Answers to Chapter 7 Exercises - Luiscabral.net

Answers to Chapter 7 Exercises - Luiscabral.net

Answers to Chapter 7 Exercises - Luiscabral.net

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

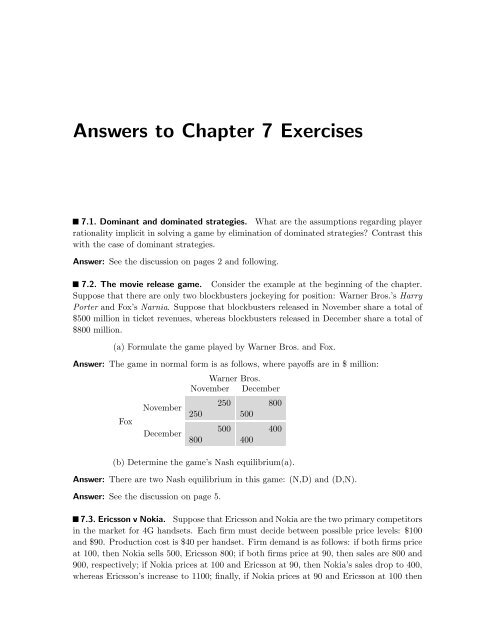

<strong>Answers</strong> <strong>to</strong> <strong>Chapter</strong> 7 <strong>Exercises</strong>7.1. Dominant and dominated strategies. What are the assumptions regarding playerrationality implicit in solving a game by elimination of dominated strategies? Contrast thiswith the case of dominant strategies.Answer: See the discussion on pages 2 and following.7.2. The movie release game. Consider the example at the beginning of the chapter.Suppose that there are only two blockbusters jockeying for position: Warner Bros.’s HarryPorter and Fox’s Narnia. Suppose that blockbusters released in November share a <strong>to</strong>tal of$500 million in ticket revenues, whereas blockbusters released in December share a <strong>to</strong>tal of$800 million.(a) Formulate the game played by Warner Bros. and Fox.Answer: The game in normal form is as follows, where payo↵s are in $ million:FoxNovemberDecemberWarner Bros.November December250800250500500400800400(b) Determine the game’s Nash equilibrium(a).Answer: There are two Nash equilibrium in this game: (N,D) and (D,N).Answer: See the discussion on page 5.7.3. Ericsson v Nokia. Suppose that Ericsson and Nokia are the two primary competi<strong>to</strong>rsin the market for 4G handsets. Each firm must decide between possible price levels: $100and $90. Production cost is $40 per handset. Firm demand is as follows: if both firms priceat 100, then Nokia sells 500, Ericsson 800; if both firms price at 90, then sales are 800 and900, respectively; if Nokia prices at 100 and Ericsson at 90, then Nokia’s sales drop <strong>to</strong> 400,whereas Ericsson’s increase <strong>to</strong> 1100; finally, if Nokia prices at 90 and Ericsson at 100 then

Nokia sells 900, Ericsson 700.(a) Suppose firms choose prices simultaneously. Describe the game andsolve it.Answer: First, it may help <strong>to</strong> write the demand curve as a matrix. (Notice this is not thegame firms are playing.)Nokia10090Ericsson100 90800 1110500 400700 900900 800Now, based on price, marginal cost and demand, we can write the payo↵ corresponding <strong>to</strong>each strategy pair. This is now the normal form game played by firmsEricsson100 90Nokia100903045484224405545Pricing at 90 is a dominant strategy for Nokia and Ericsson alike. The Nash equilibrium istherefore given by (90,90). Equilibrium profits are given by (40,45).Answer:(b) Suppose that Ericsson has a limited capacity of 800k units per quarter.Moreover, all of the demand unfulfilled by Ericsson is transferred <strong>to</strong>Nokia. How would the analysis change?The new demand matrix is given byNokia10090Ericsson100 90800 800500 700700 800900 900The new game is given by2

