<strong>GCC</strong> <strong>financial</strong> <strong>markets</strong><strong>GCC</strong> <strong>financial</strong> governance – international cooperation and compliance with global regulatory and supervisory standards 63Area AE BH KW OM QA SAG20− Full memberIMF − Full member − Full member − Full member − Full member − Full member − Full memberInternational World <strong>Bank</strong> − Full member − Member, except − Full member − Full member − Member, except − Full memberorganisationsIDAIDAUNCTAD − Full member − Full member − Full member − Full member − Full member − Full memberBIS − Full member − Full memberOfficialsurveillance<strong>Bank</strong>ingsupervisionSecurities<strong>markets</strong>AccountingInsuranceInfrastructureCorporategovernanceFinancial crimeSovereigninvestmentsSovereign debtIMF-World <strong>Bank</strong>Surveillance− FSSA 2007− IOSCO FSAP2007− FSSA 2006 − FSSA 2004− IOSCO FSAP2004− FSSA 2010− FSAP 2010 − FSAP 2007 − FSSA 2006− FSAP 2011Basel 2 − Implemented − Implemented − Implemented − Implemented − Implemented − ImplementedBasel 3− Implementation − Implementation in − Implementation − Implementation − Implementation − ImplementationunderwayprogressunderwayintendedunderwayunderwayBCBS− Sufficiently strong − Sufficiently strong− Sufficiently strongadherenceadherenceadherenceIOSCO − Full member − Full member − Full member − Affiliate member − Full memberIFRSAAOIFIIAISBIS CPSS− IFRS as publishedby IASB required− No local GAAP− IFRS not in use forSMEs as yet− AAOIFI FASadopted− Full member− Signatory MMoU− IFRS as publishedby IASB required− No local GAAP− AAOIFI FASadopted− IFRS and IFRS forSMEs aspublished by IASBrequired− IFRS as publishedby IASB required− IFRS for SMEsprohibited− IFRS and IFRS forSMEs aspublished by IASBrequired− AAOIFI FASreporting permitted− AAOIFI FASadopted− IFRS as publishedby IASB requiredIFRS is prohibitedfor SMEs− Guidelines basedon AAOIFI− Full member − Full member − Full memberMENA-OECD − Participant − Participant − Participant − Participant − ParticipantFATFOECDGAPP− Full member ofMENAFATF− Substantiallyimplemented− IWG-SWFmember− Full member ofMENAFATF− Substantiallyimplemented− IWG-SWFmember− Full member ofMENAFATF− IWG-SWFmember− Full member ofMENAFATF− IWG-SWFobserverIFSWF − Full member − Full member − Full member − PermanentobserverParis Club − Abu Dhabi is− AssociatedassociatedmembermemberIIF Principles − DIFC representedon PrinciplesConsultativeGroup− Full member ofMENAFATF− Substantiallyimplemented− IWG-SWFmember− Full member− Full member− Full member ofMENAFATF− IWG-SWFobserver− Permanentobserver− SAMA representedon Group ofTrustees of thePrinciplesNote:− World <strong>Bank</strong>: World <strong>Bank</strong> Group, including International <strong>Bank</strong> for Reconstruction and Development (IBRD), International Development Association (IDA) , International Finance Corporation, MultilateralInvestment Guarantee Agency (MIGA), International Centre for Settlement of Investment Disputes (ICSID)− FSAP: IMF-World <strong>Bank</strong> Financial Sector Assessment Programme− FSSA: IMF-World <strong>Bank</strong> Financial Sector Stability Assessment− FSA: IMF-World <strong>Bank</strong> Financial Sector Assessment− Basel: Framework for banking regulation and supervision by the Basel Committee on <strong>Bank</strong>ing Supervision− BCBS: Core Principles for Effective <strong>Bank</strong>ing Supervision by the Basel Committee on <strong>Bank</strong>ing Supervision− IOSCO: Objectives and Principles of Securities Regulation by the International Organization of Securities Commissions− IFRS: International Financial Reporting Standards by the International Accounting Standards Board− AAOIFI: Financial Accounting Standards (FAS) by the Accounting and Auditing Organization for Islamic Financial Institutions− IAIS: Insurance Core Principle and Methodology by the International Association of Insurance Supervisors− MMoU: IAIS Multilateral Memorandum of Understanding on Cooperation and Information Exchange− BIS CPSS: Core Principles for Systemically Important Payment Systems, CPSS/IOSCO Recommendations for Securities Settlement Systems and CPSS/IOSCO Recommendations for CentralCounterparties issues by the Committee on Payment and Settlement Systems at the <strong>Bank</strong> for International Settlements− MENA-OECD: MENA-OECD Initiative on Governance and Investment for Development− FATF: Recommendations on Money Laundering and Special Recommendations on Terrorist Financing by the Financial Action Task Force− OECD: Internationally Agreed Tax Standard by the OECD Global Forum on Transparency and Exchange of Information for Tax Purposes− GAPP: Generally Accepted Principles and Practices (Santiago Principles) by the International Working Group of Sovereign Wealth Funds (IWG-SWF)− IFSWF: International Forum of Sovereign Wealth Funds− Paris Club: Principles by the Paris Club on sovereign debt policy− IIF: Principles for Stable Capital Flows and Fair Debt Restructuring by the Institute of International FinanceSources: BCBS, IMF, World <strong>Bank</strong>, OECD, BIS, FSI, IOSCO, IASB, AAOIFI, IAIS, FATF, FATF-MENA, OECD, PWC, national central banks, national regulatory and supervisory authorities, other publicsources, DB <strong>Research</strong>32 | November 14, 2012 Current Issues

