Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>SAVINO</strong> <strong>DEL</strong> <strong>BENE</strong> S.p.A.<br />

DIRECTORS' REPORT ON THE INTERIM FINANCIAL STATEMENTS<br />

FOR THE SIX MONTH PERIOD ENDED 30TH JUNE 2001<br />

This report has been prepared in accordance with the Italian Civil Code and in compliance with<br />

Article No. 81 of Regulation No. 11971 dated 14th May 1999, subsequently modified and amended by<br />

the Consob Resolution No. 12475 of 6th April 2000. The company, taking advantage of the opportunity<br />

offered by paragraph 7, Article No. 81 of the abovementioned Regulation, presents the results for the<br />

six-month period before taxation.<br />

All figures are stated in millions of lire, unless otherwise indicated.<br />

Board of Directors and Board of Statutory Auditors<br />

The Board of Directors was nominated by the Shareholders’ meeting of 29th June 1999 and is made<br />

up of four members whose appointment expires on the approval of the financial statements as of 31st<br />

December 2001.<br />

The Board of Directors is comprised of the following members:<br />

Paolo Nocentini (Chairman), Giuliano Macucci (Vice-chairman), Silvano Brandani (Managing Director)<br />

and Francesca Lapi (Director).<br />

The Company’s Statute nominates the Chairman of the Board of Directors as its legal representative<br />

and grants him the authority and responsibility for all of the Company’s ordinary and extraordinary<br />

administration, with the exception of actions for which the Board of Directors’ authorisation is<br />

specifically required by law and actions of significant economic importance such as the purchase and<br />

sale of real estate, of companies and investments and the granting of guarantees for an amount in<br />

excess of Lire 300 million.<br />

The Vice-chairman’s responsibilities are the same as those attributed to the Chairman, to be carried<br />

out by the Vice-chairman in the Chairman’s absence or impediment.<br />

The Managing Director has the responsibility for the logistic organisation of the Company, the control<br />

and management of the Livorno branch and the administrative co-ordination of relations with the<br />

American subsidiary companies.<br />

The Board of Statutory Auditors was appointed by the same Shareholders’ meeting which nominated<br />

the Board of Directors and their appointment also expires on the approval of the financial statements<br />

as of 31st December 2001. The Board of Statutory Auditors is comprised of the following members:<br />

Annibale Viscomi – Chairman of the Board of Statutory Auditors, Luca Porciani – Acting Auditor,<br />

Roberto Zaffina - Acting Auditor and two supplementary auditors (Franco Vannucchi and Muzio<br />

Clementi).<br />

PERFORMANCE DURING THE PERIOD<br />

1

a) World economy<br />

The first six months of the year 2001 were characterised by the slowing down of the world<br />

economy greater than expected, due principally to the sharp slowing down of economic activity in the<br />

USA, as a result of the reduction in investment, especially in the new information technology sector.<br />

During the second quarter of the year 2001 orders for capital equipment also fell. This reduction in<br />

activity regards the manufacturing sector, not that of services, as may be seen from the employment<br />

statistics and the expectations of purchase managers in both sectors. The increase in the consumer<br />

confidence index in May and June leads us to expect that consumption shall continue to sustain<br />

production activity and that it could benefit in the future from the drop in oil prices.<br />

In addition, the expansion strategy implemented both by the Federal Reserve and by the<br />

American government should produce significant effects as from the final quarter of the year.<br />

The negative performance of the Japanese economy, which registered a drop in GNP during the<br />

first quarter of the year 2001, has not contributed to the growth in international trade. The most recent<br />

forecasts show no change in GNP for the current year and a slight growth during the year 2002.<br />

The slowing down in the world economy has also had negative effects on the emerging<br />

economies. The European economy is also slowing down. During the first quarter of the year the GNP<br />

has risen by 2.4% on an annual basis with respect to the last quarter of the year 2000. The balance of<br />

trade remains positive, due in part to the drop in imports. The maintenance of the level of household<br />

consumption has compensated for the drop in investments, although industrial production has<br />

decreased since the beginning of the year. A growth in GNP of around 2% is expected for the year<br />

2001.<br />

In Italy consumption is stagnant, due to the effects of inflation. The growth in investment has been<br />

very slight, while net foreign demand has not contributed in any way towards the growth in GNP.<br />

Following a positive trend during the first three months of the year, exports have almost come to a halt<br />

during the second quarter. Following the unsatisfactory results registered in April and May, the<br />

estimated figures for June and July show a partial recovery in industrial production. The economic<br />

indicators show better prospects for growth than those of the Euro area as a whole. In terms of our<br />

Group, we would point out that the drastic slowing down in growth registered during the first half of the<br />

year 2001 resulted in a sharp braking in trade throughout the entire world and that international imports<br />

and exports remained stagnant in terms of volume during the first three months of the year, to drop<br />

even further during the second quarter.<br />

Nevertheless, the consolidation of the recovery in the international economic situation during the<br />

year 2002, should result in an increase in imports and exports, the growth in which could well exceed<br />

7.5 %. As regards currency exchange rates, a gradual recovery is expected in the value of the euro<br />

against the US dollar during the second half of the year. The gradual strengthening of the euro should<br />

be confirmed during the year 2002, without however reaching parity with the US dollar: the average<br />

quotation during the coming year should be 0.93 dollars. These figures lead us to expect a lower<br />

growth in European exports towards the USA and a greater growth in trade on other routes.<br />

b) Company performance<br />

The Company and therefore the Savino Del Bene Group, plays a leading role in the international<br />

shipping and transport market in Italy, due both to the size of its international and national network, and<br />

to the quality of the service offered in addition to the economic results achieved. The quality of the<br />

service and the vast range of destinations reached have made us market leader in our sector and have<br />

enabled us to realise positive results in excess of those of our competitors, even in difficult market<br />

situations.<br />

The performance of the first six months of the year 2001 was characterised by a reduction in<br />

income before taxes of approx. 30%, dropping from Lire 14,598 million at 30th June 2000 to Lire<br />

10,183 million at 30th June 2001. Corresponding figures for the first six months of the year 2000 and<br />

for the entire year 2000 are provided for comparative purposes:<br />

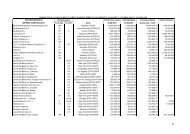

(+)Sales revenue<br />

(+) Other income and revenues<br />

Value of production<br />

(-) Goods and services consumed<br />

Added value<br />

Diff. %Diff.<br />

30.06.00 % 31.12.00 % 30.06.01 % 6.01-6.00 6.01-6.00<br />

181,966 99.3% 384,759 99.3% 177,826 99.1% -4,140 -2.28%<br />

1,215 0.7% 2,883 0.7% 1,640 0.9% 425 34.98%<br />

183,181 100% 387,642 100% 179,466 100% -3,715 -2.03%<br />

-154,821 -84.5% -328,536 -84.8% -153,729 -85.7% 1,092 -0.71%<br />

28,360 15.5% 59,106 15.2% 25,737 14.3% -2,623 -9.25%<br />

2

(-) Labour costs<br />

(-) Sundry costs<br />

Gross operating margin<br />

(-) Amortisation, depreciation and write-down<br />

of fixed assets<br />

(-) Write-down of current assets<br />

(-) Provisions for risks<br />

Net operating income<br />

-14,174 -7.7% -28,319 -7.3% -16,057 -8.9% -1,883 13.28%<br />

-427 -0.2% -1,098 -0.3% -618 -0.3% -191 44.73%<br />

13,759 7.5% 29,689 7.7% 9,062 5.0% -4,697 -34.14%<br />

-1,147 -0.6% -3,410 -0.9% -1,762 -1.0% -615 53.62%<br />

-452 -0.2% -1,193 -0.3% -310 -0.2% 142 -31.42%<br />

-327 -0.2% -459 -0.12% -377 -0.2% -50 15.29%<br />

11,833 6.5% 24,627 6.4% 6,613 3.7% -5,220 -44.11%<br />

+ (-) Financial income (expenses) 1,212 0.7% 811 0.2% 2,021 1.1% 809 66.75%<br />

+ Dividends and tax credits 1,639 0.9% 3,608 0.9% 1,539 0.9% -100 -6.10%<br />

(+/-) Adjustments to value of financial assets -7 0.0% -358 -0.09% 0 0.0% 7 -100%<br />

Income before taxes and extraordinary<br />

items 14,677 8.0% 28,688 7.4% 10,173 5.7% -4,504 -30.69%<br />

+ (-) Extraordinary income (expenses) -79 0.0% 1,824 0.5% 10 0.0% 89 -112.%<br />

Income before taxes 14,598 8.0% 30,512 7.9% 10,183 5.7% -4,415 -30.24%<br />

Income tax for the period 0 0.0% -13,468 -3.5% 0 0.0% 0 =<br />

Net income for the period 14,598 8.0% 17,044 4.4% 10,183 5.7% -4,415 -30.24%<br />

