Exchange-Rate Exposure and the Financial Sector - Journal of ...

Exchange-Rate Exposure and the Financial Sector - Journal of ...

Exchange-Rate Exposure and the Financial Sector - Journal of ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

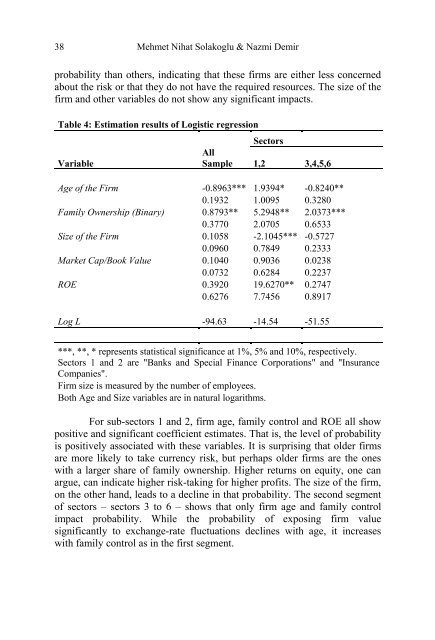

38Mehmet Nihat Solakoglu & Nazmi Demirprobability than o<strong>the</strong>rs, indicating that <strong>the</strong>se firms are ei<strong>the</strong>r less concernedabout <strong>the</strong> risk or that <strong>the</strong>y do not have <strong>the</strong> required resources. The size <strong>of</strong> <strong>the</strong>firm <strong>and</strong> o<strong>the</strong>r variables do not show any significant impacts.Table 4: Estimation results <strong>of</strong> Logistic regressionVariable<strong>Sector</strong>sAllSample 1,2 3,4,5,6Age <strong>of</strong> <strong>the</strong> Firm -0.8963*** 1.9394* -0.8240**0.1932 1.0095 0.3280Family Ownership (Binary) 0.8793** 5.2948** 2.0373***0.3770 2.0705 0.6533Size <strong>of</strong> <strong>the</strong> Firm 0.1058 -2.1045*** -0.57270.0960 0.7849 0.2333Market Cap/Book Value 0.1040 0.9036 0.02380.0732 0.6284 0.2237ROE 0.3920 19.6270** 0.27470.6276 7.7456 0.8917Log L -94.63 -14.54 -51.55***, **, * represents statistical significance at 1%, 5% <strong>and</strong> 10%, respectively.<strong>Sector</strong>s 1 <strong>and</strong> 2 are "Banks <strong>and</strong> Special Finance Corporations" <strong>and</strong> "InsuranceCompanies".Firm size is measured by <strong>the</strong> number <strong>of</strong> employees.Both Age <strong>and</strong> Size variables are in natural logarithms.For sub-sectors 1 <strong>and</strong> 2, firm age, family control <strong>and</strong> ROE all showpositive <strong>and</strong> significant coefficient estimates. That is, <strong>the</strong> level <strong>of</strong> probabilityis positively associated with <strong>the</strong>se variables. It is surprising that older firmsare more likely to take currency risk, but perhaps older firms are <strong>the</strong> oneswith a larger share <strong>of</strong> family ownership. Higher returns on equity, one canargue, can indicate higher risk-taking for higher pr<strong>of</strong>its. The size <strong>of</strong> <strong>the</strong> firm,on <strong>the</strong> o<strong>the</strong>r h<strong>and</strong>, leads to a decline in that probability. The second segment<strong>of</strong> sectors – sectors 3 to 6 – shows that only firm age <strong>and</strong> family controlimpact probability. While <strong>the</strong> probability <strong>of</strong> exposing firm valuesignificantly to exchange-rate fluctuations declines with age, it increaseswith family control as in <strong>the</strong> first segment.