Download PDF version - Bisnode

Download PDF version - Bisnode

Download PDF version - Bisnode

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

annual<br />

report<br />

2010<br />

<strong>Bisnode</strong> Business Information Group AB

03 WhaT We Do<br />

04 Johan WaLL eVaLuaTes 2010<br />

06 Where We are ToDaY<br />

07 Where We are heaDeD TomorroW<br />

08 TrenDs in our inDusTrY<br />

09 WhaT We oFFer To our cusTomers<br />

10 creDiT soLuTions<br />

12 marKeTinG soLuTions<br />

14 Business inFormaTion soLuTions<br />

16 iT’s aLL aBouT PeoPLe<br />

20 reGions anD Business areas<br />

24 corPoraTe GoVernance<br />

25 FinanciaL inFormaTion<br />

26 DirecTors’ rePorT<br />

36 accounTinG PoLicies anD noTes<br />

61 auDiT rePorT<br />

62 BoarD oF DirecTors anD auDiTors<br />

63 execuTiVe manaGemenT Team<br />

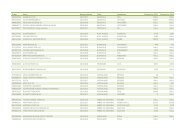

64 suBsiDiaries<br />

66 FiVe-Year summarY anD DeFiniTions serVais YimKWan<br />

database manager

WHAT WE DO<br />

<strong>Bisnode</strong> is a leading provider of digital business information in Europe, with a complete offering<br />

of solutions for marketing, credit and business information. <strong>Bisnode</strong>’s services help companies<br />

maximise sales, minimise business risks and make better business decisions.<br />

3.<br />

<strong>Bisnode</strong> database<br />

2.<br />

1.<br />

PAR<br />

4.<br />

Soliditet<br />

Hoppenstedt<br />

3<br />

1. collect<br />

<strong>Bisnode</strong> collects data about<br />

companies and consumers from<br />

multiple sources in each country.<br />

2. enhance<br />

<strong>Bisnode</strong> enhances data through<br />

harmonisation, validation and<br />

verification. Data in a wider<br />

context becomes value-added<br />

information.<br />

3. package<br />

<strong>Bisnode</strong>’s local subsidiaries<br />

package and customise relevant<br />

information into products and<br />

services by adding the value of<br />

usability, accessibility and innovative<br />

solutions. The same information<br />

is re-used many times,<br />

enabling <strong>Bisnode</strong> to achieve<br />

synergies across markets.<br />

4. oFFeR<br />

Products and services are<br />

offered to different market<br />

segments under strong local<br />

brands to fulfil the various needs<br />

of a diverse customer base.

JOHAN WALL<br />

EVALUATES 2010<br />

2010 was a year of recovery in the European market for business information and for <strong>Bisnode</strong>.<br />

The market strengthened and has now returned to near normal levels of business activity<br />

and demand.<br />

<strong>Bisnode</strong> ended the year on a positive note with organic<br />

growth of over 1 per cent in the second half of the year, partly<br />

as a result of gradually improving market development in<br />

Europe. For the year as a whole, revenue however decreased<br />

organically by 1 per cent. Our operating margin adjusted for<br />

capital gains rose slightly.<br />

Growth<br />

Growth is key for our future, as are leveraging the power of<br />

the <strong>Bisnode</strong> Group and the synergies from our 17 country<br />

operations. In 2010 we took several steps to strengthen<br />

innovation and product development and to extend our<br />

customer offering. Among them launching new Credit<br />

Solutions offerings in Germany, leveraging our existing,<br />

market-leading German data assets.<br />

Our Swedish subsidiary Business Check and German<br />

Hoppenstedt Creditcheck are two good examples of how we<br />

can drive growth. Business Check offers smart, easy-to-use<br />

web-based credit solutions targeting small- and mid-sized<br />

companies in Sweden. By moving the entire concept, business<br />

model, product templates and technology to Germany and<br />

launching it under the strong local brand Hoppenstedt<br />

Creditcheck, we have been able to reduce both time to market<br />

and costs while staying focused on gaining market share. We<br />

are now in the process of launching the same product concept<br />

in other countries, starting with Switzerland and Austria.<br />

By leveraging the power of the <strong>Bisnode</strong> Group and taking<br />

advantage of synergies, we will continue to improve our<br />

growth in the future.<br />

In addition to organic growth, <strong>Bisnode</strong> strives to grow by<br />

making selected acquisitions providing access to new customers<br />

and products while leveraging existing data assets. In the past year<br />

we made strategic acquisitions in our core offering of Marketing,<br />

Credit and Business Information Solutions across Europe.<br />

It’s all about people<br />

<strong>Bisnode</strong>’s success relies on innovation, our ability to<br />

understand and serve our customers’ needs. This is only<br />

possible through the valuable contributions of all our<br />

team members. In 2011 we are further strengthening our<br />

commitment to <strong>Bisnode</strong>’s talent by launching several<br />

initiatives to ensure that we attract, develop and retain the<br />

very best people in our industry.<br />

Future outlook<br />

The business information market is in transformation.<br />

Wider access to data, rapid growth in data usage, new<br />

technologies and evolving customer needs coupled with a<br />

changing regulatory framework are providing both business<br />

opportunities and challenges for <strong>Bisnode</strong>. The key activities<br />

for us in 2011 include launching new products and offerings in<br />

all served markets, dealing with the changed operating model<br />

for spar data and further developing our partnership with d&b.<br />

At <strong>Bisnode</strong> we have strengthened our market position<br />

and see tremendous opportunities to expand. In an era<br />

of information excess, we offer our customers effectively<br />

packaged information that is accessible, structured, verified<br />

and relevant.<br />

Our aim at <strong>Bisnode</strong> is to be the leading provider of digital<br />

business information in Europe. <strong>Bisnode</strong>’s long-term goal is<br />

to achieve an ebita margin of 15 per cent and to grow by 10<br />

per cent per year through a combination of above-average<br />

organic growth and acquisitions.<br />

Thanks to our great offering and committed <strong>Bisnode</strong><br />

talent, we are on the right path to achieving our goals.<br />

Johan Wall<br />

President and CeO<br />

5

6<br />

WHERE WE<br />

ARE TODAY<br />

<strong>Bisnode</strong> operates in 17 European countries<br />

with nearly 3,000 employees. The revenue for<br />

2010 amounted to SEK 4.451 million with<br />

an operating profit of SEK 536 million. The<br />

Group is divided into four geographical<br />

regions. In these regions <strong>Bisnode</strong> provides a<br />

core offering of Credit, Marketing and Business<br />

Information Solutions. In addition, there<br />

are two separate business areas: Product<br />

Information and Software and Applications.<br />

<strong>Bisnode</strong> has operations<br />

in 17 european countries,<br />

With its head office in<br />

stockholm, sWeden<br />

REVENUE PER REGION AND BUSINESS AREA<br />

4%<br />

17%<br />

REVENUE PER PRODUCT OFFERING<br />

18%<br />

keY figures 2010 2009<br />

Revenue (Sek M) 4,451 4,741<br />

operating profit, ebitda (Sek M) 671 728<br />

operating profit, ebita (Sek M) 536 593<br />

operating margin, ebita (%) 12.0 12.5<br />

average number of employees 3,080 3,167<br />

number of customers 200,000 197,000<br />

SEK M<br />

5 000<br />

4 000<br />

3 000<br />

2 000<br />

1 000<br />

0<br />

10%<br />

10%<br />

7%<br />

7%<br />

19%<br />

2006 2007 2008<br />

43%<br />

33%<br />

32%<br />

2009 2010<br />

NORDIC 43%<br />

DACH 19%<br />

BENEFRA 17%<br />

CENTRAL EUROPE 4%<br />

PRODUCT INFORMATION 10%<br />

SOFTWARE AND APPLICATIONS 7%<br />

NORDIC: Denmark, Estonia, Finland,<br />

Norway, Sweden<br />

DACH: Austria, Germany, Switzerland<br />

BENEFRA: Belgium, France, Netherlands<br />

CENTRAL EUROPE: Croatia, Czech Republic,<br />

Hungary, Poland, Slovakia, Slovenia<br />

MARKETING SOLUTIONS 33%<br />

CREDIT SOLUTIONS 32%<br />

BUSINESS INFORMATION<br />

SOLUTIONS 18%<br />

PRODUCT INFORMATION 10%<br />

SOFTWARE AND APPLICATIONS 7%<br />

750<br />

600<br />

450<br />

300<br />

150<br />

0<br />

operating profit,<br />

eBita<br />

reVenue

WHERE WE ARE<br />

HEADED TOMORROW<br />

When it comes to providing the information needed to make the right business<br />