Ericsson100 90Nokia100903045484242454040It is now a dominant strategy for Ericsson <strong>to</strong> price at $100. It is still a dominant strategyfor Nokia <strong>to</strong> price at $90.(c) Suppose you work for Nokia. Your Chief Intelligence O cer (CIO) isunsure whether Ericsson is capacity constrained or not. How muchwould you value this piece of info?Answer: Nokia has a dominant strategy: price at 90. Therefore, it has no value for theinformation of whether Ericsson is or is not capacity constrained (as far as the present gameis concerned).7.4. ET. In the movie “E.T.,” a trail of Reese’s Pieces, one of Hershey’s chocolate brands,is used <strong>to</strong> lure the little alien out of the woods. As a result of the publicity created by thisscene, sales of Reese’s Pieces trebled, allowing Hershey <strong>to</strong> catch up with rival Mars.Universal Studio’s original plan was <strong>to</strong> use a trail of Mars’ M&Ms. However, Marsturned down the o↵er, presumably because it thought $1m was a very high price. Themakers of “E.T.” then turned <strong>to</strong> Hershey, who accepted the deal.Suppose that the publicity generated by having M&Ms included in the movie wouldincrease Mars’ profits by $800,000 and decrease Hershey’s by $100,000. Suppose moreoverthat Hershey’s increase in market share costs Mars a loss of $500,000. Finally, let b be thebenefit for Hershey’s from having its brand be the chosen one.Describe the above events as a game in extensive form. Determine the equilibrium as afunction of b. If the equilibrium di↵ers from the actual events, how do you think they canbe reconciled?Answer:The game’s extensive form is the following (payo↵s in millions of dollars):.-.5, b -1Mrejectaccept.Hacceptreject.0, 0.-.2, -.1If b>1, then Hershey is better o↵ by accepting Universal’s o↵er, were it ever asked <strong>to</strong> makethat choice; in which case Mars is better o↵ by accepting Universal’s o↵er. If b

in which case Mars is better o↵ by rejecting Universal’s o↵er.7.5. ET (reprise). Return <strong>to</strong> Exercise 7.4. Suppose now that Mars does not know thevalue of b, believing that either b =$1,200,000 or b =$700,000, each with probability 50%.Unlike Mars, Hershey knows the value of b. Draw the tree for this new game and determineits equilibrium.Answer:dollars):The game’s extensive form is now given by the following (payo↵s in millions ofM-500.500 ⇥ 50% + 0 ⇥ 50% = H= 250b = 1200 (50%).Nb = 700 (50%)reject.Hbuy0acceptrejectacceptreject....-500, 2000, 0-500, -3000, 0.-200, -100where M and H refers <strong>to</strong> Mars and Hershey, whereas N refers <strong>to</strong> the player Nature. Thevalues next <strong>to</strong> the H nodes correspond <strong>to</strong> M’s expected payo↵ if we ever get <strong>to</strong> thatnode. Nature is not a strategic player: it simply chooses di↵erent branches according<strong>to</strong> predetermined probabilities. In the present case, Nature flips a fair coin and choosesb =$1,200,000 or b =$700,000 with equal probability. This implies that, from M’s point ofview, the expected value given that we are in the N node is given by500 ⇥ 50% + 0 ⇥ 50% = 250It follows that M’s optimal choice is <strong>to</strong> accept Universal’s o↵er. To summarize, the equilibriumstrategies are given by• Mars: accept Universal’s o↵er• Hershey: accept Universal’s o↵er if b is high, reject otherwise.7.6. Hernan Cortéz. Hernan Cortz, the Spanish naviga<strong>to</strong>r and explorer, is said <strong>to</strong> haveburnt his ships upon arrival <strong>to</strong> Mexico. By so doing, he e↵ectively eliminated the optionof him and his soldiers returning <strong>to</strong> their homeland. Discuss the strategic value of thisaction knowing the Spanish colonists were faced with potential resistance from the Mexicannatives.Answer: By eliminating the option of turning back, Hernan Cortéz established a crediblecommitment regarding his future actions, that is, <strong>to</strong> fight the Mexican natives should theyattack. Had Cortéz not made this move, natives could have found it better <strong>to</strong> attack,knowing that instead of bearing losses the Spaniards would prefer <strong>to</strong> withdraw.4

