You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

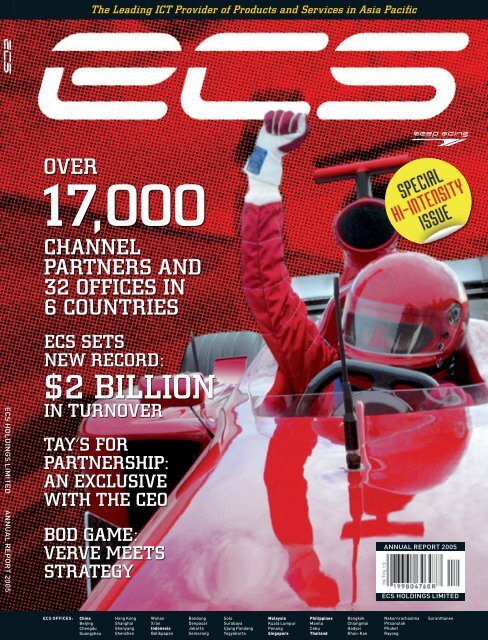

Contents04. Corporate Information05. Note from the Editor12. Chairman’s Message14. Tay’s For Partnership:An exclusive with the CEO0620. Board of Directors24. Senior Management26. 2005 Highlights27. 2005 Awards28. Group Structure0830. Corporate Governance38. Financial Report10

teamwork <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Nothing moves untileveryone is ready. Therally team is as good asits weakest link. No onewants to be that link,yet someone will alwaysfind a reason to do better.Revving up for the startexcites everyone in <strong>ECS</strong>.The collective preparationand anticipation isvery often the fun andreward in itself.Keep Going<strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

CorporateInformationBoard of DirectorsMr Lin Chien (Chairman, Independent Director)Mr Seah Moon Ming (Vice-Chairman, appointedon 3 January 2005)Mr Liu Wei (Vice-Chairman)Mr Tay Eng Hoe (Group Chief Executive Officer)Mr Narong Intanate (Executive Director)Mr Foo Sen Chin (Executive Director)Mr Chay Yee Meng (Independent Director)Mr Leong Horn Kee (Independent Director)Mrs Lee Suet Fern (Independent Director)Mr Teo Ek Tor (Independent Director)Mr Chang Yew Kong (Non-Executive Director,appointed on 9 May 2005)Mr Tan Hup Foi (Independent Director,appointed on 7 February 2006)Audit CommitteeMr Leong Horn Kee (Chairman)Mrs Lee Suet FernMr Teo Ek TorMr Chay Yee MengMr Tan Hup FoiCompensation CommitteeMr Teo Ek Tor (Chairman)Mr Lin ChienMr Chang Yew KongNominating CommitteeMrs Lee Suet Fern (Chairman)Mr Tay Eng HoeMr Leong Horn KeeMr Chay Yee MengMr Chang Yew KongAuditorKPMGCertified Public Accountants16 Raffles Quay #22-00Hong Leong Building, Singapore 048581Partner-in-chargeMs Lee Tuck Ngor, Adeline (Since FY2001)RegistrarM&C Services Private <strong>Limited</strong>138 Robinson Road #17-00The Corporate Office, Singapore 068906Registered Office19 Kallang Avenue #07-153Singapore 339410Senior Management at<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong>:Mr Tay Eng HoeGroup Chief Executive OfficerMr Jansen EkGroup Chief Operating OfficerMr Wong Heng ChongGroup Chief Financial OfficerMr Lim Tow ChengSenior Vice President, Business DevelopmentMr Eddie Foo Toon EeGroup Financial ControllerMr Adrian Chong Yew FuiGroup Internal Audit ManagerSenior Management at<strong>ECS</strong> Holding <strong>Limited</strong>’s subsidiaries:Mr Foong Kam ThoPresident<strong>ECS</strong> Computers (Asia) <strong>Limited</strong>Mr Liu Wei +Chief Executive Officer<strong>ECS</strong> Technology (China) <strong>Limited</strong>Mr Narong IntanatePresidentThe Value Systems Co., LtdMr Foo Sen ChinManaging Director<strong>ECS</strong> Kush Sdn BhdMr Lim Tow ChengChief Executive Officer (Acting)<strong>ECS</strong> Indo Pte. Ltd.Mr Nana Juhana OsayExecutive DirectorPT <strong>ECS</strong> Indo JayaMr Jimmy GoPresidentMSI-<strong>ECS</strong> Phils., Inc.Principal BankersStandard Chartered BankThe Development Bank of SingaporeOversea-Chinese Banking CorporationMalayan Banking BerhadUnited Overseas Bank <strong>Limited</strong>Company SecretaryEddie Foo Toon Ee, CPA+ Mr Foong Kam Tho was appointed CEO of <strong>ECS</strong> Chinaeffective from 1st January, 2006 (See also page 24) <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep GoingNote fromThe EditorMr Jansen Ek Group Chief Operating OfficerFrom a company with a turnover of $530 million in 2001 with presence inthree countries, we have gained enormous strides to become a truly regionalgroup with operations in six countries, breaking the $2 billion mark in salesin 2005.This fourfold surge in four years is nothing short of a formidable feat in anextremely competitive industry. In many ways <strong>ECS</strong> is akin to a top-notchFormula 1 team. With a power-charged spirit of achievement coupled withteamwork, drive and endurance — these are the very factors integral to F1victory — we have raced towards business excellence.Success has inspired us to stay the course, but at the core of it all, it is peoplethat have driven our focus — our staff, partners, associates, customersand shareholders. We conduct our day-to-day business with the maxim“Technology is a tool...people make the difference” in mind. In all that we do,we seek to add value to their lives and businesses.We’ve done well to cross the finish line in 2005 triumphantly. But we knowthe race has only begun. We have set our sights farther and wider in the daysahead. We will keep going — and keep on winning.<strong>ECS</strong> HOLDING LIMITED Annual Report 2005

drive <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Lest it seems thecircuit is but one man’sglory, let it be knownthat like fine prose theintoxicating allure ofunbridled speed on thetracks is the result of awhole ecosystem of pureadrenaline. Pure drive.In <strong>ECS</strong>, we believe thebest defence is offence.Instead of waiting forchallenges to overtakeus, we drive head on intothe fearless zone andsurmount the frontiersof our imagination.Keep Going<strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

endurance <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

It is not over until itis over. The race doesnot end until it does.While sheer grit canovercome the mostformidable odds, doubtslikewise can overtakethe enfeebled mind, nomatter how momentarythe lapse. Such is thesport’s magic. It goesalmost without sayingthat it is a tense marketout there, dynamic andrelentless. Yet <strong>ECS</strong> hasscarcely been drawntowards the easier route.Since Day 1, we havestayed the course, badeour time, and kept ourlead. Anything lessis inconceivable.Keep Going<strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

achievemen10 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

The end of a rally,regardless of the results,is always greeted withmutual recognition forhaving done the bestgiven the changingcircumstances. It is alsothe moment to raiseone’s hand and proclaim:“I will be back”. Workingwith the world’s best in<strong>ECS</strong> is a continuum ofrallies. It just goes on.It simply gets better.tKeep Going<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200511

Chairman’sMessage<strong>ECS</strong>’s profitability in 2005 outpaced2004’s by $3.9m to $17.3m ingroup net profit after tax andminority interest. Earnings pershare raced to 4.9 cents from 3.8 centsin 2004. These are due to the efforts ofmanagement, staff, and vendors, of whomI am deeply appreciative.Achieving growth in a very competitiveenvironment is no easy task but, beingranked 14 th in the inaugural SingaporeInternational 100 Ranking of companies withthe highest overseas revenue demonstratesthat success can be achieved if we stayfocused, committed, and loyal to ourpartners, customers, and stakeholders.<strong>ECS</strong> is run like a finely-tuned Formula1 (F1) racing car. A successful F1 teamneeds high-tech engineering, preciseexecution, disciplined teamwork, and anunderstanding of risk versus reward. Wehave a deep knowledge of the ICT sector,an extensive network across key marketsin the Asia Pacific, a cohesive team and theability to act at the right time.Every F1 team needs solid sponsors’backing. Vendors want to deal with strongregional players and that’s what we are– amongst the top 3 distributors in everycountry where we have a presence. Withour latest acquisition of a stake in MSI-<strong>ECS</strong> in the Philippines, where we seean ICT sector poised for good growth,we have over 17,000 channel partnersand 32 offices in six countries.A major regional player needs anextensive network. So we keepstrengthening our geographicalreach for wider pan-Asian coverageto better serve our customers.Like F1, the barriers of entry arevery high, few have succeededin the highest echelons of ICTdistribution.More than just track record,financial resources and theman at the steering wheel,there remains a whole host ofsupport that keeps the competitive enginerevving in top form regardless of externalconditions. This is the amazing effort of acomplete team.That is why a world-class driver requiresdedicated teamwork to achieve perfection ina race. Likewise, in managing a group – themanagement team needs support to maketough decisions in a highly competitiveoperating environment.The Group expects to do well, delivering onwhat we have committed to achieve. I amconfident that we are on the right track withour geographical expansion, consolidationof our China operations, and move towardsthe higher-margin Enterprise Systems andAccessories businesses.Already a $2 billion group by sales, we willcontinue to work our capital and assetsmore efficiently and manage costs. Weare on track to rev up earnings quality andincrease shareholder value.In our planned succession for our Chinaoperations, our Vice-Chairman, Liu Wei,has been promoted to Chairman of <strong>ECS</strong>Technology China. Mr Foong Kam Tho waspromoted to Chief Executive Officer.We welcome Mr Tan Hup Foi to the Boardas an independent director. He replacesMr Wang Fangmin, whom we thank for hissterling service.We strive to look for ways to improve overallreturns to shareholders. With our consistentand improved profit performance in 2005,we are proposing to reward shareholderswith a one-tier tax exempt dividend of 1.4cents per share for the year compared to 0.8cents in 2004.Again, I want to thank shareholders,management, and staff for their continuedsupport, without which <strong>ECS</strong> cannotsuccessfully perform.Lin ChienChairmanApril 200612 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep Going<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200513