During the period the Company recorded sales revenues of Lire 177,826 million, with a decrease<br />

of only 2.28% with respect to the figure for six months ended 30th June 2000, despite the fact that the<br />

company's business, and particularly that regarding the American market, has undergone a significant<br />

reduction in volume. The Company has continued its policy of expanding its direct presence on new<br />

markets and during the first six months of the year 2001 it opened a new office in Padova and another<br />

three offices at Buenos Aires, at Campinas (Brazil) and at Philadelphia (USA). With respect to the first<br />

half of the previous year, the volumes of goods shipped have decreased in the sea shipment sector (-<br />

14.86%) and increased in the air sector (+3.81%), the same applies to revenues, which show a<br />

decrease in the sea shipment sector (-7.78%) and an increase in the air sector (+11.92%). The gross<br />

operating margin has fallen from Lire 13,759 million during the first six months of the year 2000 to Lire<br />

9,062 million during the first six months of the year 2001, representing a decrease of approx. 34% and<br />

the gross operating margin /total sales revenue ratio has fallen from 7.5% to 5%. The decrease in<br />

profitability is due both to the higher incidence of labour costs on revenues, which rose from 7.79% at<br />

30.6.00 to 9.03% at 30.6.01, and to the decrease in turnover per employee, which amounted to Lire<br />

490 million against Lire 551 million as at 30.6.00. Once again the contribution made to the result for the<br />

period from the company's financial management (Lire 3,560 million) was considerable, due to<br />

significant exchange gains and income from equity investments.<br />

As regards the company's performance, the table below shows the following a decrease:<br />

30.06.00 31.12.00 30.06.01<br />

Difference<br />

30.6.2001<br />

-30.6.2000<br />

% Difference<br />

30.6.2001-<br />

30.6.2000<br />

Sales revenue 181,966 384,759 177,826 -4,140 -2.28%<br />

Gross operating margin 13,759 29,689 9,062 -4,697 -34.14%<br />

Net operating income 11,833 24,627 6,613 -5,220 -44.11%<br />

Net income before taxation 14,598 30,512 10,183 -4,415 -30.24%<br />

In particular, the decrease in income has led to a reduction in the principal financial and economic<br />

ratios:<br />

30.06.00 30.06.01<br />

Gross operating margin /Total sales revenue 7.6 5.1<br />

Net operating income / Total sales revenue (ROS) 6.5 3.7<br />

Return on equity (ROE) 21.0 11.8<br />

Return on investments (ROI) 18.2 10.2<br />

Debt ratio (net liquidity/capital invested) 20.1 3.4<br />

The following table shows an analysis of sales revenue by sector, showing the variations that have<br />

taken place with respect to the figures for the year ended 31st December 2000 and the six months<br />

ended 30th June 2000:<br />

3

30.06.00 % 31.12.00 % 30.06.01 %<br />

Difference %Difference<br />

6.01-6.00 6.01-6.00<br />

By sea 111,901 61.50% 234,352 60.91% 103,195 58.03% -8,706 -7.78%<br />

By air 50,970 28.01% 113,007 29.37% 57,044 32.08% 6,074 11.92%<br />

By land 6,890 3.78% 13,144 3.42% 6,103 3.43% -787 -11.42%<br />

Importation and<br />

customs clearing<br />

services 12,007 6.60% 23,806 6.19% 11,240 6.32% -767 -6.39%<br />

Other revenues 198 0.11% 450 0.11% 244 0.14% 46 23.23%<br />

Total 181,966 100% 384,759 100% 177,826 100% -4,140 -2.28%<br />

The following table shows an analysis of the above revenue by geographical area:<br />

30.06.01 %<br />

North America 80,598 45.32%<br />

Central America 637 0.36%<br />

South America 4,027 2.26%<br />

Europe 80,477 45.26%<br />

Africa 269 0.15%<br />

Middle East 2,356 1.32%<br />

Far East 9,336 5.25%<br />

Australia and South Pacific 126 0.08%<br />

Total 177,826 100%<br />

The following table shows the variation in costs with respect to prior periods:<br />

30.06.00 31.12.00 30.06.01<br />

Diff.<br />

6.01-6.00<br />

%Diff.<br />

6.01-6.00<br />

Freight charges 99,764 209,230 98,362 -1,402 -1.41%<br />

Haulage charges 16,796 35,040 15,253 -1,543 -9.19%<br />

Customs charges 6,195 12,887 4,314 -1,881 -30.36%<br />

Cost of haulage, porterage and storage 4,192 8,857 4,008 -184 -4.39%<br />

Cost of insuring goods 350 873 462 112 32.00%<br />

Cost of visas and fees to customs operators 28 91 31 3 10.71%<br />

Agents and correspondents’ fees and charges 18,496 42,034 20,512 2,016 10.90%<br />

Cost of shipping carried out by authorised third<br />

parties 217 455 281 64 29.49%<br />

Other services 6,967 15,210 8,124 1,157 16.61%<br />

Purchase of consumable materials 641 1,430 895 254 39.63%<br />

Leasing and rental charges 1,175 2,429 1,487 312 26.55%<br />

Total costs for goods and services 154,821 328,536 153,729 -1,092 -0.71%<br />

In particular, the utilisation of Group companies in North America for the carrying out of<br />

“brokerage” activities and delivery of goods to their destination, represents the principal reason for the<br />

increase in agents and correspondents’ fees and charges. The decrease in the cost of goods and<br />

services consumed was not sufficient to compensate for the reduction in the volume of sales revenue<br />

realised during the period.<br />

Shipments by sea<br />

Revenues from shipments by sea amount to Lire 103,195 million, against Lire 234,352 million at 31st<br />

December 2000 and Lire 111,901 million at 30th June 2000. The analysis of this revenue by<br />

geographic area is shown in the table below. For the first time the figures are analysed by the<br />

4

geographic area of the customer invoiced for the service. However the percentage analysis of the<br />

revenues by destination area is more or less the same as that shown in the table detailing the<br />

geographical analysis by destination of volumes shipped by sea.<br />

30.06.01 %<br />

North America 59,702 57.85%<br />

Central America 488 0.47%<br />

South America 2,426 2.35%<br />

Europe 36,037 34.92%<br />

Africa 158 0.15%<br />

Middle East 2,224 2.16%<br />

Far East 2,097 2.03%<br />

Australia and South Pacific 63 0.06%<br />

Total 103,195 100%<br />

During the first six months of the year 2001, the drop in the volume of goods shipped by sea (-<br />

14.86%) was only partly matched by the drop in revenues from goods shipped by sea (-7.78%). This is<br />

due principally to an increase in the rates charged to customers.<br />

The reduction in volumes shipped towards the Company's main North American market was<br />

partially compensated for by the increase registered in shipments towards the Far East (+28.6%) which<br />

represents a market with a high potential for future growth.<br />

The following table shows the variation in the volume of goods shipped by sea towards the<br />

following destinations with respect to 30.6.00 and to 31.12.00 (figures expressed in No. of Teus<br />

shipped):<br />

5

30.06.00 % 31.12.00 % 30.06.01 %<br />

Diff.<br />

6.01-6.00<br />

% Diff.<br />

6.01-6.00<br />

North America 22,895 86.18% 44,232 84.99% 18,909 83.59% -3,986 -17.41%<br />

Central America 184 0.69% 466 0.90% 272 1.20% 88 47.83%<br />

South America 721 2.71% 1,630 3.13% 911 4.03% 190 26.35%<br />

Europe 358 1.35% 633 1.22% 231 1.02% -127 -35.47%<br />

Africa 475 1.79% 1,015 1.95% 331 1.46% -144 -30.32%<br />

Middle East 672 2.53% 1,161 2.23% 336 1.49% -336 -50.00%<br />

Far East 1,187 4.47% 2,705 5.20% 1,527 6.75% 340 28.64%<br />

Australia and South<br />

Pacific 76 0.29% 200 0.38% 103 0.46% 27 35.53%<br />

Total 26,568 100% 52,042 100% 22,620 100% -3,948 -14.86%<br />

While North America remains our principal destination, traffic towards Central and South America<br />

and the Far East has increased significantly, thanks to new trade contacts developed by the new<br />