7.7. HDTV standards. Consider the following game depicting the process of standardsetting in high-definition television (HDTV). 4 The U.S. and Japan must simultaneouslydecide whether <strong>to</strong> invest a high or a low value in<strong>to</strong> HDTV research. If both countrieschoose a low e↵ort than payo↵s are (4,3) for U.S. and Japan, respectively; if the U.S.chooses a low level and Japan a high level, then payo↵ are (2,4); if, by contrast, the U.S.chooses a high level and Japan a low one, then payo↵s are (3,2). Finally, if both countrieschoose a high level, then payo↵ are (1,1).(a) Are there any dominant strategies in this game? What is the Nashequilibrium of the game? What are the rationality assumptions implicitin this equilibrium?Answer: The game in matrix form looks like the following:E↵ort by U.S.LowHighE↵ort by JapanLow High3 44 22 13 1It is a dominant strategy for the U.S. <strong>to</strong> choose Low. Given that the U.S. chooses Low,Japan’s best response is <strong>to</strong> choose High. (Low, High) is thus the only Nash equilibrium ofthe game.(b) Suppose now the U.S. has the option of committing <strong>to</strong> a strategyahead of Japan’s decision. How would you model this new situation?What are the Nash equilibria of this new game?Answer: The most natural way <strong>to</strong> model this situation is by writing an extensive formgame as follows:U.S.HLJapan.Japan.HLHL.1, 1.3, 2.2, 4.4, 3Japan’s optimal strategy is <strong>to</strong> choose H if the U.S. choses L and <strong>to</strong> choose L if the U.S.chooses H. Anticipating that strategy, the U.S. optimal strategy is <strong>to</strong> choose H. The equilibriumis therefore (H,L).5

(c) Comparing the answers <strong>to</strong> (a) and (b), what can you say about thevalue of commitment for the U.S.?Answer: In the simultaneous move game, U.S. and Japan choose (L,H), respectively, whichgives the U.S. a payo↵ of 2. In the sequential move game (with the U.S. moving first), U.S.and Japan choose (H,L), respectively, which gives the U.S. a payo↵ of 3. It follows that thevalue of commitment for the U.S. is 3 2 = 1.(d) “When pre-commitment has a strategic value, the player that makesthat commitment ends up ‘regretting’ its actions, in the sense that,given the rivals’ choices, it could achieve a higher payo↵ by choosinga di↵erent action.” In light of your answer <strong>to</strong> (b), how would youcomment this statement?Answer: In the sequential choice game (with the U.S. moving first), Japan ends up choosingL. Given that Japan chooses L, the payo↵ for the U.S. would be higher if it chose L insteadof H. In this sense, there is ex-post regret. However, the sole reason for Japan choosing Lis precisely the fact the U.S. commits <strong>to</strong> H. Were such commitment not credible, that is,were the U.S. able <strong>to</strong> change its choice easily, then Japan should anticipate that change andaccordingly chose H. In this sense, the U.S. should not regret having committed <strong>to</strong> H in thefirst place.7.8. Finitely repeated game. Consider a one-shot game with two equilibria and supposethis game is repeated twice. Explain in words why there may be equilibria in the two-periodgame which are di↵erent from the equilibria of the one-shot game.Answer: When the game is repeated twice the strategy space for each player becomes morecomplex. Each player’s strategy specifies the action <strong>to</strong> be taken in period 1 as well as theaction <strong>to</strong> be taken in period 2 as a function of the outcome in period 1. The possibility oflinking period 2’s actions <strong>to</strong> past actions allows for equilibrium outcomes that would not beattainable in the corresponding one-shot game (for example, the use of a ’punishment’ actionin period 2 if one of the players deviates from the designated period 1 payo↵-maximizingaction).7.9. American Express’s spino↵ of Shearson. In 1993, American Express sold Shearson<strong>to</strong> Primerica (now part of Citigroup). In the March 9 Wall Street Journal: “Among thesticking points in acquiring Shearson’s brokerage operations would be the firm’s litigationcosts. More than most brokerage firms, Shearson has been socked with big legal claimsby inves<strong>to</strong>rs who say they were mistreated, though the firm has made strides in cleaningup its backlog of inves<strong>to</strong>r cases. In 1992’s fourth quarter alone, Shearson <strong>to</strong>ok reserves of$90 million before taxes for ’additional legal provisions.”’ When the deal was completed,Primerica bought most of Shearson’s assets but left the legal liabilities with AmericanExpress. Why do you think the deal was structured this way? Was it fair <strong>to</strong> AmericanExpress?7.10. Sale of business. Suppose that a firm owns a business unit that it wants <strong>to</strong>6

