WorkSIGHT WINTER 2012 - Workers' Compensation Board

WorkSIGHT WINTER 2012 - Workers' Compensation Board

WorkSIGHT WINTER 2012 - Workers' Compensation Board

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

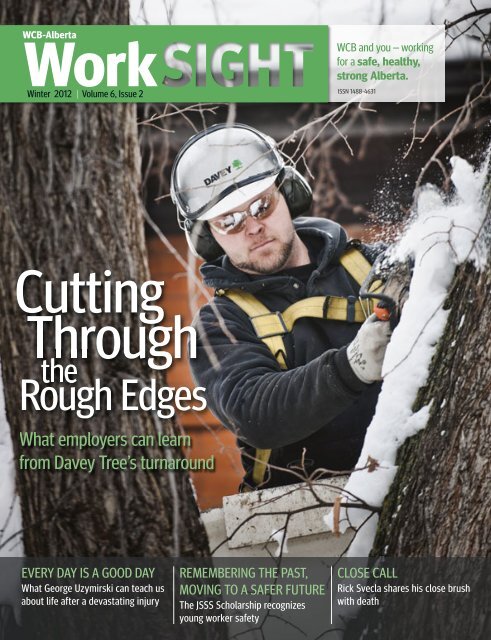

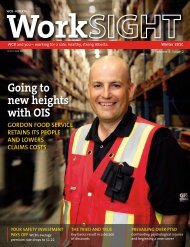

WorkWCB-AlbertaContents<strong>WINTER</strong> <strong>2012</strong>VOLUME 6, ISSUE 2EditorSHAWN FRIEDENBERGERGraphic DesignerDOUG KISILEVICHContributing WritersPAT ARCHERSHAWN FRIEDENBERGERKARLA JOHNSTONDOUGLAS R. MAHContributing PhotographersLAUGHING DOG PHOTOGRAPHYWCB’s <strong>WorkSIGHT</strong> is published twice a year by theWorkers’ <strong>Compensation</strong> <strong>Board</strong> – Alberta and isdistributed to employers, labour organizations,employer and safety associations and injured workergroups. Content may be reproduced if the sourceis credited.To provide a change of address or obtainextra copies of this publication, contact:DINA DASILVA at 780-498-8616,or by email at: dina.dasilva@wcb.ab.ca.For further information and advertisinginquiries contact:SHAWN FRIEDENBERGER, EditorWorkers’ <strong>Compensation</strong> <strong>Board</strong> – AlbertaCorporate CommunicationsPO Box 24159925 - 107 StreetEdmonton, AB T5J 2S5Phone: 780-498-8685Fax: 780-498-7875Email: shawn.friedenberger@wcb.ab.caWebsite: www.wcb.ab.caFEATURES16|PROFILE12|ON THE COVER8|I don’t have time to dieTwenty-eight years ago George Uzymirski suffered aninjury that would have killed most workers. Instead ofhanging his head and giving up, Uzymirski has becomea symbol of courage and strength.Safety practices evolve with industryRick Svecla reflects on his serious injury andreminds all workers that it is their responsibilityto keep themselves and their co-workers safe.Better days aheadAfter a difficult year, Davey Treefound itself in a poor performancesurcharge position. Then managementand employees decided towork together and turn thingsaround—the results were nothingshort of incredible.COVER PHOTO BY LAUGHING DOG PHOTOGRAPHYWCB-Alberta does not warrant that products advertisedmeet any required certification under any law orregulation, nor that any advertiser meets certificationrequirements of any body governing the activity.Publication mail agreement #40062676Return undeliverable Canadian addresses to:Workers’ <strong>Compensation</strong> <strong>Board</strong> – AlbertaCorporate CommunicationsPO Box 24159925 - 107 StreetEdmonton, AB T5J 2S518|The Job Safety Skills Society'sJames Rintoul OH&S Memorial ScholarshipOn May 31, <strong>2012</strong> the JSSS awarded its first everscholarship. The moment was extra special for itsexecutive director, Dr. Michael Alpern.WCB BUSINESS6 | Going down2013 industry rates range from $0.17 to $5.82. Understandthe factors that shape these rates and what you can do tohelp improve your rate next year.20| Paying the right premiumHow to avoid common errors on your annual return.IN EVERY ISSUE4 | Editor’s note4 | Employer briefs22| Legal View23| Seminars and workshopsfor employersCert no. SCS-COC-00867<strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong> | 3

