V1 2013-2014 Verification Worksheet - Standard - Westminster ...

V1 2013-2014 Verification Worksheet - Standard - Westminster ...

V1 2013-2014 Verification Worksheet - Standard - Westminster ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

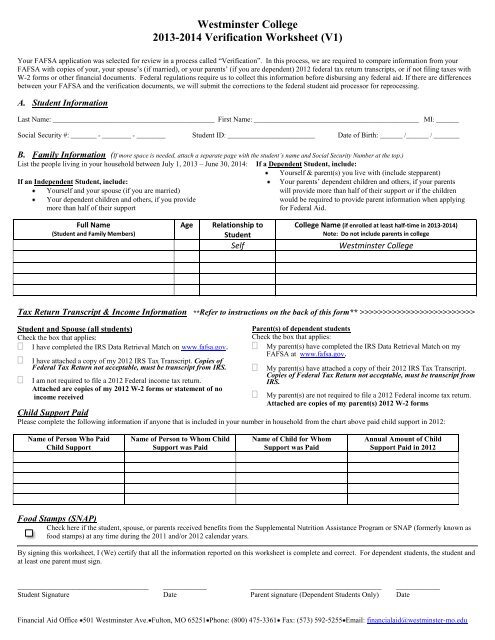

<strong>Westminster</strong> College<strong>2013</strong>-<strong>2014</strong> <strong>Verification</strong> <strong>Worksheet</strong> (<strong>V1</strong>)Your FAFSA application was selected for review in a process called “<strong>Verification</strong>”. In this process, we are required to compare information from yourFAFSA with copies of your, your spouse’s (if married), or your parents’ (if you are dependent) 2012 federal tax return transcripts, or if not filing taxes withW-2 forms or other financial documents. Federal regulations require us to collect this information before disbursing any federal aid. If there are differencesbetween your FAFSA and the verification documents, we will submit the corrections to the federal student aid processor for reprocessing.A. Student InformationLast Name: __________________________________________________ First Name: ___________________________________________________ MI: _______Social Security #: ________ - _________ - _________ Student ID: ___________________________ Date of Birth: _______ /_______ / ________B. Family Information (If more space is needed, attach a separate page with the student’s name and Social Security Number at the top.)List the people living in your household between July 1, <strong>2013</strong> – June 30, <strong>2014</strong>:If an Independent Student, include:Yourself and your spouse (if you are married)Your dependent children and others, if you providemore than half of their supportIf a Dependent Student, include:Yourself & parent(s) you live with (include stepparent)Your parents’ dependent children and others, if your parentswill provide more than half of their support or if the childrenwould be required to provide parent information when applyingfor Federal Aid.Full Name(Student and Family Members)AgeRelationship toStudentSelfCollege Name (if enrolled at least half-time in <strong>2013</strong>-<strong>2014</strong>)Note: Do not include parents in college<strong>Westminster</strong> CollegeTax Return Transcript & Income Information **Refer to instructions on the back of this form** >>>>>>>>>>>>>>>>>>>>>>>>>Student and Spouse (all students)Check the box that applies:I have completed the IRS Data Retrieval Match on www.fafsa.gov.I have attached a copy of my 2012 IRS Tax Transcript. Copies ofFederal Tax Return not acceptable, must be transcript from IRS.I am not required to file a 2012 Federal income tax return.Attached are copies of my 2012 W-2 forms or statement of noincome receivedParent(s) of dependent studentsCheck the box that applies:My parent(s) have completed the IRS Data Retrieval Match on myFAFSA at www.fafsa.gov.My parent(s) have attached a copy of their 2012 IRS Tax Transcript.Copies of Federal Tax Return not acceptable, must be transcript fromIRS.My parent(s) are not required to file a 2012 Federal income tax return.Attached are copies of my parent(s) 2012 W-2 formsChild Support PaidPlease complete the following information if anyone that is included in your number in household from the chart above paid child support in 2012:Name of Person Who PaidChild SupportName of Person to Whom ChildSupport was PaidName of Child for WhomSupport was PaidAnnual Amount of ChildSupport Paid in 2012Food Stamps (SNAP)Check here if the student, spouse, or parents received benefits from the Supplemental Nutrition Assistance Program or SNAP (formerly known asfood stamps) at any time during the 2011 and/or 2012 calendar years.By signing this worksheet, I (We) certify that all the information reported on this worksheet is complete and correct. For dependent students, the student andat least one parent must sign.____________________________________ ____________ ____________________________________ ____________Student Signature Date Parent signature (Dependent Students Only) DateFinancial Aid Office 501 <strong>Westminster</strong> Ave. Fulton, MO 65251 Phone: (800) 475-3361 Fax: (573) 592-5255 Email: financialaid@westminster-mo.edu