Table 7.1Sale of businessProbability Exp. value ExpectedPrice of sale if accepted profit100 10 110 1110 20 115 1120 30 120 0130 40 125 -2140 50 130 -5150 60 135 -9160 70 140 -14170 80 145 -20180 90 150 -27190 100 155 -35sell. Potential buyers know that the seller values the unit at either $100m, $110m, $120,. . . $190m, each value equally likely. The seller knows the precise value, but the buyeronly knows the distribution. The buyer expects <strong>to</strong> gain from synergies with its existingbusinesses, so that its value is equal <strong>to</strong> seller’s value plus $10m. (In other words, there aregains from trade.) Finally, the buyer must make take-it-or-leave-it o↵er at some price p.How much should the buyer o↵er?Answer: We can write down Table 7.1, which summarizes, for each o↵er that the buyermakes, the probability that the o↵er gets accepted, the expected value (<strong>to</strong> the buyer)conditional on having the o↵er accepted, and the overall expected profit from any giveno↵er. From this we see that the seller should thus o↵er either $100m or $110m.Suppose the buyer o↵ers p = 100 (in $m). Then, in most cases the o↵er is rejected.Specifically, 90% of the times the o↵er is rejected. O↵ering more would imply a higherprobability of sale, but the expected value of the unit would increase by less than the pricepaid. The intuition for this result is the force of adverse selection: the seller will only sellthe unit if its value is relatively low.Challenging exercises7.11. Ad games. Two firms must simultaneously choose their advertising budget.Suppose payo↵s are given by the values in the table below.Firm 27

LHFirm 1LH58511484(a) Determine the Nash equilibria of the one-shot game.Answer: H is a dominant strategy, so the unique Nash equilibrium is (H, H).Answer:(b) Suppose the game is indefinitely repeated and that the relevant discountfac<strong>to</strong>r is = .8. Determine the optimal symmetric equilibrium.The condition that (L, L) is an equilibrium is that518+413which is equivalent <strong>to</strong>4.Since = .8, it follows that (L, L) is indeed an equilibrium.(c) (challenge question) Now suppose that, for the first 10 periods, firmpayo↵s are twice the values represented in the above table. What isthe optimal symmetric equilibrium?Answer: From the analysis in the previous answer, we conclude that, after t = 10, (L, L)is an equilibrium. Consider the situation at t = 9. Current payo↵s are doubled. It followsthat the no-deviation constraint is10 +516which implies7⇡ .86. If follows that (L, L) is not an equilibrium. By induction anda fortiori, we also conclude that (L, L) is not an equilibrium for any earlier t. It followsthe best symmetric equilibrium is for firms <strong>to</strong> choose H during the first 10 periods and Lthereafter.16 +7.12. Finitely repeated game I. Suppose that the game depicted in Figure 7.1 is repeatedT times, where T is known. Show that the only subgame perfect equilibrium is for players<strong>to</strong> choose B in every period.Answer: Suppose we are in period T , the last period of the finitely-repeated game. Subgameperfection implies that we look for a Nash equilibrium of this subgame. As we saw earlier,there exists a unique Nash equilibrium of this one-shot game: (B,R).Now consider the subgame starting in period T 1. This is e↵ectively a two-periodgame. Players correctly anticipate that, regardless of what happens in period T 1, (B,R)will be played in period T . For this reason, they should treat choices in period T 1 asif they were playing a one-shot game: nothing in the past or in the future depends on theoutcome of what takes place in period T 1. Since there exists a unique equilibrium in theone-shot game, players choose (B,R) inperiodT 1.418

