Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

quality of service to its customers to and from all of the areas covered by the Group. The presence of<br />

Group companies on foreign markets also serves to gather custom for traffic towards Italy.<br />

Furthermore, the direct traffic between the various foreign companies of the Group is becoming<br />

increasingly important. The most active Italian offices in this sector, in addition obviously to the head<br />

office, are those of Pisa and Segrate. This latter registered the more significant growth, both in<br />

percentage and absolute terms. The principal point of despatch for imports remains North America.<br />

The Company intends to expand this sector even further, particularly if the euro/dollar exchange<br />

rate should lead to a growth in American exports.<br />

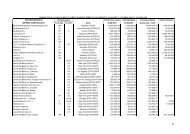

The number of import shipments per branch is shown in the table below:<br />

30.06.00 % 31.12.00 % 30.06.01<br />

Differenc<br />

e<br />

% 6.01 -6.00<br />

%Difference<br />

6.01-6.00<br />

Florence 526 21.94% 1,467 27.21% 712 25.71% 186 35.36%<br />

Livorno 0 0.00% 58 1.08% 35 1.26% 35 =<br />

Segrate (Milan) 286 11.93% 690 12.80% 651 23.51% 365 127.62%<br />

Montecosaro (Mc) 202 8.43% 464 8.61% 239 8.63% 37 18.32%<br />

Naples 149 6.22% 71 1.32% 69 2.49% -80 -53.69%<br />

Pisa 624 26.03% 975 18.09% 543 19.61% -81 -12.98%<br />

Santacroce sull'Arno<br />

(Pisa) 243 10.14% 487 9.03% 212 7.66% -31 -12.76%<br />

Treviso 0 0.00% 485 9.00% 0 0.00% 0 =<br />

Verona 18 0.75% 47 0.87% 28 1.01% 10 55.56%<br />

Vicenza 349 14.56% 647 12.00% 280 10.11% -69 -19.77%<br />

Total 2,397 100% 5,391 100% 2,769 100% 372 15.52%<br />

Investments<br />

The Company carried out the following investments during the period:<br />

a) intangible fixed assets: costs (Lire 5 million) for changes to the Company's Statute relative to the<br />

increase in share capital from Euro 18,917,600 to Euro 19,000,800 resolved by the Board of<br />

Directors on 30th March 2001 and carried out by means of the utilisation of the reserve for<br />

employee profit sharing. Other investments in intangible fixed assets regarded the implementation<br />

of existing programmes and the acquisition for licenses for the use of software for Lire 7 million<br />

and the cost of improvements to leased assets for Lire 155 million. In addition, advance payments<br />

were made to suppliers for Lire 34 million improvements to leased buildings.<br />

b) tangible fixed assets: the principal investments regarded improvements to the Company's<br />

buildings for Lire124 million, purchases of equipment for Lire 215 million and of other assets for<br />

Lire 1,348 million including mainly purchases of electronic machinery (Lire 755 million) and motor<br />

vehicles (Lire 356 million). Lastly, advance payments were made to suppliers for Lire 227 million<br />

relative to a ground lease for a period of 30 years on a building situated in the dockland district of<br />

Genoa (Lire 182 million) and for other improvements to the Company's buildings (Lire 40 million)<br />

and for purchases of equipment (Lire 5 million).<br />

c) financial fixed assets: the acquisition of an equity investment of 51% of the share capital of the<br />

company Leonardi e C. S.p.A for Lire 8,262 million; the underwriting and payment of the increase<br />

in the share capital of the company Tavoni Arimar S.p.A. for Lire 580 million; the payment of Lire<br />

530 million to reintegrate the losses sustained by the company Cavallino S.r.l.; the non-interest<br />

bearing advance payment of Lire 6,000 million for future increases in share capital of the company<br />

Savino Del Bene Internationale S.A. utilising an interest bearing loan already existing in the<br />

financial statements as at 31.12.00.<br />

Equity and financial situation<br />

The reclassified balance sheet as at 30th June 2001 shows the following situation:<br />

9