EDITOR’S NOTEEveryone loves a comeback…As a reader, I am fascinated by stories related to comebackattempts. I always find myself cheering for the individual or teamthat somehow overcomes exceedingly long odds to make it back.For me, it’s not the final outcome that’s intriguing, but rather thestep-by-step journey back up the mountain.Why do successful comebacks touch so many people? Perhapsit’s because we can imagine ourselves in the same predicament.Maybe we have seen others go through similar ordeals and notmake it. Those who do achieve magical comebacks inspire us.They make our everyday problems look small, and they energizeus so we can become the best we can be.In this issue of <strong>WorkSIGHT</strong>, you will see and read about the themeof “the comeback” in many of our stories. Davey Tree shares itsstory on how management and employees can work together toimprove safety practices and the bottom line. George Uzymirskigoes back in time to tell us about an accident that cost him all ofhis limbs. Rick Svecla expresses gratitude for still being aliveafter his near miss. Finally, we join the Job Safety Skills Society inremembering a fallen worker by naming a scholarship in hismemory.EMPLOYER BRIEFSIt’s your (re)turnMark February 28 down on your calendar—that’s the last day forsubmitting your annual return to WCB. Each year, employers withworkers are required to fill out an annual return reporting theirworkers’ insurable earnings paid in the previous year, along withthe earnings they expect to pay in the coming year.This information is vital for ensuring that proper premiums areassessed. Filing online is quick and easy, and built-in errorchecking and automated calculations help simplify the process.You can use your preferred web browser—Internet Explorer,Firefox, Chrome or Safari.All you need is your account number and password, both of whichwill be mailed out at the end of December.To request a new password online or view a demo on how to fillout your annual return, go to www.wcb.ab.ca/employers and clickFile your annual return. WI believe you will come away from reading these stories feelinginspired and thankful for all that you have in your lives.WShawn Friedenberger, Editorshawn.friedenberger@wcb.ab.ca<strong>WorkSIGHT</strong> is a magazine foremployers and workers.We’re looking for industry representatives to join themagazine’s editorial board. If you’re interested in learningmore, or participating on the board, please contact theeditor at Shawn.friedenberger@wcb.ab.ca.4 | <strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong>

Changes to your myWCB roles andreports coming April 2013WCB-Alberta is pleased to announce changes to our self-serve onlinereporting. As employers continue to increase their use of electronicreports, we want to ensure that our system is working at its best. Weare making improvements to continue providing information to helpmanage claim costs and monitor industry trends. We want to makeunderstanding workers’ compensation easier for you.Part of this upgrade includes the renaming of reports and changes tothe availability of certain reports based on your myWCB role. Becausewe want you to be prepared, now is the time to review the roles youcurrently have assigned to employees in your organization, makingsure that the right information is received by the right people.To learn more about the report changes and to ensure you have thecorrect role(s) assigned to you, visitwww.wcb.ab.ca/employers/online_learn_mywcb.asp. WExpandyourReachAdvertise in <strong>WorkSIGHT</strong> and find anaudience dedicated to safe, healthyand strong Alberta workplaces.<strong>WorkSIGHT</strong> is a cost-effective advertisingmedium that puts us directly in front of theclients we serve—industrial safety managers.– Ron McNutt, President,KnowledgeWare Communications Corp.Contact the editor atshawn.friedenberger@wcb.ab.cafor more information.WorkWCB-AlbertaAre psychiatric or psychologicalinjuries covered by WCB?The workers’ compensation system provides coverage for any condition that arises duringand out of the course of employment. In the case of psychiatric or psychological conditions,WCB looks for the following when considering work relatedness:1. A confirmed psychological or psychiatric diagnosis as defined in the most currentversion of the Diagnostic and Statistical Manual of Mental Disorders2. The condition diagnosed being a result of one of the following:• Organic brain damage (following a work injury)• An emotional reaction to a work injury• An emotional reaction to a work injury treatment process• Traumatic onset psychological injury or stress at work• Chronic onset psychological injury or stressTo learn more, seePolicy 03 – 01, Part II,Application 6:www.wcb.ab.ca/public/policy/manual/0301p2a6.asp.© ALEXANDRA ROGANOVA | DREAMSTIME.COM<strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong> | 5

WCB BUSINESSGoing downWhat’s driving your rate?What a difference a year makes.In the case of WCB’s average premium rate, a year has made a 10 cent difference for Alberta employers.The 2013 average rate is $1.12 per $100 of insurable earnings, down 10 cents from <strong>2012</strong>.Where do you fit in?Your performance drives your rate. That means fewer claims andlower costs equal lower premium rates.Employers registered with WCB fall into 337 industries.Key expectations reflected in the rateWe’ve developed our planning assumptions to align with theexpectation for stable but moderating economic growth forthe province in 2013. Here’s what we expect to see:82%15%2%of industries will see aDECREASE in their rate thanksto their strong performance.will see an INCREASE.will see NO CHANGE at all. CLAIM DURATIONAverage claim duration is forecast to decrease slightlyto 34.5 days. INSURABLE EARNINGSInsurable earnings are forecast to go up by 5.8 per centto $95 billion compared to <strong>2012</strong> forecast. FULLY FUNDED CLAIM COSTSForecast to increase six per cent from the <strong>2012</strong> forecast.Industry rates range from a low of 17 cents to a high of $5.82.Investments in safety and prevention, modified work and other jointsafety initiatives deliver positive results for all working Albertans.They also have a positive impact on your premium rates. You are thedifference. MAXIMUM INSURABLE EARNINGS (MIE)MIEs are designed to cover the full wages of 90 per centof all workers covered. It will be increasing to $90,200. LOST-TIME CLAIM (LTC) VOLUMEThe volume of LTCs is expected to rise slightly from28,400 to 28,700 for 2013 (1 per cent).6 | <strong>WorkSIGHT</strong> SPRING/SUMMER <strong>WINTER</strong> <strong>2012</strong> <strong>2012</strong>

