You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

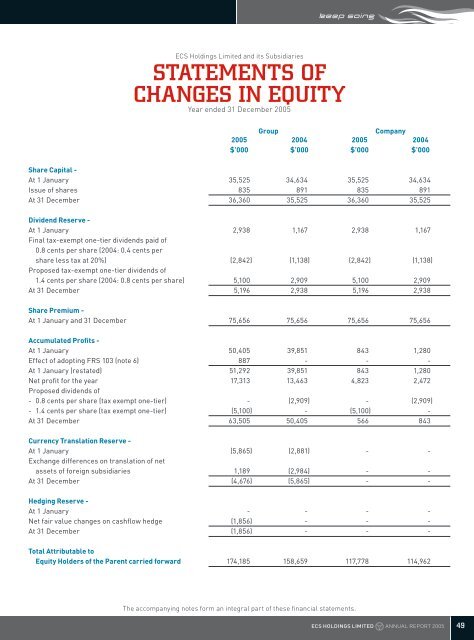

Keep Going<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> and its SubsidiariesStatements ofChanges in EquityYear ended 31 December 2005GroupCompany2005 2004 2005 2004$’000 $’000 $’000 $’000Share Capital -At 1 January 35,525 34,634 35,525 34,634Issue of shares 835 891 835 891At 31 December 36,360 35,525 36,360 35,525Dividend Reserve -At 1 January 2,938 1,167 2,938 1,167Final tax-exempt one-tier dividends paid of0.8 cents per share (2004: 0.4 cents pershare less tax at 20%) (2,842) (1,138) (2,842) (1,138)Proposed tax-exempt one-tier dividends of1.4 cents per share (2004: 0.8 cents per share) 5,100 2,909 5,100 2,909At 31 December 5,196 2,938 5,196 2,938Share Premium -At 1 January and 31 December 75,656 75,656 75,656 75,656Accumulated Profits -At 1 January 50,405 39,851 843 1,280Effect of adopting FRS 103 (note 6) 887 - - -At 1 January (restated) 51,292 39,851 843 1,280Net profit for the year 17,313 13,463 4,823 2,472Proposed dividends of- 0.8 cents per share (tax exempt one-tier) - (2,909) - (2,909)- 1.4 cents per share (tax exempt one-tier) (5,100) - (5,100) -At 31 December 63,505 50,405 566 843Currency Translation Reserve -At 1 January (5,865) (2,881) - -Exchange differences on translation of netassets of foreign subsidiaries 1,189 (2,984) - -At 31 December (4,676) (5,865) - -Hedging Reserve -At 1 January - - - -Net fair value changes on cashflow hedge (1,856) - - -At 31 December (1,856) - - -Total Attributable toEquity Holders of the Parent carried forward 174,185 158,659 117,778 114,962The accompanying notes form an integral part of these financial statements.<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200549