, given thediscovery and its development, the probability that the quantity of resources will beequal to or higher than the mean is: 48% for Sands A; 48% for Sands B; and 48% forSands C.The report was based on the results of a 3D seismic survey carried out by Petroleum Geo-Services in 2009 and processed in 2010 and on information collected from the Leviathan 1and Leviathan 3 drillings.The resources are contingent on approval of the development plan for the Leviathan project,which includes a reasonable forecast for natural gas sales. In addition, according to thereport, based on development of similar reservoirs, there is a reasonable probability that thecontingent resources in the best estimate category will be economically viable.The contingent resources report prepared by NSAI includes a number of assumptions andqualifications:(1) The estimates were not adjusted to reflect commercial risk.(2) The assessor did not visit the drilling site, and did not assess the mechanical activityat the well or its state.(3) The assessor did not assess possible exposure from environmental events. However,the assessor noted that at the date of the report, it is unaware of any possible liabilityfor environmental events that could have a material effect on the amount of contingentresources in the assessor's report.(4) The contingent resources are in an undeveloped location, therefore the appraisal isbased on the estimated volume of the reservoir and the recovery efficiencies, with ananalogy to reservoirs with similar geological characteristics and properties.In view of the considerable estimated resources in the Leviathan discovery, the mainpotential market for these resources is the international market. Therefore, the Partnership isexamining various alternatives for the gas shortage, including the option of exporting gasand selling it on the international market. For a description of the potential market for theresources and a number of possible alternatives, see section 7.28 below. At this stage, it isnot possible to determine an estimated timetable for preparing or implementing adevelopment plan for the Leviathan reservoir, until completion of the milestones set outbelow and preparation of a development plan and commercialization of the reservoir. It isemphasized that each option has a different timetable and different establishment andoperational costs, and until the option for commercialization of gas is selected and thedevelopment plan for the field is approved, it is not possible to reasonably estimate thetimetables and development budget of the field.A-87