By induction, we conclude that, in a subgame perfect Nash equilibrium, players mustchoose (B,R) ineveryperiod.7.13. Finitely repeated game II. Consider the game depicted in Figure 7.13. l(a) Determine the set of Nash equilibrium of the game where choices aremade once.Answer: The best-response mapping for Player 1 is given by (M,M,B) as Player 2 chooses(L, C, R); and the best-response mapping for Player 2 is given by (C, C, R) as Player 1chooses (T,M,B). It follows there are two possible Nash equilibria: (M,C) and (B,R). m(b) Suppose that the matrix game in Figure 7.13 is played twice. Howmany di↵erent strategies does a player now have?Answer: A strategy is defined as a player’s complete contingent plan of action for all possibleoccurrences in the game. Since there are nine possible outcomes in the first period, threepossible actions in the second period, and three possible actions in the first period, Player1 has 3 times 3 <strong>to</strong> the power or 9, or 59,049, possible strategies.(c) Show that there exists a subgame perfect Nash equilibrium such that(T,L)isplayedinthefirstperiod.Answer: Given the requirement of subgame perfection, the equilibrium of the subgamecorresponding <strong>to</strong> the second period must be one of the equilibria found in the first answer:(M,C) or (B,R). Consider the following strategy for Player 1 in the two-period game: playT in period 1. In period 2, play M if period 1 actions were (T,L); otherwise, play B. Asfor Player 2, take the following strategy: play L in period 1. In period 2, play C if period1 actions were (T,L); otherwise, play R.Let us now check that these strategies constitute an equilibrium of the repeated game.In period 2, assuming that the period 1 outcome was (T,L), the designated strategies callfor players <strong>to</strong> choose (M,C). Since these actions form a Nash equilibrium of the one-shotgame, it must be in the players’ best interest <strong>to</strong> choose them in the second period of a twoperiodrepeated game. That is, no player would be able <strong>to</strong> improve its payo↵ by unilaterallychoosing something di↵erent. Likewise, in period 2 and assuming that the period 1 outcomewas di↵erent from (T,L), the designated strategies call for players <strong>to</strong> choose (B,R). Sincethe latter also constitute an equilibrium of the one-shot game, the same reasoning applies.Finally, we must check that period 1 actions are also part of a Nash equilibrium strategy.Take Player 1: choosing the action T , as indicated by the designated strategy, yields a payo↵of 5 in the first period. Since, by assumption, Player 2 is playing the designated strategy(L in period 1), Player 1’s period 1 choice will lead <strong>to</strong> (M,C) in period 2, yielding Player1 an additional payo↵ of 4. Total payo↵ is therefore 9.Now suppose that, in period 1, Player 1 chooses M instead. Period 1 payo↵ would thenbe 6, since Player 2 chooses L. However, choosing M in period 1 would lead <strong>to</strong> the playl. This game is identical <strong>to</strong> that in Figure 7.1 except that we add a third strategy <strong>to</strong> each player. Whilethis third strategy leads <strong>to</strong> an extra Nash equilibrium, the main feature of the game in Figure 7.1is still valid — namely, the conflict between individual and joint incentives that characterizes the“prisoner’s dilemma.”m. Technical note: I am here referring only <strong>to</strong> equilibria in pure strategies.9

Figure 7.13Stage gamePlayer 2L C RT553600Player 1M634400B000011of (B,R) in period 2, yielding Player 1 an additional payo↵ of only 1. Total payo↵ wouldtherefore be 7, which is less than 9. A similar comparison is obtained if we consider otherdeviations from the designated strategies by either Player 1 or Player 2. We conclude thatthe designated strategies constitute a Nash equilibrium.(d) Compare your answers <strong>to</strong> the previous questions and comment.Answer: In words, the above designated strategies may be described in the following way.The players agree <strong>to</strong> choose the payo↵ maximizing actions in the first period: (T,L). Althoughthis cannot be sustained in a one-shot game — both players would have an incentive<strong>to</strong> deviate —, an arrangement can be made whereby (T,L) is part of an equilibrium in thetwo-period game. The idea is that period 2 actions are used <strong>to</strong> “punish” players in casethey deviate from the designated period 1 actions. Because of this period 2 “punishment,”a period 1 deviation that would be profitable in the short run (that is, in the one-shot game)is not profitable once the two periods are taken in<strong>to</strong> consideration. In fact, the period 1gain from deviation (6 minus 5) is less that the loss in period 2 payo↵ that results fromPlayer 2’s “retaliation” (4 minus 1).7.14. Centipede. Consider the game below. 5 Show, by backward induction, that rationalplayers choose d at every node of the game, yielding a payo↵ of 2 for Player 1 and zero forPlayer 2. Is this equilibrium reasonable? What are the rationality assumptions implicit init?"r r r r r r r r1 2 1 2 1 2 1 2. . . . . ... . . . .. . . . . . . .d d d d d d d d.20# ".13# ".42# ".35# ".64# ".9799# ".10098#".99101#"100100#Answer: Starting from the right-most node, we observe that Player 2’s strategy, if thatnode is reached, is <strong>to</strong> play d, in which case its gets 101, whereas Player 1 gets 99. Thisimplies that, in the second <strong>to</strong> last node, Player 1 is better o↵ choosing d. In fact, by choosingr, Player 1 expects <strong>to</strong> get 99 (see sentence above) instead of 100 from d. And so forth. We10

