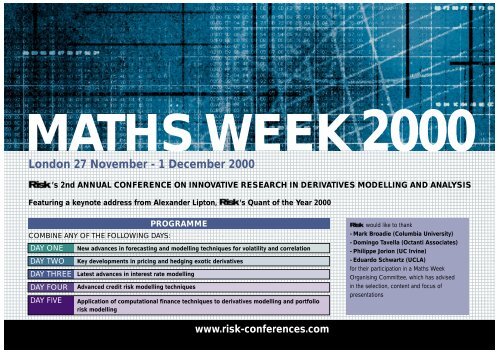

London 27 November - 1 December 2000

London 27 November - 1 December 2000

London 27 November - 1 December 2000

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Day One - New advances in forecasting and modelling techniques for volatility and correlationThe debate over stochastic volatility versus implied volatility surfaces to model and price derivatives is refreshed and renewed by a first class selection of expert academics andpractitioners. Nicholas Dunbar, 's Technical Editor, will launch the event by introducing a keynote address by Alexander Lipton, 's Quant of the Year <strong>2000</strong>. Alex will present asnapshot of derivatives modelling techniques by assessing past methods, examining the expanding scope of current techniques and speculating on future trends. The day, which includesa special masterclass will be chaired by Eric Reiner, Managing Director, UBS WARBURG, who will lead the discussions and provide continuity and scrutiny on behalf of delegates.08.0008.3008.4009.4010.4011.0012.0013.00Registration and breakfastChairman's opening remarksKEYNOTE ADDRESS: INTERACTIONS BETWEEN MATHEMATICS AND FINANCE:PAST, PRESENT, AND FUTURE· A new life of old ideas: option pricing via actuarial methods and the Esscher transformation· New applications of old tools: symmetry transforms, regular and singular perturbations, eigenfunctionexpansions, etc.· Path-dependent options and custom-made financial products· A unified treatment of path-dependent options via analytical, perturbative, and numericalmethods· Options on the trading account in financial and energy markets· Deviations from the Black-Scholes paradigm and their qualitative implications for pricing andhedging· New directions: the future merger of financial engineering, actuarial science, game theory, etc.MASTERCLASSSTOCHASTIC VOLATILITY CORRECTION TO BLACK-SCHOLES· Deriving a stochastic model from S&P 500 data· Articulating the variation in the data on a set of relevant time scales- tick by tick scale- scale on the order of weeks· Volatility as a fast mean reverting on a scale on the order of days· Systematic day effect in the dataMorning breakMASTERCLASS (CONTINUED)STOCHASTIC VOLATILITY CORRECTION TO BLACK-SCHOLES· Considering stochastic volatility models to account for the "smile" in European derivatives· Data analysis to infer that the volatility process is "running" on a faster scale than typicalmaturities· Derivation of singular perturbation of the Black-Scholes equation· Identifying the leading correction and calibrating it from derivative prices· Proving that correction is model independent and stable in time· Applications to other exotic or American derivativesMATHEMATICAL MODELS FOR REAL OPTIONS· Consideration of a number of models for investments in real assets- production scheduling- sequential entry and exit decisions- discretionary stopping· Demonstration that the pricing of investments conforming to these models gives rise toexplicitly solvable stochastic optimisation problems· Solutions show that the optimal strategies can take qualitatively different forms, depending onthe problem's dataLunchEric S. Reiner, Managing Director, UBS WarburgAlex Lipton, Deutsche Bank AG, New YorkAlex Lipton is a Vice President at the Deutsche Bank Forex Product Development Group and an AdjunctProfessor of Mathematics at the University of Illinois. Upon receiving Ph.D. in pure mathematics from MoscowState University he worked for the Russian Academy of Sciences. After arriving in the United States as arefugee, Alex worked at MIT, the University of Massachusetts and the University of Illinois where he was a FullProfessor of Applied Mathematics; in addition, for several years he was a consultant at Los Alamos NationalLaboratory. As an academic, Alex conducted research and taught numerous courses on analytical andnumerical methods for fluid and plasma dynamics, and mathematical finance. In January, 1997, Alex joint theGlobal Analytics team at Bankers Trust where he was responsible for developing new pricing and riskmanagement tools for equity, FX, and FI derivative products. In June, 1999, Alex joint the Deutsche Bank ForexProduct Development Group where he is responsible for modelling exotic multi-currency options includingstochastic volatility aspects. Alex is the author of two books ("Magnetohydrodynamics and spectral theory",Kluwer, 1989, and "Mathematical methods for foreign exchange", to be published shortly by World ScientificPublishing Co.), about 80 research papers, and approximately 40 technical reports. In January, <strong>2000</strong>, Alexbecame the first recipient of the prestigious Quant of the Year Award by Risk Magazine.Knut Solna, University of California at IrvineKnut Solna is Assistant Professor at the University of California Irvine. I received his PhD in 1997 from StanfordUniversity and has been a Wylie instructor in the Departement of Mathematics at the University of Utah untilthis year. He is working on random media and the analysis of their scale contents. In collaboration with J.P.Fouque, G. Papanicolaou and R. Sircar he is developing tools for identifying volatility time-scales from observedreturns. His publications can be found at: http://www.math.utah.edu/~solna/Jean-Pierre Fouque, Professor of Mathematics, North Carolina State UniversityJean-Pierre Fouque studied at the University Pierre et Marie Curie in Paris. He was "Charge de Recherche" atthe French CNRS and "Maitre de Conferences" at the Ecole Polytechnique until 1998. He is now AssociateProfessor of Mathematics at the North Carolina State University.The talk is based on research presented in:· Mean-reversion of S&P 500 volatility by J.P Fouque G. Papanicolaou, R. Sircar and K. Solna and also on thematerial presented in the book:· Derivatives in Financial Markets with Stochastic Volatility by J.P Fouque G. Papanicolaou and R. Sircar.Mihail Zervos, King's College, <strong>London</strong>Mihail Zervos graduated from the Department of Electrical Engineering, National Technical University of Athensin 1990. He received his MSc degree in control systems and his PhD degree in stochastic control andoptimisation in 1991 and 1995, respectively, from Imperial College, University of <strong>London</strong>. During the years1995-<strong>2000</strong> he was a lecturer in the Department of Statistics, University of Newcastle.His current research interests include stochastic analysis, stochastic control and optimisation, optimal stoppingproblems, valuation of investment decisions and investments in real options, options of American type,derivative pricing in incomplete markets.

