Tax Tables B-D (April 2012) Taxable Pay Tables Manual Method

Tax Tables B-D (April 2012) Taxable Pay Tables Manual Method

Tax Tables B-D (April 2012) Taxable Pay Tables Manual Method

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

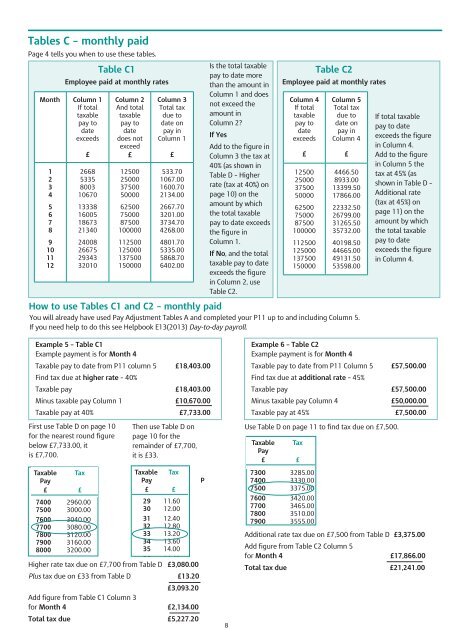

<strong>Tables</strong> C – monthly paid<br />

Page 4 tells you when to use these tables.<br />

Table C1<br />

Employee paid at monthly rates<br />

Is the total taxable<br />

pay to date more<br />

than the amount in<br />

Table C2<br />

Employee paid at monthly rates<br />

Month Column 1<br />

If total<br />

taxable<br />

pay to<br />

date<br />

exceeds<br />

Column 2<br />

And total<br />

taxable<br />

pay to<br />

date<br />

does not<br />

exceed<br />

Column 3<br />

Total tax<br />

due to<br />

date on<br />

pay in<br />

Column 1<br />

Column 1 and does<br />

not exceed the<br />

amount in<br />

Column 2?<br />

If Yes<br />

Add to the figure in<br />

Column 4<br />

If total<br />

taxable<br />

pay to<br />

date<br />

exceeds<br />

Column 5<br />

Total tax<br />

due to<br />

date on<br />

pay in<br />

Column 4<br />

If total taxable<br />

pay to date<br />

exceeds the figure<br />

in Column 4.<br />

£<br />

£<br />

£<br />

Column 3 the tax at £<br />

£ Add to the figure<br />

40% (as shown in<br />

in Column 5 the<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

7<br />

2668<br />

5335<br />

8003<br />

10670<br />

13338<br />

16005<br />

18673<br />

12500 533.70<br />

Table D – Higher<br />

12500 4466.50<br />

25000 1067.00<br />

25000 8933.00<br />

37500 1600.70 rate (tax at 40%) on<br />

37500 13399.50<br />

Table 50000 D – 2134.00 40% Higher page Rate 10) on the<br />

50000 17866.00<br />

Also<br />

62500<br />

to be used<br />

2667.70<br />

amount by which<br />

for Code D0. Pages 2 and 4 tell you when 62500 to use this 22332.50 table.<br />

75000 3201.00 the total taxable<br />

75000 26799.00<br />

87500 3734.70 pay to date exceeds 87500 31265.50<br />

tax at 45% (as<br />

shown in Table D –<br />

Additional rate<br />

(tax at 45%) on<br />

page 11) on the<br />

amount by which<br />

8 21340 100000 4268.00 the figure in Table D0 100000 35732.00 the total taxable<br />

9 24008 112500 4801.70 Column 1.<br />

<strong>Tax</strong>able <strong>Tax</strong> <strong>Tax</strong>able <strong>Tax</strong> <strong>Tax</strong>able<br />

