AnnuAl REpORt - Bisnode

AnnuAl REpORt - Bisnode

AnnuAl REpORt - Bisnode

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

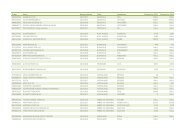

JanMayJunAugOctNovNew regional organisationimplemented to maximise businesspotential and synergiesInter Dialog, a direct marketingconsultancy company in Norway,divestedThe Nomi group, a niche playerproviding information to thepharmaceutical industry, divestedICC, a provider of business-criticalinformation in UK and Ireland,divestedRAAD Research, a market researchsolutions company for the IT sectorin Germany, acquired121 Media, a direct marketing servicescompany in Finland, acquired<strong>Bisnode</strong> has operations in 18 European countries,with ITS head office in Stockholm, Swedenyou findus hereDecJan2010Finfo, a provider of article informationsolutions in Sweden, divestedSverige Bygger and Norge Bygges,niche players of information for theconstruction industry, divestedMajority shareholding in Teleadress,a supplier of Swedish high qualityconsumer information, acquiredDirectinet, a provider of onlinedirect marketing solutions in France,acquiredOperating profit margin, EBITA12%KEY figures 2009 2008Revenue (SEK m) 4,741 4,325Total operating income (SEK m) 4,829 4,430Revenue growth (%) 9.6 18.1Operating profit, EBITDA (SEK m) 728 679Operating profit, EBITA (SEK m) 593 533Operating margin, EBITA (%) 12.3 12.0Average number of employees 3,167 2,940NUMBER OF EMPLOYEES at 31 DEC 3,095 3,189SEK M5,0004,0003,0002,0001,0000REVENUEOPERATING PROFIT, EBITA2005 2006 20072008 20097506004503001500

3This isBiSNODE<strong>Bisnode</strong> is a leading provider of digital business information in Europe, with a completeoffering of online solutions for marketing, credit and business information. <strong>Bisnode</strong>’sbusiness information services help companies maximise sales, minimise business risksand make better business decisions. <strong>Bisnode</strong> was founded in 1989 and has more than3,100 employees in 18 European countries. <strong>Bisnode</strong> is owned 70 per cent by Ratos and30 per cent by Bonnier.business modelDATABRANDDATABRANDDATACOLLECT ENHANCE PACKAGE SELLData about companiesand consumers iscollected from multiplesources in each country.The data is enhancedthrough harmonisation,standardisation andverification. Data in awider context becomesvalue-added information.Information is packagedand customised into productsand services. Thesame information is reusedmany times to increaseeconomies of scale.<strong>Bisnode</strong> sells products todifferent market segmentsunder unique brands, andcreates customised localservices to fulfil the needsof a diverse customer base.BRANDCore offering Marketing solutions Credit solutions Business InformationSolutionsOfferingBrandsMarketpositionMain marketsegmentsCompetitorsBusiness and consumer contact data for mail,email or telephone, business and consumerdata quality services, data intelligence,database management services includingexecuting online communication campaigns.121 Media, Baby DM Scandinavia, <strong>Bisnode</strong>Interact, Directinet, DirektMedia, PAR, SpectronBusiness Solutions and WDMMarket leader in Belgium, France, Sweden andNorway and strong position in the Netherlands.Automotive, Fast-Moving Consumer Goods,Finance, Fundraising, Government, Insurance,Leisure, Mailorder, Media, Retail, Telecommunicationsand Utilities1000 Mercis, Acxiom, Global Direct andSchoberBusiness and consumer credit informationsolutions and reports, portfolio monitoring, creditstatus updates, credit scoring and risk analysisfor the management of credit risk on a transactionaland/or whole portfolio basis.AAA Soliditet, Business Check, Cekia,Connectus, Credita, D&B (Dun&Bradstreet),Hoppenstedt Kreditinformationen,Hoppenstedt 360, Wisur and Credit CheckInternational credit – strong position via D&Bbrand for Austria, Czech Republic, Denmark, Finland,Hungary, Germany, Norway, Poland, Swedenand Switzerland. Domestic credit – strong positionin Nordic countries, building local brands in Austria,Switzerland, Germany and Central Europe.Automotive, Construction, Computers &Electronics, Engineering, Financial Services,Government, Logistics, Oil & Chemical andUtilities.Coface, Creditreform, Creditsafe, Delta Vista,Equifax, Experian and UC SwedenCustomised general business informationsolutions including financial and legal information,media monitoring, legal documents, in-depthindustry analysis and extensive people informationlisting.Affärsdata, Agent25, Eurodata, GV IN, Greens, HBI,Hoppenstedt Firmeninformationen, iBon, InfoTorg,Javnirazpisi, Newsline, Svensk Handelstidning Justitiaand Svenska NyhetsbrevMarket leader in Denmark, Sweden and Sloveniaand strong positions in Germany and CentralEuropean countries.Corporations, Financial Institutions, PublicAdministrations and Small to Medium Enterprises(SME)Bundensanzeiger Verlag, Bureau Van Dijk, Ergo-Group, Factiva, GBI-Genios and Lexis Nexis

42009 inbriefActivity remained high in 2009 with the introduction of a neworganisation focusing on <strong>Bisnode</strong>’s core offering, investments tostrengthen the market position as well as a number of companyacquisitions and divestments. The market was challenging, but<strong>Bisnode</strong> managed to gain markets shares.Focus oncorebusiness<strong>Bisnode</strong> demonstrated its highestoperating profit of all time at sek 593(533) million with an operating marginexceeding 12.3 (12.0) per cent and a strongcash flow from operations. The Groupachieved continued strong revenuegrowth mainly as a result of acquisitionsand net revenue amounted to sek 4,741(4,325) million.<strong>Bisnode</strong> made four acquisitions andfive divestments to better focus on itscore offering and to further boost salesand profitability. The acquisitions includeTeleadress, which has given <strong>Bisnode</strong>a stronger position in the market forconsumer contact information while alsogenerating cost synergies in Sweden. Theleading marketing solutions company121 Media was acquired to strengthen<strong>Bisnode</strong> in marketing informationservices in Finland. The FrenchDirectinet acqusition, which closed inJanuary 2010, has boosted <strong>Bisnode</strong> withinonline marketing information services.Directinet adds new technology andknowledge in e-marketing, while theacquisition of German raad Researchadds expertise in market research andanalysis for the it sector.The Product Information businessarea considerably strengthened its marketoffering in digital product informationservices in Europe when “Wer LiefertWas?” was acquired at the end of2008. The operations were successfullyintegrated in 2009 inspite of a decliningmarket for advertising-based services.As a market-leader, “Wer Liefert Was?”successfully managed to weather therecession and performed well during2009.Focus on core businessIn line with <strong>Bisnode</strong>’s strategy to aimfor a top three market position in eachmarket and segment, the credit solutionscompany icc was divested and the ukand Irish operations were closed as themarket position was weak in a fiercelycompetitive market. Other units divestedduring the year include Sverige Bygger,Norge Bygges, Finfo, Inter Dialog andoperations in the Nomi Group.To expand the market share incredit solutions, <strong>Bisnode</strong> invested innew databases of company informationin Germany during 2008–09. Theinvestments are expected to improve longterm profitability and allow for furthersegmentation of the market offering.At the beginning of 2009 a neworganisation was implemented to betterleverage economies of scale and tofacilitate the transfer of knowledge andconcepts across markets.<strong>Bisnode</strong>’s core offering consists ofMarketing Solutions, Credit Solutionsand Business Information Solutions,which together accounted for 82 percent of total revenue in 2009. The corebusiness has local synergies, similarmarket conditions and businessopportunities at the country level.Product Information and Software andApplications made up the remaining 18per cent and have synergies in similarbusiness models, shared infrastructure orknowledge platforms.Awards in 2009A highlight in 2009 were the awardsto <strong>Bisnode</strong> presented by the EuropeanAssociation of Directory and DatabasePublishers for the online database ofHoppenstedt Firmeninformationen andfor the innovative sales force managementat Wer Liefert Was?<strong>Bisnode</strong> made fouracquisitions and fivedivestments to betterfocus on its core offeringand to further boostsales and profitability

