MPA - statement of accounts

MPA - statement of accounts

MPA - statement of accounts

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

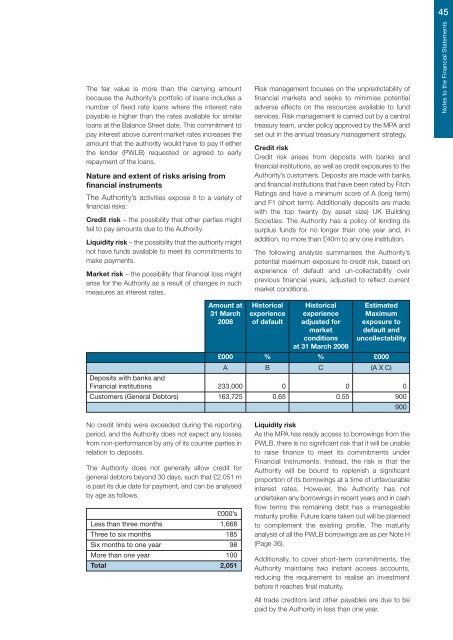

45The fair value is more than the carrying amountbecause the Authority’s portfolio <strong>of</strong> loans includes anumber <strong>of</strong> fixed rate loans where the interest ratepayable is higher than the rates available for similarloans at the Balance Sheet date. This commitment topay interest above current market rates increases theamount that the authority would have to pay if eitherthe lender (PWLB) requested or agreed to earlyrepayment <strong>of</strong> the loans.Nature and extent <strong>of</strong> risks arising fromfinancial instrumentsThe Authority’s activities expose it to a variety <strong>of</strong>financial risks:Credit risk – the possibility that other parties mightfail to pay amounts due to the Authority.Liquidity risk – the possibility that the authority mightnot have funds available to meet its commitments tomake payments.Market risk – the possibility that financial loss mightarise for the Authority as a result <strong>of</strong> changes in suchmeasures as interest rates.Risk management focuses on the unpredictability <strong>of</strong>financial markets and seeks to minimise potentialadverse effects on the resources available to fundservices. Risk management is carried out by a centraltreasury team, under policy approved by the <strong>MPA</strong> andset out in the annual treasury management strategy.Credit riskCredit risk arises from deposits with banks andfinancial institutions, as well as credit exposures to theAuthority’s customers. Deposits are made with banksand financial institutions that have been rated by FitchRatings and have a minimum score <strong>of</strong> A (long term)and F1 (short term). Additionally deposits are madewith the top twenty (by asset size) UK BuildingSocieties. The Authority has a policy <strong>of</strong> lending itssurplus funds for no longer than one year and, inaddition, no more than £40m to any one institution.The following analysis summarises the Authority’spotential maximum exposure to credit risk, based onexperience <strong>of</strong> default and un-collectability overprevious financial years, adjusted to reflect currentmarket conditions.Amount at Historical Historical Estimated31 March experience experience Maximum2008 <strong>of</strong> default adjusted for exposure tomarket default andconditions uncollectabilityat 31 March 2008£000 % % £000A B C (A X C)Deposits with banks andFinancial institutions 233,000 0 0 0Customers (General Debtors) 163,725 0.65 0.55 900900Notes to the Financial StatementsNo credit limits were exceeded during the reportingperiod, and the Authority does not expect any lossesfrom non-performance by any <strong>of</strong> its counter parties inrelation to deposits.The Authority does not generally allow credit forgeneral debtors beyond 30 days, such that £2.051 mis past its due date for payment, and can be analysedby age as follows.£000’sLess than three months 1,668Three to six months 185Six months to one year 98More than one year 100Total 2,051Liquidity riskAs the <strong>MPA</strong> has ready access to borrowings from thePWLB, there is no significant risk that it will be unableto raise finance to meet its commitments underFinancial Instruments. Instead, the risk is that theAuthority will be bound to replenish a significantproportion <strong>of</strong> its borrowings at a time <strong>of</strong> unfavourableinterest rates. However, the Authority has notundertaken any borrowings in recent years and in cashflow terms the remaining debt has a manageablematurity pr<strong>of</strong>ile. Future loans taken out will be plannedto complement the existing pr<strong>of</strong>ile. The maturityanalysis <strong>of</strong> all the PWLB borrowings are as per Note H(Page 36).Additionally, to cover short-term commitments, theAuthority maintains two instant access <strong>accounts</strong>,reducing the requirement to realise an investmentbefore it reaches final maturity.All trade creditors and other payables are due to bepaid by the Authority in less than one year.

![Appendix 1 [PDF]](https://img.yumpu.com/51078997/1/184x260/appendix-1-pdf.jpg?quality=85)

![Transcript of this meeting [PDF]](https://img.yumpu.com/50087310/1/184x260/transcript-of-this-meeting-pdf.jpg?quality=85)

![Street drinking in Hounslow [PDF]](https://img.yumpu.com/49411456/1/184x260/street-drinking-in-hounslow-pdf.jpg?quality=85)