Group companies set up in these areas.<br />

The analysis of Tues shipped by sea from the Company's various branches and offices is shown<br />

in the table below (figures expressed in No. of Teus shipped):<br />

30.06.00 % 31.12.00 % 30.06.01 %<br />

Diff.<br />

6.01-6.00<br />

% Diff.<br />

6.01-6.00<br />

Florence 14,889 56.04% 26,898 51.69% 10,945 48.39% -3,944 -26.49%<br />

Bologna 946 3.56% 1,524 2.93% 431 1.91% -515 -54.44%<br />

Segrate (Mi) 580 2.18% 1,503 2.89% 688 3.04% 108 18.62%<br />

Montecosaro (Mc) 152 0.57% 248 0.48% 113 0.50% -39 -25.66%<br />

Naples 2,583 9.72% 6,204 11.92% 3,098 13.70% 515 19.94%<br />

Pisa 14 0.05% 28 0.05% 26 0.11% 12 85.71%<br />

Prato 210 0.79% 445 0.86% 223 0.99% 13 6.19%<br />

Santacroce Sull'Arno (Pi) 506 1.90% 1,040 2.00% 641 2.83% 135 26.68%<br />

Treviso 3,705 13.95% 7,984 15.34% 3,049 13.48% -656 -17.71%<br />

Verona 641 2.41% 1,316 2.53% 650 2.87% 9 1.40%<br />

Padova 0 0.00% 0 0.00% 591 2.61% 591 =<br />

Vicenza 1,837 6.91% 3,849 7.40% 1,568 6.93% -269 -14.64%<br />

Livorno 505 1.90% 1,003 1.93% 597 2.64% 92 18.22%<br />

Total 26,568 100% 52,042 100% 22,620 100% -3,948 -14.86%<br />

The main decreases relate to the Florence, Bologna, Treviso and Vicenza branches. While, as<br />

regards Florence and Bologna the decrease was due to the abandonment of low value added<br />

customers, the Treviso decrease was due to the negative trends in the specialised product sector in<br />

which the branch operates. Finally, as regards the Vicenza branch, we would point out that the Padova<br />

branch, which became operative during the first quarter of the year 2001, has absorbed part of the<br />

traffic which was previously carried out by the Vicenza branch. The Naples branch has benefited from<br />

the acquisition of new customers by the American affiliated companies, which has led to an increase in<br />

the volume of traffic in the “food” sector.<br />

Shipments by air<br />

Revenues from shipments by air amount to Lire 57,044 million, against Lire 113,007 million at 31st<br />

December 2000 and Lire 50,970 million at 30th June 2000. The following table shows the geographic<br />

analysis of revenue. For the first time the figures are analysed by the geographic area of the customer<br />

invoiced for the service. However the analysis of the revenues by destination area is more or less the<br />

same, in percentage terms, as that shown in the table detailing the geographical analysis by<br />

destination of volumes shipped by air.<br />

6

30.06.01 %<br />

North America 20,220 35.45%<br />

Central America 147 0.26%<br />

South America 1,593 2.79%<br />

Europe 27,639 48.45%<br />

Africa 104 0.18%<br />

Middle East 129 0.23%<br />

Far East 7,150 12.53%<br />

Australia and South Pacific 62 0.11%<br />

Total 57,044 100%<br />

The air sector registered an increase of 3.8% in the volume of goods transported. This result is<br />

extremely positive, given that the market as a whole registered a decrease of more than 10% during<br />

the first quarter of the current year. The following table shows the variations in the volumes shipped by<br />

air with respect to 30.6.00 and to 31.12.00 (figures expressed in thousand of Kg.) :<br />

30.06.00 % 31.12.00 % 30.06.01 %<br />

Diff.<br />

6.01- 6.00<br />

% Diff.<br />

6.01-6.00<br />

North America 6,438 69.80% 13,534 68.70% 6,447 67.33% 9 0.14%<br />

Central America 52 0.56% 176 0.89% 57 0.60% 5 9.62%<br />

South America 239 2.59% 536 2.72% 361 3.77% 122 51.05%<br />

Europe 64 0.69% 157 0.80% 72 0.75% 8 12.50%<br />

Africa 88 0.95% 181 0.92% 90 0.94% 2 2.27%<br />

Middle East 98 1.06% 213 1.08% 273 2.85% 175 178.57%<br />

Far East 2,212 23.98% 4,853 24.63% 2,018 21.08% -194 -8.77%<br />

Australia and<br />

South Pacific 33 0.36% 50 0.25% 257 2.68% 224 678.79%<br />

Total 9,224 100% 19,700 100% 9,575 100% 351 3.81%<br />

The analysis of the quantities shipped by air by point of despatch, and detailed in the table below,<br />

shows a consolidation of the quantities shipped in the previous year: the principal variations, both<br />

positive and negative, are linked to the quantities shipped by our customers, given that no significant<br />

variations took place in our customer base during the period. The table below shows the quantities<br />

shipped by air by point of despatch (figures expressed in thousands of Kg.):<br />

30.06.00 % 31.12.00 % 30.06.01 %<br />

Diff.<br />

6.01-6.00<br />

% Diff.<br />

6.01-6.00<br />

Florence 2,950 31.98% 6,054 30.73% 2,825 29.50% -125 -4.24%<br />

Bologna 0 0.00% 113 0.57% 90 0.94% 90 =<br />

Segrate (Milan) 2,406 26.08% 5,407 27.45% 2,344 24.48% -62 -2.58%<br />

Montecosaro (Mc) 555 6.02% 1,283 6.51% 807 8.43% 252 45.41%<br />

Naples 32 0.35% 62 0.31% 58 0.61% 26 81.25%<br />

Pisa 355 3.85% 732 3.72% 528 5.51% 173 48.73%<br />

Prato 213 2.31% 529 2.69% 305 3.19% 92 43.19%<br />

Santacroce sull'Arno (Pisa) 770 8.35% 1,604 8.14% 694 7.25% -76 -9.87%<br />

Treviso 318 3.45% 759 3.85% 280 2.92% -38 -11.95%<br />

Verona 118 1.28% 256 1.30% 170 1.78% 52 44.07%<br />

Padova 0 0.00% 0 0.00% 91 0.95% 91 =<br />

Vicenza 1,507 16.34% 2,901 14.73% 1,383 14.44% -124 -8.23%<br />

Total 9,224 100% 19,700 100% 9,575 100% 351 3.81%<br />

The Montecosaro office benefited from the favourable trend in footwear exports. Again, we would<br />

point out that the Padova office has absorbed part of the traffic which was previously handled by the<br />

Vicenza office.<br />

Shipments by land<br />

7

Revenues from shipments by land (road haulage) amount to Lire 6,103 million, against Lire<br />

13,144 million at 31st December 2000 and Lire 6,890 million at 30th June 2000. They are analysed by<br />

geographic destination in the table below (figures expressed in millions of lire):<br />

Diff. % Diff.<br />

30.06.2000 31.12.2000 30.06.2001 6.01-6.00 6.01-6.00<br />

North America 0 0 16 16 =<br />

Europe 6,890 13,109 6,087 -803 -11.65%<br />

Middle East 0 35 0 0 =<br />

Total 6,890 13,144 6,103 -787 -11.42%<br />

After a period of growth, this sector registered a decrease in revenue of 11.42% with respect to<br />

the first half of the year 2000. The sector's activity is concentrated mainly in the three offices at Vicenza<br />

(which has absorbed the traffic originated by the Verona branch), Montecosaro and Santa Croce<br />

sull’Arno (which in turn has absorbed a significant part of the traffic which passed through Florence).<br />

Overland shipment is carried out within Europe only and particularly with the Group's Iberian<br />

companies.<br />

The decrease is due to a general reduction in goods shipped overland by customers, and to the<br />

loss for the Vicenza office, of the traffic generated by the Milan office. While the overland transport<br />

sector is considered complementary to the Group's core business and does not enter within the<br />

Group's strategic development and expansion plans, it is still of fundamental importance as it enables<br />

the Savino Del Bene Group to offer its customers a complete and fully integrated transport service. An<br />

analysis of goods transported overland is given below, by point of despatch (thousands of Kg shipped):<br />

30/06/00 % 31/12/00 % 30/06/01 %<br />

Diff.<br />

6/01-6/00<br />

% Diff.<br />

6.01-6.00<br />

Florence 223 1.65% 301 1.19% 0 0.00% -223 -100.00%<br />

Montecosaro (Mc) 4,660 34.53% 7,970 31.64% 4,074 36.89% -586 -12.58%<br />

Santacroce sull'Arno<br />

(Pisa) 3,792 28.10% 7,640 30.33% 3,375 30.56% -417 -11.00%<br />

Verona 0 0.00% 30 0.12% 0 0.00% 0 =<br />

Vicenza 4,820 35.72% 9,248 36.71% 3,596 32.57% -1,224 -25.39%<br />

Total 13,495 100% 25,189 100% 11,045 100% -2,450 -18.15%<br />

Importation and customs clearing activity<br />

Revenues from importation and customs clearing activity amounts to Lire 11,240 million, against Lire<br />