Lost-time claim and disabling injury rates—LTCs are claims wherethe injured worker misses time from work beyond the day of injury.When LTCs are added to modified work claims (where the workerwas able to remain on the job in an alternate role or schedule),the result is the total number of disabling injuries—the number ofinjuries that are, or could potentially be, lost-time claims.The LTC and disabling injury rates reflect the number of claims per100 workers. Both of these rates are expected to remain stable. Thedisabling injury rate is expected to remain at 2.8 per 100 coveredworkers and the LTC rate at 1.5 per 100 covered workers for 2013.Now what?Collaboration continues to be the key to improved performance,and we’re here to help. Our focus is on collaborating with ourpartners to deliver positive results.We encourage you to take advantage of the resources available.Access programs like Partnerships in Injury Reduction, join anindustry or safety association, learn more about safety, and investin modified work. Check out the WCB for Employers>ManagePerformance and Cost section on our website for more informationon how WCB can help you. WLOST-TIME CLAIM AND DISABLING INJURY RATESStaying steady—A stable disabling injury rate and lost-timeclaim rate are good indicators that employers’ ongoing safetyefforts are paying off.# of industries ➞Disablinginjury rateLost-timeclaim rate1251007550252.8 2.8 2.82.72.81.6 1.51.6 1.5 1.52009 2010 2011 <strong>2012</strong>Forecast2013BudgetDISTRIBUTION OF INDUSTRIES (highest-lowest industry rates)Middle ground—Most industries will be paying a premium rate ofbetween $1.01-$2.00. The average 2013 premium rate is $1.12.0$0.17Lowest 2013Industry Rate$1.12Average 2013Industry RatePremium Rate $5.82➞Highest 2013Industry RateRATE COMPONENTSBreaking it down—Rates components are broken down intosix areas, with fully funded claims costs making up almost 75 percent of the average rate.TRANSFER LEVIESMaking the transfer—Premium rates are set annually tocover the lifetime cost of claims occurring in the year as well asadministrative costs and transfer levies.Fully funded claim costs – 74.5%Administration – 17.4%Occupational Health and Safety – 3.5%Safety associations – 1.9%$ Millions706050403020$48.8$52.9$56.4 $57.5$68.3Reserve requirement – 1.7%10Appeals Commission – 1.0%020092010 2011 <strong>2012</strong>Forecast2013BudgetWH&S Safety Assoc. Appeals Comm. Medical PanelWH&S Safety Assoc. Appeals Comm. Medical Panel<strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong> | 7

8 | <strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong>PHOTOS BY LAUGHING DOG

FEATUREBetter days aheadHow Davey Tree worked as a teamto improve performanceBY SHAWN FRIEDENBERGERHENRY FORD ONCE SAID, “Even a mistake may turn outto be the one thing necessary to a worthwhile achievement.”This observation certainly holds meaning forDavey Tree, a Canadian treecare company that specializes ineverything from tree care to lawn and landscaping service.A year to forgetBy the end of 2010, Davey Tree’shealth and safety record was in desperateneed of a focused health and safetyaction plan. Workers were missing timeas a result of injuries, not enough modifiedwork hours were being utilized andinteraction with out-of-town workers ondisability management practices waspoor, impacting their return-to-workresults.The outcome was predictablypainful. Davey Tree earned a poor performancesurcharge, having reached themaximum surcharge for its size of companyin the experience rating plan. Anexperience rating plan distributes thecost of workers’ compensation coverageamong employers by adjusting theindustry premium rate based on thecompany’s actual accident experience.“I think we all had a feeling that2010 was going to be a very costly year,but when we sat down with Andrea atthe end of 2011, we found out just howcostly it was,” says Chris Staby,Regional Skills Trainer at Davey Tree.Andrea is WCB-Alberta accountmanager Andrea Dodd. “Before I evenmet with the staff at Davey Tree, Ilooked at their experience-rated costsfrom 2008 to 2010. They have twoaccounts with WCB, and one accountin particular was dragging Davey Treedown. I knew this was going to be achallenge, both for myself and theircompany,” explains Dodd.Wake-up callIn November 2011, Dodd set up ameeting with Davey Tree’s managementteam, led by Patrick Perry, DaveyTree’s Regional Safety Manager forCanadian Operations. Dodd was rightto the point.“I didn’t mince words; I told managementthey needed to develop a disabilitymanagement program. I showedthem statistics indicating that one oftheir accounts was trending towards anincreased surcharge,” states Dodd.Based on 2010–2013 performanceforecasts, that performance surchargewould be significant.What was management’sresponse?“Clearly, it was a wake-up call,” saysPerry. “We took our eyes off the ball,and we needed to hear Andrea tell usthat. We were expecting bad news, andwe got it; now it was time to change ourapproach on how we handled healthand safety issues including return towork. The good news that came out ofthe meeting with Andrea was that seniormanagement was ready to show supportand leadership in turning our performancearound.” Something goodcould grow from their experience andnew commitment.Realistic objectivesIn order to improve performance,Davey Tree set achievable goals.Management wanted to be aggressive,so with the help of Dodd, they agreed >><strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong> | 9

