Fraud & Identity Theft - Peel Regional Police

Fraud & Identity Theft - Peel Regional Police

Fraud & Identity Theft - Peel Regional Police

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

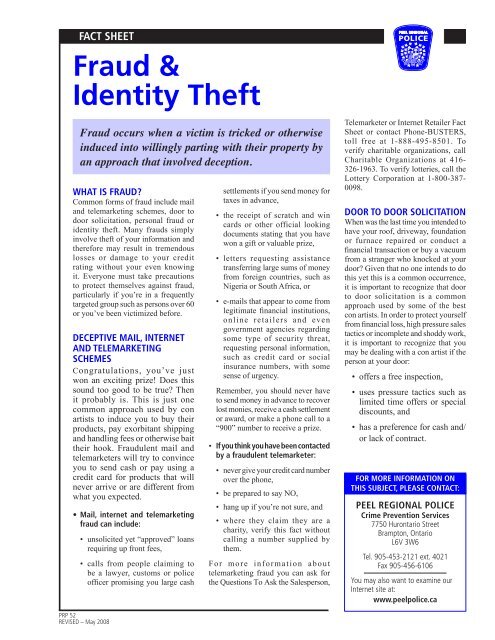

Fact Sheet<strong>Fraud</strong> &<strong>Identity</strong> <strong>Theft</strong><strong>Fraud</strong> occurs when a victim is tricked or otherwiseinduced into willingly parting with their property byan approach that involved deception.What is <strong>Fraud</strong>?Common forms of fraud include mailand telemarketing schemes, door todoor solicitation, personal fraud oridentity theft. Many frauds simplyinvolve theft of your information andtherefore may result in tremendouslosses or damage to your creditrating without your even knowingit. Everyone must take precautionsto protect themselves against fraud,particularly if you’re in a frequentlytargeted group such as persons over 60or you’ve been victimized before.Deceptive mail, internetand telemarketingschemesCongratulations, you’ve justwon an exciting prize! Does thissound too good to be true? Thenit probably is. This is just onecommon approach used by conartists to induce you to buy theirproducts, pay exorbitant shippingand handling fees or otherwise baittheir hook. <strong>Fraud</strong>ulent mail andtelemarketers will try to convinceyou to send cash or pay using acredit card for products that willnever arrive or are different fromwhat you expected.• Mail, internet and telemarketingfraud can include:• unsolicited yet “approved” loansrequiring up front fees,• calls from people claiming tobe a lawyer, customs or policeofficer promising you large cashsettlements if you send money fortaxes in advance,• the receipt of scratch and wincards or other official lookingdocuments stating that you havewon a gift or valuable prize,• letters requesting assistancetransferring large sums of moneyfrom foreign countries, such asNigeria or South Africa, or• e-mails that appear to come fromlegitimate financial institutions,online retailers and evengovernment agencies regardingsome type of security threat,requesting personal information,such as credit card or socialinsurance numbers, with somesense of urgency.Remember, you should never haveto send money in advance to recoverlost monies, receive a cash settlementor award, or make a phone call to a“900” number to receive a prize.• If you think you have been contactedby a fraudulent telemarketer:• never give your credit card numberover the phone,• be prepared to say NO,• hang up if you’re not sure, and• where they claim they are acharity, verify this fact withoutcalling a number supplied bythem.For more information abouttelemarketing fraud you can ask forthe Questions To Ask the Salesperson,Telemarketer or Internet Retailer FactSheet or contact Phone-BUSTERS,toll free at 1-888-495-8501. Toverify charitable organizations, callCharitable Organizations at 416-326-1963. To verify lotteries, call theLottery Corporation at 1-800-387-0098.Door to door solicitationWhen was the last time you intended tohave your roof, driveway, foundationor furnace repaired or conduct afinancial transaction or buy a vacuumfrom a stranger who knocked at yourdoor? Given that no one intends to dothis yet this is a common occurrence,it is important to recognize that doorto door solicitation is a commonapproach used by some of the bestcon artists. In order to protect yourselffrom financial loss, high pressure salestactics or incomplete and shoddy work,it is important to recognize that youmay be dealing with a con artist if theperson at your door:• offers a free inspection,• uses pressure tactics such aslimited time offers or specialdiscounts, and• has a preference for cash and/or lack of contract.For more information onthis subject, please contact:<strong>Peel</strong> <strong>Regional</strong> <strong>Police</strong>Crime Prevention Services7750 Hurontario StreetBrampton, OntarioL6V 3W6Tel. 905-453-2121 ext. 4021Fax 905-456-6106You may also want to examine ourInternet site at:www.peelpolice.caPRP 52Revised – May 2008