decisions, relevance, access and accuracy are key factors. <strong>Bisnode</strong> combines these factors,<br />

presents them in user-friendly solutions and provides them as part of our customer’s<br />

daily workflow.<br />

Vision<br />

<strong>Bisnode</strong>’s vision is to be the leading provider<br />

of digital business information in Europe.<br />

Mission<br />

<strong>Bisnode</strong>’s mission is to help customers maximise<br />

their sales, minimise their business risks<br />

and make better business decisions. <strong>Bisnode</strong><br />

aims to be a partner for companies of all<br />

sizes in Europe, offering digital business<br />

information and decision support for the<br />

general business-to-business market. By<br />

providing state-of-the-art information solutions,<br />

<strong>Bisnode</strong> helps its customers achieve their<br />

business goals.<br />

Strategy<br />

The main components of <strong>Bisnode</strong>’s strategy<br />

are to work in close relationships with our<br />

customers through strong local presence,<br />

exploit the economies of scale in collecting<br />

and enhancing our own data and build<br />

superior segmented solutions by utilising<br />

the power of the Group. By doing so and<br />

by embracing the opportunities of new<br />

innovative methods and technologies,<br />

<strong>Bisnode</strong> will meet the objective of becoming<br />

an indispensible part of our customers’ daily<br />

business activities – and continue to grow as<br />

a leader in the markets we serve.<br />

Customer value<br />

The key to serving customers well is to provide<br />

clearly segmented offerings under strong<br />

local brands. By working closely with our<br />

customers and utilising the local expertise<br />

when validating, aggregating, selecting and<br />

packaging data in the most accessible format,<br />

we believe <strong>Bisnode</strong> is better able to add more<br />

value to each service.<br />

Scalable, digital business model<br />

<strong>Bisnode</strong>’s digital business model enables<br />

scalability and effective use of our core asset,<br />

the data set in each country. By collecting<br />

and enhancing data that can be sold multiple<br />

times, <strong>Bisnode</strong> is thus able to realise cost<br />

synergies. By sharing best practices and<br />

solutions, we can capitalise on revenue<br />

synergies throughout the Group.<br />

Leveraging the power of the <strong>Bisnode</strong> Group<br />

With the resources of a market-leading<br />

European organisation, combined with<br />

local insight and knowledge in 17 countries,<br />

<strong>Bisnode</strong> offers customers value-added solutions<br />

tailored to their local needs. At <strong>Bisnode</strong><br />

we strive to maximise revenue synergies by<br />

reusing successful concepts, business models<br />

and technologies combined with our local<br />

datasets. By leveraging the power of <strong>Bisnode</strong>,<br />

we are able to reduce time to market, increase<br />

effectiveness and serve our customers well.<br />

Driving future growth for <strong>Bisnode</strong><br />

Expanding the breadth and depth of the<br />

solutions we offer will be vital for <strong>Bisnode</strong>’s<br />

continued growth – both with customers we<br />

currently serve and in new markets where we<br />

establish our presence in the future.<br />

By continuing to develop innovative<br />

technologies that can be more easily adapted<br />

7<br />

to changing consumer behaviours, we will be<br />

able to attract new customers. In addition,<br />

by identifying talented individuals within the<br />

<strong>Bisnode</strong> Group and rewarding their creativity<br />

and entrepreneurial spirit, we will continue<br />

to enhance our position as leaders in the<br />

markets where we operate.<br />

Financial targets<br />

<strong>Bisnode</strong>’s financial target is to achieve an<br />

operating margin, ebita, of at least 15 per cent<br />

and annual revenue growth of 10 per cent<br />

over an economic cycle.<br />

key to SeRving cuStoMeRS<br />

well iS to pRovide cleaRly<br />

SegMented oFFeRingS undeR<br />

StRong local bRandS

8<br />

TRENDS iN<br />

OUR iNDUSTRY<br />

An increasing flow of information, regulatory changes and new technologies are<br />

re-shaping the market for digital business information. Customers are demanding<br />

access to the right information, whenever, wherever – and in a user-friendly format.<br />

The transfer of business information is merging with customers’ work and private lives.<br />

