You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The provision for leaving indemnities, pension funds and similar represents the provision accrued in order to<br />

pay an indemnity to the Company’s long-term directors at the end of their collaboration. This provision<br />

shows an increase during the period of Lire 99 million representing the indemnity matured during the<br />

period.<br />

The provision for taxation is comprised of a provision of Lire 250 million in order to cover the risks<br />

relative to a fiscal assessment in course.<br />

Other provisions are comprised of:<br />

• Provision for the coverage of subsidiary company losses for Lire 30 million; this provision shows a<br />

decrease of Lire 258 million during the period relative to the utilisation of the provision for the<br />

coverage of the losses for the year ended 31.12.00 sustained by the subsidiary company<br />

Cavallino S.r.l.; the residual balance of the provision as at 30.6.01 of Lire 30 million relates to the<br />

subsidiary company Hani Transport Co. Ltd.;<br />

• provision for litigation, penalties and disputes for Lire 700 million; this provision shows a decrease of<br />

Lire 27 million during the period due to utilisation and an increase of Lire 127 million due to<br />

additional provision accrued.<br />

Employee termination indemnity<br />

This amounts to Lire 9,968 million, against Lire 9,323 million at 31st December 2000 and Lire 8,772<br />

million at 30th June 2000. The following movements took place during the period:<br />

Balance at 31.12.00 9,323<br />

Increases for : 0<br />

- indemnity matured during the period 709<br />

- indemnity on employees transferred from Group companies 0<br />

- revaluation in accordance with Law No. 297/82 173<br />

Decreases for: 0<br />

- indemnity paid to employees leaving the Company -177<br />

- advance payments in accordance with Law No. 297/82 -60<br />

Balance at 30.06.01 9,968<br />

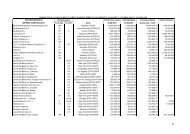

Payables<br />

These amount to Lire 93,014 million, against Lire 101,257 million at 31st December 2000 and Lire<br />

79,140 million at 30th June 2000, and comprise the following:<br />

30.06.00 31.12.00 30.06.01<br />

Payables towards banks<br />

- due within 12 months<br />

Advances from customers<br />

10,534 15,094 13,808<br />

- due within 12 months<br />

Trade payables<br />

606 484 509<br />

- due within 12 months<br />

Payables towards subsidiary<br />

companies<br />

43,708 50,331 42,598<br />

- due within 12 months<br />

Payables towards associated<br />

companies<br />

11,181 11,592 10,820<br />

- due within 12 months 47 49 78<br />

Payables<br />

authorities<br />

towards fiscal<br />

- due within 12 months 5,183 17,295 9,846<br />

Payables towards social<br />

welfare institutions<br />

- due within 12 months<br />

Other payables<br />

2,092 1,963 2,333<br />

- due within 12 months 5,764 4,424 8,331<br />

- due after 12 months 25 25 4,691<br />

Total 79,140 101,257 93,014<br />

29