conclude that the unique sub-game perfect Nash equilibrium is for each player <strong>to</strong> play dwhenever it is called upon <strong>to</strong> make a move. The outcome of this equilibrium is Player 1getting 2 and Player 2 getting 0.Obviously, one might question whether this result is reasonable or not. Here, the implicitassumption is that each player is rational, believes that the other player is rational, believesthat the other player believes that the first player is rational, and so forth.To see how important this assumption is, suppose that Player 1 chooses r in the firstperiod. Since this is not according <strong>to</strong> the equilibrium, Player 2 may not conjecture thatPlayer 1 is not rational. But then choosing d may no longer be in Player 2’s best interest.But then choosing r may be, after all, a rational strategy by Player 1 in the first place.7.15. Advertising levels. Consider an industry where price competition is not veryimportant: all of the action is on advertising budgets. Specifically, <strong>to</strong>tal value S (in dollars)gets splits between two competi<strong>to</strong>rs according <strong>to</strong> their advertising shares. If a 1 is firm 1’sadvertising investment (in dollars), then its profit is given bya 1a 1 + a 2S a 1(The same applies for firm 2). Both a 1 and a 2 must be non-negative. If both firms investzero in advertising, then they split the market.Answer:(a) Determine the symmetric Nash equilibrium of the game whereby firmschoose a i independently and simultaneously.Firm i’s profit is given by⇡ i =a ia i + a jSa iwhere i 6= j. The first order condition for profit maximization with respect <strong>to</strong> a i is given by(a i + a j ) a i(a i + a j ) 2 S 1=0In a symmetric equilibrium, we have a 1 = a 2 = ba. Thus(ba + ba) ba(ba + ba) 2 S 1=0or simplyba = 1 4 SEach player’s payo↵ is then given byb⇡ = 1 2 S 14 S = 1 4 SFor aficionados: Note that in deriving the above solution I “cut some corners” by assumingthe solution is symmetric. I next follow a more complete line of reasoning. From the11

first-order condition, we can derive firm i’s best response mapping. From the first-ordercondition we geta j S =(a i + a j ) 2or simplySolving the system, and imposing that a iderivation.Answer:a i = p a j Sa j0, we get a i = a j , as assumed in the earlier(b) Determine the jointly optimal level of advertising, that is, the level a ⇤that maximizes joint profits.⇡ 1 + ⇡ 2 = S a 1 a 2It follows that a 1 = a 2 = a ⇤ = 0 maximizes joint profits.(c) Given that firm 2 sets a 2 = a ⇤ , determine firm 1’s optimal advertisinglevel.Answer: Given a 2 = 0, any positive a 1 gives firm 1 100% of the market. Since advertisingis costly, firm 1’s best response is <strong>to</strong> set an arbitrarily small but strictly positive value of a 1(similarly <strong>to</strong> price undercutting under Bertrand competition).(d) Suppose that firms compete indefinitely in each period t =1, 2,..., andthat the discount fac<strong>to</strong>r is given by 2 [0, 1]. Determine the lowestvalue of such that, by playing grim strategies, firms can sustain anagreement <strong>to</strong> set a ⇤ in each period.Answer: By choosing a ⇤ each period, each firm gets S/2. The optimal deviation yields approximatelyS. Finally, the static Nash equilibrium yields S/4 for each firm. The conditionfor a grim strategy equilibrium whereby firms set a = 0 in each period is then given byor simply1112 S S + 12314 S12