Business information consists of a range of<br />

different types of data, including corporate<br />

and consumer information. Long-term<br />

growth in Europe is estimated to progress at a<br />

three to five per cent annual rate. The market<br />

for digital business information is currently<br />

in a trend of cautious recovery. However,<br />

<strong>Bisnode</strong> mostly operates in segments of the<br />

information industry that are outperforming<br />

the industry average.<br />

The European market for digital<br />

business information is fragmented with<br />

many competing players, especially at the<br />

local and regional levels. At the present<br />

time, the market is experiencing a trend of<br />

consolidation among small operators.<br />

Mobility trend remains strong<br />

New opportunities and user patterns<br />

continue to emerge as the regulatory<br />

framework changes and new technologies<br />

are launched – including mobile, social,<br />

personal, semantic web and portable devices.<br />

The way information is presented,<br />

experienced and used is changing<br />

dramatically. Significant market drivers<br />

include ever-increasing amounts of<br />

information and closer system integration<br />

with end-users. The mobility trend is growing<br />

stronger, and in 2010 the use of personal<br />

tablet computers proliferated. The launching<br />

of solutions for smart phones and tablets<br />

offers a new level of mobility and allows users<br />

to access and process content at their point<br />

of need.<br />

The impact of next-generation content<br />

software technology had dramatic effects<br />

in 2010, and its evolution is expected to<br />

have an even greater impact on the industry<br />

in the year to come. <strong>Bisnode</strong>’s offerings<br />

continuously evolve to meet customer<br />

demands for next-generation services for<br />

business intelligence, social networks,<br />

embedded solutions and information<br />

searches.<br />

Customers are requesting increasingly<br />

sophisticated solutions based on new<br />

technologies with a more precise information<br />

transfer process. There is also a strong<br />

infographic trend, elevating the importance<br />

of design features that facilitate the process of<br />

digesting information.<br />

Sophisticated services and big data<br />

As fixed costs for collecting and managing<br />

data are relatively high, and the additional<br />

cost for packaging and distributing the data<br />

is low, it is imperative that we strive to add<br />

more value to the services <strong>Bisnode</strong> provides.<br />

This ensures the necessary scope for achieving<br />

large economies of scale as user numbers<br />

increase.<br />

Price pressure has risen as the volume<br />

of information has grown, thus increasing<br />

the importance of quality assurance, data<br />

enhancement and value-added services. Onesize-fits-all<br />

solutions are being replaced by<br />

solutions that allow mass customisation. As<br />

the amounts of data grow, new opportunities<br />

arise for analytical tools that can extract<br />

trends, patterns and consumer behaviours.<br />

Vast quantities of data, if refined, enrich<br />

business information services.<br />

<strong>Bisnode</strong> gathers increasing amounts of<br />

data via web crawling and crowd sourcing<br />

to harness the power of user and customer<br />

interactions. Content creation will scale faster<br />

as models take advantage of the network<br />

effect. In order to maintain and strengthen<br />

the Group’s market position, <strong>Bisnode</strong><br />

continues to expand its offer of increasingly<br />

customised products and services, which<br />

includes more focus on user-friendly<br />

innovative solutions.<br />

eveR-incReaSing aMount oF<br />

inFoRMation, cloSeR SySteM<br />

integRation with end-uSeRS<br />

and the Mobility tRend aRe<br />

iMpoRtant MaRket dRiveRS

WHAT WE OFFER TO<br />

OUR CUSTOMERS<br />

<strong>Bisnode</strong> offers high-quality business information,<br />

including company and consumer information.<br />

<strong>Bisnode</strong>’s core offering consists of credit, marketing<br />

and business information solutions that help customers<br />

to maximise sales, minimise risks and make better<br />

business decisions.<br />

core offering credit solutions marketing solutions Business information<br />

solutions<br />

offering<br />

Brands<br />

market<br />

position<br />

main market<br />

segments<br />

competitors<br />

business and consumer credit information<br />

solutions and reports, portfolio monitoring,<br />

credit status updates, credit scoring and risk<br />

analysis for the management of credit risk on a<br />

transactional and/or portfolio basis.<br />

aaa Soliditet, business check, bonitete, cekia,<br />

connectus, credita, d&b, hoppenstedt<br />

creditcheck, hoppenstedt360, wisur<br />

and partnercontrol.<br />

global credit – strong position via d&b brand<br />

for austria, czech Republic, denmark, Finland,<br />

hungary, germany, norway, poland, Sweden<br />

and Switzerland. domestic and regional credit<br />

– strong position in nordic countries, building<br />

local brands in austria, Switzerland, germany<br />

and central europe.<br />

large enterprises with global needs. large<br />

enterprises with domestic/regional needs.<br />

Small to Medium enterprises (SMe).<br />

coface, creditreform, creditsafe, delta vista,<br />

experian and uc Sweden.<br />

business and consumer contact data for mail,<br />

email or telephone, business and consumer<br />

data quality services, data intelligence, database<br />

management services including executing<br />

online communication campaigns.<br />

baby dM Scandinavia, bisnode interact, direkt-<br />

Media, direktMedia 121, paR, wdM and<br />

wdM directinet.<br />

Market leader in belgium, Finland, France,<br />

Sweden and norway and strong position in the<br />

netherlands.<br />

automotive, Fast-Moving consumer goods,<br />

Finance, Fundraising, government, insurance,<br />

leisure, Mailorder, Media, Retail, telecommunications<br />

and utilities.<br />

customised general business information solutions<br />

including financial and legal information,<br />

media monitoring, legal documents, in-depth<br />

industry analysis and extensive personal<br />

information listing.<br />

9<br />

eurodata, gv in, greens, hbi, hoppenstedt<br />

Firmeninformationen, ibon, infotorg, Javnirazpisi,<br />

newsline, poslovna hrwatska, Svensk handelstidning<br />

Justitia, Svenska nyhetsbrev and yritystele.<br />

Market leader in denmark, Sweden and Slovenia<br />

and strong positions in croatia, Finland, germany<br />

and central european countries.<br />

corporations, Financial institutions, public<br />

administrations and Small to Medium enterprises<br />

(SMe).<br />

1000 Mercis, acxiom, global direct and Schober. bundensanzeiger verlag, bureau van dijk,<br />

ergo- group, Factiva, gbi-genios and lexis nexis.

10<br />

CREDiT<br />

SOLUTiONS<br />

<strong>Bisnode</strong> offers a wide range of solutions for credit and risk management, including financial<br />

and economic information, as well as credit assessments. In 2010, <strong>Bisnode</strong> strengthened its<br />

portfolio of both local and global services by developing and enhancing solutions that are<br />

increasingly sophisticated and user-friendly.<br />

<strong>Bisnode</strong> offers business and consumer credit<br />

information services, credit status updates<br />

and business records, including original legal<br />

documents. Most services are offered at both<br />

the local and global levels. Local services are<br />

available through strong regional companies<br />

in the Group with standardised as well as<br />

customised information and specialised<br />

services, often integrated or combined with<br />

the customer’s systems.<br />

Global services are offered through the<br />

market-leading supplier of global credit<br />

information, d&b (Dun & Bradstreet).<br />

<strong>Bisnode</strong> is the largest partner of d&b,<br />

owning and operating d&b companies in<br />

ten European countries. With a portfolio<br />

of both local and global services, <strong>Bisnode</strong><br />

has a leading position in the majority of its<br />

markets.<br />

A resilient market<br />

Following the financial turbulence and frozen<br />

credit markets in 2009, many companies<br />

struggled through hard times. During such<br />

times, the share of business transactions<br />

that are preceded by a credit report is high.<br />

However, it tends to decrease in a strong<br />

economy. During 2010, the market took a<br />

positive turn, and the demand for credit<br />

solution services shifted. As the economy<br />

recovers, the number of business transactions<br />

increases, which in part makes up for the<br />

decrease in credit risk.<br />

– Our continued growth in 2010 is due to an<br />

expansion of the Small to Medium Enterprise<br />

(SME) market, in combination with the<br />

proliferation of more sophisticated solutions<br />

in the Large Enterprise segment, says Mattias<br />

Aronsson, CIO and Competence Centre<br />

Director Credit Solutions.<br />

Market growth in SME segment<br />

A strong trend during 2010 was the expansion<br />

of the market for credit solutions in the sme<br />

segment. <strong>Bisnode</strong>’s solutions offer easy access<br />

to user-friendly credit services meeting the needs<br />

of small businesses and contribute to driving<br />

demand for credit solutions in the sme segment.<br />

– Traditionally, our solutions have primarily<br />

been directed toward advanced users. Now,<br />

as the share of smaller companies that are<br />

performing credit checks is on the rise, we<br />

have focused on developing more user-friendly<br />

solutions, says Mattias Aronsson.<br />

Sophisticated services add value<br />

In the recent past, the need for sophisticated<br />

risk management solutions has increased. This<br />

trend has fuelled the development of value-<br />

added services in addition to the data <strong>Bisnode</strong><br />

delivers in the Large Enterprise segment.<br />

– In our line of business, adding value means<br />

moving from delivering reports and data<br />

to refining and processing the data for our<br />

customers with analytical tools and integrated<br />

services. Delivering more sophisticated services<br />

allows us to retain premium pricing and enables<br />

our customers to focus on their core business,<br />

says Mattias Aronsson.<br />

<strong>Bisnode</strong> strengthened its Credit Solutions<br />

offering and market position in Germany<br />

in 2010. Recent start-up Hoppenstedt<br />

CreditCheck is now an established player<br />

with significant brand recognition in the<br />

market. <strong>Bisnode</strong> also launched Hoppenstedt<br />

360, focusing on the needs for domestic credit<br />

solutions in the Large Enterprise segment. In<br />

Central Europe, <strong>Bisnode</strong> developed a small<br />

business offering, PartnerControl, which is<br />

now offered in Hungary, the Czech Republic<br />

and Slovakia.<br />

Although the demand for credit solutions<br />

is traditionally counter-cyclical in nature, the<br />

development of <strong>Bisnode</strong>’s Credit Solutions<br />

remained strong throughout the business<br />

cycle. Credit Solutions showed a positive<br />

development in 2010 and increased its share<br />

of <strong>Bisnode</strong>’s total revenue to 32 percent.<br />

adding value MeanS Moving FRoM<br />

deliveRing RepoRtS to ReFining<br />

the data with analytical toolS<br />

and integRated SolutionS

1.<br />

3.<br />

4. 5.<br />

2.<br />

11<br />

product example: every company can benefit from minimising the risks connected to their<br />

business. one major part of bisnode’s offering is to provide credit Solutions as sophisticated<br />

integrated solutions that enable companies to maximise their sales, without taking unnecessary<br />

risks.<br />

1. Many major retailers, for example electronics firms, offer payment plans to reach more<br />

customers and sell more products, such as tvs. to ensure that a particular customer has the<br />

necessary means to pay for items they would like to purchase, bisnode’s integrated credit<br />

Solution can be utilised to instantly perform a comprehensive credit check on the customer.<br />

2. every potential customer has his or her creditworthiness data gathered in a stored and integrated<br />

scorecard. during checkout, a cashier can easily enter the customer’s personal data and<br />

immediately get a green or red light to approve or deny a purchase<br />

3. the information that is the basis for a consumer scorecard is gathered from local sources<br />

such as tax authorities, courts, official registers and the land registration authority. on this<br />

scorecard, factors such as age, date of employment, home ownership, involvement in company<br />

bankruptcies, etc. are merged together with the customers’ own regulations of providing credit<br />

to the client. a score from 1 to 10 that indicates the client’s creditworthiness is compiled from<br />

this information.<br />

4. when a customer is approved, the necessary information is entered into the system and a<br />

payment plan is established.<br />

5. the customer goes home with a new tv, and the electronics firm gets a new customer.