Which premiumwould you rather pay?Number of workersInsurable earnings (<strong>2012</strong>)Lost time claims (2008-10)Lost time days (2008-10)Average Lost Time Days per claimExperience ratingPoor performance surchargeIndustry rateEmployer ratePremium PaidEmployer A225$6.25 million4338.2530.92% discount0%$0.96$0.66$41,085Employer B181$5 million1622113.834.33% surcharge88.36%$0.96$2.14$107,023can make thedifference!<strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong> | 11

FEATURE PROFILE“Twenty-eight years later, George Uzymirski”reflects on the accident that almost killed himBY GEORGE UZYMIRSKII don’t havetime to dieMY NAME IS GEORGE UZYMIRSKI. I was born in Wimbledon,England in 1952—yes, the Wimbledon where all the greattennis players come to play each year. At the age of four, myfamily relocated to Montreal and then we eventually settled in Edmonton.On Saturday, August 17, 1984, I wasworking as a sandblaster at the NiskuIndustrial Park. It was a day that wouldchange my life forever.A young foreman and I began moving along steel platform that was used on oilrigs. There were some deep ruts that hadformed in the ground from the rain thathad fallen the night before.As we slowly guided the platform onits side, the foreman caught a power linethat was sticking out of an adjacent building.I lost consciousness as 15,000 voltsof electricity ripped through my body.When I awoke, I was on a hospital bed.I looked down and saw no legs. I turnedmy head from one side to the other andsaw no arms. A team of doctors came inand told me that I suffered third-degreeburns and that there were three exitwounds where the electricity had passed—below my armpit, out my left side andthrough my toes. >>“When I awoke I was on a hospitalbed. I looked down and saw no legs.I turned my head from one side to theother and saw no arms.”12 | <strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong>

In August <strong>2012</strong>, George Uzymirskireturned to WCB to share his story.PHOTOS BY LAUGHING DOG<strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong> | 13

“I don’t have time to die” >> continuedThe good news—the exit woundsmissed all of my vital organs, I hadsuffered no brain damage and my facehad no scarring. Also, I found out mypartner on the job was alive, althoughhe lost his foot below the ankle.I spent almost a year in hospital andhad to learn how to do even the simplestof tasks, such as sitting up. However,rehabilitation went extremely well forme. I had wonderful doctors and nurseswho were very patient, and I was ingreat physical shape prior to my accident.Doctors told me that my recoverytime would be four to five years. I wasup and doing things in a year and a half.“Doctors told me that my recoverytime would be four to five years.I was up and doing things in a yearand a half.”Although it took me a while to getused to wearing prosthetics, I began toexperiment on my own. I would somehowget myself on the floor and try towork myself into a position to get up.I would spend hours every day learninghow to sign my name.They say that time heals all wounds.That was certainly true in my case.My attitude towards life became increasinglymore positive when I was able toget up and move around. I have neverbeen a person who liked to sit still.“They say that time heals all wounds.That was certainly true in my case.My attitude towards life becameincreasingly more positive when I wasable to get up and move around.”“My wife Maria (pictured on left) and step-daughter have been my pillars,” says Uzymirski.Another inspiration came from like myself. That was very healing andwhere I was located in the hospital. rewarding for me. I was able to remindThe spinal cord unit gave me a chance myself that I wasn’t the only one who hadto see what other injured people were these challenges. Eventually, I learnedgoing through. From that vantage about conferences where new productspoint, I considered myself lucky and were being launched, and I began todecided to concentrate fully on my attend them.recovery.In 1986, I began chatting with a ladynamed Marie. She was born in Cuba and“One of the saving graces for me atthat time was the Internet. I wasable to find chat and messageboards to talk with people withphysical challenges like myself.”One of the toughest parts of myhealing was the day I was releasedfrom the hospital. What was I going todo with the rest of my life? How was Igoing to stay busy?One of the saving graces for me atthat time was the Internet. I was able tofind chat and message boards to talkwith people with physical challengesworked as a nurse. She was a very positiveperson, so we hit it off right away. One ofthe advantages of talking with Marie wasthat she had some physically challengedfriends, so I could openly discuss myinjuries with her. In April 2000, we weremarried, and it was the happiest day ofmy life.“At this point, you are probably wonderingwhat my story has to do withWCB-Alberta. My answer is everything.”At this point, you are probably wonderingwhat my story has to do with WCB-Alberta. My answer is everything. I can14 | <strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong>