14.0015.0016.0016.3017.3017.40FORECASTING IMPLIED VOLATILITY SURFACES· Stochastic volatility and the implied volatility smile· The implied volatility surface as state variable· Full-blown estimation vs. reduced form smile calibration· The sticky strike and sticky delta rule· Singular perturbations : the Fouque-Papanicolaou-Sircar (FPS) approach· Behavior of at-the-money volatility in the different approaches.· Implementation of the FPS approach to smile forecasting.· Empirical comparison of price forecast errors in sticky delta, sticky strike and FPS methods· A modified FPS method for smile forecastingTHE INSTABILITY AND NON-UNIQUENESS OF IMPLIED VOLATILITY· Establishing the non-linear relationship between model parameters and observable data incontrast to many non-financial modelling problems- particular importance in inferring volatility from price data· Explaining the relevance of the Inverse Function Theorem and its potential for failure or nearfailure in the computation of implied volatility- examples of the often meaningless nature of implied volatility (generation of fake skews andsmiles from noisy price data and multiple solutions for implied volatility for exotics andconvertibles)· Highlighting the need for detailed understanding of the noise within price data used tocalibrate models and the potential for misguided detailed volatility modelling in the presence ofunstable inversion mappingsAfternoon breakIMPACT OF MULTIVARIATE CORRELATION AND VOLATILITY MODELS· Examining the impact of models within a portfolio optimisation framework- perfect foresight of the expected return component· Comparing the different models within an absolute and relative risk measure· RecommendationsChairman's closing remarksEnd of day oneRama Cont, CNRS Research Scientist, Ecole PolytechniqueRama Cont is CNRS Research Fellow in Applied Mathematics at the Centre de Mathematiques Appliquées,Ecole Polytechnique (France) and scientific director of Frontiers in Finance. Cont's research interests includeinverse problems in financial modeling, stochastic partial differential equations and applications to interest ratemodeling, multiresolution analysis of irregular time series and applications of extreme value theory. He haspreviously taught courses on mathematical finance and stochastic processes at Ecole Polytechnique, Universitede Paris IX, Ecole Superieure d'Aeronautique, American University of Paris and HEC School of Management.He holds a PhD from the Université de Paris XI and a degree in engineering from Ecole Polytechnique.Dr William T. Shaw, Director, Nomura International plcDr William Shaw received a B.A. in Mathematics from King's College at the University of Cambridge in 1980and a D. Phil in Mathematical Physics from Oxford University in 1984. He subsequently held postdoctoral andteaching positions at Cambridge and M.I.T. before beginning a career as a consultant to government andindustry. At present, he is responsible for modelling equities and equity derivatives in the Quantitative AnalysisGroup at Nomura International plc, in <strong>London</strong>. He also teaches pure and applied mathematics at BalliolCollege, Oxford. His most recent book, "Modelling Financial Derivatives with Mathematica", was published byCambridge University Press in 1998. He also co-authored "Applied Mathematica" (Addison Wesley, 1993),and is completing a book on complex analysis. He has authored over 30 papers on other topics includingapplied electromagnetics, string theory and environmental diffusion, and is a specialist in the numerical analysisof financial problems.Frederick Bourgoin, Associate, Barclays Global InvestorsFrederick Bourgoin is an Associate in the Active Fixed Income Portfolio Management team at Barclays GlobalInvestors in <strong>London</strong>. Prior to joining Barclays Global Investors, Frederick Bourgoin was Risk manager andQuantitative analyst at UBK Asset Management. He holds a MSc in Finance from ESSEC Graduate BusinessSchool and a post-graduate Degree in Econometrics from Pantheon-Sorbonne University. He has beenstudying GARCH models for the last six years.D A Y O N E

Day Two - Key developments in pricing and hedging exotic derivativesFollowing from day one on volatility and correlation modelling techniques, the theme of stochastic volatility against implied volatility surfaces is extended to exotic derivatives. Toplevel researchers present new and varied techniques with vast experience in practically applying new methods. This practical focus will be maintained by Stephen Blyth fromMorgan Stanley Dean Witter.08.0008.3008.4009.4010.4011.0012.0013.0014.00Registration and breakfastChairman's opening remarksTRADING VOLATILITY PRODUCTS· Analysing the growing trend of correlation and volatility based products- greater historical volatility levels- correlation risk in quanto, index and basket options· Successfully hedging the portfolio with correlation and volatility based products· Answering key questions regarding volatility contracts- how to hedge volatility contracts- using volatility contracts rather than options· Creating covariance contracts from volatility contractsEXOTIC OPTIONS AND EXOTIC