You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

8<br />

PRODUCTION CAPACITY AND EXPORTS OF COATED WOODFREE PAPER OUT OF<br />

CHINA HAVE BEEN ON THE INCREASE IN THE LAST COUPLE OF YEARS. ASIAN<br />

PRODUCERS ARE KNOWN TO BE QUICK TO ADAPT TO CHANGING MARKET<br />

NEEDS AND THIS IS NOW BEING PUT TO THE TEST AS THEY FACE ANTI-DUMPING<br />

DUTIES IN MANY MARKETS AROUND THE WORLD, LOWER DOMESTIC DEMAND<br />

AND RISING COSTS.<br />

HAS THE CHINESE TIGER LOST ITS ROAR?<br />

Since 2000, China has tripled its paper<br />

production. In 2009 China accounted for<br />

over 17% of the world's output and<br />

consolidated its place as one of the<br />

world's largest exporters in the industry.<br />

In the last two years there have been<br />

over three million tons of Coated<br />

Woodfree (CWF) and 350,000 tons of<br />

Lightweight Coated (LWC) capacity<br />

coming on stream in China. The export<br />

of CWF out of China has also been<br />

increasing. Only 930,000 tons in 2007, it<br />

had been expected to grow to<br />

approximately 3 million tons by 2015.<br />

Capacity control is now a very important<br />

issue in the paper industry. Most recent<br />

cutbacks in coated paper capacity have<br />

been in the mature regions, whilst new<br />

capacity has been built in China because<br />

of expected demand growth in the<br />

region, as well as finance and financial<br />

incentives being available to those<br />

willing to commit themselves to this<br />

industry. This has accelerated the “west<br />

to east” shift in the paper industries'<br />

manufacturing centre of gravity and<br />

could see a change in the names of the<br />

leading players (see Table1).<br />

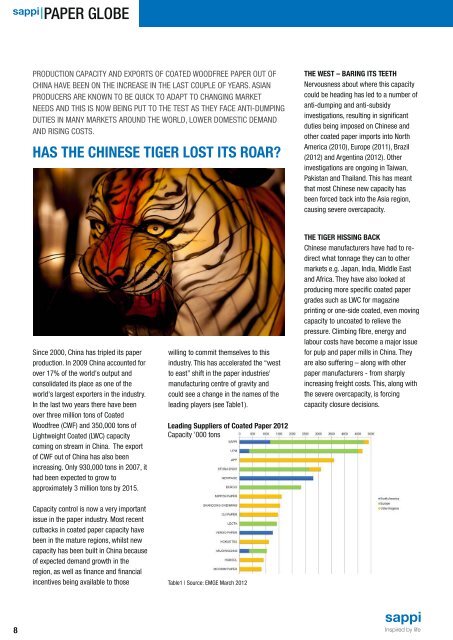

Leading Suppliers of Coated Paper 2012<br />

Capacity '000 tons<br />

Table1 | Source: EMGE March 2012<br />

THE WEST – BARING ITS TEETH<br />

Nervousness about where this capacity<br />

could be heading has led to a number of<br />

anti-dumping and anti-subsidy<br />

investigations, resulting in significant<br />

duties being imposed on Chinese and<br />

other coated paper imports into North<br />

America (2010), Europe (2011), Brazil<br />

(2012) and Argentina (2012). Other<br />

investigations are ongoing in Taiwan,<br />

Pakistan and Thailand. This has meant<br />

that most Chinese new capacity has<br />

been forced back into the Asia region,<br />

causing severe overcapacity.<br />

THE TIGER HISSING BACK<br />

Chinese manufacturers have had to redirect<br />

what tonnage they can to other<br />

markets e.g. Japan, India, Middle East<br />

and Africa. They have also looked at<br />

producing more specific coated paper<br />

grades such as LWC for magazine<br />

printing or one-side coated, even moving<br />

capacity to uncoated to relieve the<br />

pressure. Climbing fibre, energy and<br />

labour costs have become a major issue<br />

for pulp and paper mills in China. They<br />

are also suffering – along with other<br />

paper manufacturers - from sharply<br />

increasing freight costs. This, along with<br />

the severe overcapacity, is forcing<br />

capacity closure decisions.