7COMMENTSBY THE CEO<strong>Bisnode</strong> had a good year and gained market share in 2009,despite challenging market conditions. Our focus during theyear has been on further developing the core business,operational efficiency, and positioning <strong>Bisnode</strong> for the future.<strong>Bisnode</strong> had a good year in 2009, despite the challengespresented by the financial crisis. Confidence amongcompanies and consumers was low in Europe andin other major world economies. However, demandfor Credit Solutions held up well, which is normal inperiods of economic downturns. Demand for BusinessInformation Solutions was stable, while MarketingSolutions struggled as demand for these services islargely cyclical.In 2009, we continued working on <strong>Bisnode</strong>’splatform for growth by further focusing on our corebusiness, increasing efficiency and expanding ouroffering. Consolidated net revenue amounted to sek4,741 million with an operating profit, ebita, of 12 percent for 2009. Although <strong>Bisnode</strong> in 2009 did not meetlong-term financial targets of an operating margin,ebita, of at least 15 per cent and annual revenue growthof 10 per cent, we did relatively well considering thevery challenging market conditions.A new <strong>Bisnode</strong> taking shapeAn important activity in shaping the future <strong>Bisnode</strong>is to focus on and strengthen our core business. As aresult <strong>Bisnode</strong> carried out four acquisitions and fivedivestments in 2009.<strong>Bisnode</strong>’s vision is to become the leading providerof digital business information in Europe. To reachour goal we emphasise organic growth supplementedby strategic acquisitions. By acquiring Teleadress, forexample, <strong>Bisnode</strong> reinforced its position as a supplierof high-quality consumer information in Sweden whilealso gaining cost synergies. The Directinet acquisitionstrengthens our position in online marketinginformation services in France. Through acquisitionssuch as these, we add new technology, databases andbrands in order to further build our market position.Also, in 2009, <strong>Bisnode</strong> divested operations in uk andIreland due to weak market positions in these highlycompetitive markets.Keeping the focusAt the beginning of 2009, <strong>Bisnode</strong> launched a neworganisation to clarify our offering and to achieveoperational synergies. The new organisation is workingout well resulting in increased synergies.The process of strengthening <strong>Bisnode</strong>’s operationswill continue in 2010, including further acquisitions anddivestments. By achieving critical mass in all <strong>Bisnode</strong>markets and segments, we can increase efficiency in datacollection, data enhancement, packaging and sales ofinformation solutions.Outlook 2010Digital business information from <strong>Bisnode</strong> is an integralpart of many customers’ daily operations. Althoughdemand varies greatly across markets, industry estimatesindicate a long term yearly composite growth of threeto five per cent. However, in 2010, as the marketrecovers <strong>Bisnode</strong> estimates only a modest growth.We expect new technologies, business modelsand market offerings to shape the European marketfor digital business information in the years ahead.In addition, changes in legal frameworks and dataaccessibility together with new market entrants willincrease competition. With a more complex marketahead, it is important for <strong>Bisnode</strong> to work even closerwith our customers, and deliver compelling productsand being an innovation leader in the digital businessinformation industry.With a strong focus on innovation and a more stabledemand situation, the outlook for the next couple ofyears is looking brighter again.Johan WallPresident and CEO

BISNODE’S VISIONIS TO BE THE LEADING PROVIDER OFDIGITAL BUSINESSINFORMATION IN EUROPE

10The businessinformation marketAn increasing flow of information, regulatory changes and new technologies arereshaping the market for digital business information. The way informationis presented, experienced and used is changing dramatically and creatinga business environment of both opportunities and challenges.Business information consists of a rangeof different types of data, includingcorporate and consumer information.Industry analysts estimate the numberof potential users at approximately 20million and forecast the relevant marketto be worth around sek 300 billion inEurope, with a long term annual growthrate of about three to five per cent.The European market for digitalbusiness information is fragmentedwith many competing players, especiallyat the local and regional level. Theconsolidation trend is continuing amongsmall local operators.Constant change generatesopportunitiesNew opportunities and user patternsemerge as the regulatory frameworkchanges and new technologies arelaunched – mobile, social, personal,semantic web and portable devices.The way information is presented,experienced and used is changingdramatically. Significant market driversinclude ever-increasing amounts of informationand closer system integrationwith end-users.Although the fixed costs for collectingand managing information are relativelyhigh, the additional cost for packagingand distribution is low. This providesscope for large economies of scale as usernumbers increase. Price pressure hasrisen as the volume of information hasgrown, making quality assurance, dataenhancement and value added servicesmore important.Demand for more sophisticatedonline solutionsUnderlying trends in <strong>Bisnode</strong>’s marketsinclude continued digitalisation withbroader and more sophisticated onlineservices and more cost-effective directmarketing at the expense of mass-marketmailings, as well as new low-cost playersin the risk and credit information market.In order to maintain and strengthenthe Group’s market position, <strong>Bisnode</strong>must offer more customised products andservices including refined and exclusiveinformation. The most important step tosucceed is to embrace new technologies,devices and user patterns and toimplement these into new concepts andsolutions in the market at the right time.EMBRACE NEW TECHNOLOGIES,DEVICES AND USER PATTERNS,AND IMPLEMENT THESEIN NEW CONCEPTS ANDSOLUTIONS PROVIDINGADDITIONAL CUSTOMER VALUE

Coreoffering<strong>Bisnode</strong> offers high-quality businessinformation, including company andconsumer information. <strong>Bisnode</strong>’s core offeringconsists of credit, marketing and businessinformation solutions that help customers tomaximise sales, minimise risks and make betterbusiness decisions.CAmilla jacobsaccount managerANJA WRIGFELDtCOMMUNICATIONs OFFICER

12Marketingsolutions<strong>Bisnode</strong> is one of Europe’s leading providers of marketing solutionservices including Customer Relationship Management, addressedand online direct marketing. In 2009 <strong>Bisnode</strong> strengthened itsposition in online marketing, analysis and research.<strong>Bisnode</strong>’s services are offered in twomain segments, business-to-business andbusiness-to-consumer. With the helpof <strong>Bisnode</strong>’s solutions, customers canidentify new customers and customersegments and can retain and developexisting customer relationships.<strong>Bisnode</strong> compiles and completesbusiness and consumer lists from sourcesof all types, in addition to creating andbuilding its own databases. <strong>Bisnode</strong> offerssolutions based on extensive databasesources, to be used for segmentation,reference or market research. This createsa competitive edge, whether the customerneeds sophisticated niche information orpan-European solutions.Strategic handling of dataa valuable assetTrends are changing at a faster pace.As consumers are becoming more of amoving target, marketers will need tocapture more data, mine all that data andfind smarter ways to extrapolate the data.Data handling is expected to becomeso complex that it will be very difficultto manage it all in-house. Data and thestrategic handling of data will become avery valuable asset.Against this background, <strong>Bisnode</strong> isworking actively to improve its offeringof powerful analytical resources for webanalytics, customer segmentation andcampaign effectiveness. Among otherthings, web analytics can be used totrack internet customers and give themrelevant offers faster as they surf a website.Creating an integrated online offeringDemand keeps growing for onlinecommunication; online direct marketingand other integrated online offerings.Customers also want to have anintegrated view of offline and online data.<strong>Bisnode</strong> must be able to offer integratedonline services and has therefore recentlyacquired the French online marketingsolutions company Directinet. Directinetwas early to identify the potential of theInternet as a direct marketing channeland has a dedicated focus on interactivemarketing.Furthermore, <strong>Bisnode</strong> can assistcustomers in project-based campaigns orservices as well as in the implementationand streamlining of ongoing marketingactivities. Other marketing servicesinclude business and consumer listbroking, data mining, distribution,project management and specialisedvalue-added offerings such as datacleansing, hosting loyalty card schemesand advanced statistical segmentation.Marketing Solutions account for31 per cent of <strong>Bisnode</strong>’s total revenue.Customers are sales and marketingdrivencompanies in both commercialand financial industry, as well as crm anddirect marketing users.Offering Brands Market position Main marketsegmentsCompetitorsBusiness and consumer contactdata for mail, email or telephone,business and consumer data qualityservices, data intelligence, databasemanagement servicesincluding executing online communicationcampaigns.121 Media, Baby DM Scandinavia,<strong>Bisnode</strong> Interact, Directinet,DirektMedia, PAR, SpectronBusiness Solutions and WDMMarket leader in Belgium, FranceSweden and Norway and strongposition in the Netherlands.Automotive, Fast-MovingConsumer Goods, Finance, Fundraising,Government, Insurance,Leisure, Mailorder, Media, Retail,Telecommunication and Utilities1000 Mercis, Acxiom, Global Directand Schober