UNDERLYINGS· Credit, insurance, weather and electricity as option underlyings· Catastrophic call spreads and arbitrage pricing of insurance derivatives· Credit derivatives as an example of market incompleteness· The limits of the Merton jump-diffusion process to represent electricity price spikes and fat tails· Seasonality effects and mean reversion in commodities markets· Weather derivatives as Asian options in a non-Black-Scholes world· Hedging weather derivatives using insurance derivatives and exotic energy derivativesMorning breakLEVY PROCESSES IN OPTION PRICING, VG AND BEYOND· The Theoretical Case for Pure Jump Processes· The Empirical Case for such Processes· The VG model and its Properties· The Generalization to CGMY and learning how to change measure· Calibrating the surface parsimoniously using VG Markov and CGMYSA· Exotic Option Pricing using Vanilla calibrated StructuresA NEW METHODOLOGY FOR STATIC HEDGING OF BARRIER OPTIONS· Methodology that enables direct identification of statically replicating European optionportfolios for barrier options· Demonstrating that results are valid for barrier options with:- completely general knock-out/knock-in sets and- hold for both state-dependent volatility and jumps· Application of our technique to Bermudan options, lookback options, and fixed incomeproducts· Impact of stochastic volatilityLunchEXTENDING BLACK & SCHOLES TO COVER STOCHASTIC VOLATILITY MODELS· We take a closer look at equities markets specific features such as- skewness of the return distribution of stocks and indices- discrete dividend payments of stocks and indices- cross currency products (quanto and composite options)and their interplay.· The standard approaches to incorporate these in the Black and Scholes framework areextended to cover local and stochastic volatility models.Stephen Blyth, Morgan Stanley Dean WitterFrançois Mantion, Head of Research & Advanced Risk (<strong>London</strong>), Chase Manhattan BankFrançois Mantion is Head of Research and Advanced Risk in <strong>London</strong> for the FX Options/Commodities Groupof The Chase Manhattan Bank. He is responsible for the analysis of currency/metal/energy option markets, inparticular the pricing and hedging of new exotic products. Prior to joining Chase in 1996, he was with theCentre for Quantitative Finance at Imperial College. He is a graduate from the French Grande Ecole SUPELECand holds a PhD in Mathematical Finance.Hélyette Geman, Professor of Finance, Université de Paris Dauphine and ESSECHélyette Geman is Professor of Finance ant the University of Paris Dauphine and at ESSEC GraduateBusiness School. She is a graduate from Ecole Normale Superieure, holds a master's degree in theoreticalphysics and a Ph.D. in mathematics from the University of Paris Pierre et Marie Curie and a Ph.D. in Financefrom the University of Paris Pantheon Sorbonne. Previously a Director at Caisse des Depots in charge ofresearch and development, she is currently a Scientific Advisor for major financial institutions and industrialfirms. In 1993, Dr Geman received the first prize of the Merrill Lynch awards for her work on exotic options.She is also President of the Bachelier Finance Society and the author of the book "Insurance and WeatherDerivatives" published by Risk.Dilip Madan, Professor of Finance, University of MarylandDilip Madan joined the Robert H. Smith School of Business in 1988 where he now specializes in mathematicalfinance. His work is dedicated to improving the quality of financial valuation models, enhancing the performanceof investment strategies, and advancing the understanding and operation of efficient risk allocation in moderneconomies. Of particular note are contributions to the field of option pricing and the pricing of default risk. Heis a founding member and President Elect of the Bachelier Finance Society and Associate Editor forMathematical Finance. Recent contributions have appeared in European Finance Review, Finance andStochastics, Journal of Computational Finance, Journal of Financial Economics, Journal of Financial andQuantitative Analysis, Mathematical Finance and Review of Derivatives Research.Jesper Andreasen, Vice President, General Re Financial ProductsJesper Andreasen is a Vice President in the quantitative research department at General Re Financial Productsin <strong>London</strong>, where he since 1997 has worked on development and implementation of models for fixed income,foreign exchange, and equity derivatives. His research interests include: exotic options, volatility skews andsmiles, yield curve models and numerical methods. Jesper holds a Ph.D. in mathematical finance from AarhusUniversity.Oliver Brockhaus, Vice President (Equity Derivatives), The Chase Manhattan BankOliver Brockhaus recently joined Chase Manhattan, where he is responsible for Equity Derivatives QuantitativeResearch Europe and Asia. Before entering finance in 1996 as Quantitative Researcher for Deutsche Bank in<strong>London</strong> he was a consultant at Andersen Consulting. He was awarded a masters degree (DEA) in probabilitytheory at the University Pierre et Marie Curie in Paris in 1991 and holds a PhD in mathematics from theUniversity of Bonn.