Tay’s forPartnership:an exclusive with the CEOOverviewIt was an invigorating year for <strong>ECS</strong> as wecrossed 2005’s finish line with a record ofover $2.0 billion in revenue. The marketenvironment remains challenging but webenefited from the ongoing build-out ofour pan-Asia network.Our ability to capture greater vendorand customer mindshare helped usgained market share, even as theregional Information & CommunicationsTechnology (ICT) supply chain continues toconsolidate.Our profit record is the culminationof our team’s in-depth marketknowledge, careful planning, andprecise execution of a focusedstrategy, honed through yearsof operating in Asia Pacific.Ever alert to growthopportunities, we acceleratedour move up the value-addedchain, with encouraging earlyresults. Our concerted pushinto China’s EnterpriseSystems business segmentand the Accessoriessegment in Singaporecontributed positively.I am pleased to report<strong>ECS</strong> delivered again bymaintaining our unbrokenprofit record, with 2005group net profit attributableto shareholders hitting $17.3million. Net tangible assetsper share leapt to 38.7 cents,against 35.5 cents in 2004. Returnon shareholders’ equity also rose to10.4% from 8.8%.Operational ReviewEnterprise SystemsEnterprise Systems’ sales were 2005’skey revenue and earnings drivers, withrevenue growing a robust 24.9% to$781.1 million on strong demand forenterprise servers, software and networkinfrastructure products. Contribution toGroup revenue rose to 38.4% in 2005, from33.5% in 2004, while the share of profitbefore interest and tax (PBIT) increasedto 49.8%, from 40.8%.Taking advantage of buoyant corporatedemand, to improve profitability, we shiftedgears in China, pushing aggressivelyinto the higher-margin Enterprise Systemsbusiness segment. Our success significantlyboosted Enterprise Systems’ 2005performance, with its PBIT roaring 42.1%to $14.9 million, from $10.5 million in 2004.DistributionDistribution sales improved marginallyby 1.5% to $1.23 billion in 2005. Growthmoderated due mainly to our plannedmove away from the lower-margindistribution business in China. However,the strong 28.0% surge in South EastAsia’s sales more than offset China’ssales decline. In particular, Malaysia andThailand exceeded expectations with salesup 59.9% and 30.3%, respectively.Digital consumer electronics, the fastestgrowingproduct segment in 2005,contributed some in excess of 10% to Grouprevenue. Our success with iPod openedup opportunities with other vendors andproducts. New products added during theyear, such as HP iPAQ smartphone, O2 PDAphone, etc, also boosted our network’srevenue yield. The Group continues to beon the look out for exciting new productsthat enhance our consumer electronicproduct offerings.14 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep Going<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200515

Revenue ByBusiness Segment ($M)Revenue ($M)‘021,185.3‘031,422.8‘041,865.7‘052,036.3DistributionEnterprise SystemsIT Services1,233.2781.122.0Revenue ByGeographical Segment ($M)IT ServicesPerformance for the IT Services segmentwas rather mixed. Revenue for China rose,as the Group secured more EnterpriseSystems’ sales, but declined in Singaporeprimarily due to a lack of major projectsin 2005. Singapore’s 2004 performancewas boosted by a couple of majorregional projects. Despite the competitiveenvironment, Malaysia and Thailandreported steady IT services revenue fromrecurrent contracts.During 2005, the Group invested andbuilt up the infrastructure and trainingprocesses, to enhance and support theknowledge and expertise of the servicesteams in the various countries. Inparticular, the Group is positioning itsteam to capture the rising demand for ITservices in China.Geographical market reviewSouth East AsiaSouth East Asia overtook China for thefirst time to contribute 50.2% to 2005’srevenue. South East Asia’s revenue grew22.7% to $1.02 billion, underpinned bythe strong resurgence in distributionsales growth in Malaysia, Indonesia, andThailand. South East Asia also contributedto a higher share of 2005’s PBIT at 55.2%.MalaysiaMalaysia was the star performer in2005, with revenue revving 50.1% against2004. The supply chain consolidationstrengthened our partnership withleading PC vendors and we gained marketshare. Demand was particularly strongfor desktops, notebooks, and printersupplies that drove the 59.9% surge inDistribution sales.South East AsiaNorth Asia1,022.81,013.5AccessoriesAfter a successful pilot run in 1H05,we officially launched our accessoriesbusiness in Singapore in mid 2005. Fromaccessories bundling via existing dealersfor Apple iPod, we expanded to otherPDAs, phones, and PC accessories. The2H’s results were very heartening witha fourfold revenue leap and a positivecontribution to Group earnings.We are excited about this business’ growthprospects. The regional market (excludingChina) is currently fragmented and thereare no dominant players as yet. With ourextensive network, we are well positionedto capture more market share from thegrowing market in the next three years.Enterprise Systems also did well with31.9% rise in revenue. Several majorprojects for the Ministry of Education,Government Audit Department, NationalRegistration Department, and NationalDefence Department were completedduring the year.SingaporeRevenue improved by 6.3%, underpinned,by 13.0% growth in Enterprise Systemssales. Market condition remainedcompetitive. To enhance our revenue yieldand profitability, we extended our agency’sbreadth and depth during the year. Usingnew, expanded channels in the audio/visualand telecom segment, from our successwith the iPod’s launch in 2004, we pushed16 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep GoingRevenue By Business Segment ($M)Profitability ($M)21.322.5‘02‘03474.1 683.5 27.71,185.3569.8 833.0 20.01,422.814.29.719.113.517.3625.6 1,215.2 24.9‘04‘05EnterpriseSystems1,865.7781.1 1,233.2 22.0DistributionITServices2,036.3more products through, including the newAccessories business. Opening Appleservice centers and HP parts distributioncenter are initiatives to enhance our valueaddedservices.ThailandThailand had a slow start to 2005 asthere were fewer government projects.This affected the Enterprise Systemssales. But, overall revenue grew 17.8% onstrong Distribution sales growth of 30.3%,boosted by expanded product offeringssuch as O2 PDA phones, Nokia, NetApp,and Oracle.IndonesiaIndonesia strengthened its infrastructureand regional coverage outside itstraditional Jakarta stronghold, with keyfocus in the Surabaya and Yogyakarta.We were recognized by Cisco as the BestDistributor for 2005, and appointed by HPto be the top distributor for consumerproducts in Indonesia. Strong corporatedemand, across a broad spectrum ofindustries, boosted overall revenuegrowth of 35.4%.North AsiaLast year was challenging but rewardingfor our China operations. The team’ssteadfast execution of the business shiftto focus on Enterprise Systems led to a31.6% surge in Enterprise Systems’ sales.Overall revenue for North Asia eased 1.8%to $1.01 billion, arising from a declinein Distribution sales as we scaled backlower-margin consumer ICT products.6.3‘02 ‘03 ‘04 ‘05Profit Before TaxProfit After TaxMarket consolidation following the mergerof one of our key PC and notebook vendorsalso affected our China Distribution salesin the first half of 2005. Demand hadbottomed out by the end of third quarter,with firm recovery in the fourth quarter.One positive development was therevaluation of the renminbi in 2H05 thatboosted our profitability. The improvementin revenue mix, coupled with positivecurrency effect, lifted PBIT margins forNorth Asia to 1.3% in 2005, up from 0.9%in 2004.Financial ReviewKey operating efficiencies and financereturns broadly improved in 2005. A betterrevenue mix stabilized the gross marginabout 4.7%, similar to levels achieved in2004.We diligently kept a tight rein on expenditurebut continued to invest in selected areaswhich are crucial to sustaining earningsgrowth. As we added headcounts to pushaggressively into the Enterprise Sector,especially in China, operating expensesrose by 12.1% to $71.0 million, but stillat a low 3.5% of sales, marginally higherthan 2004’s 3.4%. However, we were ableto keep our overheads low as a result fromthe significant economies of scale – whichis a critical success factor in our business.Net profit margin rose to 0.9% in 2005, upfrom 0.7% in 2004.Working capital remained a key focus areafor management. Net gearing ratio stoodat 0.8x, compared with 0.7x in 2004.<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200517

