Tax Tables B-D (April 2012) Taxable Pay Tables Manual Method

Tax Tables B-D (April 2012) Taxable Pay Tables Manual Method

Tax Tables B-D (April 2012) Taxable Pay Tables Manual Method

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

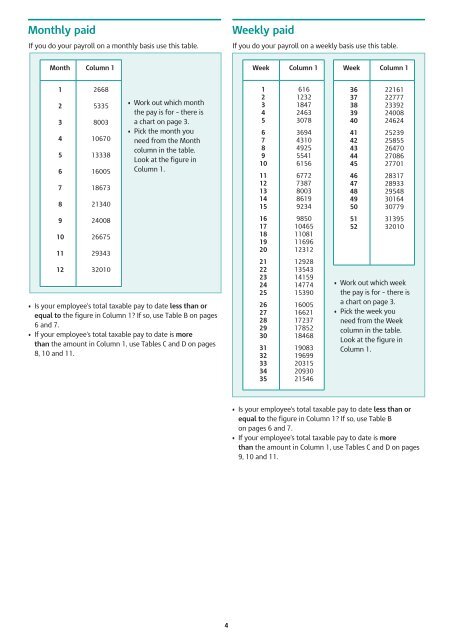

Monthly paid<br />

Month Column 1<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

2668<br />

5335<br />

8003<br />

10670<br />

13338<br />

16005<br />

18673<br />

21340<br />

24008<br />

26675<br />

29343<br />

32010<br />

• Work out which month<br />

the pay is for – there is<br />

a chart on page 3.<br />

• Pick the month you<br />

need from the Month<br />

column in the table.<br />

Look at the figure in<br />

Column 1.<br />

4<br />

Weekly paid<br />

If you do your payroll on a monthly basis use this table. If you do your payroll on a weekly basis use this table.<br />

• Is your employee’s total taxable pay to date less than or<br />

equal to the figure in Column 1? If so, use Table B on pages<br />

6 and 7.<br />

• If your employee’s total taxable pay to date is more<br />

than the amount in Column 1, use <strong>Tables</strong> C and D on pages<br />

8, 10 and 11.<br />

Week Column 1<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

8<br />

9<br />

10<br />

11<br />

12<br />

13<br />

14<br />

15<br />

16<br />

17<br />

18<br />

19<br />

20<br />

21<br />

22<br />

23<br />

24<br />

25<br />

26<br />

27<br />

28<br />

29<br />

30<br />

31<br />

32<br />

33<br />

34<br />

35<br />

616<br />

1232<br />

1847<br />

2463<br />

3078<br />

3694<br />

4310<br />

4925<br />

5541<br />

6156<br />

6772<br />

7387<br />

8003<br />

8619<br />

9234<br />

9850<br />

10465<br />

11081<br />

11696<br />

12312<br />

12928<br />

13543<br />

14159<br />

14774<br />

15390<br />

16005<br />

16621<br />

17237<br />

17852<br />

18468<br />

19083<br />

19699<br />

20315<br />

20930<br />

21546<br />

Week Column 1<br />

36<br />

37<br />

38<br />

39<br />

40<br />

41<br />

42<br />

43<br />

44<br />

45<br />

46<br />

47<br />

48<br />

49<br />

50<br />

51<br />

52<br />

22161<br />

22777<br />

23392<br />

24008<br />

24624<br />

25239<br />

25855<br />

26470<br />

27086<br />

27701<br />

28317<br />

28933<br />

29548<br />

30164<br />

30779<br />

31395<br />

32010<br />

• Work out which week<br />

the pay is for – there is<br />

a chart on page 3.<br />

• Pick the week you<br />

need from the Week<br />

column in the table.<br />

Look at the figure in<br />

Column 1.<br />

• Is your employee’s total taxable pay to date less than or<br />

equal to the figure in Column 1? If so, use Table B<br />

on pages 6 and 7.<br />

• If your employee’s total taxable pay to date is more<br />

than the amount in Column 1, use <strong>Tables</strong> C and D on pages<br />

9, 10 and 11.