Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

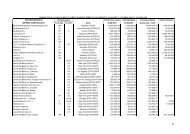

The parent company's income statement includes the following costs and revenues relative to<br />

subsidiary and associated companies:<br />

30.06.00 31.12.00 30.06.01<br />

(+) Revenues and income:<br />

Revenues from services, mainly shipping<br />

services 83,084 167,297 81,935<br />

Other revenues from rental of real estate 103 206 117<br />

Other revenues from payroll services rendered: 54 85 56<br />

Financial income from dividends and relative tax credits 1,638 3,608 1,538<br />

Financial income from interest on loans 147 609 0<br />

Income from writeback of book value of equity investments 0 241 0<br />

Extraordinary gains realised on the sale of equity investments<br />

(-) Costs and charges:<br />

Costs for services received, mainly related to<br />

0 1,939 0<br />

shipping activities 28,202 52,717 27,055<br />

Costs for rental of real estate: 423 840 429<br />

Exchange losses 0 1,830 0<br />

Provision for coverage of losses 0 288 0<br />

Write-down of equity investments 0 524 0<br />

Significant events subsequent to 30th June 2001<br />

Subsequent to 30th June 2001 the Company opened a new office in Genoa, which became<br />

operative as from the beginning of August 2001 and which is expected to lead to a further expansion of<br />

traffic from North Italy towards Asia in general.<br />

In accordance with a previous agreement, the company acquired a further share of 2% in the<br />

company Leonardi and Co. S.p.A.<br />

Finally, a preliminary agreement has been signed for the acquisition of a building, for office use,<br />

close to the Company's head offices in Scandicci (Florence) for a cost of Lire 515 million; the additional<br />

space shall permit a more rational distribution of operations.<br />

No other events have taken place after the period end which could have a significant effect on the<br />

Company's equity, financial and economic situation.<br />

Forecast for the remainder of the current year<br />

The following figures are forecast for the year 2001 as a whole:<br />

31.12.00 30.06.01 31.12.01<br />

Value of production 387,642 179,466 385,000<br />

Gross operating margin 29,689 9,062 22,000<br />

Net operating result 24,627 6,613 17,000<br />

The net financial position has changed from a net liquidity of Lire 12,189 million at 31st December<br />

2000 to Lire 2,882 million as a result of the significant equity investments acquired during the period.<br />

Given that no significant investments are expected to take place during the second half of the year<br />

2001 we expect to be able to maintain, and indeed improve, the result achieved during the first six<br />

months of the year.<br />

ACCOUNTING PRINCIPLES AND VALUATION CRITERIA<br />

The accounting principles adopted in the preparation of these interim financial statements are<br />

consistent with those adopted in the previous annual financial statements. The more significant<br />

accounting principles are disclosed below:<br />

17