You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

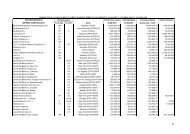

Other receivables amount to Lire 9,956 million, against Lire 14,534 million at 31st December 2000<br />

and Lire 8,409 million at 30th June 2000.<br />

The current portion due within 12 months amounts to Lire 7,093 million and is comprised of the<br />

following:<br />

• Lire 4,984 million - fiscal authorities for advance payment of taxes, tax withheld at source and tax<br />

credits;<br />

• Lire 267 million - VAT authorities;<br />

• Lire 796 million - advances to suppliers;<br />

• Lire 589 million - due from the company Ventura S.p.A. for the sale of the investments in the<br />

companies Da Verrazzano S.r.l. and Vespucci S.r.l.;<br />

• Lire 393 million - advance taxation;<br />

• Lire 64 million - INAIL.<br />

The non-current portion amounts to Lire 2,863 million and is comprised of the following:<br />

• Lire 1,817 million - due from an insurance company relative to insurance policies for directors<br />

leaving indemnity;<br />

• Lire 724 million - advances to employees;<br />

• Lire 205 million - advance taxation;<br />

• Lire 117 million - mainly comprised of sundry receivables from the fiscal authorities for direct and<br />

indirect tax refunds.<br />

Financial assets amount to Lire 3,987 million, against Lire 4,374 million at 31st December 2000<br />

and Lire 3,781 million at 30th June 2000. They comprise the following :<br />

30.6.00 31.12.00 30.06.01<br />

Own shares 963 1,497 1,079<br />

Other securities 2,818 2,877 2,908<br />

Total 3,781 4,374 3,987<br />

During the period No. 80,730 own shares were purchased and No. 187,875 own shares were sold,<br />

giving rise to a net loss on trading of Lire 352 million (a loss of Lire 357 million and a gain of Lire 5<br />

million), deriving principally from the sale of own shares (No. 184,875) to managers of the Group as<br />

part of the “stock option” programme resolved by the shareholders. At 30th June 2001 the Company<br />

held No. 222,915 own shares, for a total nominal value of € 115,915.8, equivalent to Lire 224,444,286.<br />

The average cost per share purchased amounts to approx. Lire 4,840 equivalent to € 2.4998.<br />

Other securities amount to Lire 2,908 million, against Lire 2,877 million at 31st December 2000<br />

and Lire 2,818 million at 30th June 2000 and represent an investment portfolio administered externally<br />

by a stock-brokerage company.<br />

Liquid funds amount to Lire 12,703 million against Lire 22,909 million at 31st December 2000 and<br />

Lire 18,416 million at 30th June 2000 and comprise the following:<br />

30.06.00 31.12.00 30.06.01<br />

Bank and post office deposit accounts 17,260 21,947 10,684<br />

Cheques 1,064 879 1,899<br />

Cash on hand 92 83 120<br />

Total 18,416 22,909 12,703<br />

D) Accrued income and prepaid expenses<br />

These comprise the following:<br />

30.06.00 31.12.00 30.06.01<br />

Accrued income 254 0 0<br />

Prepaid expenses 256 145 250<br />

Total 510 145 250<br />

Prepaid expenses refer to that part of costs incurred during the period but relative to subsequent<br />

periods for insurance (Lire 158 million), advance shipping charges (Lire 44 million), and contract<br />

maintenance and assistance (Lire 10 million) and other costs (Lire 38 million).<br />

27