112500<br />

<strong>Tax</strong> <strong>Tax</strong>able<br />

40198.50 pay to date<br />

<strong>Tax</strong><br />

n to use this table. 10 26675 125000 5335.00<br />

<strong>Pay</strong> <strong>Pay</strong>If No, and the total<br />

125000 44665.00 exceeds the figure<br />

<strong>Pay</strong> <strong>Pay</strong><br />

11 29343 137500 5868.70<br />

137500 49131.50 in Column 4.<br />

12 32010 150000 £ 6402.00<br />

£ £ taxable pay £ to date £<br />

150000<br />

£<br />

53598.00<br />

£ £<br />

exceeds the figure<br />

Where the exa<br />

1 0.40 50 20.00 100 40.00 5100 2040.00<br />

ax <strong>Tax</strong>able <strong>Tax</strong><br />

2 0.80 51<br />

in Column<br />

20.40<br />

2, use<br />

200 80.00 5200 2080.00<br />

amount of tax<br />

<strong>Pay</strong><br />

3 1.20 52Table<br />

20.80 C2. 300 120.00 5300 2120.00 is not shown,<br />

ble D – Additional rate (tax at 4 45%) 1.60 53 21.20 400 160.00 5400 2160.00 together the f<br />

£ How £ to use £ <strong>Tables</strong> C1 and C2 5 – monthly 2.00 54 paid 21.60 500 200.00 5500 2200.00<br />

so to be used for code D1. Pages 8 and Where 9 tell the you exact when to use this table.<br />

two (or more)<br />

.00 You 5100 will already 2040.00 have used <strong>Pay</strong> Adjustment 6 <strong>Tables</strong> 2.40 A and 55 completed 22.00 your P11 600 up to 240.00 and including Column 5600 5. 2240.00 make up the a<br />

.00 5200 2080.00<br />

amount of 7 taxable 2.80pay<br />

If you need help to do this see Helpbook E13(2013) Day-to-day 56 payroll. 22.40 700 280.00 5700 2280.00<br />

taxable pay to<br />

.00 5300 2120.00 Table is D not – <strong>Tax</strong> shown, 8 at add 45% 3.20 57 22.80 800 320.00 5800 2320.00<br />

.00 5400 2160.00<br />

Example 5 – Table C1 together the 9 figures 3.60 for 58 23.20 900 360.00 5900 2360.00 nearest £1 be<br />

<strong>Tax</strong>able <strong>Tax</strong> <strong>Tax</strong>able <strong>Tax</strong> <strong>Tax</strong>able <strong>Tax</strong> <strong>Tax</strong>able<br />

.00 5500 2200.00<br />

10 4.00<br />

Example 6 – Table <strong>Tax</strong> C2<br />

59 23.60 1000 400.00 6000 2400.00<br />

pay Example payment is pay for Month two (or 4 more) entries pay to<br />

Example pay payment is for Month<br />

.00 5600 2240.00<br />

11 4.40 60 24.00<br />

make up the amount of<br />

1100 440.00 6100<br />

4<br />

2440.00<br />

.00 £ <strong>Tax</strong>able 5700 £ pay 2280.00 to date from £ P11 column £ 12 5 4.80 £18,403.00<br />

£ 61 £ 24.40 <strong>Tax</strong>able £ 1200 pay 480.00 to date £ from 6200 P11 Column 2480.00 5 £57,500.00<br />

.00 5800 2320.00<br />

taxable pay 13 to the<br />

1<br />

5.20 62 24.80 1300 520.00 6300 2520.00<br />

Find tax 0.45 due at higher 51 rate<br />

.00 5900 2360.00 nearest – 40% 22.95 200 90.00 6100<br />

Where the<br />

£1 14 below. 5.60 63 25.20<br />

Find<br />

1400<br />

tax due 2745.00<br />

560.00<br />

at additional 6400 rate – 45%<br />

2 0.90 52 23.40 300 135.00 6200 2790.00 exact amount 2560.00<br />

.00 3 <strong>Tax</strong>able 6000 1.35 pay 2400.00 53 23.85<br />

15 6.00<br />

400 £18,403.00 64<br />

180.00<br />

25.60<br />

6300 <strong>Tax</strong>able 1500 pay 600.00 2835.00<br />

6500 2600.00<br />

of taxable pay £57,500.00<br />

Table D – 40% Higher Rate<br />

.00 4 Minus 6100 1.80 taxable 2440.00 pay Column 54 1 24.30 16 6.40 500 £10,670.00<br />