14Creditsolutions<strong>Bisnode</strong> offers a wide range of solutions for credit and riskmanagement, including financial and economic informationas well as credit assessment of both businesses and consumers.With a portfolio of both local and global services, <strong>Bisnode</strong>can offer a unique range of services.<strong>Bisnode</strong> offers business and consumercredit information services, credit statusupdates and business records includingoriginal legal documents. Most servicesare offered at both the local and globallevel. Local services are available throughstrong regional companies in the Groupwith customised information andspecialised services, often integrated orcombined with the customer’s systems.Global services are offered through themarket-leading supplier of global creditinformation, d&b (Dun & Bradstreet).Through the ownership of ten Europeand&b companies, <strong>Bisnode</strong> is one of theleading d&b worldwide network partners.With a portfolio of both local and globalservices <strong>Bisnode</strong> has a leading position inthe majority of its markets.<strong>Bisnode</strong>’s quality assurance processOver the past year, <strong>Bisnode</strong> has continuedto build and extend its company registersand consumer databases with additionalfinancial and legal information. Throughdata processing: all of the informationis harmonised through classification,summarisation and aggregation of keyinformation. <strong>Bisnode</strong>’s quality assuranceprocess ensures that the data input isconsistent, accurate and timely.<strong>Bisnode</strong> continuously analyses companysolvency so that customers better canpredict bankruptcies and prepare for shiftsin the business cycle. Using these services,customers can secure their payments anddeliveries and reduce risks ahead of thecompetitors. The ability to deliver theright information when the customer needsit has become as an increasingly importanttrend.Customers become content providersThe vast bulk of information is publiclysourced and local company registrationoffices are in most cases the main source.The past few years have seen a trendwhere customers also become contentproviders, as <strong>Bisnode</strong> is collectingpayment data from companies abouttheir customers’ payment habits. Thisinformation provides a critical advantage,since it is not readily accessible and is akey factor in assessing creditworthiness.Integration of information within thecustomer’s existing information systemsis increasingly important and <strong>Bisnode</strong>has been developing a more sophisticatedproduct range to increase customerloyalty by making information availabledirectly in the customer’s business system.Highly competitive marketThe market for credit solutions is highlycompetitive. Competition has increasedwith the entry of more low-cost players,which has resulted in decreasing pricesfor credit reports. <strong>Bisnode</strong> has developedmore advanced solutions that add morecustomer value and enable <strong>Bisnode</strong> toretain premium pricing. <strong>Bisnode</strong> alsooffers a wide range of basic and fastcredit information services to meet theincreasing demand of internet basedsolutions.Many of the customers can be foundin the financial sector and include banks,leasing companies, credit departments ofcommercial businesses and professionalfirms such as auditors, merchant bankersand lawyers.Following the financial turbulenceand frozen credit markets in 2009, manycompanies struggled through hard times.Because the credit solution business isslightly counter-cyclical with higherdemand in times of rising risks, CreditSolutions showed a positive developmentin 2009 and increased its share of<strong>Bisnode</strong>’s total revenue to 31 per cent.Offering Brands Market position Main marketsegmentsCompetitorsBusiness and consumer creditinformation solutions and reports,portfolio monitoring, credit statusupdates, credit scoring and riskanalysis for the management ofcredit risk on a transactional and/orwhole portfolio basis.AAA Soliditet, Business Check,Cekia, Connectus, Credita, D&B(Dun&Bradstreet), HoppenstedtKreditinformationen, Hoppenstedt360, Wisur and Credit CheckInternational credit – strong positionvia D&B brand for Austria,Czech Republic, Denmark, Finland,Hungary, Germany, Norway,Poland, Sweden and Switzerland.Domestic credit – strong positionin Nordic countries, building localbrands in Austria, Switzerland,Germany and Central Europe.Automotive, Construction,Computers & Electronics,Engineering, Financial Services,Government, Logistics, Oil &Chemical and Utilities.Coface, Creditreform, Creditsafe,Delta Vista, Equifax, Experian andUC Sweden

Customer caseCarsten Diederich, ALPIQ HOLDINGCustomer of D&B SwitzerlandImproving credit risk management at Alpiq HoldingAlpiq is the largest energy company in Switzerland, whereabout half of the group’s 10,000 staff are employed. Alpiqgenerates and transports electricity and engages in energytrading, electricity transmission and electricity sales. Alpiqowns more than one third of Switzerland’s electricity gridsand is the largest grid owner in the country. Alpiq owes itsstrong market presence in Switzerland and Europe to closecollaboration with many strong partners, including D&B.Through D&B Switzerland, Alpiq always has access to currentbusiness data and segmented business information, whichprovide valuable input for the group credit risk management.D&Bs database enables consistent identification of counterpartiesthrough the use of the D&B D-U-N-S ® number, andallows Alpiq to improve credit risk management through therapid availability of data.“We have very good experiences from working withD&B Switzerland. They take our customer feedbackseriously and act upon it and their service has constantlyexpanded and improved over the years. D&B Switzerlandgives us true value for money, excellent service andgood coverage throughout Europe. The counterpartyidentification through the unique D-U-N-S® number isinvaluable to us.”Carsten Diederich, Head of Credit Risk Management at Alpiq

25financialinforMATIONDirectors’ report 26Consolidated income statement 28Consolidated statement of comprehensive income 28Consolidated balance sheet 29Consolidated statement of changes in equity 30Consolidated cash flow statement 31Parent Company income statement 32Parent Company balance sheet 33Parent Company statement of changes in equity 34Parent Company cash flow statement 35Accounting policies and notes 36Note 1. General information 36Note 2. Summary of significant accounting policies 36Note 3. Financial risk management 40Note 4. Critical accounting estimates and judgements 41Note 5. Segment reporting 42Note 6. Other operating income 43Note 7. Board members and senior executives 43Note 8. Average number of employees. Average number of Boardmembers, CEO and senior executives 43Note 9. Wages, salaries and other remuneration – Group 44Note 10. Compensation to Board members and senior executives 45Note 11. Average number of employees. Wages, salaries andother remuneration – Parent Company 45Note 12. Fees to auditors 45Note 13. Results from participations in group companies 45Note 14. Financial income 45Note 15. Financial expenses 46Note 16. Income tax expense 46Note 17. Intangible assets 46Note 18. Property, plant and equipment 48Note 19. Participations in associates 49Note 20. Available-for-sale financial assets 49Note 21. Participations in group companies 50Note 22. Trade and other receivables 52Note 23. Derivative financial instruments 52Note 24. Cash and cash equivalents 52Note 25. Borrowings 52Note 26. Deferred tax 53Note 27. Provisions for pensions 54Note 28. Other provisions 55Note 29. Trade and other payables 55Note 30. Accrued expenses and deferred income 55Note 31. Reserves 55Note 32. Finance leases 55Note 33. Operating leases 56Note 34. Related party transactions 56Note 35. Contingent liabilities and pledged assets 56Note 36. Share capital 56Note 37. Earnings per share 56Note 38. Business combinations 57Note 39. Sale of subsidiaries 59Note 40. Discontinued operations 59Note 41. Events after the balance sheet date 60Marko SrabotnikProduct ManagerAudit report 61