<strong>Fraud</strong> & <strong>Identity</strong> <strong>Theft</strong>Fact SheetTo protect yourself consider posting a “no solicitors,or peddlers” sign. If you do speak to a door to doorsalesperson remember these do’s and don’ts:Do• get their name and company information,• obtain 2 to 3 written estimates before you sign acontract,• seek advice from family, friends or police, and• check out references through a site visit and talk tothe homeowner.Don’t• be rushed or pressured,• give them a credit card number or show a copy of anexisting bill,• rely on phone numbers supplied to you, and• pay for work in advance.For questions related to business, contact the Ministry ofConsumer & Business Services at 416-326-8555.Personal <strong>Fraud</strong> or <strong>Identity</strong> <strong>Theft</strong>Personal fraud or identity theft is the fastest growing crimein Canada. Personal fraud can occur when a dishonest persongets a hold of your personal or credit card information anduses it to their advantage to make purchases or obtain funds.Some of the worst cases of personal fraud are identity theft.<strong>Identity</strong> theft occurs when a dishonest person uses yourpersonal information to open a bank account, obtain creditcards or otherwise take advantage of your credit rating. Anytype of personal fraud can ruin your credit rating. In order toreduce the chances that you will become a victim of personalfraud, follow these do’s and don’ts.Do• complete the <strong>Identity</strong> <strong>Theft</strong> Action Plan found on the<strong>Identity</strong> <strong>Theft</strong> fact sheet,• be extremely careful before you decide to give outpersonal information,• treat your social insurance card and birth certificate asyou would any valuable and store it in a safe place underlock and key,• carry only the credit cards you need and cancel the onesyou don’t,• consider buying a shredder,• shred your financial statements, personal informationand credit cards after they expire,• watch how salespeople swipe your credit card and makesure that a second machine is never used,• take precautions when performing online transactions,be sure the site is secure, a privacy policy is posted andthe company is known to be reputable,• carefully check your monthly statements for anyunauthorized or missing transactions,• call the credit card company immediately if your billsdon’t arrive or you applied for a new credit card thathasn’t come, (See <strong>Identity</strong> <strong>Theft</strong> Fact Sheet),• have your mail picked up by a trusted neighbour or goto your local post office (with identification) and askfor Canada Post’s “hold mail” service, if you are goingaway,• watch for people looking over your shoulder when usingyour personal identification number (pin) and avoidwriting this number down or storing it in your wallet,• protect your personal computer with a firewall,• beware of e-mail messages and promotions that ask forpersonal information,• conduct an annual credit check on yourself through thetwo national credit reporting agencies: Equifax Canada:1-800-465-7166, www.equifax.ca or TransUnion ofCanada: 1-800-663-9987, www.tuc.ca, and,• visit the Ministry of Consumer & BusinessServices website at: www.cbs.gov.on.ca for furtherinformation.Don’t• carry your social insurance card and birth certificate onyour person unless absolutely necessary,• leave credit card receipts behind or throw out financialor personal information without first making itunreadable,• use your birth date or house address number for yourpin number,• give out your phone number, address, credit card numberor SIN number on the internet, and• put personal information including photos, on yourwebsite.