23,806 million at 31st December 2000 and Lire 12,007 million at 30th June 2000 The table below<br />

shows an analysis of revenue by geographical area. For the first time the figures are analysed by the<br />

geographic area of the customer invoiced for the service.<br />

30/06/01 %<br />

North America 549 4.88%<br />

Central America 1 0.01%<br />

South America 2 0.02%<br />

Europe 10,604 94.34%<br />

Africa 7 0.06%<br />

Middle East 0 0.00%<br />

Far East 76 0.68%<br />

Australia and South Pacific 1 0.01%<br />

Total 11,240 100%<br />

The importation business is that which registered the largest growth in volume during the period<br />

(+15,52%) thanks to the acquisition of new customers by the Group's foreign companies with a view to<br />

acquiring significant market shares on the opposite routes from those utilised up until now. The direct<br />

presence of the Group at the destination areas of its routes enables it to guarantee a consistently high<br />

8

quality of service to its customers to and from all of the areas covered by the Group. The presence of<br />

Group companies on foreign markets also serves to gather custom for traffic towards Italy.<br />

Furthermore, the direct traffic between the various foreign companies of the Group is becoming<br />

increasingly important. The most active Italian offices in this sector, in addition obviously to the head<br />

office, are those of Pisa and Segrate. This latter registered the more significant growth, both in<br />

percentage and absolute terms. The principal point of despatch for imports remains North America.<br />

The Company intends to expand this sector even further, particularly if the euro/dollar exchange<br />

rate should lead to a growth in American exports.<br />

The number of import shipments per branch is shown in the table below:<br />

30.06.00 % 31.12.00 % 30.06.01<br />

Differenc<br />

e<br />

% 6.01 -6.00<br />

%Difference<br />

6.01-6.00<br />

Florence 526 21.94% 1,467 27.21% 712 25.71% 186 35.36%<br />

Livorno 0 0.00% 58 1.08% 35 1.26% 35 =<br />

Segrate (Milan) 286 11.93% 690 12.80% 651 23.51% 365 127.62%<br />

Montecosaro (Mc) 202 8.43% 464 8.61% 239 8.63% 37 18.32%<br />

Naples 149 6.22% 71 1.32% 69 2.49% -80 -53.69%<br />

Pisa 624 26.03% 975 18.09% 543 19.61% -81 -12.98%<br />

Santacroce sull'Arno<br />

(Pisa) 243 10.14% 487 9.03% 212 7.66% -31 -12.76%<br />

Treviso 0 0.00% 485 9.00% 0 0.00% 0 =<br />

Verona 18 0.75% 47 0.87% 28 1.01% 10 55.56%<br />

Vicenza 349 14.56% 647 12.00% 280 10.11% -69 -19.77%<br />

Total 2,397 100% 5,391 100% 2,769 100% 372 15.52%<br />

Investments<br />

The Company carried out the following investments during the period:<br />

a) intangible fixed assets: costs (Lire 5 million) for changes to the Company's Statute relative to the<br />

increase in share capital from Euro 18,917,600 to Euro 19,000,800 resolved by the Board of<br />

Directors on 30th March 2001 and carried out by means of the utilisation of the reserve for<br />

employee profit sharing. Other investments in intangible fixed assets regarded the implementation<br />

of existing programmes and the acquisition for licenses for the use of software for Lire 7 million<br />

and the cost of improvements to leased assets for Lire 155 million. In addition, advance payments<br />

were made to suppliers for Lire 34 million improvements to leased buildings.<br />

b) tangible fixed assets: the principal investments regarded improvements to the Company's<br />

buildings for Lire124 million, purchases of equipment for Lire 215 million and of other assets for<br />

Lire 1,348 million including mainly purchases of electronic machinery (Lire 755 million) and motor<br />

vehicles (Lire 356 million). Lastly, advance payments were made to suppliers for Lire 227 million<br />

relative to a ground lease for a period of 30 years on a building situated in the dockland district of<br />

Genoa (Lire 182 million) and for other improvements to the Company's buildings (Lire 40 million)<br />

and for purchases of equipment (Lire 5 million).<br />

c) financial fixed assets: the acquisition of an equity investment of 51% of the share capital of the<br />

company Leonardi e C. S.p.A for Lire 8,262 million; the underwriting and payment of the increase<br />

in the share capital of the company Tavoni Arimar S.p.A. for Lire 580 million; the payment of Lire<br />

530 million to reintegrate the losses sustained by the company Cavallino S.r.l.; the non-interest<br />

bearing advance payment of Lire 6,000 million for future increases in share capital of the company<br />

Savino Del Bene Internationale S.A. utilising an interest bearing loan already existing in the<br />

financial statements as at 31.12.00.<br />

Equity and financial situation<br />

The reclassified balance sheet as at 30th June 2001 shows the following situation:<br />

9

30.06.00 31.12.00 30.06.01<br />

Diff.<br />

6.01-6.00<br />

% Diff.<br />

6.01-6.00<br />

A FIXED ASSETS<br />

Intangible fixed assets 907 785 823 -84 -9.26%<br />

Tangible fixed assets 13,386 26,811 27,124 13,738 102.63%<br />

Financial fixed assets 25,497 25,199 34,136 8,639 33.88%<br />

Total fixed assets 39,790 52,795 62,083 22,293 56.03%<br />

B NET WORKING CAPITAL<br />

Trade receivables 89,191 102,158 103,462 14,271 16.00%<br />

Other assets 8,892 14,679 10,206 1,314 14.78%<br />

Trade payables -55,542 -62,456 -54,005 1,537 -2.77%<br />

Provisions for risks and charges -2,418 -2,706 -2,897 -479 19.81%<br />

Other liabilities -13,225 -23,859 -25,368 -12,143 91.82%<br />

Total net working capital<br />

CAPITAL INVESTED LESS OPERATING<br />

26,898 27,816 31,398 4,500 16.73%<br />

C LIABILITIES (A+B) 66,688 80,611 93,481 26,793 40.18%<br />

D EMPLOYEE TERMINATION INDEMNITY -8,772 -9,323 -9,968 -1,196 13.63%<br />

E NET CAPITAL INVESTED (C-D)<br />

Financed by :<br />

57,916 71,288 83,513 25,597 44.20%<br />

F SHAREHOLDERS' EQUITY<br />

NET FINANCIAL INDEBTEDNESS<br />

69,579 83,477 86,395 16,816 24.17%<br />

G (LIQUIDITY)<br />

Medium and long term financial debt 0 0 0 0 0.00%<br />

Long term financial receivables<br />

Medium and long term net financial indebtedness<br />

0 0 0 0 0.00%<br />

(liquidity) 0 0 0 0 0,00%<br />

Short term financial debt 10,534 15,094 13,808 3,274 31.08%<br />

Liquidity and short term receivables -22,197 -27,283 -16,690 5,507 -24.81%<br />

Short term net financial indebtedness (liquidity) -11,663 -12,189 -2,882 8,781 -75.29%<br />

Total net financial indebtedness (liquidity) -11,663 -12,189 -2,882 8,781 -75.29%<br />

H TOTAL SOURCES OF FINANCE (F+G) 57,916 71,288 83,513 25,597 44.20%<br />

The net financial position at 30.6.2001 has fallen from a net liquidity of Lire 11,663 million at 30th<br />

June 2000 to Lire 2,882 million at del 30th June 2001 due to the significant investments carried out,<br />

and particularly in equity investments in companies operating in the transport and shipping sector.<br />

In order to give further detail of the movements in net working capital a statement of cash flows for<br />

the Company as at 30th June 2001 is shown as an appendix to this report. This statement shows that<br />

the Company's operations have generated funds for Lire 13,306 million, against Lire 23,074 million at<br />

31st December 2000 and Lire 16,397 million at 30th June 2000 against an application of funds of Lire<br />

25,332 million at 30.6.01 and Lire 10,505 million at 30.6.00, due mainly to increases in equity<br />

investments (Lire15, 374 million) and to the payment of dividends (Lire 7,265 million against Lire 4,885<br />

million at 30.6.00).<br />

Transactions with Subsidiary, Associated and Parent Companies and Other Related Parties<br />

during the period the Company Savino Del Bene S.p.A carried out transactions with subsidiary and<br />

associated companies as part of its normal business activities and at normal market conditions. As<br />

regards transactions between other Group companies and other related parties, reference should be<br />

made to the Directors’ Report on the interim consolidated financial statements.<br />

As regards the company Savino Del Bene S.p.A. we would point out that during the period<br />

1.1.2001-30.6.2001 no transactions took place with other related parties. Detail of the results of the<br />

principal subsidiary companies listed in Appendix No. 1 to the consolidated interim financial statements<br />

as at 30.6.2001 is given below:<br />

10

• Savino Del Bene USA Inc. (New York): this company, which is held indirectly through Savino Del<br />