26Directors’reportThe Board of Directors and the Chief ExecutiveOfficer of <strong>Bisnode</strong> Business Information Group AB,556681-5725, hereby submit their report for 2009.The Group’s operations<strong>Bisnode</strong> is a leading provider of digital businessinformation in Europe, with a complete offering ofonline solutions for market, credit and businessinformation. <strong>Bisnode</strong>s business information serviceshelp companies to maximise sales, minimise businessrisks and make better business decisions.<strong>Bisnode</strong> conducts operations in 18 Europeancountries and has approximately 3,100 employees.Consolidated revenue in 2009 amounted to slightlyover SEK 4.7 billion.Significant events during the financial yearIn the beginning of 2009 <strong>Bisnode</strong> introduced a neworganisation based on four geographical regions(Nordic, DACH, BeNeFra and Central Europe), allcovering the product offerings Market Solutions,Credit Solutions and Business Information Solutions.In addition, two separate business areas, ProductInformation and Software and Applications, andcentral support functions were created.The motive for the organisational change is thatthe market for digital business information is local innature, and that data collection, enhancement, packagingand sales take place primarily at the nationallevel. With a regional organisation, combined withcentral support functions, the Group has greater opportunitiesto realise both revenue and cost synergies.Acquisitions and divestituresTwo major acquisitions were carried out during theyear. In October <strong>Bisnode</strong> acquired the Finnish companyKauppalehti 121 Oy (name changed to 121Media Oy). The company is a leading provider ofdirect marketing services in Finland with 55 employeesand annual revenue of EUR 8 million in 2009.In December <strong>Bisnode</strong> acquired 80.1 per cent ofthe shares in the previously partly-owned companyTA Teleadress Information AB. After the acquisition,<strong>Bisnode</strong>’s holding is 100%. TA Teleadress Informationhas a leading position in the Swedish market forsales of contact data for direct marketing and informationpurposes. The company has 35 employeesand annual revenue of approximately SEK 60 million.Aside from the above acquisitions, the Grouphas acquired the remaining 9.9 per cent of theshares in One Holding AS and taken over operationsin the German company RAAD Researchthrough the acquisition of net assets.Five units were divested during the year. In May<strong>Bisnode</strong> divested the net assets of the Norwegiancompany Inter Dialog AS and in July divested NomiGroup, which is active in the Nordic market forpharmaceutical intelligence.In August <strong>Bisnode</strong> completed the divestiture ofICC in the UK and Ireland and a couple of smallerBritish operations. The divestitures included allbusiness operations Region UK and Ireland, whichhas thus been discontinued.In December <strong>Bisnode</strong> divested Finfo AB and theGroup’s companies active in information and marketingservices for the construction industry, SverigeBygger AB och Norge Bygges AS.In accordance with IFRS 5 Non-current AssetsHeld for Sale and Discontinued Operations, allincome and expenses in the discontinued operations,including capital gains, are reported in profitfrom discontinued operations on a separate line inthe consolidated income statement. The consolidatedcash flow statement is also presented with a separationbetween continuing and discontinued operations.The figures for the comparison period havebeen restated accordingly.Earnings and financial positionRevenue and profitRevenue improved by 10 per cent to SEK 4,741million (4,325). Organic growth amounted to 4 percent. Adjusted for foreign exchange effects, organicgrowth was -1 per cent.Operating profit, EBITA, was SEK 593 million(533), equal to an operating margin of 12.3 per cent(12.0). Adjusted for capital gains on the sale of subsidiaries,operating profit, EBITA, was SEK 563 million(492) and operating margin was 11.9 per cent (11.4).Operating profit, EBIT, fell to SEK 428 million(446) as a result of goodwill impairment andincreased amortisation of intangible assets attributableto business combinations. The year’s goodwillimpairment losses amounted to a total of SEK 41million. The increased amortisation of intangibleassets attributable to business combinations refersto the acquisition of Wer Liefert Was that was completedat the end of 2008.Net financial items totalled SEK -189 million(-416). A stronger Swedish krona rate led to unrealisedforeign exchange gains of SEK 75 million (-131)attributable to the Group’s long-term borrowing. Inaddition, net financial items were positively affectedby lower market interest rates and a reduced loandebt.Income tax for the year totalled SEK -69 million(-14), equal to an average tax rate of 29 per cent(47). The high tax rate for the comparison period isexplained by tax adjustments attributable to priorperiods.Profit from continuing operations was SEK 170million (16), equal to earnings per share of SEK 1.3(0.0).Profit from discontinued operations for the fullyear was SEK -108 million (-4). This figure includesall profit and loss items from Region UK and Ireland,including the capital gain on the sale of ICC andimpairment of goodwill attributable to the region.Profit for the year was SEK 62 million (13) andearnings per share, basic and diluted, were SEK0.4 (0.0).Cash flow and investmentsThe year’s cash flow from operating activities wasSEK 471 million (426). The stronger cash flow ismainly explained by an improved profit beforedepreciation/amortisation and impairment. <strong>Bisnode</strong>is taking active measures to reduce working capitaland is seeing the positive effects of these efforts.Financial positionConsolidated net debt fell from SEK 3,148 million toSEK 2,684 during the year. The large decrease isexplained by strong cash flow from operating activitiestogether with lower expenditure and a net gainof SEK 81 million on the acquisition and divestitureof subsidiaries.Cash and cash equivalents amounted to SEK368 million, compared to SEK 324 million at 31December 2008. In addition, the Group has totalgranted but unutilised bank overdraft facilities ofSEK 400 million.

27EmployeesThe number of employees at 31 December 2009was 3,095 (3,189 at 31 December 2008). The averagenumber of employees during the year was3,167, compared to 2,940 in 2008.Significant events after the balance sheet dateAt the beginning of 2010 <strong>Bisnode</strong> completedthe acquisition of Directinet, a leading supplier ofonline direct marketing solutions in France. Thecompany has 97 employees and annual net salesof EUR 14 million in 2009.Future outlook<strong>Bisnode</strong>’s vision is to be the leading provider ofdigital business information in Europe. The Group’slong-term financial targets are annual revenue growth,including acquisitions and divestitures, of 10 percent over a business cycle and an operating margin,EBITA, of at least 15 per cent over a business cycle.The <strong>Bisnode</strong> Group has recorded average annualgrowth of around 9 per cent over the past tenyears. This growth has been achieved mainlythrough acquisitions. The Group’s strategy is tocontinue expanding primarily through organic growth.<strong>Bisnode</strong> is working actively to streamline theGroup’s offering and increase the focus on coreactivities. As part of this process, <strong>Bisnode</strong> regularlyevaluates the opportunities to both acquire strategicallysuitable companies and to sell off operationsthat are not consistent with the Group’s corebusiness.Risks and uncertaintiesAll business operations involve risks. <strong>Bisnode</strong>works continuosly to identify, measure and managerisk. In cases in which events are beyond<strong>Bisnode</strong>’s control, the aim is to minimise theconsequences. The risks to which the <strong>Bisnode</strong>Group are exposed are classified into three maincategories: external-related risks, operating risksand financial risks.External-related risks– Macroeconomics<strong>Bisnode</strong>’s operations are influenced by a numberof external factors whose effects can be controlledto a varying extent. Demand for the Group’s servicesand products is largely steered by economicdevelopment in the respective country. However,the Group’s external-related risks are reduced bymaintaining a good geographical spread with salesin 18 countries, a large number of customers anda wide range of services and products.– LegislationTo a large extent, the information used by theGroup comes from publicly accessible sources.As a result, the Group’s operations are influencedby the laws and regulations governing publicsector information in each country. In 2003 theEU implemented the so-called PSI Directiveaimed at increasing the availability of public sectorinformation in the EU. The immediate effects ofthe directive are minor, but in a longer perspectivethe directive is expected to increase accessibilityto basic data and thereby drive the supply of anddemand for business information in Europe. TheGroup’s assessment is that it is well positioned touse its experience from the Nordic markets, wheresuch information has been easily accessible forseveral decades, in order to grow and capturemarket shares in the rest of Europe as access toinformation increases.– CompetitionAs technological advances reduce the costs of procuringand delivering digital information, start-upcosts and certain barriers to entry in <strong>Bisnode</strong>’smarkets may be reduced, allowing for more marketentrants and greater competition.To fend off competition from low cost players,<strong>Bisnode</strong> is working actively to develop a more segmentedproduct range and to increase customerloyalty through integrated solutions where the informationis made available directly in the customer’sbusiness system when possible.Operating risks– Product and technology developmentThe <strong>Bisnode</strong> Group’s long-term profitability dependson the Group’s ability to successfully develop andsell new products and services.Digital business information is delivered to customersusing a number of delivery methods, includingdigital media, the Internet and direct integrationinto our customers’ IT systems. If <strong>Bisnode</strong> fails toenhance the current delivery methods or developnew methods in response to changes in technologyor customer preferences, or do not act quicklyenough to enhance or develop new delivery methods,the customers may choose to receive digital businessinformation from other providers.– EmployeesThe most important resource for <strong>Bisnode</strong> is theemployees. In order to retain existing staff andrecruit new talents, <strong>Bisnode</strong> is working actively tooffer competence development and competitiveemployment terms for its employees.Financial risks<strong>Bisnode</strong>’s exposure to financial risk factors such asinterest rate and foreign exchange risk is monitoredand analysed regularly. Interest rate risk is managedthrough the use of derivative instruments to reduceexposure to interest rate movements. Foreignexchange risk is limited by raising part of the longtermborrowing in euro, the currency in which mostof the Group’s sales are denominated.Environment<strong>Bisnode</strong>’s operations have a limited impact on theenvironment and the Group conducts no operationsthat are subject to permitting or reporting requirements.In its purchasing, the Group takes environmentalaspects and social responsibility into considerationwhen choosing products and suppliers.Research and development<strong>Bisnode</strong> conducts product development in its subsidiaries.Parent CompanyThe operations of the Parent Company consist offinancing and ownership of subsidiaries.The Parent Company reported an operating lossof SEK 1 million (11) for the year. Profit after financialitems was SEK 100 million (0). Net financial itemsinclude dividends of SEK 100 million (0) from subsidiaries.The Parent Company made no investmentsduring the year.Group conditions<strong>Bisnode</strong> Business Information Group AB is a subsidiaryof Ratos AB, corporate identity number556008-3585. Ratos’ holding in the companyamounts to 70 per cent of the votes and capital.The remaining shares are held by Bonnier Holding AB.Accounting policiesThe <strong>Bisnode</strong> Group applies reporting in accordancewith International Financial ReportingStandards (IFRS). For additional information seeNote 2.Proposed appropriation of earningsProfits available for appropriation by the AnnualGeneral Meeting (SEK):Retained earnings 538,733,572Profit for the year 99,966,472Total 638,700,044The Board of Directors and the CEO propose thatthe profits be appropriated as follows:To be carried forward 638,700,044Total 638,700,044