15.0016.0016.3017.3017.40EXOTIC OPTIONS, VOLATILITY SMILES, LAPLACE TRANSFORMS, ANDEIGENFUNCTION EXPANSIONS· Pricing Options when the underlying follows a scalar diffusion process: general results- Exponentially-stopped options, static pricing ODE and its fundamental solutions- Pricing Exponentially Stopped Single- and Double-Barrier and Lookback Options- Inverting the Laplace transform numerically via Abate-Whitt algorithm and analytically viaeigenfunction expansions· The CEV Process- Volatility smiles generated by the CEV model- Pricing of barrier and lookback options under the CEV process via Laplace transforms- Inverting Laplace transforms analytically via eigenfunction expansions· Pricing and Hedging Exotic Options with Volatility Smiles: ExamplesAfternoon breakROBUST HEDGING OF BARRIER OPTIONS· Black-Scholes only works if the model is correct· Call prices contain information about price movements· Only some models are consistent with call prices· Vanilla calls as hedging instruments· Super-replicating strategies· A range of possible prices for exotic options· Arbitrage-free bounds· Barrier puts and calls, lookback options· Simple hedges can be "optimal" for hedgingChairman's closing remarksEnd of day twoVadim Linetsky, Northwestern UniversityVadim Linetsky is an Associate Professor in the Department of Industrial Engineering and ManagementSciences at Northwestern University in Evanston where he teaches courses in financial engineering andstochastic modeling. Previously he was an Assistant Professor at the University of Michigan in Ann Arbor. Hiscurrent research interests are in asset pricing, exotic options, term-structure models and credit risk. His paperson option pricing appeared in Mathematical Finance, Computational Economics and RISK. Previously, he was aresearcher in mathematical physics, specializing in quantum mechanics and quantum field theory. Dr. Linetskyhas a Ph.D. in Mathematical Physics from the Russian Academy of Sciences, as well as an MS in electricalengineering.David Hobson, Senior Lecturer, University of BathDr David Hobson is a Senior Lecturer in Statistics at the University of Bath. Prior to this, he worked on themodelling of financial markets at the Judge Institute of Management Studies, University of Cambridge. He isinterested in Brownian motion and the theory of diffusions as well as applications to finance. These applicationsinclude the study of stochastic volatility, passport options and robust hedging strategies for exotic options.D A Y T W O

Day Three - Latest research in interest rate modellingInnovations in existing models are contrasted with a new geometric methodology for interest rate modelling in a specially extended masterclass. Leading names will provide thecontent and a practitioner's orientation will be upheld by Dr. Peter Jäckel from The Royal Bank of Scotland in his role as chairman.08.0008.3008.4009.4010.4011.0012.0013.00Registration and breakfastChairman's opening remarksMARKOV INTEREST RATE MODELS AND CALIBRATION· Short rate models· Market rate models· Numerical implementation· Calibration to options· Calibration to volatility smiles· Pricing complex interest rate derivativesMONTE CARLO IN THE BGM/J FRAMEWORK: using a non-recombining tree todesign a new pricing method for Bermudan swaptions· Choosing an appropriate instantaneous volatility structure· Calibrating to European swaptions· Predictor-Corrector handling of the state dependent drift coefficients· Using a non-recombining tree to select the best coordinate system for the parametrisation ofthe exercise boundary· Numerical resultsMorning breakA VARIANCE GAMMA BGM MODEL FOR PRICING EXOTIC INTEREST-RATEDERIVATIVES· Review of the variance gamma model for stock evolution.· Fitting forward rates into the variance gamma setting; changes of numeraire· Time-dependent instantaneous volatility in the variance gamma model· Smiles produced by the modelA MARTINGALE APPROACH TO RISK COMPUTATION· Background- Gradual retirement of long-dated US Treasuries; MBS used as substitution- "Monte Carlo over Monte Carlo" in risk computation for portfolios with significant positions inMBS or other agency issues· Discrete-Time Analysis- Tree Construction- Markov Property- Girsanov Transformation- Prepayments· Continuous-Time Analysis- Boundary Conditions- Fokker-Planck Equation- Jump Conditions- Computational Considerations· Empirical AnalysisLunchDr. Peter Jäckel, Quantitative Research Centre, The Royal Bank of ScotlandAnlong Li, Director of Quantitative Research, Citadel Investment Group, L.L.C.Before joining Citadel Investment Group, Mr Li was Senior Vice President and head of Structured ProductsGroup for fixed-income derivatives at ABN AMRO North America in Chicago, responsible for structuring,trading and the development of new derivative products, from 1996 to 1999. He was head of ProductDevelopment and Derivative Research for Global Derivatives at the First National Bank of Chicago in Chicago,IL, from 1994 to 1996. He also worked in derivative products at both Salomon Brothers and Lehman Brothers.Mr Li received his Ph.D. in Operations Research from Case Western Reserve University. His work appears inmany academic as well as professional journals.Dr. Peter Jäckel, Quantitative Research Centre, The Royal Bank of ScotlandDr. Peter Jäckel received his DPhil from Oxford University in 1995. In 1997, he moved into quantitative analysisand financial modelling when he joined Nikko Securities. Currently, he works as a Senior Quantitative Analyst inthe Quantitative Research Centre of the enlarged Royal Bank of Scotland Group. His primary responsibilitiesare independent model validation and derivatives modelling research but he is also consulted firm-wide onvarious risk assessment and derivatives pricing methodology issues.Dr Mark