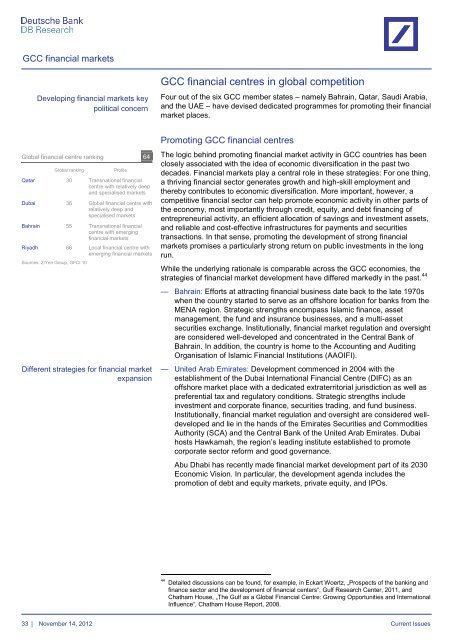

<strong>GCC</strong> <strong>financial</strong> <strong>markets</strong>Developing <strong>financial</strong> <strong>markets</strong> keypolitical concern<strong>GCC</strong> <strong>financial</strong> centres in global competitionFour out of the six <strong>GCC</strong> member states – namely Bahrain, Qatar, Saudi Arabia,and the UAE – have devised dedicated programmes for promoting their <strong>financial</strong>market places.Global <strong>financial</strong> centre ranking 64Global rankingProfileQatar 30 Transnational <strong>financial</strong>centre with relatively deepand specialised <strong>markets</strong>Dubai 36 Global <strong>financial</strong> centre withrelatively deep andspecialised <strong>markets</strong>Bahrain 55 Transnational <strong>financial</strong>centre with emerging<strong>financial</strong> <strong>markets</strong>Riyadh 66 Local <strong>financial</strong> centre withemerging <strong>financial</strong> <strong>markets</strong>Sources: Z/Yen Group, GFCI 10Different strategies for <strong>financial</strong> marketexpansionPromoting <strong>GCC</strong> <strong>financial</strong> centresThe logic behind promoting <strong>financial</strong> market activity in <strong>GCC</strong> countries has beenclosely associated with the idea of economic diversification in the past twodecades. Financial <strong>markets</strong> play a central role in these strategies: For one thing,a thriving <strong>financial</strong> sector generates growth and high-skill employment andthereby contributes to economic diversification. More important, however, acompetitive <strong>financial</strong> sector can help promote economic activity in other parts ofthe economy, most importantly through credit, equity, and debt financing ofentrepreneurial activity, an efficient allocation of savings and investment assets,and reliable and cost-effective infrastructures for payments and securitiestransactions. In that sense, promoting the development of strong <strong>financial</strong><strong>markets</strong> promises a particularly strong return on public investments in the longrun.While the underlying rationale is comparable across the <strong>GCC</strong> economies, thestrategies of <strong>financial</strong> market development have differed markedly in the past. 44— Bahrain: Efforts at attracting <strong>financial</strong> business date back to the late 1970swhen the country started to serve as an offshore location for banks from theMENA region. Strategic strengths encompass Islamic finance, assetmanagement, the fund and insurance businesses, and a multi-assetsecurities exchange. Institutionally, <strong>financial</strong> market regulation and oversightare considered well-developed and concentrated in the Central <strong>Bank</strong> ofBahrain. In addition, the country is home to the Accounting and AuditingOrganisation of Islamic Financial Institutions (AAOIFI).— United Arab Emirates: Development commenced in 2004 with theestablishment of the Dubai International Financial Centre (DIFC) as anoffshore market place with a dedicated extraterritorial jurisdiction as well aspreferential tax and regulatory conditions. Strategic strengths includeinvestment and corporate finance, securities trading, and fund business.Institutionally, <strong>financial</strong> market regulation and oversight are considered welldevelopedand lie in the hands of the Emirates Securities and CommoditiesAuthority (SCA) and the Central <strong>Bank</strong> of the United Arab Emirates. Dubaihosts Hawkamah, the region’s leading institute established to promotecorporate sector reform and good governance.Abu Dhabi has recently made <strong>financial</strong> market development part of its 2030Economic Vision. In particular, the development agenda includes thepromotion of debt and equity <strong>markets</strong>, private equity, and IPOs.44 Detailed discussions can be found, for example, in Eckart Woertz, „Prospects of the banking andfinance sector and the development of <strong>financial</strong> centers“, Gulf <strong>Research</strong> Center, 2011, andChatham House, „The Gulf as a Global Financial Centre: Growing Opportunities and InternationalInfluence“, Chatham House Report, 2008.33 | November 14, 2012 Current Issues