Keep GoingProfitFocus on increasingour revenue yieldand shareholders’ returnImproveProfitabilityGrow highvalue-addedproduct businessGeographicand channelexpansionImprove ChinaContributionContinue efficientmanagement ofworking capital andlower costGrow servicesbusinessStrategic DirectionsOutlook – The Next CircuitFor 2006, management will stay focused onenhancing profitability. We are adopting athree-pronged approach to improve profitsand returns:Harvest the value ofour extensive regional networkIn January 2006, we acquired a 50% equitystake in MSI, the No. 2 ICT distributor inthe Philippines. The deal strengthenedour leading position in Asia Pacific, as wenow cover six countries in 32 cities. Whilewe still seek to expand geographically, ourpriority is to maximize the revenue streamfrom our existing network.Leading vendors value our extensivenetwork of over 17,000 partners acrossthe ICT, audio/visual, and telco channelsfor their market breadth and depth.We are able to support vendors in theircommercial and consumer productofferings region-wide.Enhance profitability viaimproved product mixWe will keep accelerating the shift inChina’s business mix to better-marginedproducts and services by building on thegrowing demand for Enterprise Systemsthere. With the addition of Huawei-3Comin November 2005, we lined up aggressiveinitiatives to capture the growing networkand communications market.The Group has scored well with digitalconsumer electronic products such asiPod, Smart-phones and PDA phones. Wesee good regional opportunities to expandand scale our portfolio of new and excitingproducts in this fast-growing segment ofthe ICT market.We are excited about our Accessoriesbusiness prospects. Our 2006 focus is tobuild a strong brand name and expand ourregional markets – Malaysia, Indonesiaand Thailand in 1H06, China in 2H06. Weare confident of replicating our Singaporesuccess in the other regional markets.Increase operating andfinancial efficienciesOur management will spare no effortsto improve productivity and operatingefficiency. We will persevere in improvingon our capital management to boostreturns to shareholders.We are committed to our mission to createshareholder value via medium and longterm strategic initiatives. The industry hasmany challenges but we see opportunitiestoo and we are optimistic that 2006 will beanother good year.I applaud our staff for a job well done andtheir unwavering dedication to the Group’ssuccess. My heartfelt thanks to our vendors,customers, and shareholders for theircontinuous support. We look forward tosharing the podium for many more years.Tay Eng HoeGroup CEOApril 2006<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200519

1 2Board of directors341. Mr Lin ChienMr Lin Chien was appointed Chairman of the Board on 1 October 1998and is also a member of the Compensation Committee. He was theExecutive Vice President of Solectron Corporation and was President,Solectron Asia/Pacific, a position he held until 31 March 2004. Mr Linbegan his career with General Instruments of Taiwan, specializing inthe areas of production, quality and engineering. Mr Lin previouslyworked for SCI Systems (now known as Sanmina-SCI), where he wasresponsible for leading the company’s expansion into Asia and foundedSCI’s Singapore site in 1984. He was Chief Executive Officer of NatsteelElectronics from 1993 to 2001 and was instrumental in transformingNatsteel Electronics into the sixth largest contract manufacturer inthe world. Natsteel Electronics was acquired by Solectron Corporationin 2001. Mr Lin is also the Chairman of Mototech Co and AlliedIntegrated Patterning Corporation. Mr Lin is also a director of Hi-PInternational <strong>Limited</strong>, which is listed on Singapore Exchange SecuritiesTrading <strong>Limited</strong>. He holds a Bachelor of Science degree in ElectricalEngineering from the Taipei Institute of Technology.2. Mr Seah Moon MingMr Seah Moon Ming was appointed Vice Chairman of the Company on 3January 2005. He is Deputy CEO of Singapore Technologies Engineering<strong>Limited</strong>, overseeing the Electronics and Land Systems sectors ofbusiness. He is concurrently President, Singapore TechnologiesElectronics Ltd, a position he has held since 8 December 1997 afterserving as Managing Director from 1 July 1997. He is Chairman of iDirect,Inc, Guizhou Jonyang Kinetics Co., Ltd and Unicorn Pte Ltd. He is alsoVice Chairman of Trek 2000 <strong>Limited</strong>. Mr Seah holds a Master of Sciencein Electrical Engineering, with distinction, from the Naval PostgraduateSchool, USA. Mr Seah is Adjunct Professor to the National University ofSingapore’s Entrepreneurship Centre and Deputy Chairman of the Boardof Governors of Temasek Polytechnic as well as a Fellow of the Institutionof Engineers Singapore. He is also a member of the International AdvisoryPanel of the National Information & Communications Technology,Australia; an Executive Council member of the China Council for thePromotion of International Trade and a member of the Network IndiaSteering Committee of International Enterprise Singapore.3. Mr Liu WeiMr Liu Wei was appointed Vice Chairman of the Company on 3December 2001 and is currently the Chairman of <strong>ECS</strong> Technology(China) <strong>Limited</strong>, our subsidiary in China. Mr Liu is one of the foundingmembers of Pacific City International <strong>Holdings</strong> <strong>Limited</strong>, a substantialshareholder of the Company and has more than 16 years of experiencein the IT industry in China. Mr Liu has assumed the positions of ViceChairman of Guangdong CAD and Executive Chairman of GuangdongAcademy of Electronics, and is a member of Guangzhou People’sCongress. In recognition of his contributions and achievements,Mr Liu had received many awards from the Guangzhou Governmentand Industry Publications including, “Ten Best Young Achievers” by theGuangzhou Government in 1998 and was listed by Computer World asIT Fortune Top 50 by Computer World in 2001. He was awarded ChinaChannel Permanent Achievement Medal by Computer Business Newsin 2002. He was recipient of the “Outstanding Enterprise ContributionAward” in 2003 and was recognized in 2004 as one of the top 10 ITleaders in China. Mr Liu graduated with a Bachelor’s degree in AppliedMechanics from the Zhongshan University, PRC.4. Mr Tay Eng HoeMr Tay Eng Hoe was appointed the Executive Director of the Company on1 April 2000. He is also the Group Chief Executive Officer of the Companyand a member of the Nominating Committee. Mr Tay is the founder of<strong>ECS</strong> Computers (Asia) Pte Ltd, our Singapore subsidiary and bringstogether with him more than 20 years of experience in the IT Distributionbusiness. Mr Tay is a Non-Executive Director of AusGroup <strong>Limited</strong> andsits on the Boards of various companies and government statutoryorganizations and is also actively involved in charitable organizations.He sits on the Board of International Enterprise Singapore and is also amember of their Audit Committee. He is also a councillor of the SingaporeInfocomm Technology Federation. Mr Tay is a member of the Committeeon Industry & Development of the Singapore Corporation of RehabilitativeEnterprise (SCORE) as well as a member of the Mechanical EngineeringAdvisory Committee of the Ngee Ann Polytechnic. Mr Tay was conferredthe Pingat Bakti Masyarakat (PBM) by the President of Singapore in2005. Mr Tay holds a Bachelor of Science (Honours) degree from La-Trobe University and a Master of Business Administration degree fromMelbourne University.20 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep Going87565. Mr Narong IntanateMr Narong Intanate is the founder and President of The Value SystemsCo., Ltd., our subsidiary, since 1988. He is actively involved in themanagement of The Value Systems Co., Ltd. and plays a pivotal role insteering the strategic direction of The Value Systems. He was appointedas an Executive Director of the Company on 15 December 2000. He isan advisor of the Hatyai University and the Srinakharinwirot UniversitySecondary Demonstration School, Prasarnmit. He holds a Bachelorof Science in Business Administration and a Master of BusinessAdministration from California State University. Prior to forming TheValue Systems Co., Ltd., he was the Marketing Manager of SahaviriyaInfortech Computers Co., Ltd. from 1982 to 1983 and the MarketingDirector of Sahaviriya OA from 1983 to 1988.6. Mr Foo Sen ChinMr Foo Sen Chin was appointed as an Executive Director on 15December 2000. He is also the Managing Director and founder of <strong>ECS</strong>Kush Sdn Bhd, our subsidiary. Mr Foo plays a pivotal role in steeringthe strategic direction of <strong>ECS</strong> Kush Sdn Bhd. His responsibilitiesinclude the development of its long term business goals, overalloperation and administrative management of <strong>ECS</strong> Kush. Prior tojoining our Group, he was the General Manager of a computer bureauservices company in Kuala Lumpur before forming <strong>ECS</strong> KU Sdn Bhd(formerly known as K.U. Sistems Sdn Bhd) in 1985. Mr Foo has aBachelor of Science degree in Electrical and Electronic Engineeringfrom the University of Birmingham, UK and he also holds a Master’sdegree in Business Administration from the Cranfield School ofManagement in the United Kingdom.7. Mr Chay Yee MengMr Chay Yee Meng is an Independent Director of our Company and amember of the Audit Committee. He was appointed as a Director ofour Company on 1 October 1998 and was one of the founding directorsof the Company. He is also Director of <strong>ECS</strong> Computers (Asia) Pte Ltd,The Value Systems Co., Ltd., and <strong>ECS</strong> Kush Sdn Bhd. In addition, MrChay is currently Deputy Chairman & CEO of Infowave Pte Ltd andChairman of the Audit Committee of Trek 2000 Ltd. He holds a Bachelorof Accountancy degree from Nanyang University. He was a Directorand Chief Financial Officer of Natsteel Electronics Ltd / SolectronTechnology Singapore Pte Ltd from 1993 to 2002. Mr Chay became aDirector of National Kidney Foundation since 17 January 2006.8. Mr Leong Horn KeeMr Leong Horn Kee, was appointed as an Independent Director on15 December 2000, and currently serves as Chairman of the AuditCommittee and a member of the Nominating Committee. He iscurrently the Chief Operating Officer and Executive Director of FarEast Organization. Mr Leong is a Member of Parliament and Chairmanof Parliament’s Public Accounts Committee. Mr Leong has beenappointed Singapore’s Non-Resident Ambassador to Mexico in 2006.He graduated with a Bachelor of Technology in Production Engineeringfrom Loughborough University in the United Kingdom. He also holdsan Economics degree from the University of London and a Masters inBusiness Administration from INSEAD, France.<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200521

