V1 2013-2014 Verification Worksheet - Standard - Westminster ...

V1 2013-2014 Verification Worksheet - Standard - Westminster ...

V1 2013-2014 Verification Worksheet - Standard - Westminster ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

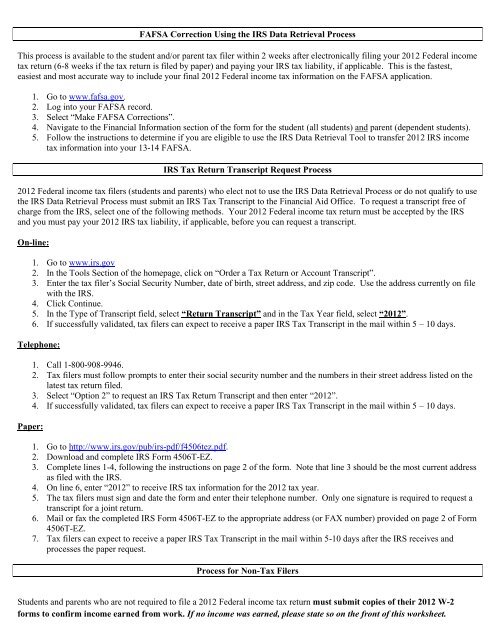

FAFSA Correction Using the IRS Data Retrieval ProcessThis process is available to the student and/or parent tax filer within 2 weeks after electronically filing your 2012 Federal incometax return (6-8 weeks if the tax return is filed by paper) and paying your IRS tax liability, if applicable. This is the fastest,easiest and most accurate way to include your final 2012 Federal income tax information on the FAFSA application.1. Go to www.fafsa.gov.2. Log into your FAFSA record.3. Select “Make FAFSA Corrections”.4. Navigate to the Financial Information section of the form for the student (all students) and parent (dependent students).5. Follow the instructions to determine if you are eligible to use the IRS Data Retrieval Tool to transfer 2012 IRS incometax information into your 13-14 FAFSA.IRS Tax Return Transcript Request Process2012 Federal income tax filers (students and parents) who elect not to use the IRS Data Retrieval Process or do not qualify to usethe IRS Data Retrieval Process must submit an IRS Tax Transcript to the Financial Aid Office. To request a transcript free ofcharge from the IRS, select one of the following methods. Your 2012 Federal income tax return must be accepted by the IRSand you must pay your 2012 IRS tax liability, if applicable, before you can request a transcript.On-line:1. Go to www.irs.gov2. In the Tools Section of the homepage, click on “Order a Tax Return or Account Transcript”.3. Enter the tax filer’s Social Security Number, date of birth, street address, and zip code. Use the address currently on filewith the IRS.4. Click Continue.5. In the Type of Transcript field, select “Return Transcript” and in the Tax Year field, select “2012”.6. If successfully validated, tax filers can expect to receive a paper IRS Tax Transcript in the mail within 5 – 10 days.Telephone:Paper:1. Call 1-800-908-9946.2. Tax filers must follow prompts to enter their social security number and the numbers in their street address listed on thelatest tax return filed.3. Select “Option 2” to request an IRS Tax Return Transcript and then enter “2012”.4. If successfully validated, tax filers can expect to receive a paper IRS Tax Transcript in the mail within 5 – 10 days.1. Go to http://www.irs.gov/pub/irs-pdf/f4506tez.pdf.2. Download and complete IRS Form 4506T-EZ.3. Complete lines 1-4, following the instructions on page 2 of the form. Note that line 3 should be the most current addressas filed with the IRS.4. On line 6, enter “2012” to receive IRS tax information for the 2012 tax year.5. The tax filers must sign and date the form and enter their telephone number. Only one signature is required to request atranscript for a joint return.6. Mail or fax the completed IRS Form 4506T-EZ to the appropriate address (or FAX number) provided on page 2 of Form4506T-EZ.7. Tax filers can expect to receive a paper IRS Tax Transcript in the mail within 5-10 days after the IRS receives andprocesses the paper request.Process for Non-Tax FilersStudents and parents who are not required to file a 2012 Federal income tax return must submit copies of their 2012 W-2forms to confirm income earned from work. If no income was earned, please state so on the front of this worksheet.