65225.0026.00<br />

6400 1600 640.00 6600 2640.00<br />

Minus taxable 2880.00 pay Column is 4 not shown, £50,000.00<br />

.00 5 6200 Also 2.25 to 2480.00 be used 17 6.80 66 26.40 1700 680.00 6700 2680.00<br />

55 for Code D0. 24.75 Pages 2 and 600 4 tell you when 270.00to<br />

use this 6500 table. 2925.00<br />

.00 <strong>Tax</strong>able 6300 pay 2520.00 at 40% 18 7.20£7,733.00<br />

67 26.80 <strong>Tax</strong>able 1800 pay 720.00 at 45% 6800 add together 2720.00 £7,500.00<br />

6 2.70 56 25.20 700 315.00 6600 2970.00<br />

.00 6400 2560.00 Table 19D<br />

– 7.60 40% Higher 68 27.20 Rate 1900 760.00 6900 the figures 2760.00<br />

7<br />

.00<br />

First 6500 use 3.15 Table 2600.00 D on page 57 10 25.65<br />

Then 20use<br />

Table<br />

800 360.00 6700 3015.00<br />

8.00 69 27.60 2000 800.00 7000 2800.00<br />

8 3.60 58 26.10 900 Table D on D0<br />

Use Table D on page 11 to find for tax two due (or on £7,500.<br />

405.00 6800 3060.00<br />

n .00to<br />

use this for 6600 the table. nearest 2640.00 round figure Also to 21 be used 8.40 for Code D0. 70 Pages 28.00 2 and 4 tell 2100 you when 840.00 to use this 7100 table.<br />

9 4.05 59<br />

page 10 for the<br />

26.55 1000 450.00 6900 3105.00 more) entries 2840.00<br />

.00 10 below 6700£7,733.00, <strong>Tax</strong>able<br />

4.502680.00<br />

it<br />

<strong>Tax</strong> <strong>Tax</strong>able<br />

remainder 22<br />

<strong>Tax</strong><br />

of 8.80 £7,700,<br />

<strong>Tax</strong>able<br />

71<br />

<strong>Tax</strong><br />

28.40<br />

<strong>Tax</strong>able<br />

2200 880.00<br />

<strong>Tax</strong> 7200 2880.00<br />

60 27.00 1100 495.00 7000 3150.00<br />

.00 6800 2720.00<br />

<strong>Pay</strong> <strong>Pay</strong> 23 9.20 <strong>Pay</strong> 72 28.80 2300<br />

<strong>Pay</strong><br />

to make up<br />

920.00 7300 2920.00<br />

11 is £7,700. 4.95 61 27.45 it is £33.<br />

.00 6900 2760.00 £ £ £ 24 £<br />

1200<br />

9.60 £<br />

540.00<br />

73 £ 29.20 Table 7100<br />

2400 £ D0 3195.00<br />

960.00 £ 7400 the amount 2960.00 of<br />

12 5.40 62 27.90 1300 585.00 7200 3240.00<br />

.00 7000 2800.00<br />

25 10.00 74 29.60 2500 1000.00 7500 taxable Where pay the 3000.00 exact to<br />

<strong>Tax</strong> 13 <strong>Tax</strong>able5.85 1<strong>Tax</strong><br />

0.40 63 50 28.35 <strong>Tax</strong>able 20.00 <strong>Tax</strong> 1400 100 <strong>Tax</strong>able 630.00 40.00<strong>Tax</strong><br />

7300 5100 <strong>Tax</strong>able 2040.00 3285.00 <strong>Tax</strong> <strong>Tax</strong>able <strong>Tax</strong><br />

.00 7100 <strong>Pay</strong> 2840.00<br />

<strong>Pay</strong> 26 10.40 <strong>Pay</strong> 75 30.00 2600 <strong>Pay</strong> 1040.00 7600 <strong>Pay</strong><br />

the nearest 3040.00 £1<br />

14 6.30 2 0.80 64 51 28.80 20.40 1500 200 675.00 80.00 7400 5200 2080.00 3330.00 amount of taxable pay<br />

