Kwadukuza IDP 2011 - KZN Development Planning

Kwadukuza IDP 2011 - KZN Development Planning

Kwadukuza IDP 2011 - KZN Development Planning

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

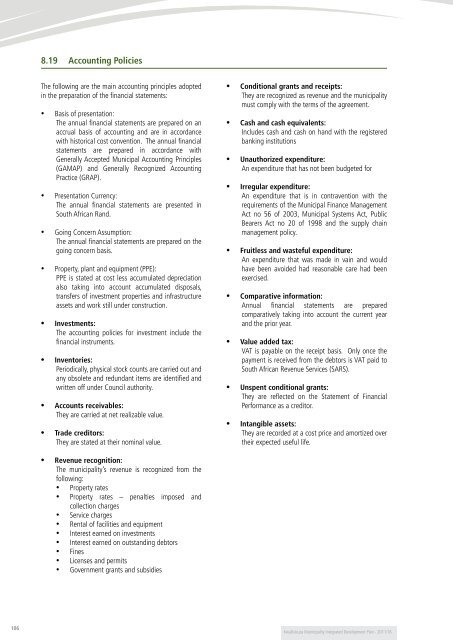

8.19 Accounting PoliciesThe following are the main accounting principles adoptedin the preparation of the financial statements:• Basis of presentation:The annual financial statements are prepared on anaccrual basis of accounting and are in accordancewith historical cost convention. The annual financialstatements are prepared in accordance withGenerally Accepted Municipal Accounting Principles(GAMAP) and Generally Recognized AccountingPractice (GRAP).• Presentation Currency:The annual financial statements are presented inSouth African Rand.• Going Concern Assumption:The annual financial statements are prepared on thegoing concern basis.• Property, plant and equipment (PPE):PPE is stated at cost less accumulated depreciationalso taking into account accumulated disposals,transfers of investment properties and infrastructureassets and work still under construction.• Investments:The accounting policies for investment include thefinancial instruments.• Inventories:Periodically, physical stock counts are carried out andany obsolete and redundant items are identified andwritten off under Council authority.• Accounts receivables:They are carried at net realizable value.• Trade creditors:They are stated at their nominal value.• Conditional grants and receipts:They are recognized as revenue and the municipalitymust comply with the terms of the agreement.• Cash and cash equivalents:Includes cash and cash on hand with the registeredbanking institutions• Unauthorized expenditure:An expenditure that has not been budgeted for• Irregular expenditure:An expenditure that is in contravention with therequirements of the Municipal Finance ManagementAct no 56 of 2003, Municipal Systems Act, PublicBearers Act no 20 of 1998 and the supply chainmanagement policy.• Fruitless and wasteful expenditure:An expenditure that was made in vain and wouldhave been avoided had reasonable care had beenexercised.• Comparative information:Annual financial statements are preparedcomparatively taking into account the current yearand the prior year.• Value added tax:VAT is payable on the receipt basis. Only once thepayment is received from the debtors is VAT paid toSouth African Revenue Services (SARS).• Unspent conditional grants:They are reflected on the Statement of FinancialPerformance as a creditor.• Intangible assets:They are recorded at a cost price and amortized overtheir expected useful life.• Revenue recognition:The municipality’s revenue is recognized from thefollowing:• Property rates• Property rates – penalties imposed andcollection charges• Service charges• Rental of facilities and equipment• Interest earned on investments• Interest earned on outstanding debtors• Fines• Licenses and permits• Government grants and subsidies106KwaDukuza Municipality Integrated <strong>Development</strong> Plan - <strong>2011</strong>/16