12<br />

MARKETiNG<br />

SOLUTiONS<br />

<strong>Bisnode</strong> is one of Europe’s leading providers of marketing services including Customer<br />

Relationship Management, addressed and interactive direct marketing. In 2010, <strong>Bisnode</strong><br />

also strengthened its cross-channel integration and solutions for harnessing the information<br />

in social networks.<br />

<strong>Bisnode</strong>’s services are offered in two main<br />

segments: business-to-business and businessto-consumer.<br />

With the help of <strong>Bisnode</strong>’s<br />

solutions, customers can identify their<br />

own prospects and customer segments.<br />

<strong>Bisnode</strong> also offers up-to-date solutions for<br />

retaining and developing existing customer<br />

relationships by actively interacting with<br />

businesses and consumers. It is necessary to<br />

interact with customers via the most relevant<br />

channel and to take into consideration that<br />

the nature of the message will affect which<br />

channel produces the best results.<br />

– The speed of the dialogues is quicker, and<br />

customers have set higher standards on receiving<br />

sharper messages via the right channel. This<br />

increases the importance of high-quality crosschannel<br />

contact points. Linking the customer<br />

value from our databases with the estimation of<br />

their social value is an important focal point for<br />

the future, says Norbert Verkimpe, Competence<br />

Centre Director Marketing Solutions.<br />

Evolution of Business Intelligence<br />

As consumers become more of a moving<br />

target, marketers will need to capture more<br />

information about them, mine all of the<br />

available data and find smarter ways to<br />

extrapolate it. More data than ever is being<br />

collected. However, a larger quantity of<br />

information is not in itself the answer. The<br />

demand for higher quality data drives the<br />

evolution of Business Intelligence. The<br />

marketing solutions become more effective<br />

by taking a wider look at the people <strong>Bisnode</strong>’s<br />

customers want to reach, and by applying all<br />

of the available information.<br />

– A highly noticeable trend is that customers<br />

are asking for more relevant data, rather than<br />

just more data. They also want it presented in a<br />

user-friendly format. <strong>Bisnode</strong>’s processing power<br />

saves the customers time and allows for more<br />

effective cross-channel communication, says<br />

Norbert Verkimpe.<br />

It’s time to interact with the customers<br />

2010 was the year in which companies and<br />

brands seriously started reflecting on how<br />

to harness the power of social networks.<br />

Now the time has come for companies to<br />

start having more serious dialogues with<br />

their consumers. In 2010, we witnessed an<br />

explosion of social media. As a result, brands<br />

have become increasingly intrigued by how<br />

they should position themselves. In 2011, it’s<br />

time for companies to become more active.<br />

– The explosion of social media has also caught<br />

the attention of governments, who are looking<br />

at how to protect people’s integrity online. Our<br />

job is to offer privacy proof solutions for the<br />

individual that are set in accordance with local<br />

laws, says Norbert Verkimpe.<br />

About <strong>Bisnode</strong> Marketing Solutions<br />

<strong>Bisnode</strong> can assist customers in projectbased<br />

campaigns or services, as well as in the<br />

implementation and streamlining of ongoing<br />

marketing activities. Other marketing services<br />

include business and consumer list broking,<br />

data mining and project management.<br />

Specialised value-added offerings such as<br />

data cleansing, hosting loyalty schemes and<br />

advanced statistical segmentation are also<br />

available.<br />

Marketing Solutions account for 33% of<br />

<strong>Bisnode</strong>’s total revenue. Customers are sales-<br />

and marketing-driven companies in both the<br />

commercial and financial industries, as well<br />

as crm and direct marketing users.<br />

biSnode’S pRoceSSing poweR in<br />

pRoviding Relevant inFoRMation<br />

SaveS tiMe FoR the cuStoMeR and<br />

allowS FoR MoRe eFFective cRoSSchannel<br />

coMMunication

3.<br />

4.<br />

1.<br />

2.<br />

13<br />

product example: bisnode allows its clients, such as insurance companies, to keep track of<br />

their customers and give them relevant offers at the right time. one way of accomplishing this<br />

is by establishing key indicators that describe a customer’s lifestyle and purchasing power.<br />

1. Jean is a young man who lives with his parents. he is represented in bisnode’s system by<br />

three different keys. his individual key – representing Jean himsef. the household key – representing<br />

Jean and his parents. and finally the geographical key – representing the house they live in.<br />

2. when Jean moves out to his own flat, all three of those keys change. the insurance company<br />

can send an offer to Jean to get insurance for his new flat, and since he is on his own now, perhaps<br />

accident insurance as well. at the same time, they also offer his parents the chance to<br />

update their insurance.<br />

3. Jean meets a girl, and she moves in. the insurance company receives an indication from<br />

bisnode in their system suggesting that new relevant offers can be provided. when they buy a<br />

car or have children, the insurance company knows and can adjust its marketing accordingly.<br />

4. this way, handling the data is easier and more secure for bisnode. it also allows the customers<br />

to create marketing activities targeted at individuals, families or addresses.

14<br />

BUSiNESS iNFORMATiON<br />

SOLUTiONS<br />

<strong>Bisnode</strong>’s Business Information offering ranges from general financial and legal information to<br />

media monitoring services and people information solutions. During 2010, <strong>Bisnode</strong> advanced<br />

in the area of embedded information in customer workflows, and continued to utilise new<br />