.00<br />

£ 15 7200<br />

£ 6.752880.00<br />

27 10.80 76 30.40 2700 1080.00 7700 3080.00<br />

3 £ 1.20<br />

£ £ £ £ £ £<br />

below.<br />

65 52 29.25 20.80<br />

£ £<br />

.00 7300 2920.00<br />

28 11.20<br />

1600 300<br />

77<br />

720.00 120.00 7500 5300 2120.00 3375.00 is not shown, add<br />

30.80 2800 1120.00 7800 3120.00<br />

16 7.20 4 1.60 66 Where 53 29.70 the 21.20 exact<br />

.00 .00 7400 5100 2960.00 2040.00<br />

291<br />

11.60<br />

1700 400<br />

0.40 78<br />

765.00 160.00<br />

50 31.20<br />

7600 5400 2160.00<br />

20.00 2900 100 1160.00<br />

3420.00 together the figures for<br />

40.00<br />

7900 5100 3160.00 Where the exa<br />

17 7.65 5 2.00 67 54<br />

2040.00<br />

.00 .00 7500 5200 3000.00 2080.00<br />

amount 30.15 21.60<br />

30 of<br />

2<br />

taxable 12.00<br />

1800 500<br />

0.80pay<br />

79<br />

810.00 200.00<br />

51 31.60<br />

7700 5500 2200.00<br />

20.40 3000 200 1200.00<br />

3465.00<br />

80.00<br />

8000 two (or<br />

5200 3200.00 more) entries to<br />

2080.00<br />

amount of tax<br />

18 8.10 6 2.40 68 55 30.60 22.00 1900 600 855.00 240.00 7800 5600 2240.00 3510.00<br />

.00 7600 5300 3040.00 2120.00 is not shown, 313<br />

add 12.40 1.20 80 52 32.00 20.80 3100 300 1240.00 120.00 8100 5300 make up 3240.00 2120.00 the amount ofis<br />

not shown,<br />

19 8.55 7 2.80 69 56 31.05 22.40 2000 700 900.00 280.00 7900 5700 2280.00 3555.00<br />

.00 7700 5400 3080.00 2160.00 together 324<br />

the figures 12.80 1.60 for 81 53 32.40 21.20 3200 400 1280.00 160.00 8200 5400 3280.00 2160.00<br />

20 9.00 8 3.20<br />

together the f<br />

.00 7800 5500 3120.00 2200.00<br />

70 57 31.50 22.80<br />

33 13.20 82 32.80<br />

two (or more)<br />

5<br />

entries<br />

2.00 2100 800<br />

to<br />

54<br />

945.00 320.00 8000 5800 2320.00<br />

taxable pay to the<br />

3600.00<br />

21.60 Additional 3300 500 rate 1320.00 200.00 tax due on £7,500 8300 5500 from 3320.00 2200.00 Table D £3,375.00<br />

21 9.45 9 3.60 71 58 31.95 23.20<br />

two (or more)<br />

.00 .00 7900 5600 3160.00 2240.00<br />

34 13.60 2200 900<br />

83990.00<br />

360.00<br />

33.20 8100 5900 2360.00 nearest £1 below.<br />

3400 1360.00 3645.00 8400 3360.00<br />

make up 6the<br />

amount<br />

2.40<br />

of<br />

55 22.00 600 240.00 5600 2240.00<br />

.00<br />

22<br />

.00 8000<br />

9.90 10 4.00<br />

5700 3200.00<br />

72 59 32.40 23.60<br />

2280.00<br />

357<br />

14.00 23001000<br />

2.80 841035.00<br />

400.00<br />

56 33.60 Add 8200<br />

6000<br />

22.40 3500 figure from 2400.00<br />

700 1400.00 3690.00 Table C2 Column<br />

280.00<br />

8500 5<br />

5700 3400.00 make up the a<br />

2280.00<br />

23 10.35 11 4.40 73<br />

.00 8100 5800 3240.00 2320.00<br />

taxable 60 32.85<br />

36 pay 24.00<br />

8<br />

to 14.40 the 24001100<br />

1080.00 440.00<br />

3.20 85 57 34.00 22.80<br />

for 8300 6100 Month<br />

3600 800<br />

4 2440.00 3735.00<br />

1440.00 320.00 8600 5800 3440.00 2320.00 £17,866.00 taxable pay to<br />

24<br />

.00 Higher<br />

8200 5900rate 10.80tax<br />

12<br />

3280.00 2360.00 due on 4.80 74 £7,700 nearest from 61 33.30 Table<br />

24.40<br />

37 £1 9 below. D 14.80 £3,080.00 25001200<br />

1125.00 480.00 8400 6200 2480.00 3780.00<br />

3.60 86 58 34.40 23.20 Total 3700 900 tax due 1480.00 360.00 8700 5900 3480.00 2360.00 £21,241.00<br />