S. Joshi, Quantitative Research Centre, Group Risk, Royal Bank of ScotlandBiographical note:BA (Oxon) 1990, Phd (MIT) 1994 In the theory of PDEs. 1994-1999 Assistant Lecturer, Department of PureMathematics and Mathematical Statistics, University of Cambridge, 1999-<strong>2000</strong>, Senior Quantative Analyst,Quantitative Research Centre, Natwest Group Risk the RboS Group Risk, researching derivatives pricing anddoing model validation.Bernard Lee, Director of Financial Engineering Consulting, SunGard Trading and Risk SystemsProfessor Nicos Christofides, Director, Centre for Quantitative Finance, Imperial College <strong>London</strong>Bernard Lee, CFA, is Director of Financial Engineering Consulting at SunGard Trading and Risk Systems andResearcher at the Centre of Quantitative Finance at Imperial College, <strong>London</strong>. He holds undergraduate andpostgraduate degrees in finance, applied mathematics and computer science from Princeton and Stanford, andis a charter holder of the CFA designation. Prior to joining SunGard, he worked for two proprietary tradingdesks and ran a relative-value arbitrage book, among taking other "quant" positions in the industry. Mr. Lee haspublished in Risk Magazine, Journal of Risk Finance, Derivatives Strategy, Derivatives Week and FinancialEngineering News, as well as co-edited the Infinity Guide to FAS 133/IAS 39 Compliance. (At press time, Mr.Lee has accepted an offer to join the Financial Commodities Risk Consulting Group at Arthur Andersen LLP inNew York.)Professor Nicos Christofides graduated from Imperial College in 1963 (BSc) and 1966 (PhD) in ElectricalEngineering. He has been a member of academic staff at Imperial College since 1967 and was appointed theProfessor of Operational Research in 1984. His teaching and research includes Graph Theory, Networks, andOptimisation. Since its inception in 1992 he has been a Director of the Centre for Quantitative Finance andconcentrates on the application of mathematical techniques to financial problems. Professor Christofides hassupervised over 80 successful PhD students in Imperial College and published over 100 papers and fourbooks in fields as diverse as distribution systems (location, routing and scheduling), cost benefit analysis,computer vision and quantitative finance.

14.0015.0016.0016.3017.3017.40MASTERCLASSSTATISTICAL GEOMETRY IN TERM STRUCTURE MODELLING: THEORY ANDAPPLICATIONPart 1: Theory· Review of information geometry and its applications to modern statistics· Theory of probability distribution comparisons and statistical manifolds· General characterisation of positive interest rate term structures by use of statistical geometry· New formulation for Heath-Jarrow-Morton term structure dynamics as a process on a statisticalmanifoldMASTERCLASS (CONTINUED)STATISTICAL GEOMETRY IN TERM STRUCTURE MODELLING: THEORY ANDAPPLICATIONPart 2: Application· Principal moment dynamics for yield curve structures· Statistical divergences for term structures· Quasi-lognormal models· Canonical parametric models and calibration· Hilbert space dynamics for infinite dimensional term structure movements: statistical geometryas a natural setting for interest rate string theoryAfternoon breakMATHEMTAICAL FOUNDATION OF CONVEXITY CORRECTION CALUCLATIONS FORPRICING EXOTIC INTEREST RATE DERIVATIVES· Convexity Correction and Change of Numeraire· Options on Convexity Corrected Rates· Linear Swap Rate Model· Single Index Products- LIBOR in Arrears- Constant Maturity Swap- Diffed LIBOR- Diffed CMS· Multi-Index Products- Rate Based Spread Options- Spread Digital- Other Multi-Index Products- Comparison with Market Models· A Warning on Convexity CorrectionChairman's closing remarksEnd of day threeDr. Dorje C. Brody, Royal Society University Research Fellow, Imperial CollegeDr. Brody is a Royal Society University Research Fellow at Imperial College, <strong>London</strong>. He also holds a ResearchFellowship at Churchill College, Cambridge, where he is based at the Centre for Mathematical Sciences,Cambridge University. His research specialities include mathematical finance and its applications to interestrate modelling, statistical mechanics, and the foundations of quantum theory.Professor Lane P. Hughston, Centre for Financial Mathematics, King's College <strong>London</strong>Lane Hughston is Professor of Financial Mathematics at King's College <strong>London</strong>. He received his D. Phil. inMathematics from Oxford University. Before joining King's he was Director of Derivative Product RiskManagement at Merrill Lynch, where he was responsible for managing the development of pricing models forinterest rate and foreign exchange derivatives, and other products. His research interests include: mathematicalfinance and its applications in an investment banking context; the pricing and risk management of derivatives;martingale models for interest rates and foreign exchange; the impact of transaction costs; stochastic volatilitymodels; and applications of information geometry and stochastic differential geometry. For more informationsee: http://www.mth.kcl.ac.uk/Dr Antoon Pelsser, Sr Actuary, Nationale-NederlandenDr. Antoon Pelsser is a Senior Actuary at the insurance company Nationale-Nederlanden (part of ING group)and is responsible for the calculation of market values and risk measures of the insurance portfolio. From 1993until <strong>2000</strong> he was Vice President at ABN-Amro Bank in Amsterdam, where he was responsible for thedevelopment of pricing models for exotic interest rate derivative products. During that time he also held apart-time position as an assistant professor at the Erasmus University of Rotterdam in the Department ofFinance. In 1999 his PhD thesis on interest rate derivative models has been awarded by the Royal DutchAcademy of Sciences the Christiaan Huygens prize. Dr. Pelsser has been published in several academicjournals including Finance and Stochastics, European Journal of Operational Research, Journal of FinancialEngineering and the Journal of Derivatives. He is also author of the book Efficient Methods for Valuing InterestRate Derivatives, published by Springer Verlag.DAY THREE