technologies to facilitate the usage of business information.<br />

<strong>Bisnode</strong>’s offering includes a wide range of<br />

information, media monitoring and legal<br />

documents of p&l statements, land registry<br />

information and car registry information<br />

for in-depth industry analysis. The offering<br />

also includes extensive personal information<br />

such as decision-makers, managers and board<br />

members. Detailed business information<br />

can also be obtained about individual<br />

entrepreneurs and small- to medium-sized<br />

enterprises that otherwise can be hard to find.<br />

<strong>Bisnode</strong>’s information provides a solid base<br />

for well-founded decisions, from determining<br />

who to contact at a company to extensive<br />

processes needed for acquisitions and other<br />

corporate actions that require substantial<br />

decision support.<br />

Easy access to accessible data<br />

Demand for standardised and segmented<br />

products is expected to continue to<br />

expand alongside the need for one-stop<br />

shop solutions. New technologies create<br />

opportunities to offer enhanced solutions<br />

for data access. The infographic trend<br />

continues to grow stronger, and customers<br />

are demanding that detailed and complex<br />

information be presented in a user-friendly,<br />

visual format. Customers are demanding the<br />

right information at the right time and place,<br />

and in an accessible format. <strong>Bisnode</strong> has<br />

re-shaped and re-launched several solutions<br />

in 2010. InfoTorg, Poslovna Hravatska and<br />

Hoppenstedt Firmeninformationen presented<br />

services with new visual qualities and adapted<br />

them for use in mobile devices.<br />

– Customers are asking for solutions that make<br />

data more accessible from mobile devices such<br />

as smartphones and tablet computers. We<br />

also speed up the transfer of information by<br />

enhancing visual elements including graphs<br />

that convey data faster than a table of numbers<br />

would, says Maria Anselmi, Competence Centre<br />

Director of Business Information Solutions.<br />

Data collection and embedded usage<br />

The broad range of services attracts a wide<br />

variety of customers, from managers and<br />

key decision-makers to consultants and<br />

business analysts. A significant share of the<br />

information comes from the government<br />

and other public sources, as well as private<br />

sources. Some information is collected<br />

through media and Internet monitoring. An<br />

increasing share of the data is collected using<br />

web crawling and crowd sourcing.<br />

– Web crawling is gathering data from<br />

the Internet via a computer program that<br />

automatically and methodically browses the<br />

web. Crowd sourcing outsources data collection<br />

that is traditionally performed by employees, to<br />

an undefined large group of people in society,<br />

says Maria Anselmi.<br />

Customers need updated information<br />

about news, events, competitors and credit<br />

risk in each market. Embedded usage is<br />

growing, which means that external business<br />

information is integrated with internal<br />

systems and workflows. By offering qualified<br />

business information services and solutions<br />

that integrate well with the customer<br />

platform, the level of customer benefit is<br />

increased.<br />

– Integrating internal and external data gives<br />

our customer a wider spectrum of information.<br />

A more complete data set offers our customers a<br />

better base for accurate decision-making, states<br />

Maria Anselmi.<br />

The market for business information is in a<br />

recovering trend, although the market tends<br />

to be fairly robust in relation to the business<br />

cycle. Business Information Solutions account<br />

for 18 per cent of <strong>Bisnode</strong>’s total revenue.<br />

pRoviding SolutionS that Make<br />

data MoRe acceSSible FRoM Mobile<br />

deviceS and enhance it with MoRe<br />

gRaphical viSualS iS an incReaSing<br />

deMand FRoM ouR cuStoMeRS

3.<br />

4.<br />

1.<br />

2.<br />

15<br />

product example: every company can benefit from keeping tabs on the world around it.<br />

bisnode provides online monitoring services for small- and medium-sized companies to help<br />

them with day-to-day fact finding on their market, their competitors and partners.<br />

1. companies can keep tabs on what is written by business publications. bisnode searches the<br />

daily business press and indexes articles into a database that numbers more than one million<br />

articles in various countries. driven by a powerful search engine, customers get the latest news<br />

and market trends at all times.<br />

2. bisnode gathers information about companies and decision-makers from sources such as<br />

local courts, banks, official government agencies and business partners.<br />

3. bisnode uncovers information about insolvency cases, legal issues, payment indices and<br />

other information that enables our customers to perform benchmark analyses, study balance<br />

sheets, annual reports and more.<br />

4. bisnode business information Solutions gives each client sufficient data to continuously<br />

monitor the market in order to make better and safer decisions in their day-to-day business.

16<br />

iT’S ALL ABOUT<br />

PEOPLE<br />

Talent is the key to business success. <strong>Bisnode</strong> works strategically to attract, develop and retain the<br />

right talent for today and tomorrow. Employees at <strong>Bisnode</strong> have the advantages of working for<br />

small and mid-sized entrepreneurial companies at the same time that the Group provides the<br />

opportunities available in a large organisation.<br />

Knowing our markets<br />

The <strong>Bisnode</strong> Group is present in 17 countries<br />

in Europe and had 2,974 employees at the<br />

end of 2010. The Group is divided into<br />

four geographical regions in which <strong>Bisnode</strong><br />

provides a core offering of credit, marketing<br />

and business information solutions. The<br />

local focus enables <strong>Bisnode</strong> to work close<br />

to the customers and take advantage of the<br />

competitive edge locally. In addition, there<br />

are two separate business areas – Product<br />

Information, offering product information<br />

and online-based advertising services across<br />

Europe, and Software and Applications.<br />

Power of the Group<br />

<strong>Bisnode</strong> is committed to sharing ideas and<br />

enhancing its longstanding entrepreneurial<br />

tradition. Three Competence Centres – for<br />

Credit Solutions, Marketing Solutions and<br />

Business Information Solutions – allow<br />

the sharing of knowledge and ideas while<br />

encouraging an innovative approach to new<br />

business opportunities. These Competence<br />

Centres strive to transfer successful concepts<br />

throughout regions and to create revenue by<br />

searching for business opportunities across<br />

borders.<br />

The local focus combined with increased<br />

transparency enables maximised business<br />

potential and synergies throughout the<br />

Group.<br />

Maximizing performance and potential<br />

One of <strong>Bisnode</strong>’s strategic objectives is to<br />

offer an environment where individuals<br />

can grow in their professional roles, and<br />

the Group shares a comprehensive strategy<br />

for Talent Management. With a large<br />

number of <strong>Bisnode</strong> companies in many<br />

geographical markets and a wide range of<br />

business information solutions, <strong>Bisnode</strong><br />

offers a multitude of opportunities for career<br />

advancement within the Group for not only<br />

current but also future talent.<br />

– Our strategic focus on talent development<br />

and knowledge sharing allows us to maximize<br />

the potential of the talent we have in-house to<br />

increase profitability and growth at the same<br />

time that we attract new talent, says Karin<br />

Svensson, Talent Director.<br />

<strong>Bisnode</strong> is focused on developing the<br />

right leadership for today and tomorrow,<br />

identifying talent in all areas of the business<br />

and developing it to its full potential, as<br />

well as dynamically sharing talent within<br />

the Group by allowing the organisation to<br />

become more transparent. Our goal is to<br />

successfully develop employee talent and offer<br />

our employees interesting career paths and<br />

mobility within the company in order to gain<br />

new skills and experiences. A good Talent<br />

Management strategy is a way to retain top<br />

talent within the Group.<br />

Building engagement<br />

A motivated team is a more proactive team.<br />

<strong>Bisnode</strong> recognises that the ability to attract<br />

and engage talented people within the<br />

Group is a key differentiator in remaining<br />

ahead of the competition and growing the<br />

entire organisation. By taking a strategic<br />

view of talent development in the same<br />

way as we do with product development<br />

and demonstrating a culture of continuous<br />

learning and cooperation, we engage the inhouse<br />

talent to create a positive spiral where<br />

talented people attract other talented people.<br />

– By injecting passion, energy and fun into our<br />

work and continuously connecting with our<br />

people, we can better understand the drivers for<br />

their engagement, meaning and each employee’s<br />

experience of being part of the <strong>Bisnode</strong> Group,<br />

says Karin Svensson.<br />

Values<br />

entRepReneuRial SpiRit<br />

<strong>Bisnode</strong> was built by entrepreneurs, and<br />

it is vital to maintain the entrepreneurial<br />

spirit in order to continue growing.<br />

local FocuS<br />

By working closely with customers,<br />

knowing <strong>Bisnode</strong>’s markets and taking<br />

advantage of the competitive edge locally.<br />

a winning attitude<br />

By striving for the number one position,<br />

exploring new possibilities and being<br />

ambitious while having fun.<br />

integRity<br />

By caring for the individual, securing<br />

the credibility of the Group’s business<br />

information and using it responsibly.<br />

openneSS<br />

By pursuing open communication and<br />

transparency.

