Defined Benefit Pension Plan SPD - uphs

Defined Benefit Pension Plan SPD - uphs

Defined Benefit Pension Plan SPD - uphs

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

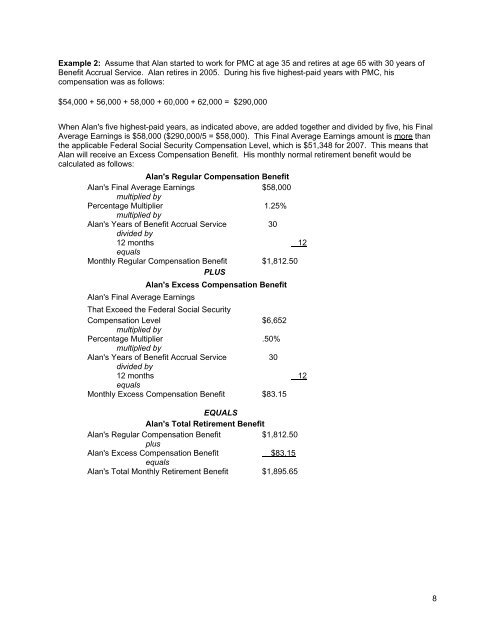

Example 2: Assume that Alan started to work for PMC at age 35 and retires at age 65 with 30 years of<strong>Benefit</strong> Accrual Service. Alan retires in 2005. During his five highest-paid years with PMC, hiscompensation was as follows:$54,000 + 56,000 + 58,000 + 60,000 + 62,000 = $290,000When Alan's five highest-paid years, as indicated above, are added together and divided by five, his FinalAverage Earnings is $58,000 ($290,000/5 = $58,000). This Final Average Earnings amount is more thanthe applicable Federal Social Security Compensation Level, which is $51,348 for 2007. This means thatAlan will receive an Excess Compensation <strong>Benefit</strong>. His monthly normal retirement benefit would becalculated as follows:Alan's Regular Compensation <strong>Benefit</strong>Alan's Final Average Earnings $58,000multiplied byPercentage Multiplier 1.25%multiplied byAlan's Years of <strong>Benefit</strong> Accrual Service 30divided by12 months 12equalsMonthly Regular Compensation <strong>Benefit</strong> $1,812.50PLUSAlan's Final Average EarningsAlan's Excess Compensation <strong>Benefit</strong>That Exceed the Federal Social SecurityCompensation Level $6,652multiplied byPercentage Multiplier .50%multiplied byAlan's Years of <strong>Benefit</strong> Accrual Service 30divided by12 months 12equalsMonthly Excess Compensation <strong>Benefit</strong> $83.15EQUALSAlan's Total Retirement <strong>Benefit</strong>Alan's Regular Compensation <strong>Benefit</strong> $1,812.50plusAlan's Excess Compensation <strong>Benefit</strong>__$83.15equalsAlan's Total Monthly Retirement <strong>Benefit</strong> $1,895.658