Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

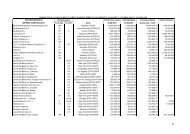

• Additions 145 214 1,349 227 1,935<br />

• Disposals:<br />

• Historical cost<br />

• Accumulated depreciation<br />

0<br />

0<br />

• Depreciation charge -792 -109 -709 0 -1,610<br />

Balance at 30.06.01<br />

Historical cost 10,489 2,023 11,412 227 24,151<br />

Revaluation 41,973 0 0 0 41,973<br />

Accumulated depreciation -9,742 -1,359 -6,840 0 -17,941<br />

Revaluation of accum. depreciation -21,059 0 0 0 -21,059<br />

Net book value 21,661 664 4,572 227 27,124<br />

The more significant additions during the period were:<br />

• land and buildings: work for a value of Lire 124 million carried out on the buildings in Via delle<br />

Nazioni Unite, Scandicci (Lire 1 million) and in No. 65, Via delle Cateratte, Livorno (Lire 123<br />

million) and additions to light construction for Lire 21 million;<br />

• purchases of equipment for Lire 214 million;<br />

• other assets: purchases of electronic machinery for Lire 756 million, trucks for Lire 356 million,<br />

plant, furniture and equipment for Lire 222 million and motor vehicles for Lire 15 million. The<br />

disposals during the period regarded trucks for Lire 159 million, electrical and electronic machinery<br />

for Lire 32 million and plant, furniture and equipment for Lire 7 million.<br />

Lastly, advance payments of Lire 227 million were made for the acquisition of the ground lease<br />

(Lire 182 million) on council land in Genoa for office use up until 31.12.2051 and for restructuring work<br />

on the Livorno building (Lire 40 million) and for the purchase of equipment (Lire 5 million).<br />

The only assets included in the financial statements which have been subject to revaluation are<br />

land and buildings. The table below shows the gross book value:<br />

Commercial buildings Agricultural<br />

land<br />

Light construction Total<br />

Historical cost of land and<br />

buildings not revalued<br />

124 0 274 398<br />

Historical cost of revalued<br />

assets<br />

9,989 102 0 10,091<br />

Revaluation of historical cost: 0 0 0 0<br />

- Merger losses 5,676 0 0 5,676<br />

- Law No. 576/1975 24 0 0 24<br />

- Law No. 413/1991 1,050 25 0 1,075<br />

- Law No. 342/2000 35,198 0 0 35,198<br />

Total gross book value 52,061 127 274 52,462<br />

Financial fixed assets, comprised of equity investments, receivables and other securities, amount<br />

to Lire 34,136 million against Lire 25,200 million at 31st December 2000 and Lire 25,498 million at 30th<br />

June 2000.<br />

Investments in subsidiary and associated companies amount to Lire 33,298 million against Lire<br />

18,486 million at 31st December 2000 and Lire 18,796 million at 30th June 2000 and show the<br />

following movements during the period:<br />

-42<br />

42<br />

Subsidiary<br />

companies<br />

-198<br />

186<br />

Associated<br />

companies<br />

Balance at 31.12.00<br />

Historical cost 16,926 3,558 20,484<br />

Write-downs -1,007 -991 -1,998<br />

Net book value 15,919 2,567 18,486<br />

Movements during the first six months<br />

of the year 2001<br />

• additions 15,374 0 15,374<br />

0<br />

0<br />

-240<br />

228<br />

Total<br />

23