Board of directors10119129. Mrs Lee Suet FernMrs Lee Suet Fern is an Independent Director of our Company andcurrently serves as Chairman of the Nominating Committee and amember of the Audit Committee. She was appointed a Director ofour Company on 15 December 2000. She is a practising advocate andsolicitor of the Supreme Court of Singapore and works at StamfordLaw Corporation as its Senior Director. She has extensive experienceas a corporate law practitioner in Singapore and London and serveson the boards of listed companies as well as professional and otherorganisations. She qualified as a barrister-at-law at Gray’s Inn, Londonand graduated from Cambridge University with a double first in law.10. Mr Teo Ek TorMr Teo Ek Tor joined the Board on 4 March 2002 and became thean Independent Director on 6 January 2003. He is Chairman of theCompensation Committee and a member of the Audit Committee.Mr Teo is the Managing Partner of PrimePartners Asset ManagementPte Ltd which manages private-equity funds. He has over 25 yearsof experience in investment banking in Asia. Mr Teo has contributedto and been instrumental in the building up of two major regionalinvestment banking groups – Morgan Grenfell Asia (1980-1993) andBNP Prime Peregrine (between 1994-1999). Mr Teo is a graduate ofthe University of Western Ontario, with an Honours degree in BusinessAdministration.11. Mr Chang Yew KongMr Chang Yew Kong was appointed as a Non-Executive Director on9 May 2005 and is a member of the Nominating and CompensationCommittees. He is currently President, ST Electronics (Info-SoftwareSystems) Pte Ltd, a wholly-owned subsidiary of ST Electronics. MrChang graduated from the then University of Singapore with a Bachelorof Electrical Engineering (First Class Honours) in 1978. He completedhis Masters in Engineering and a Diploma in Business Administrationin the National University of Singapore in 1982 and 1984 respectivelyand attended the Stanford-NUS Executive Program. He served in theDefence Science Organisation/MINDEF and Data General Singaporebefore joining Singapore Technologies. He worked in various seniormanagement positions in Singapore Computer Systems Ltd from1987 to 1996.12. Mr Tan Hup FoiMr Tan Hup Foi was appointed as an Independent Director on7 February 2006, and currently serves as member of the AuditCommittee. He was the Chief Executive of Trans-Island Bus Services Ltdfrom 1994 to 2005 and also the Deputy president of SMRT CorporationLtd from 2003 to 2005. Mr Tan is known internationally as the HonoraryVice President of the International Association of Public Transport.Mr Tan is the Chairman of Ngee Ann Polytechnic and also the Chairmanof Industrial & Services Cooperative Society Ltd as well as a Boardmember of the National Environment Agency. He was awarded thePingat Bakti Masyarakat (The Public Service Medal) by the Presidentof Singapore in1996. Mr Tan graduated from Monash University inAustralia with a First Class Honours degree in Mechanical Engineeringin 1974 and he obtained a Master of Science (Industrial Engineering)degree from University of Singapore in 1979.22 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep Going<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200523

Senior Management(Country CEOs)From left to right: Mr Foo Sen Chin, Mr Nana Juhana Osay, Mr Liu Wei, Mr Narong Intanate, Mr Foong Kam Tho, Mr Jimmy Go & Mr Tay Eng HoeMr Tay Eng Hoe (please refer to page 20 for his profile)Mr Liu Wei (please refer to page 20 for his profile)Mr Narong Intanate (please refer to page 21 for his profile)Mr Foo Sen Chin (please refer to page 21 for his profile)Mr Foong Kam ThoMr Foong Kam Tho is the President of <strong>ECS</strong> Computers (Asia) Pte Ltd,our subsidiary. He joined <strong>ECS</strong> Computers (Asia) Pte Ltd in 1985 andhas had more than 20 years experience in the industry. Mr Foongholds a Bachelor of Science degree (Computer Science) from theNational University of Singapore. Mr Foong was posted as Senior VicePresident of <strong>ECS</strong> China, focusing on the value added business unit inNovember 2003. He was promoted to Chief Executive Officer of <strong>ECS</strong>China effective from 1 January 2006.Mr Nana Juhana OsayMr Nana Juhana Osay is the Executive Director of PT <strong>ECS</strong> Indo Jaya.He is responsible for overseeing <strong>ECS</strong> Indonesian operations and hasover 15 years experience in the IT industry. Mr Osay was appointedSecretary General for Indonesia Computer Business Association, aposition he held since 1999. Mr Osay was educated in the BandungInstitute of Technology from 1976 to 1981.Mr Jimmy GoMr Jimmy Go is the founder and President of MSI-<strong>ECS</strong> Phils. Inc. Hehas more than 23 years of experience in the Information Technologyindustry in the Philippines. He started the IT industry way back in 1982after graduating from College selling Fujitsu & Apple computers. Hecurrently holds a Bachelor degree in Electronics & CommunicationEngineering from De La Salle University with an award of MagnaCum Laude and Post Graduate degree of Masters in BusinessAdministration in Ateneo de Manila University. Mr Go was also thepast President of COMDDAP (Computer Manufacturers, Distributors& Dealers Association of the Philippines). In 1998, Mr Go was namedPresident and CEO of MSI-Digiland. He was instrumental in growingthe business of MSI in the Philippines making it one of the biggest I.T.distributor in the country in less than 5 years.24 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep GoingSenior Management(Corporate Headquarters)From left to right: Mr Eddie Foo, Mr Lim Tow Cheng, Mr Wong Heng Chong, Mr Jansen Ek, Mr Adrian Chong & Mr Tay Eng HoeMr Tay Eng Hoe (please refer to page 20 for his profile)Mr Wong Heng ChongMr Wong Heng Chong is the Group Chief Financial Officer of theCompany. Mr Wong is a member of The Institute of CharteredAccountants in Australia and holds a diploma in Management Studiesfrom the University of Chicago Graduate School of Business. Prior tojoining the Group, he was an Executive Director of Boustead Singapore<strong>Limited</strong>. He was also a Director and the group financial controller ofQAF <strong>Limited</strong>. Prior to joining QAF <strong>Limited</strong>, he was a Director and GroupGeneral Manager of Sunshine Allied Investments <strong>Limited</strong> (now knownas Network Foods International <strong>Limited</strong>).Mr Jansen EkMr Jansen Ek was appointed Group Chief Operating Officer on 17January 2002. He is responsible for the overall operational managementof the Group including setting business strategies and building longtermcustomers, partners and employee’s relationships. Mr Ek hasmore than 20 years of experience in the IT industry. Prior to joining theGroup, Mr Ek was the Vice-President of Silicon Graphics Inc and hasworked with Hewlett-Packard Company for 21 years, holding varioussenior management positions. Mr Ek holds a Bachelor of Engineering(Honours) from the University of Singapore.has previously worked with Digiland International Ltd for more than8 years, holding several senior management positions, including asChief Executive Officer. Mr. Lim has an Honours Degree in Economicsfrom the National University of Singapore.Mr Eddie FooMr Eddie Foo is the Group Financial Controller and is also the CompanySecretary of the Group. He is responsible for the financial managementof the Group, which covers accounting, treasury, tax, financial controland reporting. Prior to joining the Group, Mr Foo worked for Dell asits Regional Controller. Mr Foo holds a degree in Accountancy from theNanyang Technological University and is a member of the Institute ofCertified Public Accountants in Singapore.Mr Adrian ChongMr Adrian Chong is the Group Internal Audit Manager of the Company. Heis a member of CPA Australia and a member of The Institute of InternalAuditors. Prior to joining the Group, he joined Natsteel Electronics Ltdin 1998 and was seconded to Guangzhou as the Finance Manager ofthe joint venture between Pacific City International <strong>Holdings</strong> Ltd andSolectron Asia in 2000. The joint venture was subsequently acquired bythe Company as the current <strong>ECS</strong> China, and Mr Chong was appointedto his current position since January 2002.Mr Lim Tow ChengMr Lim Tow Cheng was appointed Senior Vice President, BusinessDevelopment on 18 October 2005. He is responsible for managingthe regional expansion strategy and for identifying new businessopportunities of the Group. Mr Lim has more than 20 years ofexperience in the trade and IT senior management. Prior to joining theGroup, Mr Lim was the Director for South Asia of Western Digital and<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200525