peter trap<br />

direCtOr internatiOnaL<br />

business deveLOPment<br />

organisation<br />

REGION<br />

NORDIC<br />

REGION<br />

DACH<br />

FINANCE<br />

COMMUNICATIONS<br />

STRATEGIC IT<br />

TALENT<br />

REGION<br />

BENEFRA<br />

CEO<br />

REGION<br />

CENTRAL<br />

EUROPE<br />

COMPETENCE CENTRES<br />

CREDIT<br />

SOLUTIONS<br />

MARKETING<br />

SOLUTIONS<br />

BUSINESS<br />

INFORMATION<br />

SOLUTIONS<br />

BUSINESS<br />

AREA<br />

PRODUCT<br />

INFORMATION<br />

17<br />

BUSINESS<br />

AREA<br />

SOFTWARE<br />

AND<br />

APPLICATIONS<br />

personnel keY figures 2010 2009<br />

average number of emloyees 3,080 3,167<br />

number of emloyees at 31 december 2,974 3,095<br />

total revenue per employee (Sek th) 1,445 1,497<br />

operating profit (ebita) per employee (Sek th) 174 187<br />

number of men in the group 1,731 1,749<br />

number of women in the group 1,348 1,418<br />

EMPLOYEES BY REGION/BUSINESS AREA 2010<br />

11%<br />

8%<br />

16%<br />

7%<br />

1%<br />

21%<br />

35%<br />

NORDIC 35%<br />

DACH 21%<br />

BENEFRA 16%<br />

CENTRAL EUROPE 11%<br />

PRODUCT INFORMATION 8%<br />

SOFTWARE AND APPLICATIONS 7%<br />

CENTRAL 1%<br />

emploYees BY function 2010 %<br />

SaleS & MaRketing 46%<br />

pRoduction 41%<br />

adMiniStRation 13%

18<br />

claudine knop<br />

managing direCtOr<br />

Through dedicated and passionate leadership, Claudine Knop,<br />

Managing Director of wdm Belgium, has shaped a company in which<br />

innovation is at the heart of day-to-day business. Claudine recognises<br />

the talent in every employee and motivates her colleagues to achieve<br />

the best possible results.<br />

Knop was awarded Leadership of the Year 2010, whereby she was<br />

recognised for her innovative thinking, good communication skills<br />

and for creating a good team spirit. “It feels inspiring to be in a<br />

company with 3,000 passionate digital information specialists who all<br />

strive to develop unique solutions in different business areas.”<br />

Leadership of the Year<br />

“I feel really honoured to have won the Leadership of the Year award.<br />

I didn’t quite expect it since I have only been ceo for two years. Of<br />

course, I share the recognition with the members of my team, all of<br />

whom are very innovative and make a positive difference in our every-<br />

day business. My main contribution to our success is that I have empowered<br />

my team by welcoming and recognising new ideas”, Knop says.<br />

Communication is the key<br />

Knop firmly believes that effective communication skills are essential<br />

for successful leadership. It’s how you create solidarity and common values.<br />

“I have worked hard to create an atmosphere where everyone feels<br />

comfortable bringing new ideas to me. However, people assimilate<br />

information differently. Therefore, it’s as important to offer face-toface<br />

communication as it is to write a weekly blog or share your vision<br />

in a report. One of the initiatives for promoting innovation is a web<br />

forum where all employees can post their ideas.”<br />

Talent Management Program<br />

Knop points out that the <strong>Bisnode</strong>’s Talent Management Program will<br />

have a positive effect on the future of the Group.<br />

“A company’s employees are just as important as its products and<br />

services. If we allow people to grow, continue to promote innovative<br />

thinking and develop new digital solutions, it won’t be long before<br />

we’re number one in all markets.”<br />

name: Claudine Knop<br />

position: managing director at Wdm belgium<br />

since 2009, with 170 employees. Knop has worked<br />

with the bisnode group since 1994.<br />

Business target for 2011: to increase<br />

revenue, to integrate new technology with our<br />

digital solutions and to continue to develop the<br />

team.<br />

personal character traits: Perceptive,<br />

genuine and demonstrating excellent<br />

communication skills.

name: Pasi Leino<br />

position: account director at soliditet<br />

Finland. Leino has been with the bisnode group<br />

since 2005.<br />

Business target for 2011: to expand the<br />

market in the consumer credit business segment<br />

and be the first person to win the Performance of<br />

the Year award two years in a row.<br />

personal character traits: Listens well to<br />

customers, keeps his promises and will do what it<br />

takes to close the deal.<br />

name: Christian brandlhuber<br />

position: account manager at sales &<br />

marketing solutions in d&b germany. He has<br />

worked within the bisnode group since 2008.<br />

Business target for 2011: Compared to 2010,<br />

brandlhuber’s budget has been raised by more<br />

than 150 per cent for 2011. the reason for this is to<br />

encourage even greater contributions that will<br />

further strengthen the position of the group in the<br />

marketplace.<br />

personal character traits: Creative,<br />

diligent, flexible, friendly, persistent and persistent<br />

and persistent.<br />

pasi leino<br />

aCCOunt direCtOr<br />

Pasi Leino, Account Director at Soliditet<br />

Finland, received the Performance of the<br />

Year award. He had a very successful year<br />

in 2010 and managed to sign contracts with<br />

large customers in a new business area. “I am<br />

truly honoured to have been selected, and to<br />

be a part of a very successful organisation.<br />

Winning the award has spurred me to deliver<br />

even better results this year.”<br />

Performance of the Year<br />

Pasi Leino is known for his ambitious drive<br />

and winning attitude. In 2007, he played a<br />

key role in breaking up the monopoly in the<br />

personal credit business segment in Finland.<br />

This greatly helped strengthen <strong>Bisnode</strong>’s<br />

market position.<br />

Last year he exceeded all sales goals and<br />

received the Performance of the Year award<br />

for his achievements.<br />

christian BrandlhuBer<br />

aCCOunt manager<br />

Christian Brandlhuber, Account Manager at<br />

d&b Germany, was awarded 2010 Salesperson<br />

of the Year. He won the award for exceeding<br />

his individual annual sales budget by 288 per cent.<br />

This was the highest figure in the Group.<br />

“Excellent support from my managers and my<br />

team helped me achieve such an excellent result.”<br />

Salesperson of the Year<br />

Despite the challenges of the financial crisis,<br />

Christian Brandlhuber had a successful year<br />

in 2010 by closing a large number of deals<br />

and attracting new customers. As a result,<br />

he reached remarkable sales figures and was<br />

selected as Salesperson of the Year.<br />

Brandlhuber is recognised for his customer<br />

relationship skills and for creatively modifying<br />

market solutions to fit customer demands.<br />

“As an Account Manager, it is necessary to really<br />

listen, recognise what the customer needs and<br />

act upon it. I never sell just a product. I offer<br />

a solution to a real problem,” Brandlhuber says.<br />

19<br />

Working together leads to success<br />

“The success I enjoyed in 2010 could not have<br />

been possible without the support of my<br />

colleagues. In order to meet the challenges<br />

successfully, it was necessary to apply<br />

knowledge shared by my colleagues, and<br />

also to work creatively with them to create<br />

customised solutions,” says Leino.<br />

Innovation and entrepreneurship<br />

Leino points out that the Group has given<br />

him complete confidence to pursue leads for<br />

new customers. He feels that innovation and<br />

entrepreneurship are encouraged, which helps<br />

him maximise his results.<br />

“The balance between freedom and<br />

responsibility has been essential to my<br />

achievements. I am convinced that if <strong>Bisnode</strong><br />

continues to support this kind of development,<br />

we have a great future ahead of us.”<br />

The key to success<br />

Brandlhuber’s accomplishment is based on<br />

several factors. “To succeed in sales you have<br />

to be at the right place, at the right time and<br />

offer the right solution,” Brandlhuber explains.<br />

He suggests that another key to success is<br />

to identify the gatekeeper. By getting through<br />

to the decision-maker you close the deal<br />

faster. Brandlhuber continues by saying, “in<br />

my Account Manager role, I never let the lost<br />

deals bring me down. It is a natural part of<br />

the job. Be persistent, always knock on new<br />

doors and focus on your goals. My motto is<br />

abc – Always Be Closing.”<br />

A creative environment<br />

<strong>Bisnode</strong> Group strives to offer a stimulating<br />

environment that allows the individuals to<br />

grow and develop. Brandlhuber truly believes<br />

that <strong>Bisnode</strong> lives up to that ambition.