30Consolidated statement of changes in equityEquity attributable to owners of the parentSEK thousandsSharecapitalOthercapitalcontributionsReservesRetainedearnings incl.profit forthe yearTotalMinorityinterestTotalequityBalance at 1 January 2008 482,356 1,327,417 37,228 535,188 2,382,189 52,221 2,434,410Total comprehensive income for the year 148,741 -784 147,957 15,433 163,390Share redemption -217,042 -1,132,958 -1,350,000 -1,350,000Bonus issue 217,042 -217,042 0 0Dividend -450,000 -450,000 -1,182 -451,182Shareholder contributions received 435,680 435,680 435,680Minority interest acquired 0 -13,656 -13,656Minority interest divested 0 4,489 4,4890 435,680 0 -1,800,000 -1,364,320 -10,349 -1,374,669Balance at 31 December 2008 482,356 1,763,097 185,969 -1,265,596 1,165,826 57,305 1,223,131Balance at 1 January 2009 482,356 1,763,097 185,969 -1,265,596 1,165,826 57,305 1,223,131Total comprehensive income for the year -131,966 50,551 -81,415 10,453 -70,962Dividend 0 -2,740 -2,740Minority interest acquired 0 -237 -237Other changes 671 671 6710 0 0 671 671 -2,977 -2,306Balance at 31 December 2009 482,356 1,763,097 54,003 -1,214,374 1,085,082 64,781 1,149,863

31Consolidated cash flow statementSEK thousands Note 2009 2008Cash flow from operating activitiesProfit before tax 239,406 30,154Adjustment for items not included in cash flow, etc.Depreciation, amortisation and impairment losses 299,510 232,915Capital gains and losses -30,395 -42,417Unrealised foreign exchange gains/losses -74,561 130,772Interest expense capitalised 91,686 60,658Other -18,978 61,421Income tax paid -71,987 -59,908Cash flow from operating activities before changes in working capital 434,681 413,595Cash flow from changes in working capitalIncrease (-)/Decrease (+) in inventories -1,383 -1,899Increase (-)/Decrease (+) in receivables 45,136 -20,928Increase (+)/Decrease (-) in trade payables -14,429 -26,150Increase (+)/Decrease (-) in other current liabilities 7,436 60,883Cash flow from operating activities 471,441 425,501Cash flow from investing activitiesAcquisition of subsidiaries, net of cash 38 -123,435 -555,791Investments in intangible assets 17 -38,070 -84,861Investments in property, plant and equipment 18 -61,581 -65,529Investments in available-for-sale financial assets 20 -16,617Internally generated assets 17 -19,050 -28,290Sale of subsidiaries, net of cash 39 105,019 51,322Sale of other financial assets 3,331 92,503Sale of intangible assets and property, plant and equipment 4,108 3,794Cash flow from investing activities -129,678 -603,469Cash flow from financing activitiesNew borrowings 4,437,774Repayment of borrowings -395,411 -2,798,295Repayment of non-current receivables 14,373 -4,496Shareholder contributions 435,680Share redemption -1,350,000Dividend paid to owners of the parent -450,000Dividend paid to minority shareholders -2,740 -1,178Cash flow from financing activities -383,778 269,485Cash flow from discontinued operations 40Cash flow from operating activities -1,715 8,835Cash flow from investing activities 98,777 -10,843Cash flow from financing activities -441 375Cash flow from discontinued operations 96,621 -1,633Cash flow for the year 54,606 89,884Cash and cash equivalents at the beginning of the year 323,572 214,452Exchange rate differences on cash and cash equivalents -10,334 19,236Cash and cash equivalents at the end of the year 367,844 323,572Supplementary informationCash flow from operating activities includes paid and received interest in the following amounts:Interest paid -167,578 -203,860Interest received 6,138 16,964

32Parent Company income statementSEK thousands Note 2009 2008Personnel costs 11 -8,112Other external expenses 12 -1,429 -2,401Total operating expenses -1,429 -10,513Operating profit -1,429 -10,513Result from financial itemsResults from participations in group companies 13 177,312 74,785Other interest income and similar items 14 1 23,449Interest expenses and similar items 15 -75,918 -87,763Total profit from financial items 101,395 10,471Profit after financial items 99,966 -42Tax on profit for the year 16 0Profit for the year 99,966 -42

33Parent Company balance sheetSEK thousands Note 31/12/2009 31/12/2008ASSETSNon-current assetsFinancial assetsParticipations in group companies 21 1,373,967 1,365,847Receivables from group companies 535,715 533,937Total financial assets 1,909,682 1,899,784Total non-current assets 1,909,682 1,899,784Current assetsCurrent receivablesReceivables from group companies 432,651 339,417Other receivables 119 339Total current receivables 432,770 339,756Cash and cash equivalents 1 175Total current assets 432,771 339,931TOTAL ASSETS 2,342,453 2,239,715EQUITY AND LIABILITIESEquityRestricted equityShare capital 36 482,356 482,356Statutory reserve 39,980 39,980Non-restricted equityRetained earnings 538,734 538,776Profit for the year 99,966 -42Total equity 1,161,036 1,061,070Non-current liabilitiesLiabilities to group companies 25 796,320 737,333Other liabilities 341,280 316,000Total non-current liabilities 1,137,600 1,053,333Current liabilitiesTrade payables 584 6Liabilities to group companies 42,790 121,558Tax liabilities 148 1,085Other liabilities 2,257Accrued expenses and deferred income 30 295 406Total current liabilities 43,817 125,312TOTAL EQUITY AND LIABILITIES 2,342,453 2,239,715Memorandum itemsAssets pledged 35 1,298,012 1,470,602Contingent liabilities 35 2,625,416 3,050,776

34Parent Company statement of changes in equitySEK thousandsSharecapitalStatutoryreserveNonrestrictedequityTotalequityOpening balance at 1 January 2008 482,356 39,980 1,903,098 2,425,434Share redemption -217,042 -1,132,958 -1,350,000Bonus issue 217,042 -217,042 0Dividends -450,000 -450,000Shareholder contributions received 435,680 435,680Cash flow hedges - net of tax -2 -2Profit for the year -42 -42Closing balance at 31 December 2008 482,356 39,980 538,734 1,061,070Opening balance at 1 January 2009 482,356 39,980 538,734 1,061,070Profit for the year 99,966 99,966Closing balance at 31 December 2009 482,356 39,980 638,700 1,161,036

