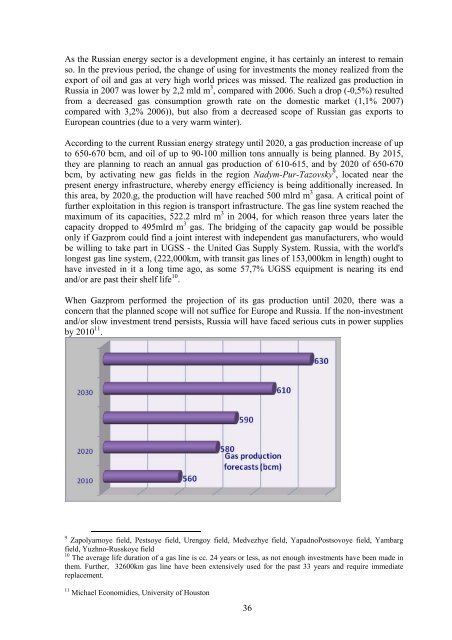

As the Russian energy sector is a development engine, it has certainly an interest to remainso. In the previous period, the change of using for investments the money realized from theexport of oil and gas at very high world prices was missed. The realized gas production inRussia in 2007 was lower by 2,2 mld m 3 , compared with 2006. Such a drop (-0,5%) resultedfrom a decreased gas consumption growth rate on the domestic market (1,1% 2007)compared with 3,2% 2006)), but also from a decreased scope of Russian gas exports toEuropean countries (due to a very warm winter).According to the current Russian energy strategy until 2020, a gas production increase of upto 650-670 bcm, and oil of up to 90-100 million tons annually is being planned. By 2015,they are planning to reach an annual gas production of 610-615, and by 2020 of 650-670bcm, by activating new gas fields in the region Nadym-Pur-Tazovsky 9 , located near thepresent energy infrastructure, whereby energy efficiency is being additionally increased. Inthis area, by 2020.g, the production will have reached 500 mlrd m 3 gasa. A critical point offurther exploitation in this region is transport infrastructure. The gas line system reached themaximum of its capacities, 522.2 mlrd m 3 in 2004, for which reason three years later thecapacity dropped to 495mlrd m 3 gas. The bridging of the capacity gap would be possibleonly if Gazprom could find a joint interest with independent gas manufacturers, who wouldbe willing to take part in UGSS - the United Gas Supply System. Russia, with the world'slongest gas line system, (222,000km, with transit gas lines of 153,000km in length) ought tohave invested in it a long time ago, as some 57,7% UGSS equipment is nearing its endand/or are past their shelf life 10 .When Gazprom performed the projection of its gas production until 2020, there was aconcern that the planned scope will not suffice for Europe and Russia. If the non-investmentand/or slow investment trend persists, Russia will have faced serious cuts in power suppliesby 2010 11 .9 Zapolyarnoye field, Pestsoye field, Urengoy field, Medvezhye field, YapadnoPostsovoye field, Yambargfield, Yuzhno-Russkoye field10 The average life duration of a gas line is cc. 24 years or less, as not enough investments have been made inthem. Further, 32600km gas line have been extensively used for the past 33 years and require immediatereplacement.11 Michael Economidies, University of Houston36