2005HighlightsJanuary - March• The Value Systems appointed Distributor for BEA Systems products in Thailand• The Value Systems opened 10 th branch of Service Center in Rayong ProvinceApril - June• The Value Systems appointed Distributor for LG products in Thailand• The Value Systems appointed Distributor for Motorola Two-Way radio products in Thailand• <strong>ECS</strong> Pericomp appointed Distributor for Motorola• <strong>ECS</strong> Astar appointed Distributor for Huawei-3ComJuly - September• The Value Systems appointed Distributor for Panda Software products in Thailand• The Value Systems appointed Distributor for O2 products in Thailand• <strong>ECS</strong> Pericomp appointed Distributor for BEA, Juniper and Red Hat• <strong>ECS</strong> Astar appointed Distributor for Linksys and Samsung• <strong>ECS</strong> Singapore appointed Exclusive Distributor for HP PDA phones• <strong>ECS</strong> Singapore appointed Distributor for OKIOctober - December• The Value Systems appointed Distributor for Socomec Unitrio UPS products in Thailand• The Value Systems appointed as Distributor for Lenovo products in Thailand• <strong>ECS</strong> Indo appointed Distributor for HP’s imaging and printing consumer products and services• <strong>ECS</strong> China appointed Distributor for Huawei-3Com networking products• <strong>ECS</strong> Singapore appointed Distributor for Quest Software• <strong>ECS</strong> Singapore commissioned HP Spare Parts business• <strong>ECS</strong> Singapore commissioned Apple Service Center26 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep Going2005AwardsRegional• Ranked 6 th Fastest Growing Tech Companies by ZDNetAsia Top Tech Index• Apple Top Regional Partner (Asia)• BEA Distributor of the Year, FY05, ASEANSingapore• Top 14 th amongst companies in inaugural SingaporeInternational 100 ranking• Top 25 th fastest growing companies in Singapore byDP Information Group• Fuji-Xerox Achievement of Breakthrough Sales for Phaser3116 / Docuprint C525 in Singapore for FY2004/05• HP Top Commercial Growth Partner 1st Half FY 2005• HP Top Consumer Growth Partner 1st Half FY 2005• HP Top Enterprise Growth Partner 1st Half FY 2005• HP Top Overall Growth Contributor 1st Half FY 2005• HP Top Enterprise Revenue Contribution 1st Half FY 2005• Oracle Value Added Distributor of the Year• Top Platform Partner for Sun/Oracle• Top Platform Partner for HP/OracleMalaysia• HP Top Wholesaler for Commercial Portables• HP Top Master Parts Reseller for South East Asia• HP Top CIP (Consumer Imaging Printing) Wholesaler FY2005• HP Top Supplies Wholesaler FY2005• HP Best Wholesaler of the Year FY2005• SUN Top Channel Development Partner• IBM Top Software Partner• Huawei Top Distributor FY2005• Lexmark Outstanding Performance Annual DistributorThailand• HP Business Critical Systems Excellence Award 2005• HP Best Performance Award 2H05 of Imaging andPrinting Group Business• HP Best Performance Award 2H05 of Personal SystemsGroup Business• Microsoft Partner Excellence Award 2005• The Professional Services Team won the 2nd Runner UpTech Mastermind in APAC from Cisco in 2005China• HP Commercial PC Top Distributor FY 2005• HP Commercial Computer Peripheral EquipmentTop Contribution FY2005• HP Top Linearity Growth Program• D-Link Top Distributor FY2005• IBM Long Period Service Partner• IBM Asia Pacific Business Partner• China Second Distributor by China Information Worldin April 2005• Second Distributor of China by Computer Partner World• China Yearly Distributor chosen by Computer Partner World• China 2 nd Largest Distributor by Smart Partners• China Computer Times awards <strong>ECS</strong> China with “2005 ITDeployment Achievement Award”• “Enterprise contributing to the development of Chinainformation industry for the past 20 years” - awarded byChina Department of Information Industry• Top 100 Best Administered Enterprises awarded by Talents,Beijing Youth Report, Phoenix TV and Sina.comIndonesia• Cisco Best Distributor 2005<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200527

GroupStructure<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong>ThailandSingaporeChinaMalaysiaIndonesiaPhilippinesThe ValueSystems Co., Ltd<strong>ECS</strong> Computers(Asia) Pte Ltd<strong>ECS</strong> Technology(China) <strong>Limited</strong><strong>ECS</strong> KushSdn Bhd<strong>ECS</strong> IndoPte Ltd<strong>ECS</strong> Infocom(Phils) Pte Ltd100%100%100%60%60%100%Astar Technology(S) Pte Ltd100%<strong>ECS</strong> Technology(Guangzhou)Co., Ltd100%<strong>ECS</strong> PericompSdn Bhd80%PT <strong>ECS</strong>Indo Jaya100%MSI-<strong>ECS</strong>Phils., Inc50%<strong>ECS</strong> TechnologyCo., Ltd100%<strong>ECS</strong> KUSdn Bhd100%<strong>ECS</strong> InternationalTrading (Shanghai)Co., <strong>Limited</strong>100%<strong>ECS</strong> ChinaTechnology (Shanghai)Co., <strong>Limited</strong>100%<strong>ECS</strong> AstarSdn Bhd100%<strong>ECS</strong> ICTSdn Bhd70%PCS Trading<strong>Limited</strong>100%28 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Board Membership & Board PerformanceCorporateGovernance Statement(CON’T)Principle 4 :Principle 5 :There should be a formal and transparent process for the appointment of new directors to the Board. As aprinciple of good corporate governance, all directors should be required to submit themselves for re-nominationand re-election at regular intervals.There should be a formal assessment of the effectiveness of the Board as a whole and the contribution by eachdirector to the effectiveness of the Board.The Nominating Committee was formed on 6 January 2003 and comprises five directors, including 3 independent directors, Mrs LeeSuet Fern, Mr Leong Horn Kee, and Mr Chay Yee Meng, 1 non-executive director, Mr Chang Yew Kong, and 1 executive director, MrTay Eng Hoe. Mrs Lee Suet Fern is the Chairman of the Nominating Committee.The role of the Nominating Committee is to perform the following functions:a) identifies and reviews all nominations for Board appointments and re-nominations of directors;b) assesses the effectiveness of the Board as a whole and the contribution by each individual director to the effectiveness of theBoard; andc) determines whether or not a Director is independent.In accordance with the Company’s Articles of Association, at each Annual General Meeting, one-third of the Board shall retire fromoffice by rotation provided that no Director holding office as Managing or Joint Managing Director shall be subject to retirement byrotation or be taken into account in determining the number of Directors to retire.Access to InformationPrinciple 6 :In order to fulfil their responsibilities, board members should be provided with complete, adequate and timelyinformation prior to board meetings and on an on-going basis.All directors are provided with complete, adequate and timely information prior to meeting and on a regular basis to enable them toperform their roles properly. All directors have separate and independent access to senior management and the company secretary.Should directors, whether as a group or individually, need independent professional advice in the furtherance of their duties, cost ofsuch professional advice will be borne by the Company.(B)REMUNERATION MATTERSProcedures for Developing Remuneration PoliciesPrinciple 7 :There should be a formal and transparent procedure for fixing the remuneration packages of individual directors.No director should be involved in deciding his own remuneration.The Compensation Committee oversees the general compensation of employees of our Group with a goal to motivate, recruit andretain employees and directors through competitive compensation and progressive policies. In particular, the CompensationCommittee is responsible for overseeing our employee profit sharing scheme as well as the share incentives, including the <strong>ECS</strong>Share Option Scheme I and <strong>ECS</strong> Share Option Scheme II. The Compensation Committee of the Board comprises Mr Teo Ek Tor, MrLin Chien, and Mr Chang Yew Kong. Mr Teo Ek Tor is the Chairman of the Compensation Committee.Level and Mix of Remuneration; Disclosure of RemunerationPrinciple 8 :The level of remuneration should be appropriate to attract, retain and motivate the directors needed to run thecompany successfully but companies should avoid paying more for this purpose. A proportion of the remuneration,especially that of executive directors, should be linked to performance.32 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep GoingCorporateGovernance Statement(CON’T)Principle 9 :Each company should provide clear disclosure of its remuneration policy, level and mix of remuneration, and theprocedure for setting remuneration, in the company’s annual report.The Group’s remuneration policy is to provide a competitive remuneration package so as to attract, retain and motivate directors andsenior management of the required experience and expertise to run the Group successfully. In setting remuneration packages forexecutive directors and senior management of the Group, the pay and employment conditions within the industry and in comparablecompanies are taken into consideration.The compensation package of the Group’s executive directors including its Group CEO and senior management consists of salary,allowances, share options and bonuses which are conditional upon meeting certain performance targets.Non-executive directors have remuneration packages which consist of a directors’ fee component and a share option componentpursuant to the Company’s Share Option Scheme. The directors’ fee policy is based on a scale of fees divided into basic retainerfees as a director and additional fees for serving on board committees. Directors’ fees for non-executive directors are subject to theapproval of shareholders at the Annual General Meeting. The report on directors’ remuneration is given below:Summary compensation table for the year ended 31 December 2005Name of DirectorSalary%Bonus%Fees%Allowances andother Benefits%Total%$750,000 to below $1,000,000Tay Eng Hoe$500,000 to below $750,000Narong Intanate$250,000 to below $500,000Foo Sen ChinWang FangminBelow $250,000Liu WeiLin ChienChay Yee MengLeong Horn KeeLee Suet FernTeo Ek TorSeah Moon MingChang Yew Kong5243649895-------384923-----------1--1001001001001001001001081225-------100100100100100100100100100100100100Executives’ RemunerationRather than setting out the names of the top five key executives who are not also directors of the Company, we have shown a Groupwidecross-section of executive remuneration by number of employees earning $100,000 upwards in bands of $250,000 below. Thisshould give a macro view of the remuneration pattern in the Group, while maintaining confidentiality of staff remuneration matters.<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200533