honestly say that I would not be whereI’m at today without the help ofWCB-Alberta.Since my injury, I have probablydealt with seven or eight adjudicatorsand case managers, and they have allbeen wonderful to me. Whether I wantedto take a course, or needed serviceinformation or even just support, theyhave always been there when I neededthem the most.While visiting Edmonton in August<strong>2012</strong>, I had the opportunity to share mystory with many adjudicators and casemanagers at WCB. It was important tome to look all of them in the eyes andtell them that they are making a differencein people’s lives.For example, WCB-Alberta case managerShirley-Ann Garlinski is alwaysthere for me, even though many years every day and get the most out of life,have passed since my injury. I know that I know that I’m lucky to be alive and Iif I contact Shirley-Ann, she will return have a purpose. I do public speakingmy call or email in one or two hours. and try to inspire those who are physicallychallenged.I get very emotional when speakingabout this, but I thank God every night I have a wonderful family and greatfor the support I have received from support team and do my best to changeWCB-Alberta.the stigma attached to those with physicalchallenges. I take things one day atOne thing that I want to make clearis that I don’t want people to feel sorry a time and always remind myself thatfor me. My life is more fulfilling than it this is my life and I have to make thewas before my accident. Now I enjoy most of it. W“One thing that I want to make clear is that I don’t want people to feel sorryfor me. My life is more fulfilling than it was before my accident. Now I enjoyevery day and get the most out of life, I know that I’m lucky to be alive and Ihave a purpose.”<strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong> | 15

FEATURESafety practicesevolve with industryRick Svecla shares his storyBY: PAT ARCHER, CHAIR, JOINT UTILITY SAFETY TEAMTHE DAY in 1989 whenthen-lineman RickSvecla sustained anelectric shock started out likeany other day on the job. Thecrew he worked with was performingmaintenance on anelectrical system outside a gasplant in northwestern Alberta.Svecla was working on the last polewhen a generator inside the plant wasaccidentally switched on, sending25,000 volts of electricity surgingthrough his body. The breaker tripped,but for Svecla—who was now upsidedown and hanging on for his life—things were about to get worse. The generatorwas turned on a second time.“The electricity got me both ways,”says Svecla. “First it went in one handand out my foot, and then it went inthrough the opposite foot and out myother hand.”Svecla spent six agonizing weeks inthe burn ward, undergoing surgery,physical therapy and treatments beforereturning to his job as a lineman.“The first couple of weeks were veryuncertain,” he says. “We didn’t knowthe extent of the damage, and everytime I went to sleep with all fourappendages bandaged, I wasn’t surewhat I’d wake up to.”Though Svecla still experiencessome nerve, circulation and graft-relatedcomplications since his incidentover 20 years ago, he considers himselflucky not to have suffered more devastatingconsequences—like death or lossof a limb.Svecla stresses that his crew workedin the safest way they knew at the time,but he’s pleased with the changes thathave made these jobs safer.“Nowadays, a lot more preventionand planning goes into making sureincidents like mine don’t happen,”he says.Over the years, Svecla has sharedhis story with his co-workers andevolved into a safety champion withinhis company. He was appointed areasupervisor last July. However, he pointsout that safety is in each individual’shands.“When you’re 30 miles away fromthe training room, on the job site, it’sup to you to keep yourself and yourcrew safe,” he says.“When you’re 30 miles away from the training room, on the job site, it’s up to you to keepyourself and your crew safe.”– Rick Svecla, reflecting on the accident that almost killed him16 | <strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong>

POWER LINE TECHNICIAN SAFETY CHECKLISTThe Joint Utility Safety Team (made up of AltaLink, ATCO Electric, ENMAX, EPCOR, FortisAlberta and theGovernment of Alberta) has come together to increase awareness of Alberta’s high volume of power line incidents.The team’s “Where’s the Line?” campaign has reminded operators, including Power Line Technicians (PLTs), thatlooking out for their own safety is their responsibility.Switching & lockout proceduresPLTs are trained to follow this procedure from day oneof their apprenticeships. The first step requires PLTsto obtain a guarantee of isolation from the operatorauthority of the utility. Once all switching is completeand permission is given, the PLT can proceed to thelockout procedures.Limits of approachPLTs must observe the safe working distance to a powerline, which varies by province. The consequences ofencroaching on the limits of approach could be fatal.Site safe work planningEmployers maintain documents which outline the risks ofspecific job tasks. These should be used as a reference tohelp PLTs plan their work safely.Reporting of incidentsPLTs are required to report all incidents for internal reviewby their employer. Depending on the incident’s severity,the municipal and provincial governments may also viewthe report. These are valuable learning tools that help theindustry avoid future incidents.For more information, visit www.wherestheline.ca. WEquipotential bonding and groundingIt is important for PLTs to follow equipotential bondingand grounding principles in order to protect themselvesfrom electrocution.Potential testingThis procedure determines whether or not there isvoltage at a given point. PLTs use potential testersprior to installing personal protective grounds. If thetest determines that there is voltage, PLTs must notattempt to ground.Fall protectionWhen PLTs are climbing ladders or poles, or working ina man lift, they must use fall protection equipmentappropriate to the work, such as a body harness.Personal protective equipmentTo protect from electric shock, PLTs should wear rubbergloves and sleeves rated to the voltage they areworking on.<strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong> | 17