Data show that in 12 years (1990-2002) Gazprom financed the reconstruction of only onethird of all the transit gas lines. For that reason, the capacity from the Nadym-Pur-Tazovskyregion dropped to 522,2 mlrd m 3 (of the projected 577,8 mlrd m 3 ).By 2020 it is necessary to reconstruct 27500 km gas lines. At the same time, Gazprom isplanning to build 28000 km of a new transit gas line. Gazprom and Russia will have todevelop new fields and especially to raise production from Sakhalin I, II, III, IV-VI, and theYamal region.Besides, by 2010, the development of new strategic regions in the Yamal peninsula is beingplanned and that especially refers to sea reefs, including the Obskaya and the Tazovskayaregions, in the Russian Far East and Eastern Siberia.Gasproduction,bcmT-5 Projection of gas production offshore Yamal2011 2015 2020 2025 20307,9 75-115 135-175 200-250 310-360Source: Gazprom Invesment ReportYamal is situated in northwestern Siberia and as a region it produces 78% total oil and 84%gas in Russia. It is considered a project of a strategic interest to Gazprom (since 2002, whenit was proclaimed as such) 12 . The proven gas reserves amount to 13,5 trillion m 3 , and canreach 50 trillion (with reserves on the Kara sea reef). The three largest gas fieldsa(Bovanenko, Kharasavey, NovyPort) contain 5,8 trillion m 3 gas, 100,2 million t gascondensate and 227 mil t oil. The proven reserves of Yamal near those in North America(7,5 trill m 3 ) and South America (7,1 trill m 3 ) together.If it is known that Russia has nearly 600 mlrd m 3 gas production today (20% worldconsumption), and projections show that production in the Yamal region will reach 250-260mlrd m3/annually (2030), then its size and need for investments is clear.The plans of Gazprom and the Russian state clearly show the priorities of building in gasinfrastructure 13 , whereby Gazprom is trying to assume total control over supplies to Europeand central Asian countries, especially by developing a united gas line supply system in theeast of Russia, which ought to link important fields and regions (Sakhalin, Khabrovsk,Vladivostok).The Sakhalin region is rich in oil and gas, which has enabled its fast production in the pastyears. In 2000, the oil and gas industry made up 58% of the industrial ouput of this regionand in 2006 it was 80%. By 2005, the island was the top recipient of foreign investments inRussia and there are almost no unemployed inhbitants (unemployment rate 1-1,5%). Oil andgas reserves are estimated at 14 mlrd bbl (2,2 km 2 ) and 96 trillion m 3 (2700 km 2 ). Theydevelop as part of agreements with international companies, such as Exxon Mobile andShell.12 Preparations for the use of resources from this part begab as early as in 1990, and the largest gas field(Bovanenko field) started working as early as in 1997. The gas for Europe will go through the main lineBovanenko-Ukhta (gas line construction began in July 2008, and the first deliveries are expected by January2011). Besides, towards the end of 2008, a plan was made also for LNG Yamal Project, where Gazprom is stillsearching for a suitable partner ( Shell, ExonMObile, ConocoPhilips..).13 Priorities by 2010-2012: SRTO-Torzhok, Gryayoveta – Vyborg, Nord Stream, expansion The Urengoy gas.After 2012, the priorities are:Bovanenkov – Ukhta, Ukhta – Torzhok trunk gas line,, Murmansk –Volkhov gasline, South Stream gas line37

- Page 3: MONITORING RUSSIA SERBIA RELATIONSI

- Page 11 and 12: Economic Crisis in Russia and Its E

- Page 13 and 14: − Sufficient NGOs, including thin

- Page 15 and 16: Their opponents point out that not

- Page 19 and 20: Russian Authorities: the Decision-M

- Page 21 and 22: Medvedev towards independence may b

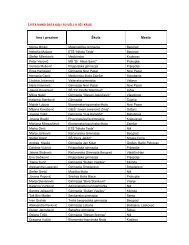

- Page 23 and 24: MinisterDeputy Prime Minister,Minis

- Page 25 and 26: not pay tangible dividends but they

- Page 27: In the internal policy, a tendency

- Page 30 and 31: On the basis of the conclusions of

- Page 32 and 33: the fields of metallurgy and financ

- Page 34 and 35: 16,5% of world gas reserves and 19,

- Page 38 and 39: In 1996, two big consortiums signed

- Page 40 and 41: G-5 Russian gas reservesG-6 Gazprom

- Page 43 and 44: Two Russias: On The Two Dominant Di

- Page 46 and 47: laid itself, i.e. its own empire, a

- Page 48 and 49: In that sense, it is characteristic

- Page 50 and 51: place in the post-cold war world),

- Page 53 and 54: Myths about Russia and Dynamics of

- Page 55 and 56: the support of her advisor and civi

- Page 57 and 58: neutrality was not interrupted even

- Page 59: Russian policy on the Balkans were

- Page 62 and 63: The fanatical course of action by a

- Page 64 and 65: of interest and influence to the se

- Page 66 and 67: It did not have any official policy

- Page 68: Milošević himself assessed in his