Day Four - Advanced credit risk modelling techniquesThe growing credit derivatives market is the focal point of day four's presentations. A range of approaches is described and explained by eminent academics and practitioners withspecial attention given to issues surrounding the pricing of basket credit derivatives. The chairman is Douglas Lucas from Chase Securities who will also open the day with a surveyof key issues in credit risk modelling.08.0008.3008.4009.4010.4011.0012.00Registration and breakfastChairman's opening remarksTHE CHALLENGES OF CREDIT RISK MODELLING- The portfolio credit analysis ideal (and its uses)- The messy practicalities· default probability· default correlation· loss in default· losses due to changes in credit spreads- More messy practicalities with derivatives· collateralization and other credit enhancements· counterparty netting· correlation of default and exposureCAPITITAL ALLOCATION TECHNIQUES IN CREDIT PORTFOLIOS· Portfolio models based on Threshold Models· Economic Capital Definition· Standard Allocation Techniques· Alternative Capital Definition· Allocation Techniques based on Conditional Expected Shortfall· An Example for the Comparison of different Allocation TechniquesMorning breakVALUATION IN PORTFOLIO RISK CALCULATION· Stand alone Valuation- approaches- calibration of a structural model to European bond data- limits of the calibration - liquidity effects, asset classes and term effects· Portfolio risk calculation and measures- default correlation - approaches- the loan loss distribution: simulation approaches- unexpected loss, Sharpe ratios, RAROC- valuation: Standalone vs. portfolio. Portfolio entry hurdle rates· Application case study- sample portfolio performance and identification of poor performance- remedial action - securitisation- tranche valuation and the waterfall- calculation of real risk transfer and the equity trancheCOMPARING MODELS FOR MEASURING OBLIGOR CREDIT RISK· Market information based models vs. financial statement based models- a brief discussion of competing approaches to quantitative default prediction· Performance measures for default prediction models- CAP Plots- Accuracy Ratios- Information Entropy· Composite Models; Taking the best of the best- How can a risk manager make the best use of available tools?- a brief discussion of competing approaches to quantitative default predictionDouglas J. Lucas, Vice President, Chase Securities IncDouglas J. Lucas, Vice President, Chase Securities IncBefore joining Chase Securities, Douglas J. Lucas was Co-Chief Executive Officer of Salomon Swapco Inc,Salomon Brother's triple-A derivative product intermediary. Prior to joining Salomon Swapco, Mr. Lucas hadpositions as Chief Risk Compliance Officer and Chief Credit Officer with derivative product boutiques.Previously, he was with Moody's Investors Service, in the Financial Institutions and the Structured AssetFinance groups. His research into default rates, rating changes, default correlation, derivative products andother credit-related topics has resulted in several published articles.Mr. Lucas earned a BA magna cum laude in Economics from UCLA and an MBA with Honors from theUniversity of Chicago.Ludger Overbeck, Head of Risk Analytics & Development, Deutsche Bank AGLudger Overbeck is Director in the Risk Management function at Deutsche Bank. His main responsibilities arethe credit portfolio model, analytic support for portfolio management, Risk Assessment for CLO/ABS structuresand the interplay of Market and Credit Risk. Before joining Deutsche Bank he worked in the examination andsupervision of internal risk models within the Deutsche Bundesbank. He holds an Ph.D. in Stochastic Analysisand is lecturing in mathematical finance at the Universities in Bonn and Frankfurt.Colin Burke, Vice President, ING BaringsColin Burke is Vice President credit measurement analytics at ING Barings. Prior to this Colin was a seniorquantitative analyst in the portfolio management unit at Barclays Capital. His work encompasses standalonecredit valuation models right through to the Monte Carlo simulation of portfolios for economic capital purposes.These calculations are used to set portfolio entry prices and for performance measurement. Colin also usesthese approaches to value and assess the impacts of credits derivatives and securitisations on the portfolio.Colin joined Barclays in 1996. Prior to that he spent 4 years as a research associate in electrodynamics atKing's College. He has also worked in the insurance industry using actuarial models to value future insuranceclaims. Colin holds Bachelor and PhD degrees in physics from King's College, <strong>London</strong>.Jorge Sobehart, VP - Senior Analyst, Risk Management Services, Moody's Investors ServiceJorge Sobehart is a VP/Senior Analyst with Moody's Risk Management Services. He works in credit riskmodelling and probabilistic risk assessment, and is the primary architect of Moody's RiskCalc for public firms.Dr. Sobehart has advanced degrees in Physics and postdoctoral experience. He has worked for prestigiousinstitutions such as the Los Alamos National Laboratory (a US government nuclear-weapons facility), IBM, theCenter for Adaptive Systems Applications (a LANL spin-off) and the Argentine Commission of Atomic Energy.He has over 70 proceedings, technical reports and refereed articles, and acted as technical reviewer forseveral professional scientific journals and agencies.