FEATUREThe Job Safety Skills Society's JamesRintoul OH&S Memorial ScholarshipRemembering the past, lookingto protect the futureBY SHAWN FRIEDENBERGERPHOTO BY LAUGHING DOGDr. Michael Alpern (left)with JSSS scholarship winnerDavid CunninghamTHE HEALTH AND SAFETY of young workers is a passion ofDr. Michael Alpern, the executive director of the Job SafetySkills Society (JSSS). “In 1991, when we were forming thesociety, I remember people asking if safety courses were availableto junior and senior high school students,” recalls Alpern.Twenty-one years later, the answeris, “Of course!” The JSSS has developedsafety courses that junior and seniorhigh school students across Albertacan take for credit as part of AlbertaEducation’s Career and TechnologyStudies program. Teachers have accessto a provincially approved curriculum,in-service training and online learningmodules. Teachers and students canwatch a wide variety of safety videosavailable through Learn Alberta.“The fact is, young people tend to getinjured more frequently, and they need18 | <strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong>

the best safety education possible.In order to do this you have to developpartnerships with business, industry,education, schools and, of course, thestudents,” says Alpern.“The fact is, young peopletend to get injured morefrequently, and they need thebest safety educationpossible.”Clearly, schools throughout theprovince have bought into the safetymessage. In <strong>2012</strong>, more than 30,000students are enrolled in safety coursesinvolving 802 schools across theprovince. Students achieving at least70 per cent in one or more of threecourses receive JSSS credentials. Inaddition to heightening awareness ofthe importance of safety, this recognitionboosts their potential to be hired.The James Rintoul OHS MemorialScholarship“Throughout our 21 years, I havealways been proud of the work we havedone: our curriculum development, theJobSafe programs and our ability toattract partners. I can say that a veryemotionally charged moment was theday we established a scholarship inJames’s memory,” states Alpern.The person Dr. Alpern speaks of isJames Rintoul, a young trucker fromCalgary. On August 8, 2008, one monthbefore his 21st birthday, Rintoul wasrun over and killed by a transport trailerin the yard of the trucking company hewas working for. The trucking companyand a co-worker were fined after pleadingguilty to charges under the provincialOccupational Health and Safety Act(the Act).In 2006, Alberta courts begandirecting fines to specific safetyprograms after the Ministry ofEmployment and Immigrationamended the Act to allow paymentsto third parties that promote healthand safety. Dr. Alpern and the JSSSwere quick to act.“We had the opportunity to make aproposal through creative sentencingto develop a scholarship for James.The scholarship was something wehad considered for a long time, so itwas natural that we applied for theopportunity to be considered. Wewanted to have something so James’smemory lived on while providingadditional funds to safety educationfor young adults before they begintheir careers,” says Alpern.On May 31, <strong>2012</strong>, DavidCunningham was announced as theinaugural winner of the James RintoulOHS Memorial Scholarship. David’sapplication met all the required criteriain terms of high school graduation,work experience, and interest in andcommitment to pursuing a careerin OHS.“By getting to know James’s family,I had the opportunity to learn aboutwhat a great person he was. It wasgreat to receive the scholarship, but itwas equally valuable to me to accept itfrom the Rintoul family,” saysCunningham.For Dr. Alpern, it meant much morethan a presentation. He remembersvisiting with the Rintouls and requestingtheir permission to name thescholarship after their late son. “I amglad that the JSSS could provide thefamily with a living memorial ofJames’s life that will continue to shedlight on the need for young workersafety,” concludes Dr. Alpern.So are we. Congratulations, David. WWORK SMART.WORK SAFEWITHHEADS UP.Stay informed aboutyoung worker safetyDo you have young workers at yourworkplace? Well, when it comes tosafety, the odds are not in their favour.That’s where Heads Up comes in.Heads Up is a safety campaign that wantsto tell young workers that, when it comesto their safety, they need to trust their gutand work safe.Want to join the conversation?You can find our blog online atheadsupab.com, or check us out onFacebook (facebook.com/headsupab)and Twitter (@headsupab). You canalso help raise awareness at yourworkplace with some of our promoitems. You find those online atwcb.ab.ca/employers/heads_up_young.asp.<strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong> | 19

