You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

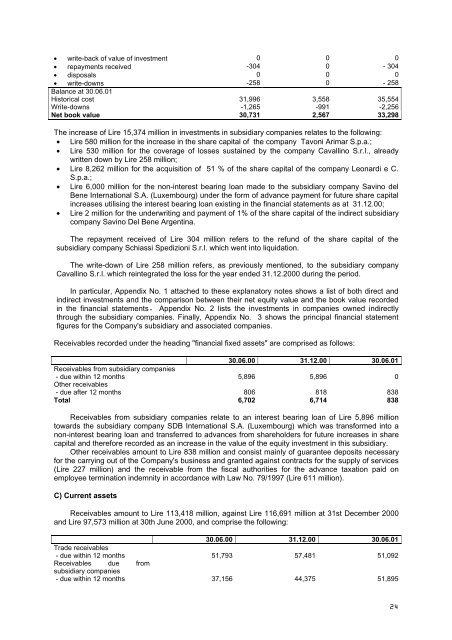

• write-back of value of investment 0 0 0<br />

• repayments received -304 0 - 304<br />

• disposals 0 0 0<br />

• write-downs -258 0 - 258<br />

Balance at 30.06.01<br />

Historical cost 31,996 3,558 35,554<br />

Write-downs -1,265 -991 -2,256<br />

Net book value 30,731 2,567 33,298<br />

The increase of Lire 15,374 million in investments in subsidiary companies relates to the following:<br />

• Lire 580 million for the increase in the share capital of the company Tavoni Arimar S.p.a.;<br />

• Lire 530 million for the coverage of losses sustained by the company Cavallino S.r.l., already<br />

written down by Lire 258 million;<br />

• Lire 8,262 million for the acquisition of 51 % of the share capital of the company Leonardi e C.<br />

S.p.a.;<br />

• Lire 6,000 million for the non-interest bearing loan made to the subsidiary company Savino del<br />

Bene International S.A. (Luxembourg) under the form of advance payment for future share capital<br />

increases utilising the interest bearing loan existing in the financial statements as at 31.12.00;<br />

• Lire 2 million for the underwriting and payment of 1% of the share capital of the indirect subsidiary<br />

company Savino Del Bene Argentina.<br />

The repayment received of Lire 304 million refers to the refund of the share capital of the<br />

subsidiary company Schiassi Spedizioni S.r.l. which went into liquidation.<br />

The write-down of Lire 258 million refers, as previously mentioned, to the subsidiary company<br />

Cavallino S.r.l. which reintegrated the loss for the year ended 31.12.2000 during the period.<br />

In particular, Appendix No. 1 attached to these explanatory notes shows a list of both direct and<br />

indirect investments and the comparison between their net equity value and the book value recorded<br />

in the financial statements. Appendix No. 2 lists the investments in companies owned indirectly<br />

through the subsidiary companies. Finally, Appendix No. 3 shows the principal financial statement<br />

figures for the Company's subsidiary and associated companies.<br />

Receivables recorded under the heading "financial fixed assets" are comprised as follows:<br />

30.06.00 31.12.00 30.06.01<br />

Receivables from subsidiary companies<br />

- due within 12 months<br />

Other receivables<br />

5,896 5,896 0<br />

- due after 12 months 806 818 838<br />

Total 6,702 6,714 838<br />

Receivables from subsidiary companies relate to an interest bearing loan of Lire 5,896 million<br />

towards the subsidiary company SDB International S.A. (Luxembourg) which was transformed into a<br />

non-interest bearing loan and transferred to advances from shareholders for future increases in share<br />

capital and therefore recorded as an increase in the value of the equity investment in this subsidiary.<br />

Other receivables amount to Lire 838 million and consist mainly of guarantee deposits necessary<br />

for the carrying out of the Company's business and granted against contracts for the supply of services<br />

(Lire 227 million) and the receivable from the fiscal authorities for the advance taxation paid on<br />

employee termination indemnity in accordance with Law No. 79/1997 (Lire 611 million).<br />

C) Current assets<br />

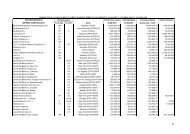

Receivables amount to Lire 113,418 million, against Lire 116,691 million at 31st December 2000<br />

and Lire 97,573 million at 30th June 2000, and comprise the following:<br />

30.06.00 31.12.00 30.06.01<br />

Trade receivables<br />

- due within 12 months 51,793 57,481 51,092<br />

Receivables due from<br />

subsidiary companies<br />

- due within 12 months 37,156 44,375 51,895<br />

24