· Performance measures for default prediction models- CAP plots- Accuracy ratios- Information entropy· Composite models;· Taking the best of the best- How can a risk manager make the best use of available tools?13.0014.0015.0016.0016.3017.3017.40LunchPORTFOLIO CREDIT RISK MODELLING AND BASKET CREDIT DERIVATIVES· Portfolio Credit Risk Modelling- main issues and objectives- economic modelling of default events- information structure and types of default correlation- dependencies and copula functions- default intensities for dependent defaults- pricing defaultable instruments· Scenario-Linked Credit Derivatives- basket credit derivatives: pricing issues- credit event scenarios- applications- derivatives contingent on scenario arrivals- scenario-linked basket credit swapsAPPLICATION OF MONTE-CARLO SIMULATION TO SYNTHETIC CDOs· Definition of synthetic CDOs· Risk management benefits for banks and investors· Using Monte-Carlo simulation to model portfolio credit performance- overview- key assumptions- interpretation of results· Applying the results to a synthetic CDO structure· Monte-Carlo simulation vs. other approachesAfternoon breakMODELLING DEPENDENT CREDIT RISKS· Clarifying essential dependence ideas· Using copulas as a tool in credit risk modelling· What characterizes risky dependence structures?· Occurence of joint extremes and tail dependence· How do different techniques play out in practice?· Which dependence measures should be used and why?· Addressing the problem of simulating dependent risksChairman's closing remarksEnd of day fourKay Giesecke, Humboldt University BerlinKay Giesecke graduated with a master's equivalent degree in electrical engineering and economics fromIlmenau University of Technology. He gained experience as a Summer Associate in the Corporate CreditDepartment of Vereinsbank International Luxembourg, in the Standard Software Division of KPMG ManagementConsulting, and in the Quantitative Credit Risk Analysis Divisions of Deutsche Bank in Frankfurt and Paris,where he developed an interest in modelling financial markets and instruments. After a research visit to HarvardUniversity, Kay continued into the Ph.D. Program Applied Microeconomics and Finance at Humboldt Universityand Free University Berlin. For a research collaboration Kay also visited the University of Cambridge. His mainresearch interests include credit risk modelling, the valuation of basket credit derivatives, and the analysis ofcredit-risky security portfolios and default dependencies. Kay expects his Ph.D. degree in fall 2001.Frank Iacono, Vice President (Structured Credit Products), Chase Securities IncFrank Iacono is a Vice President of Chase Securities, Inc. in the Structured Credit Products Group in New Yorkwhere he leads a team responsible for the structuring and development of new cash-market and syntheticCollateralized Debt Obligation ("CDO") products, with a particular emphasis on bank risk- and capitalmanagementapplications. Prior to joining Chase in June 1998, Mr. Iacono was a Vice President at CapitalMarket Risk Advisors, Inc., a leading risk management and financial engineering consulting firm. At CMRA,Mr. Iacono specialized in quantitative issues in derivatives and financial risk management including Value atRisk, stochastic processes and contingent claim analysis. Mr. Iacono earned a Juris Doctor degree, CumLaude, from Harvard Law School, and a Bachelor of Science degree, Summa Cum Laude, from Yale College inApplied Mathematics. He is a member of the New York State bar.Filip Lindskog, Researcher, RiskLab ETH Zurich (co-author Alexander McNeil)Filip Lindskog is a researcher at RiskLab, Switzerland (http://www.risklab.ch/). His current interest is independence modelling in risk management. The project aims to establish the fundamentals of dependence andcorrelation modelling and to produce results that will be applicable to all areas of risk management.D A Y F O U R

Day Five - Application of computational finance techniques to derivatives modelling and portfolio risk modellingDomingo Tavella, Principal of Octanti Associates and Editor of the Journal of Computational Finance, will introduce and chair presentations with a variety of angles on how toimprove option pricing through the use of computational techniques, which will be of special interest to portfolio risk managers and quants. All presentations are delivered byexperts with unsurpassed reputations in computational finance.08.0008.3008.4009.40Registration and breakfastChairman's opening remarksMASTERCLASS: STABILITY AND ACCURACY ANALYSIS OF FINITE DIFFERENCESCHEMES FOR FINANCIAL APPLICATIONS· The specific requirements of numerical schemes for financial applications· Construction of numerical schemes· Connection between stability and convergence· Techniques for analysing stability and distortion· Strategies for boundary conditions and end conditions· Strategies for path dependenciesWAVELET-BASED VALUATION OF DERIVATIVES· Exposition of wavelet-based discretization techniques for parabolic PDE's in 1,2,3 and higherspace dimensions· Demonstrating the suitability of