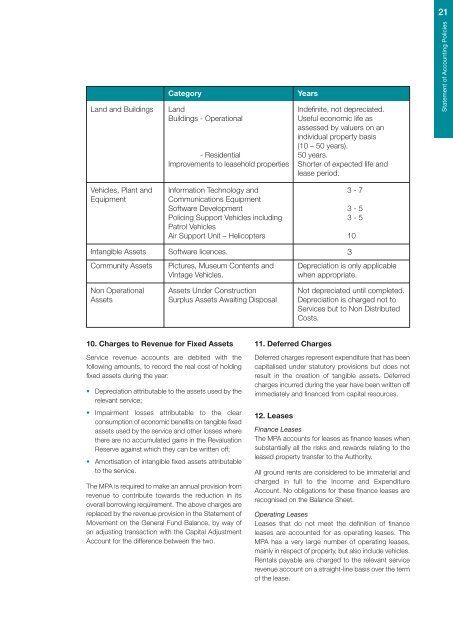

20Statement <strong>of</strong> Accounting PoliciesAuthority (e.g. s<strong>of</strong>tware licences) are capitalised whenit will bring benefits to the <strong>MPA</strong> for more than onefinancial year. The balance is amortised to the relevantservice revenue account over the economic life <strong>of</strong> theinvestment to reflect the pattern <strong>of</strong> consumption <strong>of</strong>benefits. The de-minimus level policy is to capitalizeall expenditure over £5,000 on an individual assetbasis, and projects (or grouped assets) with a totalvalue in excess <strong>of</strong> £5,000: expenditure on partnershipassets is capitalised over £1,000.9. Tangible Fixed AssetsTangible fixed assets are assets that have physicalsubstance and are held for use in the provision <strong>of</strong>services or for administrative purposes on a continuingbasis. The de-minimus level policy is to capitalize allexpenditure over £5,000 on an individual asset basis,and projects (or grouped assets) with a total value inexcess <strong>of</strong> £5,000: expenditure on partnership assetsis capitalised over £1,000.Impairment: The values <strong>of</strong> each category <strong>of</strong> assetsand material individual assets that are not beingdepreciated are reviewed at the end <strong>of</strong> each financialyear for evidence <strong>of</strong> reductions in value. Whereimpairment is identified as part <strong>of</strong> this review, or as aresult <strong>of</strong> a valuation exercise, are accounted for by:• Where attributable to the clear consumption <strong>of</strong>economic benefits – the loss is charged to therelevant service account.• Otherwise – written <strong>of</strong>f against any revaluation gainsattributable to the relevant asset in the RevaluationReserve, with any excess charged to the relevantservice revenue account.Where an impairment loss is charged to the Incomeand Expenditure Account but there were accumulatedrevaluation gains in the Revaluation Reserve for thatasset, an amount up to the value <strong>of</strong> the loss istransferred from the Revaluation Reserve to theCapital Adjustment Account.Recognition: Expenditure on the acquisition,creation or enhancement <strong>of</strong> fixed assets is capitalisedon an accruals basis, provided that it yields benefitsto the Authority and the services it provides is for morethan one financial year. Expenditure that secures, butdoes not extend the previously assessed standards<strong>of</strong> performance <strong>of</strong> an asset (e.g. repairs andmaintenance) is charged to revenue as they areincurred.Measurement: Assets are initially measured atcost, comprising all expenditure that is directlyattributable to bringing the asset into workingcondition for its intended use. Assets are carried in theBalance Sheet using the following measurementbases:• Specialised operational properties – depreciatedreplacement cost• Non-specialised operational properties – existinguse value• Dwellings and Surplus assets – market value• Vehicles, plant and equipment – lower <strong>of</strong> netcurrent replacement cost or net realisable value inexisting useAssets included in the Balance Sheet at current valueare revalued where there have been material changesin the value, as a minimum revaluations are carried outevery five years. Increases in valuations are matchedby credits to the Revaluation Reserve to recogniseunrealised gains.Disposals: When an asset is disposed <strong>of</strong> ordecommissioned, the value <strong>of</strong> the asset in the BalanceSheet is written <strong>of</strong>f to the Income and ExpenditureAccount (the receipts are credited) as part <strong>of</strong> the gainor loss on disposal. Any revaluation gains in theRevaluation Reserve are transferred to the CapitalAdjustment Account. Proceeds in excess <strong>of</strong> £10,000are categorised as capital receipts, which are creditedto the Usable Capital Receipts Reserve, and can thenonly be used for new capital investment or set aside toreduce the <strong>MPA</strong>’s underlying need to borrow. Receiptsare appropriated to the Reserve from the Statement<strong>of</strong> Movement on the General Fund Balance.Grants and Contributions: Where grants andcontributions are received that are identifiable to fixedassets with a finite useful life, the amounts are creditedto the Government Grants Deferred Account. Thebalance is then written down to revenue to <strong>of</strong>fsetdepreciation charges made for the related assets inthe relevant service account, in line with thedepreciation policy applied to them.Depreciation: This is provided for all assets with adeterminable finite life, by allocating the value <strong>of</strong> theasset in the Balance Sheet over the periods expectedto benefit from their use, on a straight-line basis. Theprincipal asset categories and their useful economiclives are:

21Land and BuildingsCategoryLandBuildings - Operational- ResidentialImprovements to leasehold propertiesYearsIndefinite, not depreciated.Useful economic life asassessed by valuers on anindividual property basis(10 – 50 years).50 years.Shorter <strong>of</strong> expected life andlease period.Statement <strong>of</strong> Accounting PoliciesVehicles, Plant andEquipmentInformation Technology andCommunications EquipmentS<strong>of</strong>tware DevelopmentPolicing Support Vehicles includingPatrol VehiclesAir Support Unit – Helicopters3 - 73 - 53 - 510Intangible Assets S<strong>of</strong>tware licences. 3Community AssetsNon OperationalAssetsPictures, Museum Contents andVintage Vehicles.Assets Under ConstructionSurplus Assets Awaiting DisposalDepreciation is only applicablewhen appropriate.Not depreciated until completed.Depreciation is charged not toServices but to Non DistributedCosts.10. Charges to Revenue for Fixed AssetsService revenue <strong>accounts</strong> are debited with thefollowing amounts, to record the real cost <strong>of</strong> holdingfixed assets during the year:• Depreciation attributable to the assets used by therelevant service;• Impairment losses attributable to the clearconsumption <strong>of</strong> economic benefits on tangible fixedassets used by the service and other losses wherethere are no accumulated gains in the RevaluationReserve against which they can be written <strong>of</strong>f;• Amortisation <strong>of</strong> intangible fixed assets attributableto the service.The <strong>MPA</strong> is required to make an annual provision fromrevenue to contribute towards the reduction in itsoverall borrowing requirement. The above charges arereplaced by the revenue provision in the Statement <strong>of</strong>Movement on the General Fund Balance, by way <strong>of</strong>an adjusting transaction with the Capital AdjustmentAccount for the difference between the two.11. Deferred ChargesDeferred charges represent expenditure that has beencapitalised under statutory provisions but does notresult in the creation <strong>of</strong> tangible assets. Deferredcharges incurred during the year have been written <strong>of</strong>fimmediately and financed from capital resources.12. LeasesFinance LeasesThe <strong>MPA</strong> <strong>accounts</strong> for leases as finance leases whensubstantially all the risks and rewards relating to theleased property transfer to the Authority.All ground rents are considered to be immaterial andcharged in full to the Income and ExpenditureAccount. No obligations for these finance leases arerecognised on the Balance Sheet.Operating LeasesLeases that do not meet the definition <strong>of</strong> financeleases are accounted for as operating leases. The<strong>MPA</strong> has a very large number <strong>of</strong> operating leases,mainly in respect <strong>of</strong> property, but also include vehicles.Rentals payable are charged to the relevant servicerevenue account on a straight-line basis over the term<strong>of</strong> the lease.

![Appendix 1 [PDF]](https://img.yumpu.com/51078997/1/184x260/appendix-1-pdf.jpg?quality=85)

![Transcript of this meeting [PDF]](https://img.yumpu.com/50087310/1/184x260/transcript-of-this-meeting-pdf.jpg?quality=85)

![Street drinking in Hounslow [PDF]](https://img.yumpu.com/49411456/1/184x260/street-drinking-in-hounslow-pdf.jpg?quality=85)