20<br />

REGiONS AND<br />

BUSiNESS AREAS<br />

<strong>Bisnode</strong>’s core offering of credit, market and business information<br />

solutions is organised into four geographical regions with similar<br />

market conditions, business opportunities and local synergies.<br />

In addition, there are two separate business areas<br />

– Product Information and Software and Applications.<br />

serVais YimkWan<br />

database manager<br />

natalie guidotti<br />

aCCOunt manager<br />

alexandre rossez<br />

database manager

egion nordic<br />

mats<br />

erWald<br />

regiOnaL direCtOr<br />

The Nordic region is the Group’s largest, with a very strong<br />

offering in all product areas. In 2010, revenue amounted to sek<br />

1.988 million with an operating profit of sek 371 million.<br />

Demand for <strong>Bisnode</strong>’s solutions was stable, and operations<br />

showed high profitability. Overall, the challenge in the region is<br />

growth. Developments differed between countries. In Denmark<br />

growth slowed following previous year’s sharp increase, and in<br />

Norway the business development remained weak. Finland<br />

continued to perform well and operations were strengthened<br />

through the acquisition of Yritystele.<br />

In Sweden, the business continued to deliver high operating<br />

profit margin, despite that the Swedish market for personal information<br />

is in transition since the Swedish Tax Agency assumed re-<br />

sponsibility for spar. This will affect the Swedish operations,<br />

however, our assesment is that other operations in <strong>Bisnode</strong> will<br />

compensate for the estimated decline in revenue.<br />

region Benefra<br />

norBert<br />

Verkimpe<br />

regiOnaL direCtOr<br />

<strong>Bisnode</strong> has a strong offering of marketing solutions and is<br />

the leading provider of services for consumer marketing in the<br />

region. In 2010, revenue amounted to sek 741 million with an<br />

operating profit of sek 30 million.<br />

Region BeNeFra reported negative organic growth of<br />

6 per cent, adjusted for foreign exchange effects. Overall, the<br />

region struggled to keep pace with market recovery, regulatory<br />

changes and re-organisations. In the Netherlands, a significant<br />

regulatory change has affected market conditions for all players<br />

and led to negative growth. To adapt these operations an<br />

action programme with substantial cost-cutting measures was<br />

implemented. In Belgium, an integration project has been<br />

carried out to unite the customer offerings in business-tobusiness<br />

and business-to-consumer information. Profits in France<br />

were affected by one-time costs, connected to the integration of<br />

Directinet, which was acquired at the beginning of the year.<br />

denmark<br />

estonia<br />

finland<br />

norWaY<br />

sWeden<br />

SEK m<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

0<br />

Belgium<br />

france<br />

netherlands<br />

SEK m<br />

900<br />

800<br />

700<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

2008 2009 2010<br />

2008 2009 2010<br />

750<br />

600<br />

450<br />

300<br />

150<br />

0<br />

120<br />

100<br />

80<br />

60<br />

40<br />

20<br />

0<br />

Continued<br />

high<br />

profitability<br />

21<br />

REVENUE<br />

OPERATING PROFIT,<br />

EBITA<br />

Challenging<br />

market<br />

REVENUE<br />

OPERATING PROFIT,<br />

EBITA

22<br />

region dach<br />

eckhard<br />

geulen<br />

regiOnaL direCtOr<br />

<strong>Bisnode</strong> has a strong offering of credit solutions in the dach<br />

region and offers business information solutions in Germany.<br />

In 2010, revenue amounted to sek 860 million with an<br />

operating profit of sek 104 million.<br />

Region dach reported positive development with organic<br />

growth of 3 per cent, adjusted for foreign exchange effects.<br />

Investments in data quality is starting to pay off in expanded<br />

offering with the launch of Hoppenstedt CreditCheck and<br />

Hoppenstedt360. Despite ongoing initiatives to increase the<br />

Group’s share of the German credit information market, the region<br />

showed higher profitability. Austria and Switzerland continued<br />

to deliver positive performances with slight growth along with<br />

improved operating margins.<br />

Eckhard Geulen has been appointed Regional Director<br />

dach following the resignation of Peter Villa in April 2011.<br />

region central europe<br />

martin<br />

coufal<br />

regiOnaL direCtOr<br />

<strong>Bisnode</strong> has a strong offering of credit solutions and business<br />

information solutions in the region. In 2010, revenue amounted<br />

to sek 182 million with an operating profit of sek 23 million.<br />

Region Central Europe posted organic growth of 6 per cent,<br />

adjusted for currency effects.<br />

Development was strongest in Poland and Slovenia.<br />

Growth-enhancing investments were made in product<br />

development, database expansion and hiring of new staff<br />

throughout the region in 2010. New products launched<br />

in all countries are starting to pay off. At the end of the<br />

year, operations in Croatia were strengthened through the<br />

acquisition of Poslovna Domena – the country’s market-leading<br />

supplier of digital business information.<br />

germanY<br />

austria<br />

sWitzerland<br />

SEK m<br />

1,000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

croatia<br />

czech repuBlic<br />

hungarY<br />

poland<br />

sloVakia<br />

sloVenia<br />

SEK m<br />

210<br />

180<br />

150<br />

120<br />

90<br />

60<br />

30<br />

0<br />

2008 2009 2010<br />

2008 2009 2010<br />

120<br />

100<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

80<br />

60<br />

40<br />

20<br />

5<br />

0<br />

0<br />

healthy<br />

growth<br />

REVENUE<br />

OPERATING PROFIT,<br />

EBITA<br />

invested<br />

for future<br />

growth<br />

REVENUE<br />

OPERATING PROFIT,<br />

EBITA

Business area<br />

product information<br />

fredrik<br />

Åkerman<br />

business area direCtOr<br />

The Product Information business area offers advertising-based<br />

online services and business journals with a focus on industrial<br />

suppliers. In 2010, revenue amounted to sek 437 million with an<br />

operating profit of sek 71 million.<br />

Revenue in the Product Information business area declined<br />

organically by 6 per cent for the year. The business area improved<br />

its operating margin compared to the previous year<br />

as a result of cost adaptations that matched the lower level of<br />

demand. Wer Liefert Was? retained its strong market position<br />

in Germany and continued to perform well. The divestiture<br />

of abc companies in Belgium, France, Luxembourg and the<br />

Netherlands during the period resulted in a capital loss.<br />

Fredrik Åkerman has been appointed Business Area<br />

Director Product Information following the resignation of<br />

Peter Villa in April 2011.<br />

Business area<br />

softWare and applications<br />

fredrik<br />

Åkerman<br />

business area direCtOr<br />

<strong>Bisnode</strong> offers software and applications with integrated<br />

business information that help customers analyse and improve<br />

their business performance while providing access to better<br />

decision support. In 2010, revenue amounted to sek 360<br />

million with an operating profit of sek 46 million.<br />

In 2010, <strong>Bisnode</strong> sold Office Team in Norway and its<br />

shareholding of slightly more than 50 per cent in Emric in<br />

Sweden, contributing to the decline in revenue and lower<br />

operating profit. The remaining companies have recovered after<br />

the previous year’s decrease due to market decline, and reported<br />

organic growth of more than 4 per cent for 2010. The offering<br />

of crm systems in the Swedish market remains successful, and<br />

expansion to Norway and Finland is proceeding as planned.<br />

austria<br />

denmark<br />

finland<br />

germanY<br />

hungarY<br />

norWaY<br />

sWeden<br />

sWitzerland<br />

SEK m<br />

600<br />

500<br />

400<br />

300<br />

200<br />

100<br />

0<br />

finland<br />

norWaY<br />

sWeden<br />

SEK m<br />

500<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

150<br />

100<br />

50<br />

0<br />

2008 2009 2010<br />

2008 2009 2010<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

100<br />

90<br />

80<br />

70<br />

60<br />

50<br />

40<br />

30<br />

20<br />

10<br />

0<br />

improved<br />

profit<br />

margin<br />

23<br />

REVENUE<br />

OPERATING PROFIT,<br />

EBITA<br />

divestments<br />

and market<br />

reCovery<br />

REVENUE<br />

OPERATING PROFIT,<br />

EBITA

24<br />

CORPORATE<br />

GOVERNANCE<br />

<strong>Bisnode</strong>’s organisation, with operations in 17 countries, makes<br />