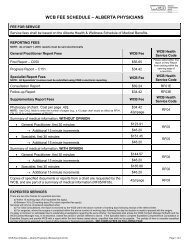

WCB BUSINESSPaying theright premiumHere’s how to avoid commonerrors on your annual returnBY KARLA JOHNSTONFILLING OUT YOUR WCB ANNUAL RETURN is an important part of doing business in Alberta. You must completeyour return accurately to make sure you are paying the right premium. Throughout the year, WCB’s premiumauditors review the submissions from employers to determine whether the right premiums are being paid.If not, corrections and adjustments to premiums are made (both refunds and assessments).Through these routine premium audits, WCB auditors have identified the five most common errors reported byemployers on their annual returns. Here are some tips to help you with the process so you can avoid makingthese common mistakes.1. Incorrect deductions for directors or shareholders.Under the Workers’ <strong>Compensation</strong> Act, directors of legalentities such as corporations and associations are not“workers” unless they have optional Personal Coverage.This means that if you’re a registered director of yourcorporation, your earnings need to be deducted in thedeductions area of the annual return form if you have alsoincluded them in your gross earnings. Do not include thepersonal coverage amount in either category—that ishandled separately.Employment earnings paid to shareholders and familymembers’ wages must also be included when reporting yourworkers’ insurable earnings. There are no exemptions forshareholders or family members, unless they are registereddirectors. If no wages are paid, but the shareholders or familymembers work in the business, a value of service needs to beestimated and included.2. Incorrect reporting of contractors/subcontractors/casuallabour. If your subcontractors aren’t incorporated and don’thave a valid WCB account, you must include the labourportion of what they were paid in your total gross insurableearnings. If they are incorporated or maintain their own WCBaccount, you can exclude them from your return.For example: You hire a helper in your shop to do inventorycontrol. This temporary helper works for a total of eight hoursand receives a cheque for $160. This casual worker isconsidered your worker, and you must include the labourcharges in your annual return reporting.Always ask subcontractors to provide you with theirWCB account number and a clearance letter or certificate beforethey start work. You can then verify this information via WCB’sonline service, DECC (Direct Employer Clearance Certificates).Information on obtaining clearances is available in theEmployers section of our website at www.wcb.ab.ca.20 | <strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong>

3. Excess earnings not being calculated correctly.Premiums are not paid on workers’ earnings exceeding WCB’smaximum insurable earnings amount per worker ($86,700 for<strong>2012</strong> and $90,200 for 2013). This amount is adjusted annuallyand is shown on the annual return form.To calculate earnings properly, first include the total grossearnings for all workers in the Additions section of the annualreturn form. Then determine how much excess earnings (grossearnings less the maximum insurable earnings) has beenincluded in the gross earnings on a worker-by-worker basis.Enter the sum of the excess amounts in the Deductions sectionof the annual return to ensure premiums are calculated on theinsurable workers’ earnings.For example: Your worker earns $88,000 in <strong>2012</strong>. The maximuminsurable earnings for <strong>2012</strong> is $86,700, so the excesscalculation would be as follows: $88,000 – $86,700 = $1,300of excess earnings. You would record $88,000 in theAdditions section and $1,300 in the Deductions section of theannual return.4. Proration of earnings. If you have workers’ compensationin two or more industries, you must keep separate insurableearnings records for the workers in each. If a worker works inonly one industry, then the earnings are reported in thatindustry or province respectively.If the worker performs work in both industries, the worker’searnings are allocated to each according to the actual workperformed in each. If the worker’s total earnings from allindustries are in excess of the maximum insurable earnings,the excess earnings are prorated to each industry (similarlyto each province if applicable).For example: A worker’s gross earnings for <strong>2012</strong> are$90,000, including $27,000 from Industry A and $63,000from Industry B. The maximum insurable earnings for <strong>2012</strong>is $86,700, so the excess earnings for this worker are$3,300, and are not insurable.Excess earnings must be prorated to each industry:Industry A’s excess earnings = $3,300 × ($27,000 /$90,000)= $990. Industry B’s excess earnings = $3,300 × $63,000 /$90,000) = $2,310. The employer would report $26,010($27,000 – $990) insurable earnings for this worker in IndustryA and $60,690 ($63,000 – $2,310) in Industry B, for a totalof $86,700.Please refer to the Prorating Insurable Earnings fact sheet onthe WCB website for more information.5. Wages not reported. Some earnings that are not included in Box14 of the T4 are still considered insurable earnings forWCB purposes (i.e., pay in lieu of notice, honoraria, recorded tipsand gratuities, etc.).These earnings must be included in your annual return reporting.Casual wages that aren’t paid via the payroll system andsubsequently may not end up being included in Box 14 of the T4have to be included in WCB reporting as well.The Reporting Insurable Earnings employer fact sheet availableon the WCB website provides additional information on thesetypes of insurable earnings.Need help?Additional information for filing your annual return can be found inthe Public Online Services for Employers section of the WCB websiteat www.wcb.ab.ca. You can also contact WCB’s Employer AccountServices toll-free at 1-866-922-9221. WMaking the gradeAnnual return season is aroundthe corner. Here are a few tips to keep inmind when filling out your annual return:Be diligent. As an employer, each year you’re requiredto fill out an annual return form reporting your workers’insurable earnings paid in the previous year and providean estimate for the coming year. It’s up to you to ensurethe information you give to WCB is correct, so please becareful. An underestimating penalty will be charged if youractual earnings exceed the latest estimate you provided by150 per cent or more.File online. The easiest way to file yourWCB annual return is online. A tutorialwalks you through the process, and helpbuttons are there to guide you if you runinto any problems. Check out thePublic Online Services for Employerssection of the WCB website for moreinformation.File on time. Your annual returnmust be submitted by February 28.<strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong> | 21