35Parent Company cash flow statementSEK thousands Note 2009 2008Cash flow from operating activitiesProfit after financial items 99,966 -42Adjustment for items not included in cash flow, etc.Interest expense capitalised 86,592 53,333Unrealised foreign exchange gains/losses -10,960Income tax paid -937Cash flow from operating activities before changes in working capital 174,661 53,291Cash flow from changes in working capitalIncrease (-)/Decrease (+) in receivables 220 10,032Increase (+)/Decrease (-) in other current liabilities -1,790 -57,099Cash flow from operating activities 173,091 6,224Cash flow from investing activitiesAcquisition of subsidiaries, net of cash -8,120 -120Cash flow from investing activities -8,120 -120Cash flow from financing activitiesNew borrowings 1,000,000Repayment of borrowings -390,879Change in group balances -339,930 99,096Shareholder contributions 435,680Share redemption -1,350,000Group contributions received 74,785Dividend received 100,000 650,000Dividend paid -450,000Cash flow from financing activities -165,145 -6,103Cash flow for the year -174 1Cash and cash equivalents at the beginning of the year 175 174Cash and cash equivalents at the end of the year 1 175Supplementary informationCash flow from operating activities includes paid and received interest in the following amounts:Interest paid -277 -5,664Interest received 1 23,449

36Accounting policiesand notesNote 1. General information<strong>Bisnode</strong> Business Information Group AB, with Corporate Identity Number556681-5725, is a subsidiary of Ratos AB, 556008-3585. The <strong>Bisnode</strong> Group isone of the leading providers of digital business information in Europe, with a completeoffering of online solutions for market, credit and business information. TheGroup operates in 18 countries.<strong>Bisnode</strong> Business Information Group AB is a public Swedish limited liabilitycompany that is registered in Stockholm. The address to the head office isSveavägen 168, S168, SE-105 99 Stockholm, Sweden.The consolidated financial statements were approved by the board and theCEO on 10 March 2010 and will be presented to the 2010 Annual General Meetingfor adoption.Note 2. Summary of significant accounting policiesThe principal accounting policies applied in the preparation of these consolidatedfinancial statements are set out below. These policies remain unchanged from theprevious year unless otherwise stated.2.1 Basis for preparationThe consolidated financial statements have been prepared in accordance withInternational Financial Reporting Standards (IFRS) as approved by the EU and withapplication of the standard RFR 1.2, Supplementary Accounting Rules for Groups,and the Annual Accounts Act. The consolidated financial statements have beenprepared under the historical cost convention, as modified by the revaluation ofavailable-for-sale financial assets and derivative financial instruments at fair valuethrough equity in accordance with hedge accounting.All amounts are stated in thousands of Swedish kronor (SEK thousands) unlessotherwise stated.2.2 Consolidation(a) SubsidiariesSubsidiaries are all entities over which the Group has the power to govern thefinancial and operating policies accompanying a shareholding of more than onehalf of the voting rights. The existence and effect of potential voting rights that arecurrently exercisable or convertible are considered when assessing whether theGroup controls another entity. Subsidiaries are fully consolidated from the date onwhich control is transferred to the Group. They are deconsolidated from the datethat control ceases.The purchase method of accounting is used to account for the acquisition ofsubsidiaries by the Group. The cost of an acquisition is measured as the fair valueof the assets given, equity instruments issued and liabilities incurred or assumedat the date of exchange, plus costs directly attributable to the acquisition. Identifiableassets acquired and liabilities and contigent liabilities assumed in a business combinationare measured initially at their fair values at the acquisition date, irrespectiveof the extent of any minority interest. The excess of the cost of acquisition overthe fair value of the Group’s share of the identifiable net assets acquired is recordedas goodwill. If the cost of acquisition is less than the fair value of the net assets ofthe subsidiary acquired, the difference is recognised directly in the income statementamong other operating income.Intra-group transactions, balances and unrealised gains on transactionsbetween group companies are eliminated. Unrealised losses are also eliminatedbut considered an impairment indicator of the asset transferred. Accountingpolicies of subsidiaries have been changed where necessary to ensure consistencywith the policies adopted by the Group.(b) AssociatesAssociates are all entities over which the Group has significant influence but notcontrol, generally accompanying a shareholding of between 20% and 50% of thevoting rights. Participations in associates are accounted for using the equitymethod of accounting and are initially recognised at cost. The Group’s participationsin associates includes goodwill identified on acquisition, net of any accumulatedimpairment loss (point 2.5).The Group’s share of its associates’ post-acquisition profits or losses is recognisedin the income statement, and its share of post-acquisition movements inreserves are recognised in reserves. Shares of profit/loss in associates are includedin operating profit since the operations of associates are closely related to thoseof other group companies. The cumulative post-acquisition movements areadjusted against the carrying amount of the investment. When the Group’s shareof losses in an associate equals or exceeds its interest in the associate, includingany other unsecured receivables, the Group does not recognise further losses,unless it has incurred obligation or made payments on behalf of the associate.Unrealised gains on transactions between the Group and its associates areeliminated to the extent of the Group’s interest in the associates. Unrealised lossesare also eliminated unless the transaction provides evidence of an impairment ofthe asset transferred. Accounting policies of associates have been changedwhere necessary to ensure consistency with the policies adopted by the Group.(c) Transactions with minority sharesThe Group applies a policy of treating transactions with minority interests astransactions with parties external to the Group. Purchases from minority interestsresult in goodwill, being the difference between any consideration paid and therelevant share acquired of the carrying value of the net assets of the subsidiary.Disposals to minority interest result in gains and losses for the Group that arerecorded in the income statement.2.3 Segment reportingOperating segments are reported in a manner consistent with the internal reportingprovided to the chief operating decision-maker. The chief operating decision-maker,who is responsible for allocating resources and assessing performance of theoperating segments, has been identified as the Chief Executive Officer of <strong>Bisnode</strong>.2.4 Foreign currency translation(a) Functional and presentation currencyItems included in the financial statements of each of the Group’s entities aremeasured using the currency of the primary economic environment in which the