Bene Finanziaria S.a. carries out the function of a sub-holding of the American subsidiary<br />

companies and of administrative and IT co-ordination and support for the American subsidiaries'<br />

operations with the aim of developing and expanding export traffic from the USA towards Europe<br />

and the rest of the world. The company had an average of No. 5 employees compared to the No.<br />

4 employees as at 30.6.00. The company recorded a loss of Lire 25 million against a net income of<br />

Lire 91 million at 30.6.00.<br />

• Savino Del Bene Inc. (New York): this subsidiary company recorded a loss of Lire 261 million for<br />

the first six months of the year 2001, compared to a net income of Lire 282 million in the first six<br />

months of the year 2000. The company employed an average of No. 32 employees during the<br />

period, compared to No. 26 during the first half of the year 2000. Total sales revenue has increased<br />

by 4.8%, rising from US$ 3,728 thousand to US$ 3,907 thousand at 30.6.01. Revenues from air<br />

imports have remained relatively stable (US$ 1,087 thousand). Revenues from sea imports have<br />

increased, reaching a total of US$ 1,692 thousand, against US$ 1,201 thousand, while export<br />

revenue has fallen from US$ 1,326 thousand to US$ 1,067 thousand. This loss is due principally to<br />

the increase in labour costs.<br />

• Savino Del Bene International Freight Forward Inc. (Chicago): this subsidiary company<br />

recorded a loss for the period of Lire 246 million, against a net income of Lire 274 million at<br />

30.6.00. The company employed an average of No. 31 employees during the period, compared to<br />

No. 24 during the first half of the year 2000. Turnover has increased by 11%, to arrive at US$<br />

2,932 thousand. Import activity accounts for approx. 72.5% of total sales revenue and has<br />

increased by 12% during the period. Export activity shows an increase of 68% for air traffic and a<br />

decrease of 14% for goods shipped by sea. The company has completed the transfer to a new<br />

warehouse close to the Chicago airport and railport and expects to see the benefits thereof in<br />

terms of increased revenues during the second half of the year.<br />

• Savino Del Bene Inc. (Los Angeles): during the first six months of the year 2001 this subsidiary<br />

company recorded a loss of Lire 637 million against a net income of Lire 32 million for the<br />

corresponding period of the previous year. The company employed an average of No. 22<br />

employees during the period. The company operates through two separate offices, one in Los<br />

Angeles and the other in San Francisco. The Los Angeles office realised an increase in turnover of<br />

28% to reach a total turnover of US$ 1,022 thousand, due principally to the increase in sea<br />

imports. The San Francisco office registered an increase of 62% in turnover, which amounted to<br />

US$ 745 thousand at 30.06.01. The loss for the period is due to the significant fixed costs relating<br />

to personnel and rental of premises. The company expects to increase the volume of its imports<br />

from Europe and to develop and expand new routes from Turkey, Brazil and China. The company<br />

is currently extending the offer of customs brokerage services to all of its customers.<br />

• Savino Del Bene (Georgia) Inc.: at 30th June 2001 this subsidiary recorded a loss of Lire 40<br />

million against a net income of Lire 74 million for the corresponding period of the previous year.<br />

The company employed an average of No. 9 employees during the period compared to No. 6 at<br />

30.6.00. The company registered an increase in turnover of 11.9%, for a total turnover of US$<br />

686.565, thanks to the increase in imports by sea and in exports by both sea and by air.<br />

• Savino Del Bene (Texas) Inc.: this company recorded a loss of Lire 585 million for the first six<br />

months of the year 2001, against a net income of Lire 19 million for the corresponding period of the<br />

previous year. The company employed an average of No. 21 employees during the period<br />

compared to No. 22 during the first half of the year 2000. The loss for the period is due to a drop in<br />

sales revenue, which fell by 14%, due essentially to a drop in imports by customers as a result of<br />

the slowing down of the US economy. In fact, while both sea and air imports show a decline, the<br />

company registered an increase of 69% in sea exports, thanks to the acquisition of new customers<br />

who export to Europe, Turkey and China. The company's customers expect to increase their<br />

activities during the second part of the year, and therefore we can reasonably expect to see a<br />

better result for the second half of the year than for the first half.<br />

• Savino Del Bene Inc. Charlotte: this subsidiary company recorded a loss for the period of Lire<br />

174 million against a loss of Lire 64 million at 30.6.00. The company employed an average of No. 3<br />

11

employees during the period. Turnover for the period amounted to US$ 223 thousand, against US$<br />

243 thousand for the period ended 30.6.00. The company registered an increase of 26% in imports<br />

by sea, which was not sufficient however to compensate for the decrease in imports by air, which<br />

fell by 22%. Air and sea exports have fallen from US$ 28 thousand to US$ 7 thousand.<br />

• Savino Del Bene Inc. (Massachusetts): this subsidiary company recorded a loss of Lire 238<br />

million against a loss of Lire 76 million for the corresponding period of the previous year. The<br />

company employed an average of No. 9 employees during the period, compared to No. 7 during<br />

the first half of the year 2000. Turnover fell by 34%, from US$ 602,344 during the period ended<br />

30.6.00 to US$ 398,326 at 30.6.01; this decrease is due principally to the decrease in imports by<br />

sea (-41%). In general, the acquisition of new customers has forced the company to apply more<br />

competitive rates, which, as can be seen, have led to a decrease in turnover but which have<br />

consolidated the volume of goods shipped.<br />

• Savino Del Bene Inc. Miami: at 30th June 2001 this subsidiary company recorded a loss of Lire<br />

144 million against a loss of Lire 75 million for the corresponding period of the previous year. The<br />

average number of employees during the period amounted to No. 10 compared to No. 9 during the<br />

first half of the year 2000. The company showed an increase in turnover of 144%, due principally to<br />

imports by sea of furniture and masonry materials which rose from US$ 171,044 to US$ 467,631.<br />

The company commenced customs brokerage activities which generated revenues of US$ 108<br />

thousand. Imports by air have increased by 56.9%, rising from US$ 100,218 to US$ 157,263. The<br />

increase in turnover was achieved through the application of competitive shipping rates to<br />

customers which were unable to cover the increase in fixed costs.<br />

• Fashion Distribution Service New Jersey Inc.: this subsidiary company realised a net income for<br />

the period of Lire 309 million, against Lire 370 million for the corresponding period of the previous<br />

year. The company employed an average of No. 20 employees during the period. Total sales<br />

revenues show an increase of 3.2% and amount to US$ 2,705 thousand. The company provides a<br />

whole series of highly advanced logistics services, thanks to its state of the art warehouse, for the<br />

storage, handling and forwarding of goods to their destination. The company uses external<br />

personnel.<br />

• Superb Custom Brokers Inc.: this subsidiary company recorded an income for the period of Lire<br />

8 million, against Lire 12 million at 30.6.00. The company employed an average of No. 18<br />

employees during both the current and the previous period. Turnover amounted to US$ 908,372<br />

against US$ 1,157,379 at 30.6.00. The company operates as a customs broker on behalf of the<br />

American Group companies.<br />

• Savino Del Bene Corp. (Canada): this subsidiary company recorded a loss of Lire 108 million<br />

against a net income of Lire 93 million during the first six months of 2000. The company employed<br />

an average of No. 10 employees during the period. Exports by sea have increased by 30% with<br />

respect to 30.6.00, while exports by air amount to 26,000 kg, representing an increase of 47.6%<br />

with respect to 30.6.00. Turnover amounted to Lire 1,332 million.<br />

• Savino Del Bene S.l. (Spain) : this subsidiary company recorded a net income of Lire 799 million<br />

at 30.6.01, against Lire 704 million for the corresponding period of the previous year. Turnover has<br />

decreased by approx. 5.4%, due to the fall in exports towards North America. Revenues from<br />

shipments by sea, which represent 63.8% of total revenues, fell by 5% and amounted to Euro<br />

5,039 thousand. Revenues from air traffic fell even further (-19%), after the significant growth<br />

registered therein during the first six months of the year 2000, and amount to Euro 1,021 thousand.<br />

By contrast, revenues from overland transport relative to both imports and exports to and from Italy<br />

have risen by 3.13% to reach Euro 1,853 thousand, even if this increase is due to the increase in<br />

rates charged to customers. In addition to its Alicante head office, the company has another two<br />

offices, one in Madrid and the other in Barcelona; this latter was opened in June 2001. The<br />

company employed an average of No. 37 employees during the period.<br />

• Savino Del Bene Ltd. (UK): this subsidiary company realised a net income of Lire 105 million at<br />

30.6.2001 against approx. Lire 31 million for the corresponding period of the previous year. At the<br />

end of April 2001, the company sold its road haulage business segment and now concentrates its<br />

activities in the international sea and air shipping sector. Turnover for the period has fallen by<br />

