ANZ Rural Banking and Microfinance in Fiji; Lessons From Experience

ANZ Rural Banking and Microfinance in Fiji; Lessons From Experience

ANZ Rural Banking and Microfinance in Fiji; Lessons From Experience

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

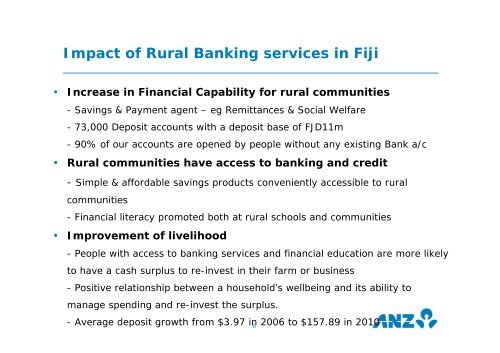

Impact of <strong>Rural</strong> <strong>Bank<strong>in</strong>g</strong> services <strong>in</strong> <strong>Fiji</strong>• Increase <strong>in</strong> F<strong>in</strong>ancial Capability for rural communities- Sav<strong>in</strong>gs & Payment agent – eg Remittances & Social Welfare- 73,000 Deposit accounts with a deposit base of FJD11m- 90% of our accounts are opened by people without any exist<strong>in</strong>g Bank a/c• <strong>Rural</strong> communities have access to bank<strong>in</strong>g <strong>and</strong> credit- Simple & affordable sav<strong>in</strong>gs products conveniently accessible to ruralcommunities- F<strong>in</strong>ancial literacy promoted both at rural schools <strong>and</strong> communities• Improvement of livelihood- People with access to bank<strong>in</strong>g services <strong>and</strong> f<strong>in</strong>ancial education are more likelyto have a cash surplus to re-<strong>in</strong>vest <strong>in</strong> their farm or bus<strong>in</strong>ess- Positive relationship between a household’s wellbe<strong>in</strong>g <strong>and</strong> its ability tomanage spend<strong>in</strong>g <strong>and</strong> re-<strong>in</strong>vest the surplus.- Average deposit growth from $3.97 <strong>in</strong> 2006 to $157.89 <strong>in</strong> 20106

![Warehouse Receipt Systems: Legal Issues [PDF]](https://img.yumpu.com/43979338/1/190x134/warehouse-receipt-systems-legal-issues-pdf.jpg?quality=85)