37entity operates (“the functional currency”). The consolidated financial statementsare reported in Swedish kronor (SEK), which is the Parent Company’s functionaland presentation currency.(b) Transactions and balancesForeign currency transactions are translated into the functional currency using theexchange rates prevailing at the dates of the transactions. Foreign exchange gainsand losses resulting from the settlement of such transactions and from the translationat year-end exchange rates of monetary assets and liabilities denominated inforeign currencies are recognised in the income statement, except when deferredin equity as qualifying cash flow hedges and qualifying net investment hedges.Translation differences on non-monetary items, such as equity held at fair valuethrough profit or loss, are reported as part of the fair value gain or loss. Translationdifferences on non-monetary items such as shares classified as available-for-sale,are reported directly in equity.c) Group companiesThe results and financial position of all group entities (none of which has the currencyof a hyperinflationary economy) that have a functional currency differentfrom the presentation currency are translated into the presentation currency as follows:( i ) assets and liabilities for each balance sheet presented are translated at theclosing rate at the date of that balance sheet;( ii ) income and expenses for each income statement are translated at averageexchange rates (unless this average is not a reasonable approximation of thecumulative effect of the rates prevailing on the transaction dates, in whichcase income and expenses are translated at the rate on the dates of thetransactions); and(iii ) all resulting exchange differences are recognised as a separate component ofequity.(e) Other intangible assetsOther intangible assets principally refer to systems development in progress.Internal development projects are capitalised if the investment meets the definitionof intangible assets, has an estimated useful life of at least 3 years and exceedsSEK 1,000 thousand.2.6 Property, plant and equipmentProperty, plant and equipment are stated at historical cost less depreciation. Subsequentcosts are included in the asset’s carrying amount or recognised as aseparate asset, as appropriate, only when it is probable that future economicbenefits associated with the item will flow to the Group and the cost of the itemcan be measured reliably. All other repairs and maintenance are recognised in theincome statement during the financial period in which they are incurred.Land is not depreciated. Depreciation on other assets is calculated using thestraight-line method to allocate their cost to their residual values over their estimateduseful lives, as follows:BuildingsComputersLand improvementsOffice equipmentOther equipmentServers25 – 50 years3 – 5 years15 – 20 years5 – 10 years5 – 20 years5 – 10 yearsThe assets’ residual values and useful lives are reviewed, and adjusted if appropriate,at each balance sheet date. An asset’s carrying amount is written down immediatelyto its recoverable amount if the asset’s carrying amount is greater than itsestimated recoverable amount (Note 2.7).Gains and losses on disposal are determined by comparing the proceeds withthe carrying amount and are recognised in the income statement.On consolidation, exchange differences arising from the translation of the netinvestment in foreign operations, and of borrowings and other currency instrumentsdesignated as hedges of such investments, are taken to shareholders’ equity.When a foreign operation is disposed of or sold, such exchange rate differencesare recognised in the income statement as part of the gain or loss on sale.Goodwill and fair value adjustments arising on the acquisition of a foreign entity aretreated as assets and liabilities of the foreign entity and translated at the closing rate.2.5 Intangible assets(a) GoodwillGoodwill represents the excess of the cost of an acquisition over the fair value ofthe Group’s share of the net identifiable assets of the acquired subsidiary/associateat the date of acquisition. Goodwill on acquisitions of subsidiaries is included inintangible assets. Goodwill on acquisitions of associates is included in participationsin associates. Goodwill is tested annually for impairment and carried at cost lessaccumulated impairment losses. Gains and losses on the disposal of an entityinclude the carrying amount of goodwill relating to the entity sold.Goodwill is allocated to cash generating units for the purpose of impairmenttesting. The Group’s cash generating units consists of the six operating segments.(b) TrademarksTrademarks are carried at historical cost. Trademarks have a finite useful life andare carried at cost less accumulated amortisation. Amortisation is calculatedusing the straight-line method to allocate the cost of trademarks over their estimateduseful lives. Useful lives have been estimated at 20 years in all cases.(c) Databases and business systemsDatabases and business systems are capitalised on the basis of the costs incurredto acquire them. These costs are amortised over their estimated useful lives (5–10 years).(d) Customer relationshipsCapitalised customer relationships refer only to those identified in a businesscombination. Customer relationships have been valued on the basis of the so-calledMulti-period Excess Earnings Method and are amortised using the straight-linemethod over the estimated useful lives of the assets. Estimated useful lives havebeen calculated on the basis of the customers’ average rate of business renewalin each company and result in amortisation periods of between 4 and 20 years.2.7 ImpairmentAssets that have an indefinite useful life are not subject to amortisation but aretested annually for impairment, or more frequently when there is an indication ofimpairment.Assets that are subject to amortisation are reviewed for impairment wheneverevents or changes in circumstances indicate that the carrying amount may not berecoverable. An impairment loss is recognised from the amount by which the asset’scarrying amount exceeds its recoverable amount. The recoverable amount is thehigher of an asset’s fair value less costs to sell and value in use. For the purposes ofassessing impairment, assets are grouped at the lowest levels for which there areseparately identifiable cash flows (cash generating units) (see also Note 17).2.8 Financial assetsThe Group classifies its financial assets in the following categories: at fair valuethrough profit or loss, loans and receivables, held-to-maturity investments, andavailable-for-sale financial assets. The classification depends on the purpose forwhich the financial assets were acquired. Management determines the classificationof its financial assets at initial recognition and reviews the classification ateach reporting date.(a) Financial assets and liabilities at fair value through profit or lossThis category has two sub-categories: financial assets held for trading, and thosethat are designated to the category upon initial recognition. A financial asset isclassified in this category if acquired principally for the purpose of selling in theshort term or if this classification is determined by management. Derivatives arealso classified as held for trading unless they are designated as hedges. Assets inthis category are classified as current assets if they are either held for trading orare expected to be sold within 12 month from the balance sheet date. During thefinancial year, the Group had no assets belonging to this category.(b) Loans and receivablesLoans and receivables are non-derivative financial assets with fixed or determinablepayments that are not quoted in an active market. They characteristically arisewhen the Group supplies money, goods or services directly to a customer withoutintending to trade with the claim that has arisen. They are included in currentassets, except for those with maturities greater than 12 months after the balancesheet date. These are classified as non-current assets. This category includesTrade and other receivables in the balance sheet (Note 22).

38(c) Held-to-maturity investmentsHeld-to-maturity investments are non-derivative financial assets with fixed ordeterminable payments and fixed maturity that the Group has the positive intentionand ability to hold to maturity. During the financial year, the Group had no assetsbelonging to this category.(d) Available-for-sale financial assetsAvailable-for-sale financial assets are non-derivatives that are either designated inthis category or not classified in any of the other categories. They are included innon-current assets unless management intends to dispose of the investmentwithin 12 months of the balance sheet date.Regular purchases and sales of financial assets are recognised on the tradedate– the date on which the Group commits to purchase or sell the asset. Investmentsare initially recognised at fair value plus transaction costs, for all financialassets not carried at fair value through profit or loss. Financial instruments arederecognised when the rights to receive cash flows from the investments haveexpired or have been transferred and the Group has transferred substantially allrisks and rewards of ownership. Available-for-sale financial assets and financialassets at fair value through profit or loss are subsequently carried at fair value.Loans and receivables and financial investments held to maturity are carried atamortised cost using the effective interest method.Realised and unrealised gains or losses arising from changes in the fair value ofthe financial assets at fair value through profit or loss are presented in the incomestatement in the period in which they arise. Unrealised gains or losses arising fromchanges in the fair value of instruments classified as available-for-sale are recognisedin equity. When instruments classified as available-for-sale are sold orimpaired, the accumulated fair value adjustments are included in the incomestatement as gains and losses from financial instruments.The fair values of quoted investments are based on current bid prices. If themarket for a specific financial asset is not active (and for unlisted securities), theGroup establishes fair value by using valuation techniques. These include the useof recent arm’s length transactions, reference to other instruments that are substantiallythe same, discounted cash flow statement and option pricing modelsthat have been refined to reflect the issuer’s special conditions.The Group assesses at each balance sheet date whether there is objectiveevidence that a financial asset or a group of financial assets is impaired. In thecase of equity securities classified as available-for-sale, a significant or prolongeddecline in the fair value of the security below its cost is considered as an indicatorthat the securities are impaired. If any such evidence exists for available-for-salefinancial assets, the cumulative loss – measured as the difference between theacquisition cost and the current fair value, less any impairment loss on that financialasset previously recognised in profit or loss – is removed from equity and recognisedin the income statement. Impairment losses recognised in the incomestatement on equity instruments are not reversed through the income statement.2.9 Derivative financial instrumentsDerivatives are initially recognised at fair value on the date a derivative contract isentered into and are subsequently remeasured at their fair value. The method ofrecognising the resulting gain or loss depends on whether the derivative is designatedas a hedging instrument, and if so, the nature of the item being hedged.The Group designates certain derivatives as either: (1) hedges of the fair value ofrecognised liabilities (fair value hedge); (2) hedges of a particular risk associatedwith a recognised liability or a highly probable forecast transaction (cash flowhedge); or (3) hedges of a net investment in a foreign operation (net investmenthedge). As of balance sheet date, the Group uses only cash flow hedges.The Group documents, at the inception of the transaction, the relationshipbetween hedging instruments and hedged items, as well as its risk managementobjectives and strategy for undertaking various hedging transactions. The Groupalso documents its assessment, both at hedge inception and on an ongoingbasis, of whether the derivatives that are used in hedging transactions are highlyeffective in offsetting changes in fair values or cash flows of hedged items.Cash flow hedgesThe effective portion of changes in the fair value of derivatives that are designatedand qualify as cash flow hedges are recognised in equity. The gain or loss relatingto the ineffective portion is recognised immediately in the income statement asfinancial income or expense.Amounts accumulated in equity are recycled in the income statement in theperiods when the hedged item affects profit or loss.When a hedging instrument expires or is sold, or when a hedge no longermeets the criteria for hedge accounting, any cumulative gain or loss existing inequity at the time remains in equity and is recognised when the forecast transactionis ultimately recognised in the income statement. When a forecast transaction isno longer expected to occur, the cumulative gain or loss that was reported inequity is immediately transferred to the income statement.2.10 InventoriesInventories are stated at the lower of cost and net realisable value. Cost is determinedusing the first-in, first-out (FIFO) method. The cost of finished goods andwork in progress comprises design costs, raw materials, direct labour, otherdirect costs and related production overheads (based on normal operatingcapacity). It excludes borrowing costs. Net realisable value is the estimated sellingprice in the ordinary course of business, less applicable variable selling expenses.2.11 Trade receivablesTrade receivables are recognised initially at fair value, less provision for impairment.A provision for impairment of trade receivables is established when there is objectiveevidence that the Group will not be able to collect all amounts due accordingto the original terms of the receivables. The amount of the provision is the differencebetween the asset’s carrying amount and the present value of the estimatedfuture cash flows. The provision is recognised in the income statement amongother expenses.2.12 Cash and cash equivalentsCash and cash equivalents includes cash in hand, deposits held at call with banksand short-term investments. Short-term investments consist of securities withmaturities of less than three months.2.13 BorrowingsBorrowings are recognised initially at fair value, net of transaction costs incurred.Borrowings are subsequently stated at amortised cost. Any difference between theproceeds (net of transaction costs) and the redemption value is recognised in theincome statement over the period of the borrowings using the effective interest method.Borrowings are classified as current liabilities unless the Group has an unconditionalright to defer settlement of the liability for at least 12 months after the balancesheet date.2.14 TaxesDeferred tax is recognised in full, using the liability method, on temporary differencesarising between the tax bases of assets and liabilities and their carryingamounts in the consolidated financial statements. However, the deferred tax is notaccounted for if it arises from initial recognition of an asset or a liability in a transactionother than a business combination that at the time of the transaction affectsneither accounting nor taxable profit or loss. Deferred tax is determined using taxrates (and laws) that have been enacted or substantially enacted by the balancesheet date and are expected to apply when the related deferred tax asset is realisedor the deferred tax liability is settled. Deferred tax relating to items that are recogniseddirectly in shareholders’ equity is recognised directly in shareholders’ equity.Deferred tax assets are recognised to the extent that it is probable that futuretaxable profit will be available against which the temporary differences can beutilised. Deferred income tax assets and liabilities are offset when there is a legalright to offset current income tax assets and liabilities and when deferred taxesrefer to the same tax authority.Temporary differences arising from investments in subsidiaries and associateswhere the Group is able to control the timing of the reversal of the temporarydifference and it is not probable that the temporary difference will be reversed inthe foreseeable future is not recognised.2.15 Employee benefits(a) Pension obligationsGroup companies operate various pension schemes. The schemes are generallyfunded through payments to insurance companies or trustee-administered funds,determined by periodic actuarial calculations. The Group has both defined benefitand defined contribution plans. A defined benefit plan is a pension plan definingan amount of pension benefit that an employee will receive on retirement, usuallydependent on one or more factors such as age, years of service and compensation.