CorporateGovernance Statement(CON’T)NO. OF EXECUTIVES IN REMUNERATION BANDSTotal CompensationNo. of Employees(Note 1)Total VariableCompensation(Note 2)Total FixedCompensation(Note 3)Total Remuneration$100,000 to $249,999$250,000 to $499,999$500,000 to $749,9991531$ 607,736$ 717,547$ 137,710$1,656,441$ 602,549$ 422,729$2,264,177$1,320,096$ 560,439Total19$1,462,993$2,681,719$4,144,712Notes :1. Including employees in local and overseas subsidiaries2. Sales commission, bonus and other statutory contributions3. Inclusive salaries, AWS, related CPF and other statutory contributions, allowances and fringe-benefits.There are no employees in the Group who are immediate family members of a director or the Group CEO.(C)ACCOUNTABILITY AND AUDITAccountabilityPrinciple 10 :The Board should present a balanced and understandable assessment of the company’s performance,position and prospects.In presenting the annual financial statements and quarterly announcements to shareholders, it is the aim of the Board to provide theshareholders with a detailed analysis, explanation and assessment of the Group’s financial position and prospects. On a quarterlybasis, Board members are provided with business and financial reports comparing actual performance with budget and with prior yearcomparisons with highlights on key business indicators and any significant business development. In addition, the Group CEO communicatesregularly with Board members through informal meetings and phone calls with appropriate updates on Company developments.AUDIT COMMITTEEPrinciple 11 :The Board should establish an Audit Committee (“AC”) with written terms of reference which clearly set out itsauthority and duties.The Audit Committee comprises five members, of which all members, including the Chairman, are independent. The members ofthe Audit Committee at the date of this report are :Leong Horn KeeLee Suet FernTeo Ek TorChay Yee MengTan Hup FoiChairmanMemberMemberMemberMember34 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep GoingCorporateGovernance Statement(CON’T)The Audit Committee meets periodically to perform the following functions:-a) reviewing the quarterly, half-yearly and annual financial statements before recommending them to the Board for approval;b) reviewing interested person transactions (as defined in Chapter 9 of the Listing Manual of the SGX-ST), including such transactionsconducted under the shareholders’ general mandate previously obtained;c) reviewing with external auditors the audit plan, their evaluation of the systems of internal controls, their annual reports and theirmanagement letters and management’s response;d) reviewing and recommending to the Board the re-appointment of the external auditors, taking into consideration the non-auditservices rendered by the external auditors and being satisfied that the nature and extent of such services will not prejudice theindependence and objectivity of the external auditors;e) reviewing the scope of internal audit procedures and the results of the internal audit; andf) considering other matters as requested by the Board.The Audit Committee has full access to and co-operation of the Company’s management and the internal auditors and has full discretionto invite any Director or executive officer to attend its meetings. The auditors, both internal and external, have unrestricted access to theAudit Committee. Reasonable resources have been made available to the Audit Committee to enable them to discharge their duties.The Audit Committee held four meetings since the date of the last annual report. The Audit Committee reviewed the InterestedPerson Transactions for the year ended 31 December 2005 in accordance with the terms of the Shareholders’ Mandates for suchtransactions as were approved on 28 April 2005. Interested Person Transactions with a total value of $33.4 million were examinedand the Audit Committee is of the opinion that the said transactions were carried out on prevailing commercial terms and did notprejudice the interest of the shareholders of the Company.The Audit Committee had reviewed and confirmed that the methods and procedures for determining the transaction prices relatingto Interested Person Transactions have not changed since the last shareholders’ approval. The Audit Committee also confirmsthat the methods and procedures are sufficient to ensure that the transactions will be carried out on normal terms and will not beprejudicial to the interests of the Company and its minority shareholders.The Audit Committee had reviewed the non-audit services provided by the external auditors and is satisfied with the independenceof the auditors. The Audit Committee has recommended to the Board that the auditors, KPMG, be nominated for re-appointment atthe forthcoming Annual General Meeting of the Company.Meetings and attendance are as follows:Audit CommitteeName of DirectorLeong Horn Kee (Chairman)Lee Suet FernTeo Ek TorChay Yee MengTan Hup FoiNo. Of Meetings44444Attended4442-<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200535

Internal Controls and Internal AuditCorporateGovernance Statement(CON’T)Principle 12 :The Board should ensure that the Management maintains a sound system of internal controls to safeguard theshareholders’ investment and the company’s assets.The Board acknowledges that it is responsible for the Group’s system of internal control. It believes that in the absence of anyevidence to the contrary and from due enquiry, the system of internal controls that has been maintained by the Group throughoutthe financial year is adequate to meet the needs of the Group in its current business environment. However, the Board notes that thesystem of internal controls is designed to manage rather than eliminate the risk of failure to achieve business objectives, and canprovide only reasonable and not absolute assurance against material misstatements or loss.The Internal Auditor plans its internal audit work in consultation with, but independent of Management, and its yearly plan issubmitted to the Audit Committee for approval at the beginning of each year. The Internal Auditor reports to the Audit Committeequarterly regarding its findings. The Audit Committee also meets with the internal auditor at least once during the year without thepresence of Management.Principle 13 :The Company should establish an internal audit function that is independent of the activities it audits.The Group has an internal audit department which is independent of the activities it audits. It performs financial audits,implements operational and compliance controls. The internal auditor reports primarily to the Chairman of the Audit Committeeand administratively to the Group CEO. The internal auditors are expected to meet or exceed the standards set by nationally orinternationally recognised professional bodies including the Standards for the Professional Practice of Internal Auditing set by TheInstitute of Internal Auditors.(D)COMMUNICATION WITH SHAREHOLDERSPrinciple 14 :Principle 15 :Companies should engage in regular, effective and fair communication with shareholders.Companies should encourage greater shareholder participation at AGMs, and allow shareholders theopportunity to communicate their views on various matters affecting the company.The Group does not practice selective disclosure. In line with continuous obligations of the Group pursuant to the SGX-ST’s ListingRules and the Companies Act, Chapter 50, the Board’s policy is that all shareholders are informed of all major developments of theGroup. Price-sensitive information is released publicly, and quarterly results and annual reports are announced or issued withinthe mandatory period and are available on the Group’s website. Thereafter, a briefing by Management is held jointly for the mediaand analysts every half yearly. All shareholders of the Group receive the annual report and notice of Annual General Meeting.Shareholders are encouraged to attend the Annual General Meeting to ensure a high level of accountability and to stay informed ofthe Group’s strategy and goals.(E)SECURITIES TRANSACTIONSThe Company has issued a policy on dealings in the securities of the Company to its Directors and Management, set out theimplications of insider trading and guidance on such dealings. It has adopted the Best Practices Guide on Dealings in Securitiesissued by SGX-ST.36 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep GoingCorporateGovernance Statement(CON’T)(F)INTERESTED PARTY TRANSACTIONSThe Group has adopted an internal policy in respect of any transactions with interested persons and has procedures established forthe review and approval of the Group’s Interested Party Transactions (“IPT”).Pursuant to Rule 907 of the Listing Manual of the Singapore Stock Exchange Securities Trading <strong>Limited</strong> (the “Listing Manual”), theGroup has the following IPTs entered into during the financial year, together with the corresponding aggregate value of the IPTsentered into with the same interested person, are disclosed as follows:Name of Interested PersonAggregate value of all IPTs during thefinancial year under review (excludingtransactions less than $100,000and transactions conducted undershareholders’ mandate pursuant to Rule920 of Listing Manual of SGX-ST)Aggregate value of all IPTsconducted under shareholders’mandate pursuant to Rule 920 ofListing Manual of SGX-ST (excludingtransactions less than $100,000)(A) Transactions for the sale of goodsand services with SingaporeTelecommunications Ltd and itssubsidiaries-$7,755,544(B) Transactions for the sale of goodsand services with Starhub Ltd andits subsidiaries-$2,014,670(C) Transactions for the sale of goodsand services with SingaporeComputer Systems Ltd and itssubsidiaries-$ 828,819(D) Transactions for the sale of goodsand services with SingaporeTechnologies Engineering Ltd andits subsidiaries and associates-$ 826,954(E) Transactions for the sale of goodsand services with GuangzhouJia Dou Ji Tuan Co Ltd and itssubsidiaries-$ 1,618,413(F) Transactions for the saleof goods and services withTemasek <strong>Holdings</strong> Pte Ltd and itssubsidiaries-$1,051,277<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200537