clear and well implemented corporate governance an important<br />

platform for the Group.<br />

In the <strong>Bisnode</strong> Group, governance, management<br />

and control are divided between<br />

the shareholders, Board of Directors, ceo,<br />

executive management team and managing<br />

directors of the operating companies.<br />

Corporate governance is regulated by<br />

Swedish law, primarily by the Swedish<br />

Companies Act, and by the rules and recommendations<br />

issued by relevant organisations.<br />

The Board of <strong>Bisnode</strong> Business Information<br />

Group has established requirements for all<br />

companies in the Group for corporate governance,<br />

including both a mandatory section<br />

and a section that is strongly recommended.<br />

<strong>Bisnode</strong>’s organisation, consisting of many<br />

independent companies in 17 countries,<br />

makes the Group heavily reliant on the<br />

use of sound internal control systems and<br />

procedures, as well as on compliance with<br />

these procedures.<br />

Work of the Board of Directors<br />

In 2010 <strong>Bisnode</strong>’s Board of Directors held<br />

eight scheduled meetings. The primary tasks<br />

of the Board of Directors are to:<br />

• Formulate and adopt <strong>Bisnode</strong>’s strategy for<br />

attaining its overall operating goals.<br />

• Review and adopt <strong>Bisnode</strong>’s annual<br />

budget.<br />

• Review and submit <strong>Bisnode</strong>’s annual<br />

report.<br />

• Report and propose the allocation of<br />

profit/loss to the Annual General Meeting.<br />

• Review and monitor <strong>Bisnode</strong>’s financial<br />

development and business situation.<br />

Aside from follow-up of business<br />

operations, the Board devoted much of<br />

its time in 2010 to discussing <strong>Bisnode</strong>’s<br />

upcoming acquisitions and divestitures.<br />

<strong>Bisnode</strong> played an active role in the<br />

consolidation of the market for business<br />

information during the year.<br />

Board committees<br />

<strong>Bisnode</strong> has two board committees: a Compensation<br />

Committee and an Audit Committee.<br />

Compensation Committee<br />

The Compensation Committee consists of<br />

Håkan Ramsin (Committee Chairman),<br />

Henrik Joelsson and C. W. Ros.<br />

The main tasks and responsibilities of the<br />

Committee are to:<br />

• Discuss the Board’s proposal for<br />

resolution by the Annual General Meeting<br />

regarding principles for compensation<br />

to senior executives according to the<br />

Swedish Companies Act. The principles<br />

approved by the agm shall constitute the<br />

framework for the compensatory forms<br />

and levels discussed and decided on by the<br />

Compensation Committee.<br />

• Discuss matters related to general option<br />

and bonus programs in terms of scope,<br />

conditions and allocation, according to<br />

proposals from the ceo or the Board of<br />

Directors.<br />

• Discuss matters related to the ceo’s<br />

employment contract, salary and other<br />

benefits prior to decision by the Board of<br />

Directors, and recommendations to the<br />

Board of Directors in these areas.<br />

• Discuss, and in consultation with the ceo,<br />

decide on matters related to the employment<br />

contracts, salaries and other benefits of other<br />

senior executives. The Committee shall<br />

continuously inform the Board of Directors<br />

when such decisions have been made.<br />

• Propose principles for compensation to<br />

members of the Board of Directors for any<br />

assignments on behalf of <strong>Bisnode</strong> beyond<br />

those which are consistent with normal<br />

Board responsibilities.<br />

Audit Committee<br />

The Audit Committee consists of Henrik<br />

Joelsson (Committee Chairman), Håkan<br />

Ramsin and Jonas Nyrén. The task of the<br />

Audit Committee is to ensure credibility,<br />

control and high quality in the company’s<br />

financial reporting. The committee’s main<br />

areas of responsibility are to:<br />

• Supervise the Board of Directors’ efforts to<br />

assure the quality of <strong>Bisnode</strong>’s financial re-<br />

porting. This quality assurance shall normally<br />

take place through examination of all<br />

critical accounting processes and financial<br />

reports published by <strong>Bisnode</strong>. Among other<br />

tasks, it is assumed that the Committee<br />

shall deal with matters related to internal<br />

control, regulatory compliance, events after<br />

the balance sheet date, changes in estimates<br />

and judgments and other issues that could<br />

affect the quality of the financial reports.<br />

• Maintain continuous contact with<br />

<strong>Bisnode</strong>’s auditor to stay informed about<br />

the focus and scope of the audit and<br />

to discuss coordination between the<br />

independent and internal audits and<br />

assessment of <strong>Bisnode</strong>’s risks.<br />

• Establish guidelines for the non-audit<br />

services that <strong>Bisnode</strong> may procure from the<br />

company’s auditor.<br />

• Evaluate the auditor’s performance.

Lobke DeSTRooPeR<br />

Account mAnAger<br />

25<br />

financial<br />

inforMaTion<br />

Directors’ report 26<br />

Consolidated income statement 28<br />

Consolidated statement of comprehensive income 28<br />

Consolidated statement of financial position 29<br />

Consolidated statement of changes in equity 30<br />

Consolidated statement of cash flow 31<br />

Parent Company income statement 32<br />

Parent Company statement of comprehensive income 32<br />

Parent Company statement of financial position 33<br />

Parent Company statement of changes in equity 34<br />

Parent Company statement of cash flow 35<br />

Accounting policies and notes 36<br />

Note 1. General information 36<br />

Note 2. Summary of significant accounting policies 36<br />

Note 3. Financial risk management 40<br />

Note 4. Critical accounting estimates and judgements 41<br />

Note 5. Operating segments 42<br />

Note 6. Other operating income 43<br />

Note 7. Board members and senior executives 43<br />

Note 8. Average number of employees. Average number of<br />

Board members, CEO and senior executives 43<br />

Note 9. Wages, salaries and other remuneration – Group 44<br />

Note 10. Compensation to Board members and senior executives 45<br />

Note 11. Wages, salaries and other remuneration – Parent Company 45<br />

Note 12. Fees to auditors 45<br />

Note 13. Results from participations in group companies 45<br />

Note 14. Financial income 45<br />

Note 15. Financial expenses 46<br />

Note 16. Income tax expense 46<br />

Note 17. Intangible assets 46<br />

Note 18. Property, plant and equipment 48<br />

Note 19. Available-for-sale financial assets 49<br />

Note 20. Deferred tax assets and liabilities 49<br />

Note 21. Participations in group companies 50<br />

Note 22. Trade and other receivables 52<br />

Note 23. Inventories 52<br />

Note 24. Cash and cash equivalents 52<br />

Note 25. Borrowings 52<br />

Note 26. Provisions for pensions 53<br />

Note 27. Other provisions 54<br />

Note 28. Trade and other payables 54<br />

Note 29. Derivative financial instruments 54<br />

Note 30. Accrued expenses and deferred income 55<br />

Note 31. Reserves 55<br />

Note 32. Finance leases 55<br />

Note 33. Operating leases 55<br />

Note 34. Related party transactions 56<br />

Note 35. Contingent liabilities and pledged assets 56<br />

Note 36. Share capital 56<br />

Note 37. Earnings per share 56<br />

Note 38. Business combinations 57<br />

Note 39. Sale of subsidiaries 59<br />

Note 40. Discontinued operations 59<br />

Note 41. Events after the balance sheet date 60<br />

Audit report 61

26<br />

DirecTors’<br />

reporT<br />

The Board of Directors and the Chief Executive Officer<br />

of <strong>Bisnode</strong> Business Information Group AB,<br />

556681-5725, hereby submit their report for 2010.<br />

The Group’s operations<br />

<strong>Bisnode</strong> is a leading provider of digital business information<br />

in Europe, with a complete offering of online<br />

solutions for market, credit and business information.<br />

<strong>Bisnode</strong>’s business information services help companies<br />

to maximise sales, minimise business risks and make<br />

better business decisions.<br />

<strong>Bisnode</strong> conducts operations in 17 European<br />

countries and has approximately 3,000 employees .<br />

Consolidated revenue in 2010 amounted to around<br />