39The Group has no legal or constructive obligations to pay further contributionsto the defined contribution pension plans if the fund does not hold sufficientassets to pay all employees the benefits relating to employee service in the currentand prior periods.The liability recognised in the balance sheet in respect of defined benefit pensionplans is the present value of the defined benefit obligation at the balance sheetdate less the fair value of plan assets, together with adjustments for unrecognisedactuarial gains or losses. The defined benefit obligation is calculated annually byindependent actuaries using the projected unit credit method. The present valueof the defined benefit obligation is determined by discounting the estimated futurecash outflows by using interest rates of high-quality corporate bonds that aredenominated in the currency in which the benefits will be paid and that have termsto maturity approximating to the terms of the related pension liability.The Group applies the corridor rule which states that actuarial gains and lossesarising from experience adjustments and changes in actuarial assumptions inexcess of the greater of 10% of the value of the plan assets or 10% of the definedbenefit obligation are charged or credited to income over the employees’ expectedaverage remaining working lives.Past-service costs are recognised immediately in income, unless the changesto the pension plan are conditional on the employees remaining in service for aspecific period of time (the vesting period). In this case, the past-service costs areamortised on a straight-line basis over the vesting period.For defined contribution plans, the Group pays contributions to publicly orprivately administered pension insurance plans on a mandatory, contractual orvoluntary basis. The Group has no further payment obligations once the contributionshave been paid. The contributions are recognised as employee benefitexpenses when they are due. Prepaid contributions are recognised as an asset tothe extent that a cash refund or reduction in the future payments is available.(b) Termination benefitsTermination benefits are payable when employment is terminated by the Groupbefore the normal retirement date, or whenever an employee accepts voluntaryredundancy in exchange for these benefits. The Group recognises terminationbenefits when it is demonstrably committed to either: terminating the employmentof current employees according to a detailed formal plan without possibility ofwithdrawal; or providing termination benefits as a result of an offer made toencourage voluntary redundancy.2.16 ProvisionsProvisions for restructuring costs, legal claims etc. are recognised when: theGroup has a present legal or constructive obligation as a result of past events; it isprobable that an outflow of resources will be required to settle the obligation; andthe amount has been reliably estimated. A provision is discounted to present valueif it is due to be settled later than twelve months after the balance sheet date andif its effect is significant. Provisions are not recognised for future operating losses.2.17 Revenue recognitionRevenue comprises the fair value of the consideration received or receivable forthe sale of goods and services, excluding value-added tax and discounts andafter eliminating intra-group sales. Revenue is recognised as follows:(a) CD IncomeFor the one-time sale of a CD, the full amount of income is recognised on the dateof the sale. If a CD subscription is sold, the income is recognised evenly over thecontract period or, alternatively, over the number of delivered CDs.(b) Income from catalogue businessIncome from catalogue business activities is accounted for in connection withdistribution to the customer.(c) Online incomeOnline income is allocated over the period covered by the contract or alternativelybased on the customer’s pattern of use.(d) Royalty incomeRoyalty income is recognised on an accrual basis in accordance with the substanceof the relevant agreements.(e) Dividend incomeDividend income is recognised when the right to receive payment is established.2.18 LeasesLeases for non-current assets where the Group substantially carries all the risksand rewards incidental to ownership of an asset are classified as finance leases.The leased asset is recognised as a non-current asset and a corresponding financialliability is recognised in interest-bearing liabilities. The initial value of these twoitems comprises the lower of the fair value of the assets or the present value ofthe minimum lease payments. Future lease payments are divided between amortisationof the liability and financial expenses, so that every accounting period ischarged with an interest amount corresponding to a fixed interest rate on therecognised liability in each period. The leased asset is depreciated according tothe same principles that apply to other assets of the same type. If it is uncertainwhether the asset will be taken over at the end of the leasing period, the asset isdepreciated over the lease term if this is shorter than the useful life that applies toother assets of the same type.Leases for assets where the risks and rewards incidental to ownership essentiallyremain with the lessor are classified as operating leases. The lease paymentsare recognised as an expense on a straight-line basis over the lease term.2.19 Dividend distributionDividend distribution to the Parent Company’s shareholders is recognised as aliability in the consolidated financial statement in the period in which the dividendsare approved by the Parent Company’s shareholders.2.20 Discontinued operationsOperations that have represented a separate major line of business or geographicalarea of operations that have either been disposed of, or are classified as held forsale, are accounted for in accordance with IFRS 5 Non-current Assets Held forSale and Discontinued Operations. According to the standard, all income andexpenses attributable to the discontinued operation are reported on a separateline in the consolidated income statement. The consolidated cash flow is alsopresented with a separation between continuing and discontinued operations.The figures for the comparison period have been restated accordingly.2.21 Changes in accounting policies and disclosuresIFRS 1 – Presentation of Financial statements (Revised)The revised standard requires changes in the titles and presentation of financialstatements. In compliance with this, <strong>Bisnode</strong> presents an additional statement ofcomprehensive income that includes items previously reported in the Group’sstatement of changes in equity.IFRS 8 – Operating SegmentsThe standard was effective from 1 January 2009 and addresses the division ofbusinesses into segments. The standard requires an entity to present segmentinformation on the same basis as that used for internal reporting purposes. Thenew standard has had no significant impact on the financial statements of theGroup.2.22 Cash flow statementThe cash flow statement is prepared in accordance with the indirect method. Thereported cash flow includes only transactions that lead to cash payments or disbursements.2.23 Clarification of IFRS standards or interpretations to standards that arenot yet effective and that will have a significant effect on future financialstatementsIFRS 3 – Business combinations (amendment)This amendment was effective from 1 July 2009 and will be applied by the Groupfrom 1 January 2010. The amendment will have an effect on how future businesscombinations will be accounted for, i.e. the accounting treatment for transactioncosts, possible contingent considerations and business combinations achieved instages. The amendment to the standard will not have any impact on previousbusiness combinations but will have an effect on how the Group accounts forfuture business combinations.