20.8%, mainly as a result of the abovementioned sale of the road haulage business segment. The<br />

12

most significant reduction regarded the traffic towards North America while traffic towards the Far<br />

East showed an increase of 10%. Following the change in activity, this company shows significant<br />

potential for growth, particularly for imports from Asia and America.<br />

• Savino Del Bene L.da. (Portugal): this subsidiary company closed the period with a net income of<br />

Lire 67 million against Lire 236 million for the corresponding period of the previous year. The<br />

company employed an average of No. 37 employees during the period. Turnover increased by a<br />

total of 1%, reaching Euro 1,786 thousand, however we would point out that the increase is due<br />

entirely to the growth in revenues from shipments by sea (Euro 1,058 thousand) as a result of the<br />

increase in rates charged to customers. All of the other sectors registered a decrease, both in<br />

terms of revenue and in terms of volumes shipped, principally as a result of the drop in exports.<br />

During the year 2001 the company expects to attend various trade fairs and to further develop its<br />

direct contacts on the principal destinations of goods shipped in order to acquire new customers.<br />

• Savino Del Bene France S.a.: this company recorded a loss for the period of Lire 267 million<br />

against a loss of Lire 74 million for the first six months of the year 2000. Turnover amounted to FF.<br />

22,419 thousand against FF. 16,769 thousand at 30.6.00. Revenues from exports by air have<br />

grown from FF. 9,356 thousand to FF. 10,553 thousand, while revenues from shipments by sea<br />

amounted to FF. 9,296 thousand, against FF. 5,387 thousand. The company employed an average<br />

of No. 21 employees during the period.<br />

• Savino Del Bene China Ltd.: this company recorded a net income for the period of Lire 139<br />

million against Lire 443 million at 30.6.00. Turnover fell by 7%, due to the loss of an important<br />

customer in the air sector, although it subsequently acquired two new major customers during the<br />

period and opened up a new shipping route to and from Mexico. The average number of<br />

employees during the period amounted to No. 17, compared to No. 12 during the corresponding<br />

period of the previous year. During the period the company extended its warehouse. Revenues<br />

from air traffic (imports and exports) amounted to HK$10,796 thousand, representing a decrease<br />

of 15.7%. Revenues from shipments by sea increased by 29% to reach a total of HK$3,926<br />

thousand. The company expects to see a further significant increase in shipments by sea during<br />

the second half of the year 2001, while it does not expect to be able to repeat the excellent results<br />

achieved during the year 2000 for the air traffic sector.<br />

• Hani Transport Co. Ltd (Korea): this subsidiary company recorded a loss of Lire 26 million for the<br />

first six months of the year 2001, against Lire 87 million for the corresponding period of the<br />

previous year. The average number of employees during the period amounted to No. 21. During<br />

the period turnover decreased by 11.6% due to the drop in revenues from air traffic, which fell from<br />

Won 457,884 thousand to Won 404,793 thousand. Revenues from exports by air (Won 78,817<br />

thousand) fell by 471% due to the negative performance of the Korean economy. The volume of<br />

goods shipped in this sector has fallen by 56.4%. The company is expanding the sea shipping<br />

sector and has acquired new customers who export to South Africa and, from the middle of June<br />

onwards, also imports from Vietnam which should guarantee an average of No. 30 Teus per<br />

month. The principal types of product shipped are machinery (overland) and textile and electronic<br />

products.<br />

• Savino Del Bene Japan Co. Ltd. (Tokyo): this subsidiary company recorded a loss of Lire 91<br />

million against Lire 511 million at 30.6.00. Turnover amounted to Yen 59,694,747. The company<br />

operates from two offices (Tokyo and Osaka) and the result for the period was influenced by the<br />

loss of important European customers and by the fierce competition from other operators which<br />

forced the company to reduce the rates it charges to customers in order to maintain business.<br />

• Savino Del Bene Nakliyati Ltd (Turkey): this subsidiary company recorded a loss for the period<br />

of Lire 6 million against a loss of Lire 9 million for the corresponding period of the previous year.<br />

average number of employees during the period amounted to No. 13, compared to No. 10 during<br />

the period ended 30.6.00. During the period the company shipped No. 382 Teus by sea, compared<br />

to No. 427 Teus in the period ended 30.6.00, while the cubic metres of groupage amounted to 90,<br />

compared to 29 at 30.6.00. The volume of goods exported by air amounted to 25,744 kg,<br />

compared to 7,793 kg at 30.6.00. The increase in exports was helped by the devaluation of the<br />

Turkish Lira (-94% with respect to the US dollar). The company has exploited the synergies offered<br />

by the Savino Del Bene Group in order to expand its own traffic.<br />

13

• S.D.B. Finanziaria S.a. (Luxembourg) : this company channels loan finance to the Group's<br />

operating companies in addition to providing administrative and tax consultancy and data gathering<br />

services to many of the Group companies included in the consolidation area. During the first six<br />

months of the year 2001 the company realised an income of Lire 435 million against Lire 206<br />

million for the corresponding period of the year 2000.<br />

• Savino Del Bene Internationale Luxembourg S.a..: this company realised a net income for the<br />

period of Lire 992 million, against a net income of Lire 1,197 million for the period ended 30.6.00.<br />

The company manages the financial resources of and provides treasury services to the entire<br />

Savino Del Bene Group.<br />

The Italian subsidiary and associated companies showed the following results for the six months ended<br />

30th June 2001:<br />

• General Noli S.p.A.: this subsidiary company realised a net income of Lire 3,731 million against a<br />

net income of Lire 3,256 million for the corresponding period of the previous year. The average<br />

number of employees during the period amounted to No. 37 against No. 25 during the first six<br />

months of the year 2000. Total sales revenue amounted to Lire 44,714 million, representing an<br />

increase of 36.4% with respect to the corresponding period of the previous year. This increase is<br />

due mainly to revenues from goods shipped by sea, which rose from Lire 31,455 million at 30.6.00<br />

to Lire 43,696 million at 30.6.01. In terms of the volume, goods shipped by sea have increased by<br />

approx. 20% arriving at No. 9,374 Teus shipped. Revenues from air traffic have decreased by<br />

approx. 27%, falling from Lire 1,239 million to Lire 897 million. More significant in terms of quantity<br />

was the decrease in goods shipped by air, which fell from 418 thousand kg. at 30.6.00 to 252<br />

thousand kg for the current period. The company's principal markets are North and Central<br />

America. The main traffic sectors in which the company operates are the transport of ceramic tiles<br />

and foodstuffs. During the period the company set up a new company in Brazil in order to develop<br />

and expand traffic on this route. The company also operates through foreign subsidiary companies<br />

in New York, Toronto and Valencia, which recorded positive results for the period. In particular, we<br />

would point out the result achieved by the subsidiary General Noli S.L. Spain in Valencia, which<br />

realised a net income for the period of Lire 862 million and which achieved an increase in turnover<br />

of 53.9%, rising from Euro 2,579,015 to Euro 3,969,092 at 30.6.2000. The company carries out<br />

sea exports and registered an increase of 49.69% in terms of number of TEUS shipped, which<br />

rose from No. 2,419 to No. 3,621. The company's principal destinations are North America (75%)<br />

and Canada (20%).<br />

• Leonardi e C. S.p.a.: this subsidiary company was acquired during the period and realised a net<br />

income of Lire 3,739 million at 30th June 2001 against an income before tax of Lire 2,798 million at<br />

31.12.00. The company carries out international shipping by sea and air; the company's principal<br />

markets are North America, the Middle East and the Far East. During the period the company<br />

employed an average of No. 49 employees. Revenues from shipments by sea amount to Lire<br />

55,701 million against Lire 114,065 million for the entire year 2000, for a total volume shipped of<br />

424 thousand kg. Revenues from air traffic amount to Lire 1,654 million against Lire 3,682 million<br />

at 31.12.2000. During the period the company shipped a total of No. 13,854 Teus.<br />

• Savitransport S.p.a.: this subsidiary company realised a net income of Lire 1,606 million for the<br />

first six months of the year 2001, compared to Lire 429 million for the first six months of the year<br />

2000. The average number of employees during the period amounted to No. 47, against No. 42<br />

during the first half of the year 2000. During the period the company recorded an increase of more<br />

than 34% in air traffic, shipping Kg 1,971 thousand against Kg 1,466 thousand at 30.6.00.<br />

Revenues from air traffic rose from Lire 8,949 million at 30.6.00 to Lire 12,575 million, representing<br />

an increase of 40.5%. The routes which saw the most significant increases were those towards<br />

North America (kg 1,805 thousand, an increase of 33%), the Far East (Kg 104 thousand, an<br />

increase of 100%) and Australia and the South Pacific (Kg 54 thousand, an increase of 94%).<br />