<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> and its SubsidiariesDirector’s ReportYear ended 31 December 2005We are pleased to submit this annual report to the members of the Company together with the audited financial statements for thefinancial year ended 31 December 2005.DirectorsThe directors in office at the date of this report are as follows:-Lin Chien (Chairman)Seah Moon Ming (Vice-Chairman, appointed on 3 January 2005)Liu Wei(Vice-Chairman)Tay Eng Hoe (Chief Executive Officer)Narong IntanateFoo Sen ChinChay Yee MengLeong Horn KeeLee Suet FernTeo Ek TorChang Yew Kong (Appointed on 9 May 2005)Tan Hup Foi (Appointed on 7 February 2006)Directors’ InterestsAccording to the register kept by the Company for the purposes of Section 164 of the Companies Act, Chapter 50, particulars ofinterests of directors who held office at the end of the financial year in shares and share options in the Company are as follows:-<strong>Holdings</strong> in the nameof the director,spouse or infant childrenOther holdings in whichthe director is deemedto have an interestCompanyOrdinary shares of $0.10 each fully paidAt beginningAt beginningof the year/of the year/date of At end date of At endappointment of the year appointment of the yearLin Chien 3,950,000 3,950,000 - -Seah Moon Ming (appointed on 3 January 2005) 200,000 200,000 100,000 100,000Liu Wei 3,166,285 3,166,285 28,500,000 28,500,000Tay Eng Hoe 24,189,481 39,302,481 14,000,000 -Narong Intanate 4,238,746 12,026,746 12,788,000 5,000,000Foo Sen Chin 125,000 3,465,000 957,000 957,000Chay Yee Meng 450,000 450,000 - -Wang Fangmin (resigned on 3 January 2006) 1,456,886 1,456,886 - -Lee Suet Fern - 200,000 - -38 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep Going<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> and its SubsidiariesDirector’s ReportYear ended 31 December 2005<strong>Holdings</strong> in the nameof the director,spouse or infant childrenOther holdings in whichthe director is deemedto have an interestAt beginningAt beginningof the year/of the year/date of At end date of At endappointment of the year appointment of the yearOptions to subscribe for ordinary shares of $0.10 eachLin Chien- Exercisable between 3/9/2002 and 2/9/2006at $0.51 per share 128,000 128,000 - -Tay Eng Hoe- Exercisable between 21/12/2002 and 20/12/2005at $0.10 per share 1,113,000 - - -- Exercisable between 11/3/2004 and 10/3/2012at $0.60 per share 2,500,000 2,500,000 - -- Exercisable between 27/6/2004 and 26/6/2013at $0.41 per share 250,000 250,000 - -Narong Intanate- Exercisable between 3/9/2002 and 2/9/2011at $0.51 per share 400,000 400,000 - -- Exercisable between 27/6/2004 and 26/6/2013at $0.41 per share 200,000 200,000 - -Foo Sen Chin- Exercisable between 21/12/2001 and 20/12/2005at $0.10 per share 1,670,000 - - -- Exercisable between 21/12/2002 and 20/12/2005at $0.10 per share 1,670,000 - - -- Exercisable between 3/9/2002 and 2/9/2011at $0.51 per share 400,000 400,000 - -- Exercisable between 27/6/2004 and 26/6/2013at $0.41 per share 120,000 120,000 - -Chay Yee Meng- Exercisable between 3/9/2002 and 2/9/2006at $0.51 per share 88,000 88,000 - -- Exercisable between 27/6/2004 and 26/6/2008at $0.41 per share 100,000 100,000 - -Leong Horn Kee- Exercisable between 3/9/2002 and 2/9/2006at $0.51 per share 128,000 128,000 - -- Exercisable between 27/6/2004 and 26/6/2008at $0.41 per share 150,000 150,000 - -Lee Suet Fern- Exercisable between 3/9/2002 and 2/9/2006at $0.51 per share 108,000 108,000 - -- Exercisable between 27/6/2004 and 26/6/2008at $0.41 per share 150,000 150,000 - -Wang Fangmin (resigned on 3 January 2006)- Exercisable between 27/6/2004 and 26/6/2013at $0.41 per share 50,000 50,000 - -Teo Ek Tor- Exercisable between 27/6/2004 and 26/6/2008at $0.41 per share 130,000 130,000 - -<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200539

<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> and its SubsidiariesDirector’s ReportYear ended 31 December 2005Except as disclosed above, no director who held office at the end of the financial year had interests in shares, debentures, warrantsor share options of the Company or of related corporations either at the beginning of the financial year, or date of appointment iflater, or at the end of the financial year.There were no changes in any of the above mentioned interests in the Company between the end of the financial year and 21 January2006.Except as disclosed under the “Share Options” section of this report, neither at the end of, nor at any time during the financial year,was the Company a party to any arrangement whose objects are, or one of whose objects is, to enable the directors of the Companyto acquire benefits by means of the acquisition of shares in or debentures of the Company or any other body corporate.During the financial year, the Company and certain of its subsidiaries have, in the normal course of business entered into transactionswith companies in which certain directors of the Company, Mr Tay Eng Hoe, Mr Narong Intanate, Mr Liu Wei and Mr Wang Fangminhave an interest. These transactions include the purchase and sale of information technology products and services of $598,578(2004: $4,111,188) and $4,703,188 (2004: $3,697,263) respectively and are carried out on normal commercial terms.In addition, professional services, amounting to $34,000 (2004: $90,000) were provided to the Company by a firm in which Mrs LeeSuet Fern is a member. Consultancy services, amounting to $73,000 (2004: nil) were provided to the Company by a firm in which MrTeo Ek Tor has an interest.However, the directors have not received nor will they be entitled to receive any benefits arising out of these transactions other thanthose to which they may be entitled to as shareholders of those companies or as a member of the firm.Except as disclosed above and in note 23 and 29 to the financial statements, since the end of the last financial year, no director hasreceived or become entitled to receive a benefit by reason of a contract made by the Company or a related corporation with thedirector or with a firm of which he is a member or with a company in which he has a substantial financial interest.Share Options(a)Share Option SchemesThe <strong>ECS</strong> Share Option Scheme I (“Scheme I”) was approved and adopted by its members at an Extraordinary General Meetingheld on 13 December 2000 to grant one-time share options to certain eligible directors and executives of the Company inrecognition of their contribution to the growth and performance of the Company.The <strong>ECS</strong> Share Option Scheme II (“Scheme II”) was approved and adopted by its members at an Extraordinary General Meetingheld on 13 December 2000. Scheme II provides an opportunity for employees and directors, including non-executive directors,of the Group who have contributed significantly to the growth and performance of the Group to participate in the equity of theCompany.The above schemes are administered by the Compensation Committee (the “Committee”) which comprises the followingdirectors:-Teo Ek Tor (Chairman)Lin ChienChang Yew KongDetails of Scheme I and Scheme II were set out in the Directors’ Report for the year ended 31 December 2000.40 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep Going<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> and its SubsidiariesDirector’s ReportYear ended 31 December 2005(b)(c)(d)Options GrantedDuring the financial year, no option was granted under Scheme II.Issue of Shares Under OptionDuring the financial year, the Company issued a total of 8,351,000 (2004: 8,906,000) ordinary shares of $0.10 each fullypaid at par for cash upon the exercise of options granted under Scheme I. There was no exercise of options granted underScheme II.Unissued Shares under OptionAt the end of the financial year, unissued shares under the share option schemes of the Company were as follows:-Date of Grant Exercise Price Number of Optionsof Option Per Share Exercise Period Option Holders OutstandingScheme INILScheme II03/09/2001 $0.51 03/09/2002 to 02/09/2006 4 452,00003/09/2001 $0.51 03/09/2002 to 02/09/2011 147 8,756,00011/03/2002 $0.72 11/03/2003 to 10/03/2012 131 4,672,00024/01/2002 $0.55 24/01/2004 to 23/01/2012 2 1,100,00011/03/2002 $0.60 11/03/2004 to 10/03/2012 2 3,500,00027/06/2003 $0.41 27/06/2004 to 26/06/2008 4 530,00027/06/2003 $0.41 27/06/2004 to 26/06/2013 203 6,231,000Total outstanding at 31 December 2005 493 25,241,000<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200541