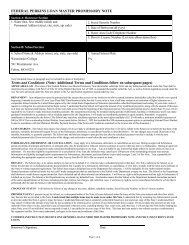

FAFSA Correction Using the IRS Data Retrieval ProcessThis process is available to the student and/or parent tax filer within 2 weeks after electronically filing your 2012 Federal incometax return (6-8 weeks if the tax return is filed by paper) and paying your IRS tax liability, if applicable. This is the fastest,easiest and most accurate way to include your final 2012 Federal income tax information on the FAFSA application.1. Go to www.fafsa.gov.2. Log into your FAFSA record.3. Select “Make FAFSA Corrections”.4. Navigate to the Financial Information section of the form for the student (all students) and parent (dependent students).5. Follow the instructions to determine if you are eligible to use the IRS Data Retrieval Tool to transfer 2012 IRS incometax information into your 13-14 FAFSA.IRS Tax Return Transcript Request Process2012 Federal income tax filers (students and parents) who elect not to use the IRS Data Retrieval Process or do not qualify to usethe IRS Data Retrieval Process must submit an IRS Tax Transcript to the Financial Aid Office. To request a transcript free ofcharge from the IRS, select one of the following methods. Your 2012 Federal income tax return must be accepted by the IRSand you must pay your 2012 IRS tax liability, if applicable, before you can request a transcript.On-line:1. Go to www.irs.gov2. In the Tools Section of the homepage, click on “Order a Tax Return or Account Transcript”.3. Enter the tax filer’s Social Security Number, date of birth, street address, and zip code. Use the address currently on filewith the IRS.4. Click Continue.5. In the Type of Transcript field, select “Return Transcript” and in the Tax Year field, select “2012”.6. If successfully validated, tax filers can expect to receive a paper IRS Tax Transcript in the mail within 5 – 10 days.Telephone:Paper:1. Call 1-800-908-9946.2. Tax filers must follow prompts to enter their social security number and the numbers in their street address listed on thelatest tax return filed.3. Select “Option 2” to request an IRS Tax Return Transcript and then enter “2012”.4. If successfully validated, tax filers can expect to receive a paper IRS Tax Transcript in the mail within 5 – 10 days.1. Go to http://www.irs.gov/pub/irs-pdf/f4506tez.pdf.2. Download and complete IRS Form 4506T-EZ.3. Complete lines 1-4, following the instructions on page 2 of the form. Note that line 3 should be the most current addressas filed with the IRS.4. On line 6, enter “2012” to receive IRS tax information for the 2012 tax year.5. The tax filers must sign and date the form and enter their telephone number. Only one signature is required to request atranscript for a joint return.6. Mail or fax the completed IRS Form 4506T-EZ to the appropriate address (or FAX number) provided on page 2 of Form4506T-EZ.7. Tax filers can expect to receive a paper IRS Tax Transcript in the mail within 5-10 days after the IRS receives andprocesses the paper request.Process for Non-Tax FilersStudents and parents who are not required to file a 2012 Federal income tax return must submit copies of their 2012 W-2forms to confirm income earned from work. If no income was earned, please state so on the front of this worksheet.