Shipments by sea fell from No. 2,612 Teus shipped at 30.6.00 to No. a 2,110 Teus shipped at<br />

30.6.01, while turnover has increased, rising from Lire 5,576 million to Lire 8,014 million, due<br />

principally to the decrease in “porto assegnato” traffic and the increase in “prepaid” traffic. Import<br />

activity shows a decrease in the number of imports handled, which fell from 511 thousand at<br />

30.6.00 to 321 thousand at 30.6.01 The company operates in Italy through its subsidiary company<br />

(51%) Savitransport Triveneto S.r.l. which realised an income for the period of Lire 83 million,<br />

14

against Lire 33 million for the period ended 30.6.00, and a turnover of Lire 3,674 million against<br />

Lire 2,474 million for the first six months of the year 2000. The company also holds investments in<br />

two American companies, with head offices in Chicago and New York, and which recorded profits<br />

for the period of Lire 113 million and Lire 169 million respectively.<br />

• Albatrans S.p.a.: this subsidiary company realised a net income of Lire 1,377 million, against Lire<br />

1,032 million during the first six months of the year 2000. Turnover has risen from Lire 15,123<br />

million to Lire 21,864 million, representing an increase of over 44%. The average number of<br />

employees during the period amounted to No. 23, compared to No. 21 during the first half of the<br />

year 2000. During the period the company saw a significant increase in shipments by air, which<br />

amounted to 1,659 thousand kg, an increase of 461 thousand kg with respect to the first six<br />

months of the year 2000. thousand. Revenue from shipments by air has risen from Lire 7,262<br />

million to Lire 10,725 million, representing an increase of over 47%. Shipments by sea have<br />

decreased by approx. 6% in terms of the number of Teus shipped, which fell from No. 3,489 at<br />

30.6.00 to No. 3,280 at 30.6.01. Revenue from shipments by sea have increased however, rising<br />

from Lire 7,703 million to Lire 10,720 million. The company controls an American company with<br />

head offices in New York which recorded a loss of Lire 438 million for the period. The company<br />

also controls another two European companies, both of which recorded positive results for the<br />

period.<br />

• Fashion Transport S.r.l.: this subsidiary company realised a net income of Lire 189 million,<br />

against a loss of Lire 85 million at 30.6.00. The average number of employees during the period<br />

amounted to No. 12, compared to No. 15 during the period ended 30.6.00. Revenues from<br />

shipments by air have increased by Lire 607 million, rising from Lire 3,636 million at 30.6.00 to Lire<br />

4,243 million, while the volume shipped shows an increase of approx. 20% with a total of Kg.<br />

363,656 shipped during the period. The company managed to increase the rates charged to<br />

several important customers and also obtained more favourable freight charges from air carriers.<br />

The main destination areas are North and South America. Revenues from road haulage within<br />

Europe registered an increase of 45.7%, rising from Lire 498 million to Lire 726 million. This<br />

increase was due to a new agreement with new correspondents on the Iberian Peninsula. Revenue<br />

from shipments by sea has decreased by approx. 19%, falling from Lire 193 million to Lire 162<br />

million. In actual fact this sector is of marginal importance and is limited to transactions with<br />

customers of the other Savino Del Bene Group companies. The company plans to open its own<br />

office in North America in order to expand traffic to and from that area.<br />

• Tavoni Arimar Spedizioni S.p.a.: this company recorded an income for the period of Lire 92<br />

million, against Lire 443 million for the corresponding period of the previous year. The average<br />

number of employees during the period amounted to No. 34, compared to No. 14 during the period<br />

ended 30th June 2000. During the period the company acquired the shipping and transport<br />

company “Tavoni International” which has No. 9 offices in Central and North Italy; consequently,<br />

the figures regarding both the volumes of goods shipped and the revenue therefrom have been<br />

influenced by this acquisition. Shipments by sea showed an increase of 57.3% in terms f the<br />

number of TEUS shipped, which rose from No. 2,000 to No. 3,146. Revenue from shipments by<br />

sea rose from Lire 7,553 million to Lire 12,020 million. The volume of kilos shipped by air increased<br />

by 279%, rising from 491 thousand kg at 30.6.00 to 1,863 thousand kg at 30.6.01, while revenues<br />

from air shipments rose from Lire 3,881 million to Lire 11,031 million. The acquisition of Tavoni<br />

has led to a shift in the principal traffic routes away from North America towards the Far East<br />

although together these two areas generate more than 50% of the total volume of goods shipped.<br />

• Centro Spedizioni Internazionali S.p.a.: this subsidiary company recorded a loss of Lire 15<br />

million against a net income of Lire 27 million for the first six months of the year 2000. The<br />

average number of employees during the period amounted to No. 16 against No. 17 during the<br />

period ended 30.6.00. Turnover has remained virtually unchanged with respect to the<br />

corresponding period of the previous year and amounted to Lire 3,893 million, despite the closure<br />

of the Santacroce sull’Arno (Pisa) office which had generated a turnover of approx. Lire 600 million<br />

at 30.6.00. Revenues from shipments by sea increased from Lire 306 million Lire 708 million with<br />

No. 316 Teus shipped during the period compared to No. 142 during the period ended 30.6.00.<br />

The loss of an important customer led to a decrease in the volume of goods shipped by air, which<br />

amounted to Kg. 38 thousand against Kg. 85 thousand in the corresponding period of the previous<br />

year. The company's main activity remains that road haulage road haulage, which generated<br />

revenues for Lire 2,323 million against Lire 2,712 million del 30.6.00.<br />

15

• Fiorino Shipping S.r.l. : the company recorded a net income for the period of Lire 428 million<br />

against a net income of Lire 382 million for the corresponding period of the previous year. The<br />

average number of employees during the period amounted to No. 9, against No. 8 at 30.6.00.<br />

Shipments by sea have increased by 35.8% to a total of No. 606 Teus shipped, while revenues<br />

from shipments by sea have fallen by 4.9% to Lire 3,170 million. The volume of goods shipped by<br />

air shows a decrease of 13.5%, falling from 462 thousand kg at 30.6.00 to 400 thousand kg at<br />

30.6.00. Revenues from shipments by air have risen from Lire 2,815 million to Lire 2,829 million.<br />

The principal sectors in which the company operates regard clothing, textiles, chemical products<br />

and leather and furs, and the principal route is represented by North America.<br />

• Novibrama S.r.l. : this subsidiary company recorded a net income of Lire 49 million, against Lire<br />

81 million for the corresponding period of the previous year. The average number of employees<br />

during the period amounted to No. 7, unchanged with respect to 30.6.00. The company carries out<br />

road haulage services and plays a strategic role within the Savino Del Bene Group. Turnover for<br />

the period amounted to Lire 4,000 million against Lire 5,941 million at 30.6.00.<br />

• Lulli S.r.l. : this subsidiary company realised an income of Lire 259 million, against Lire 340 million<br />

for the period ended 30.6.00. The company provides computer consultancy and data processing<br />

services. The average number of employees rose to No. 15, against No. 8 employees at 30.6.00.<br />

Turnover for the period amounted to Lire 3,007 million, against Lire 2,855 million for the<br />

corresponding period of the previous year.<br />

• Cavallino S.r.l.: the main activity of this subsidiary company is that of real estate management.<br />

The company recorded a net income for the period of Lire 88 million against Lire 83 million for the<br />

period ended 30.6.00. This company has no employees and realised a turnover of Lire 365 million<br />

against Lire 358 million for the period ended 30.6.00.<br />

• Sacid S.r.l.: this subsidiary company recorded a net income of Lire 38 million against Lire 171<br />

million at 30.6.00. The company employed an average of No. 9 employees during the period,<br />

compared to No. 7 during the period ended 30.6.00. Total sales revenue showed an increase of<br />

15.3%, rising from Lire 2,133 million at 30.6.00 to Lire 2,460 million at 30.6.01. The company's<br />

main activity is that of customs brokerage, importation and shipments by air, and its operations are<br />

centred on the Fiumicino Airport in Rome. In particular, the revenues deriving from importation and<br />

customs brokerage activities amounted to Lire 1,388 million, relatively unchanged with respect to<br />

the corresponding period of the previous year. Revenues from shipments by air amounted to Lire<br />

833 million against Lire 643 million del 30.6.00.<br />

• C.R.T. S.r.l.: this subsidiary company recorded a net income of Lire 207 million against Lire 97<br />

million at 30.6.00. The average number of employees during the period amounted to No. 4, as in<br />

the previous year. The company transports containers within Italy. Total sales revenues showed an<br />

increase of 35%, rising from Lire 5,662 million to Lire 7,648 million.<br />

• Do.Ca. S.r.l.: this associated company is based in Livorno and therefore operates mainly in<br />

shipments by sea. The company realised a net income of Lire 837 million against Lire 388 million<br />

for the corresponding period of the previous year. During the period the company recorded a<br />

turnover of Lire 21,031 million, against Lire 15,026 million for the period ended 30.6.00. The<br />

company registered an increase of 211% in terms of quantity of Teus shipped, which rose from No.<br />