nearest £1 be<br />

25 11.25 13 5.20<br />

.00 Plus 8300 6000 tax due 3320.00 on 2400.00 75 62<br />

33.75<br />

24.80<br />

£33 from Table D 38 10 15.20 4.00 2600<br />

1300<br />

£13.20 87 591170.00<br />

520.00 8500 6300 2520.00 3825.00<br />

34.80 23.60 3800 1000 1520.00 400.00 8800 6000 3520.00 2400.00<br />

.00<br />

26<br />

.00 8400<br />

11.70<br />

14 5.60<br />

6100 3360.00<br />

76<br />

63<br />

34.20<br />

25.20<br />

2440.00<br />

39 11 15.60 2700<br />

1400<br />

4.40 881215.00<br />

560.00 6400 2560.00<br />

60 35.20 8600<br />

24.00 3900 1100 1560.00 3870.00<br />

440.00<br />

8900 6100 3560.00 2440.00<br />

.00 27<br />

.00 850012.15 15 6.00<br />

6200 3400.00 77<br />

64<br />

34.65<br />

25.60<br />

£3,093.20<br />

2480.00<br />

40 12 16.00 2800<br />

1500<br />

4.80 891260.00<br />

600.00 6500 2600.00<br />

61 35.60 8700<br />

24.40 4000 1200 1600.00 3915.00<br />

480.00<br />

9000 6200 3600.00 2480.00<br />

28<br />

.00 Add 8600 6300 figure 12.60 from<br />

16<br />

3440.00 2520.00 Table<br />

6.40 78 C1 Column<br />

65 35.10 26.00<br />

3<br />

29001600<br />

1305.00 640.00 8800 6600 2640.00 3960.00<br />

41 13 16.40 5.20 90 62 36.00 24.80 4100 1300 1640.00 520.00 9100 6300 3640.00 2520.00<br />

29 13.05 17 6.80 79 66 35.55 26.40<br />

.00 for 8700 6400 Month 4 3480.00 2560.00<br />

42 14 16.80<br />

30001700<br />

£2,134.00 5.60 91<br />

1350.00 680.00<br />

63 36.40<br />

8900 6700 2680.00 4005.00<br />

25.20 4200 1400 1680.00 560.00 9200 6400 3680.00 2560.00<br />

30 13.50 18 7.20 67 26.80 1800 720.00<br />

.00 8800 6500 3520.00 2600.00 80 36.00 43 15 17.20 6.00 3100 92 641395.00<br />

36.80 25.60<br />

9000 6800 2720.00<br />

4300 1500 1720.00<br />

4050.00<br />

600.00 9300 6500 3720.00 2600.00<br />

Total tax due 19 7.60 68 27.20£5,227.20<br />

1900 760.00 6900 2760.00<br />

.00 31<br />

.00 890013.95 6600 3560.00 81 36.45<br />

2640.00<br />

44 16 17.60 6.40<br />

3200 93 65<br />

1440.00 37.20 4400 1760.00 9400 3760.00<br />

826.00<br />

9100<br />

1600 640.00<br />

4095.00<br />

20 8.00 69 27.60 2000 800.00 7000 2800.00 6600 2640.00<br />

.00 32<br />

.00 9000 6700<br />

14.403600.00<br />

2680.00<br />

82 36.90 45 17 18.00 6.80<br />

3300 94 66<br />

1485.00 37.60 26.40<br />

9200 4500 1700 1800.00 680.00<br />

4140.00 9500 6700 3800.00 2680.00<br />

33 14.85 21 8.40 83 70 37.35 28.00 34002100<br />

1530.00 840.00 9300 7100 2840.00 4185.00