Legal ViewHow to limit risk whenhiring foreign companiesfor local work‘Deeming orders’ available for foreign nationalsBY DOUGLAS R. MAH, QC, WCB SECRETARY & GENERAL COUNSELWith a healthy Alberta economy, there is a desire tobring goods and services into the province. This isparticularly so in the case of specialized products andservices that are only available from other countries, such asthe United States.Alberta employers should take precautions to limit risk andliability in these situations. It is well known that workers’compensation in Alberta provides no-fault protection forworkplace accidents but only where the injured person is aparticipant in Alberta’s workers’ compensation system.The definition of “worker” found at s. 1(1)(z) of the Workers’<strong>Compensation</strong> Act (the Act) excludes as a worker any person“who ordinarily resides outside Canada and is employed byan employer who is based outside Canada and carries onbusiness in Alberta on a temporary basis.”This means that a foreign national, employed by a foreigncompany, who comes into Alberta to do a specific temporaryjob (such as delivering and installing a special product),may be outside the WCB system. If such a foreign national isinjured while performing work in Alberta, the usualemployer immunity may not apply, and the Alberta employermay well be open to a lawsuit brought by the foreignnational.The fact that a foreign national may have workers’compensation in his or her jurisdiction of origin wouldnot, by itself, insulate an Alberta employer from liability.The lesson here is that if you, as an Alberta employer, hirea foreign company that does not habitually carry onbusiness in Alberta, and that foreign company sends itsforeign national employees to your workplace to performservices, you are exposed to potential lawsuits. Yourremedy is to require the foreign company, as a conditionof the contract, to apply for Alberta workers’compensation coverage for the work its foreign nationalemployees perform in Alberta. This may be achievedthrough WCB’s granting of a “deeming order” unders. 16(2) of the Act.With the deeming order in place, immunity operates toprotect the Alberta employer from lawsuits in Alberta,even if the injured foreign national chooses to pursuecompensation in the home jurisdiction.Alberta employers unsure of their potential liability whenusing foreign companies in Alberta should contact WCBfor information before the foreign nationals arrive on theworksite. W22 | <strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong>

Seminars and workshops for employersWCB offers workshops in Calgary and Edmonton, and basedon demand, in other locations throughout the province.MODIFIED DUTIES WORKSHOPModified work is a safe, effective and efficient way to return aninjured worker to the job. This interactive workshop will provide:• The framework and tools needed to develop,implement or improve a modified work program• Ideas and examples of appropriate modified dutiesWHO SHOULD ATTEND?All employers, but especially those with a disability managementprogram (which WCB’s disability management seminar can helpyou start)LENGTH:One half-day sessionDISABILITY MANAGEMENT SEMINARUnderstand the relationship between claims costs and WCBpremiums, and how to control costs through responsible disabilitymanagement. The six key elements of a disability managementprogram will be discussed.WHO SHOULD ATTEND?All employers, but especially those who will directly oversee adisability management programLENGTH:One day-long sessionIn <strong>2012</strong>, we'll be enhancing our disability management seminar toequip you with the tools that will improve your performance.You'll learn how to develop an action plan and a successful modifiedreturn-to-work program to produce positive results for your employeesand your premiums.For more information visit wcb.ab.ca/employers/seminars.aspor call 780-498-4694Call Millard Health at 780-498-3363 for more informationor to register.EMPLOYER INFORMATION WORKSHOPLearn general information about the fundamentals of workers’compensation. Topics include insurable earnings, subcontractorliabilities, managing your account and the impact of claim costson premiums.WHO SHOULD ATTEND?Individuals in human resources, payroll and other financial positionsLENGTH:One half-day sessionFor more information visit wcb.ab.ca/employers/seminars.aspor call 780-498-4694UNDERSTANDING WCB’S APPEALS SYSTEMGet an overview of WCB’s appeal structure and process, includinghow to initiate, prepare and present a claim or premium-relatedappeal.WHO SHOULD ATTEND?EmployersLENGTH:One half-day sessionFor more information visit wcb.ab.ca/employers/seminars.aspor call 780-498-4694PREVENTING WORKPLACE VIOLENCE SEMINARThis general information seminar will help employers identify,respond to and prevent a variety of workplace incidents.They’ll also learn to develop their own workplace violenceprevention program.WHO SHOULD ATTEND?Any employers with WCB coverageLENGTH:Three hoursFor more information, call 780-498-4990.What employers have said about the disability management seminar:“Great discussion! Great responses from instructors!”“Very informative, great examples provided and presented perfectly.”“Instructors were very knowledgeable, personable and flexible. Nice work!”Sign up today!Visit www.wcb.ab.ca/employers/seminars.aspMost workshops and seminars are free of charge to WCB account holders.Questions?Call: 1-866-498-4694 (toll-free)Note: Workshop dates are subject to change or cancellation.<strong>WorkSIGHT</strong> <strong>WINTER</strong> <strong>2012</strong> | 23

Return undeliverableCanadian addresses to:Workers’ <strong>Compensation</strong> <strong>Board</strong> – AlbertaCorporate CommunicationsPO Box 24159925 - 107 StreetEdmonton, AB T5J 2S5Publication mail agreement #40062676