3,770 Teus to No. 4,566. The company's principal routes are comprised of North and South<br />

America.<br />

• Levitrans S.r.l.: this associated company recorded a net income for the period of Lire 6 million<br />

against Lire 5 million at 30.6.00. This company operates in the transport of marble and masonry<br />

products sector. The company employed an average of No. 14 employees during the current<br />

period and that of the previous year. Shipping revenues amounted to Lire 17,052 million against<br />

Lire 11,791 million at 30.6.00. Revenues from shipments by sea amounted to Lire 16,984 million<br />

against Lire 11,773 million at 30.6.00. The goods shipped in terms of number of Teus amounted to<br />

No. 2,901 against No. 2,743 at 30.6.00.<br />

16

The parent company's income statement includes the following costs and revenues relative to<br />

subsidiary and associated companies:<br />

30.06.00 31.12.00 30.06.01<br />

(+) Revenues and income:<br />

Revenues from services, mainly shipping<br />

services 83,084 167,297 81,935<br />

Other revenues from rental of real estate 103 206 117<br />

Other revenues from payroll services rendered: 54 85 56<br />

Financial income from dividends and relative tax credits 1,638 3,608 1,538<br />

Financial income from interest on loans 147 609 0<br />

Income from writeback of book value of equity investments 0 241 0<br />

Extraordinary gains realised on the sale of equity investments<br />

(-) Costs and charges:<br />

Costs for services received, mainly related to<br />

0 1,939 0<br />

shipping activities 28,202 52,717 27,055<br />

Costs for rental of real estate: 423 840 429<br />

Exchange losses 0 1,830 0<br />

Provision for coverage of losses 0 288 0<br />

Write-down of equity investments 0 524 0<br />

Significant events subsequent to 30th June 2001<br />

Subsequent to 30th June 2001 the Company opened a new office in Genoa, which became<br />

operative as from the beginning of August 2001 and which is expected to lead to a further expansion of<br />

traffic from North Italy towards Asia in general.<br />

In accordance with a previous agreement, the company acquired a further share of 2% in the<br />

company Leonardi and Co. S.p.A.<br />

Finally, a preliminary agreement has been signed for the acquisition of a building, for office use,<br />

close to the Company's head offices in Scandicci (Florence) for a cost of Lire 515 million; the additional<br />

space shall permit a more rational distribution of operations.<br />

No other events have taken place after the period end which could have a significant effect on the<br />

Company's equity, financial and economic situation.<br />

Forecast for the remainder of the current year<br />

The following figures are forecast for the year 2001 as a whole:<br />

31.12.00 30.06.01 31.12.01<br />

Value of production 387,642 179,466 385,000<br />

Gross operating margin 29,689 9,062 22,000<br />

Net operating result 24,627 6,613 17,000<br />

The net financial position has changed from a net liquidity of Lire 12,189 million at 31st December<br />

2000 to Lire 2,882 million as a result of the significant equity investments acquired during the period.<br />

Given that no significant investments are expected to take place during the second half of the year<br />

2001 we expect to be able to maintain, and indeed improve, the result achieved during the first six<br />

months of the year.<br />

ACCOUNTING PRINCIPLES AND VALUATION CRITERIA<br />

The accounting principles adopted in the preparation of these interim financial statements are<br />

consistent with those adopted in the previous annual financial statements. The more significant<br />

accounting principles are disclosed below:<br />

17

1. Intangible fixed assets are recorded at purchase cost and amortised over the period that the assets<br />

are expected to benefit. In particular, Starting up and expansion costs are capitalised with the Board of<br />

Statutory Auditors’ consent and amortised over a period of five years. Goodwill is capitalised and<br />

amortised over a period of five years from the period in which it was purchased, with the Board of<br />

Statutory Auditors’ consent. Concessions, licences and similar rights relate to the cost of applications<br />

software acquired under licence for use and are amortised on a straight-line basis over the duration of<br />

the licence, which is estimated as being over a period of five years. Improvements to third party assets<br />

and are amortised over the duration of the relative lease or rental contract or over their expected useful<br />

lives, whichever is the shorter.<br />

2. Tangible fixed assets are stated at purchase cost, including directly related charges, and are shown<br />

net of accumulated depreciation thereon. The cost of certain assets has been restated, following the<br />

application of monetary revaluation laws or following mergers, within the limits of the fair value of the<br />

assets concerned. In particular, the buildings recorded in the financial statements were revalued during<br />

the year in accordance with Law No. L.342/2000 utilising the criteria of the revaluation of both historical<br />

cost and of accumulated depreciation, offset by the creation of a specific reserve in shareholders'<br />

equity, having accrued the relative substitutive tax.<br />

Repair and maintenance costs are charged entirely to the income statement in the period in<br />

which they are incurred. Tangible fixed assets are depreciated annually on a straight-line basis<br />

using rates that reflect the residual economic lives of the assets concerned.<br />

3. Assets acquired under financial leasing contracts are recorded in the financial statements in<br />

accordance with the current interpretation of the relative legislation, which requires that leasing<br />

instalments be charged to the income statement for the period.<br />

4. Equity investments intended to be held on a long-term basis are recorded as financial fixed assets<br />

and are stated at purchase cost. Investments in foreign companies are stated at cost converted into<br />

Italian lire at the exchange rate in existence at the moment of acquisition or underwriting of the<br />

investment. In the event of a permanent fall in value they are written down to their net equity value,<br />

determined on the basis of the last approved set of financial statements, taking account of reasonable<br />

expectations of future profitability, by means of the creation of a specific reserve for write-downs.<br />

Losses in excess of the book values of the investments are recorded in a specific provision under the<br />

heading "Provisions for risks and charges".<br />

The investments are restored to their original value should the reasons for such write-downs no longer<br />

apply.<br />

5. Own shares are recorded in the financial statements either as financial fixed assets or current<br />

financial assets, depending on whether they are intended to be held over the long term or whether they<br />

are designed to uphold the Company’s share quotation. In the former case they are valued at cost,<br />

18

educed where necessary to take account of permanent reductions in value; in the second case the<br />

own shares are stated at the lower of average weighted cost and market value.<br />

6. Marketable securities are classified as financial fixed assets if they are intended to be held until their<br />

maturity date, or as current financial assets if they are destined either for negotiation or to meet future<br />

finance requirements. Those securities included in financial fixed assets are stated at purchase cost,<br />

adjusted where necessary to the lower of cost and reimbursement value. The securities included in<br />

current assets are stated at the lower of average weighted cost and estimated realisable value,<br />

calculated on the basis of market trends.<br />

7. Receivables are classified as financial fixed assets or as current assets depending upon their nature<br />

and due date. Receivables included as financial fixed assets are stated at nominal value as this<br />

coincides with their estimated realisable value. The receivables included in current assets are shown<br />

net of specific provisions for bad debts considered necessary to bring these receivables into line with<br />

their estimated realisable value.<br />

8. Accruals and prepayments are recorded in order to match costs and revenues in the accounting<br />

period to which they relate. Accrued income and liabilities relate to income and expenses relative to the<br />

period, which manifest themselves in subsequent periods. Deferred income and prepaid expenses<br />

relate to income and expenses incurred during the period but which are relative to future periods.<br />

9. In order to hedge against exchange risks the Company stipulates forward exchange contracts<br />

relative to certain purchase/sale operations. The effects of the variation in exchange rates on the<br />

currencies covered by these forward contracts are recorded at the moment in which the relative costs<br />

and revenues are recorded. The gains and losses realised on these contracts are recorded in the<br />

income statement at the moment in which the relative payment/receipt is realised or when they are<br />

considered unrealisable and the relative receivable and payable is registered.<br />

10. Liquid funds are stated at numerical value.<br />

11.Provisions for risks and charges cover contingencies in relation to known or likely losses, the extent<br />

and timing of which cannot be precisely determined at the period-end. They comprise the following:<br />

provision for pensions, leaving indemnities and similar resolved by the shareholders’ meeting as<br />

recognition of an indemnity to long serving members of the Board of Directors in the event of their<br />

retirement. The criteria adopted for the recording of such provision is in line with the nominal value<br />

resolved by the shareholders;<br />

provision for taxes includes both the reserve accrued to cover the estimated future tax liability relative<br />

to tax disputes and tax assessments not yet finalised and the provision for deferred taxation;<br />

other provisions comprise the following:<br />

19

- provision for risk of disputes and penalties to cover the losses expected upon the unfavourable<br />