<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> and its SubsidiariesDirector’s ReportYear ended 31 December 2005The details of options granted and exercised are as follows:-Aggregate Aggregate Aggregate AggregateName of Options Options Options Options OptionsParticipants Granted Granted Exercised Lapsed Outstanding[1] [2] [3] [4] [5]Executive directors- Tay Eng Hoe - 4,976,000 (2,226,000) - 2,750,000 *- Narong Intanate - 9,506,000 (8,906,000) - 600,000- Foo Sen Chin - 3,860,000 (3,340,000) - 520,000Non-executive directors- Lin Chien - 128,000 - - 128,000- Chay Yee Meng - 188,000 - - 188,000- Leong Horn Kee - 278,000 - - 278,000- Lee Suet Fern - 258,000 - - 258,000- Teo Ek Tor - 130,000 - - 130,000Former directors- Wong Heng Chong - 1,713,000 (1,113,000) - 600,000- Koh Soo Keong - 120,000 - (120,000) -- Wang Fangmin - 50,000 - - 50,000- Hsieh Fu Hua - 88,000 - (88,000) -Employees (includingexecutive officers)- Foong Kam Tho - 8,629,000 (6,679,000) - 1,950,000 *- Other employees - 23,292,000 - (5,503,000) 17,789,000- 53,216,000 (22,264,000) (5,711,000) 25,241,000* Represents 5% or more of total number of options available under the schemes.[1] Options granted during the financial year under review.[2] Aggregate options granted since commencement of the schemes to the end of the financial year under review.[3] Aggregate options exercised since commencement of the schemes to the end of the financial year under review.[4] Aggregate options lapsed since commencement of the schemes to the end of the financial year under review.[5] Aggregate options outstanding as at end of the financial year under review.Except as disclosed, since the commencement of the option schemes:-(i) no option has been granted to the controlling shareholders of the Company or their associates;(ii) no participant under the schemes has been granted 5% or more of the total options available under the schemes; and(iii) no option has been granted to employees of subsidiaries under the schemes.The options granted by the Company do not entitle the holders of the options, by virtue of such holdings, to any right to participate inany share issue of any other company.42 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep Going<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> and its SubsidiariesDirector’s ReportYear ended 31 December 2005Except as disclosed above, there were:-(i) no options granted by the Company or its subsidiaries to any person to take up unissued shares in the Company or itssubsidiaries;(ii) no shares issued by virtue of any exercise of option to take up unissued shares of the Company or its subsidiaries; and(iii) no unissued shares of the Company or its subsidiaries under option at the end of the financial year.Audit CommitteeThe members of the Audit Committee during the year and at the date of this report are:-Leong Horn KeeLee Suet FernTeo Ek TorChay Yee MengTan Hup Foi(Chairman, Independent director)(Independent director)(Independent director)(Independent director)(Independent director)The Audit Committee performs the functions specified by section 201B of the Companies Act, the Listing Manual and the BestPractices Guide of the Singapore Exchange and the Code of Corporate Governance.The Audit Committee held four meetings since the last directors’ report. In performing its functions, the Audit Committee met withthe Company’s external and internal auditors to discuss the scope of their work and the results of their examination and evaluationof the Company’s internal accounting control system.The Audit Committee also reviewed the following:-• Assistance provided by the Company’s officers to the internal and external auditors;• Financial statements of the Group and of the Company prior to their submission to the directors of the Company for adoption;and• Interested person transactions (as defined in Chapter 9 of the Listing Manual of the Singapore Exchange).The Audit Committee has full access to management and is given the resources required for it to discharge its functions. It has fullauthority and discretion to invite any director or executive officer to attend its meetings. The Audit Committee also recommends theappointment of the external auditors and reviews the level of audit and non-audit fees.The Audit Committee is satisfied with the independence and objectivity of the external auditors and has recommended to the Boardof Directors that the auditors, KPMG, be nominated for re-appointment as auditors at the forthcoming Annual General Meeting ofthe Company.<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200543

<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> and its SubsidiariesDirector’s ReportYear ended 31 December 2005AuditorsThe auditors, KPMG, have indicated their willingness to accept re-appointment.On behalf of the Board of DirectorsLin ChienDirectorTay Eng HoeDirectorSingapore21 February 200644 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep Going<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> and its SubsidiariesStatement by DirectorsYear ended 31 December 2005In our opinion:(a)(b)the financial statements set out on pages 47 to 85 are drawn up so as to give a true and fair view of the state of affairs of theGroup and of the Company as at 31 December 2005 and of the results and changes in equity of the Group and of the Companyand cash flows of the Group for the year ended on that date; andat the date of this statement, there are reasonable grounds to believe that the Company will be able to pay its debts as and whenthey fall due.The Board of Directors has, on the date of this statement, authorised these financial statements for issue.On behalf of the Board of DirectorsLin ChienDirectorTay Eng HoeDirectorSingapore21 February 2006<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200545

Auditors’ ReportWe have audited the accompanying financial statements of <strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> for the year ended 31 December 2005 as set outon pages 47 to 85. These financial statements are the responsibility of the Company’s directors. Our responsibility is to express anopinion on these financial statements based on our audit.We conducted our audit in accordance with Singapore Standards on Auditing. Those Standards require that we plan and perform theaudit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includesexamining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includesassessing the accounting principles used and significant estimates made by the directors, as well as evaluating the overall financialstatement presentation. We believe that our audit provides a reasonable basis for our opinion.In our opinion:-(a)(b)the consolidated financial statements of the Group and the balance sheet, profit and loss account and statement of changes inequity of the Company are properly drawn up in accordance with the provisions of the Companies Act, Chapter 50 (the “Act”) andSingapore Financial Reporting Standards to give a true and fair view of the state of affairs of the Group and of the Company asat 31 December 2005 and of the results, changes in equity and cash flows of the Group and of the results and changes in equityof the Company for the year ended on that date; andthe accounting and other records required by the Act to be kept by the Company and by the subsidiaries incorporated in Singaporehave been properly kept in accordance with the provisions of the Act.KPMGCertified Public AccountantsSingapore21 February 200646 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005

Keep Going<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> and its SubsidiariesBalance SheetsAs at 31 December 2005GroupCompanyNote 2005 2004 2005 2004$’000 $’000 $’000 $’000Non-Current AssetsProperty, plant and equipment 3 11,651 10,916 147 170Subsidiaries 4 - - 87,008 87,008Other financial assets 5 695 634 201 140Amount due from a subsidiary 12 - - 66,600 -Goodwill on consolidation 6 33,522 32,635 - -Deferred tax assets 7 958 875 - -46,826 45,060 153,956 87,318Current AssetsInventories 8 124,870 132,295 - -Trade and other receivables 9 360,331 281,505 47,864 110,399Cash and bank balances 53,723 58,374 2,414 649538,924 472,174 50,278 111,048Current LiabilitiesBank overdrafts (unsecured) 50 260 - -Trade and other payables 13 197,098 171,690 3,179 1,377Current portion of- deferred income 15 264 741 - -- interest bearing bank loans 16 132,883 172,262 16,650 82,000- obligations under finance leases 17 22 22 - -Preference shares 18 84 82 - -Current tax payable 1,934 2,058 - -332,335 347,115 19,829 83,377Net Current Assets 206,589 125,059 30,449 27,671253,415 170,119 184,405 114,989Non-Current LiabilitiesDeferred income 15 239 313 - -Interest bearing bank loans 16 66,654 93 66,600 -Obligations under finance leases 17 43 65 - -Loans due to minority shareholdersof a subsidiary 19 4,269 4,205 - -Deferred tax liabilities 7 436 527 27 2771,641 5,203 66,627 27Net Assets 181,774 164,916 117,778 114,962Equity Attributable toEquity Holders of the ParentShare capital 20 36,360 35,525 36,360 35,525Reserves 21 137,825 123,134 81,418 79,437174,185 158,659 117,778 114,962Minority Interests 7,589 6,257 - -Total Equity 181,774 164,916 117,778 114,962The accompanying notes form an integral part of these financial statements.<strong>ECS</strong> HOLDINGs LIMITED Annual Report 200547

<strong>ECS</strong> <strong>Holdings</strong> <strong>Limited</strong> and its SubsidiariesProfit And Loss accountsYear ended 31 December 2005GroupCompanyNote 2005 2004 2005 2004$’000 $’000 $’000 $’000Revenue 22 2,036,278 1,865,658 7,656 7,215Cost of sales (1,940,966) (1,778,172) (1,034) (3,581)Gross profit 95,312 87,486 6,622 3,634Other income 5,529 1,462 4,879 3,088Selling and distribution expenses (42,006) (34,989) (274) (251)General and administrative expenses (28,953) (28,316) (933) (797)Profit from operations 23 29,882 25,643 10,294 5,674Finance costs 24 (7,398) (6,527) (4,321) (2,623)Profit from ordinary activitiesbefore taxation 22,484 19,116 5,973 3,051Taxation 26 (3,887) (4,133) (1,150) (579)Profit for the year 18,597 14,983 4,823 2,472Attributable to:Equity holders of the parent 17,313 13,463 4,823 2,472Minority interests 1,284 1,520 - -18,597 14,983 4,823 2,472Earnings per share 27- Basic 4.9 cents 3.8 cents- Fully diluted 4.8 cents 3.7 centsThe accompanying notes form an integral part of these financial statements.48 <strong>ECS</strong> HOLDINGs LIMITED Annual Report 2005