Indigenous Wages Declaration Form

Indigenous Wages Declaration Form

Indigenous Wages Declaration Form

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

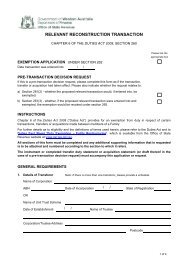

DECLARATION OF INDIGENOUS WAGES PAID IN WESTERN AUSTRALIA – PAY-ROLL TAXAbout this form:PAY-ROLL TAX (INDIGENOUS WAGES) REBATE ACT 2012In order for the Commissioner of State Revenue (the Commissioner) to determine eligibility for, and the amount of, any rebate of pay-rolltax paid in relation to wages paid to new indigenous employees, you must complete this form and keep records of all supportingdocumentation.If you want the Commissioner to consider your eligibility for the <strong>Indigenous</strong> <strong>Wages</strong> Rebate, you must send this completed declaration form,and any other documentation requested, to the Office of State Revenue (OSR). This can be done by sending this form as an attachment toa Web Enquiry which can be lodged by clicking on www.osr.wa.gov.au/PayrollEnquiry and selecting the ‘<strong>Indigenous</strong> <strong>Wages</strong> <strong>Declaration</strong>’sub-category. Upon receipt, OSR will determine the eligibility for the rebate and, if you are eligible, the amount of the rebate.The indigenous wages rebate is payable to eligible employers in respect of wages paid to eligible employees as set out in the Pay-roll Tax(<strong>Indigenous</strong> <strong>Wages</strong>) Rebate Act 2012 (“the Act”).Before completing this declaration it is recommended that you read Pay-roll Tax Circular PT 8 – 2012-13 Budget measures – Pay-roll TaxRebates.All eligible indigenous wages paid within a financial year must be declared on this form. However, please note that the<strong>Indigenous</strong> <strong>Wages</strong> Rebate is a rebate of pay-roll tax that has already been paid by an employer in respect of eligible indigenouswages that have been declared during the financial year as taxable wages. If you have any queries in this regard please contactthe OSR.Page 1 of 4

<strong>Declaration</strong> By EmployerIn making this indigenous wages declaration the employer accepts all responsibility, and has -• Fully read and understands the obligations and eligibility requirements as stated in the Pay-roll Tax (<strong>Indigenous</strong> <strong>Wages</strong>) Rebate Act2012.• Accepts that OSR may require and request further relevant information• Kept and maintained full records of wages paid to new indigenous employees.• Not previously applied for a rebate on any of the indigenous wages declared on this formSigned by Applicant :Date:Applicant details:Client IDGroup ID (if known)Business NameNature of Business / Industry CodeABNACNBusiness AddressContact NameContact Email AddressContact Telephone NumberWeb Enquiry Communication ID (if previously sent)Page 2 of 4

Employee Name Financial Period CommonwealthFirst NameSurname<strong>Indigenous</strong> <strong>Wages</strong>Subsidy ProviderIDTotal <strong>Indigenous</strong> <strong>Wages</strong> Paid in Western Australia $<strong>Indigenous</strong> <strong>Wages</strong> Paid inWestern Australia$$$$$$$$$$$$$$$$$$$$$$$Date ofCommencementof employmentEnd Date ofEmployment(if applicable)Page 3 of 4

Total WA <strong>Wages</strong> (including <strong>Indigenous</strong> <strong>Wages</strong>)Financial YearTotal WA <strong>Wages</strong> paid$$$$$$Office of State RevenuePlaza Level200 St Georges TerracePERTH WA 6000Office Hours8:00 am – 5:00 pmMonday to Fridaywww.osr.wa.gov.auEnquiries:Phone(08) 9262 13001300 368 364 (WA country STD callers only)Fax(08) 9226 0841Web Enquiry:www.osr.wa.gov.au/PayrollEnquiryPage 4 of 4