wavelet-based techniques to highly nonlinear anddiscontinuous boundary conditions relevant to European barrier and digital option payoffs· Describing current progress towards using these techniques for Bermudan and American stylederivatives· Numerical results for European vanilla, cash-or-nothing and supershare calls· Reporting speed-ups over finite difference methods for cross-currency Bermudan swaptions in3 space dimensionsDomingo Tavella, Principal, Octanti AssociatesDomingo Tavella, Principal, Octanti AssociatesDomingo Tavella is a Principal of Octanti Associates, a consulting firm focused on computational inssues inpricing, risk management, and software design and development in the financial and insurance industries.Dr. Tavella is the founding editor of the Journal of Computational Finance, and co-author of the recent book"Pricing Financial Instruments: The Finite Difference Method (Wiley, NY)" Dr. Tavella has a Ph.D. in Engineeringfrom Stanford University and an MBA in Finance from UC Berkeley.Michael Dempster, Professor of Finance and Director of Research, Judge Institute of Management,University of Cambridge & Managing Director, Cambridge System AssociatesDempster is the author of over 100 published research articles and reports and is author, editor or translator ofeight books, including Optimization Methods (with P.R. Adby), Stochastic Programming, Deterministic andStochastic Scheduling (with J.K. Lenstra and A.H.G. Rinnooy Kan) and Mathematics of Derivative Securities(with S.R. Pliska). With Professor Keith Moffat, the Director of the Isaac Newton Institute, Cambridge, he iscurrently editing Risk Management: Value at Risk and Beyond.10.4011.0012.00Morning breakA MODEL FOR JUMP RISK: THEORY AND COMPUTATION· Jump risk is important for both risk management and asset pricing.· Demonstrating a new jump risk model based on double exponential distribution· Capturing both over-reaction and under-reaction of markets· Producing asset return distributions with both high peak and two heavy tails· Closed form solutions for options pricing, including interest derivatives and exotic options· Discussing computational issuesSTOCHASTIC VOLATILITY AND JUMP LÉVY PROCESSES IN VALUE-AT-RISKMODELLING· Contrasting typical high peaked and heavy tailed return distributions for different underlyings inall markets with standard Gaussian assumptions for the risk factor dynamics· Considering pure jump Gamma process for the stochastic variance and other pure jump Lévyprocesses derived from the Maximum Entropy principle· Exploring a term structure of the risk factor kurtosis and quantiles with respect to the holdingperiod for the stochastic variance processes with independent and autocorrelated increments· Investigating a class of multivariate Stochastic Variance - VaR (SV-VaR) models with thestochastic variance driven by Lévy processes· Investigating effective calibration and Monte Carlo simulation procedures· Practical applications of the SV-VaR models in conjunction with the principal componentanalysis to the foreign exchange rates, interest rates, indices, and implied volatility curves andsurfacesS.G. Kou, Assistant Professor, Columbia UniversitySteve Kou is Assistant Professor in the Department of Industrial Engineering and Operations Research atColumbia, where he teaches Financial Engineering. He is a specialist in mathematical finance and is well-knowninternationally for his research on numerical pricing of discrete exotic options, such as discrete barrier andlookback options; option pricing in imperfect markets; market LIBOR models with jump risk; pricing ofelectricity options; and jump diffusion models and their closed form solutions for both equity and interest ratederivatives. Some of his results have been widely used in Wall Street, and have been incorporated intostandard MBA textbooks, such as the textbook by John Hull.Alexander Levin, Senior Manager, Bank of MontrealAlexander Levin is a Head of Risk Modelling, Market Risk, Bank of Montreal. Dr. Levin has a Ph.D. inMathematics from Dniepropetrovsk University (Ukraine). Alexander Levin is a member of the Society forIndustrial and Applied Mathematics, American Mathematical Society, Bachelier Finance Society. He has over30 publications in Numerical and Applied Mathematics, Inverse Problems, Integral Equations, RegularisationAlgorithms, Inverse Option Pricing Problems, and VaR. His current research is focused on Risk Management,Monte Carlo simulation, stochastic volatility models, Lévy processes in Mathematical Finance and Value-at-Risk.Alexander Tchernitser, Senior Analyst, Bank of MontrealAlexander Tchernitser is a Senior Analyst at Market and Capital at Risk Policy, Bank of Montreal, Toronto. He isinvolved in the development, vetting, and quantitative analysis of market risk methodologies and applications,pricing models and scenario simulation models. He holds a Ph.D. in Applied Control Theory from RussianAcademy of Science. His current research interest is the stochastic volatility models driven by jump processesand their application for risk management and pricing.

13.0014.0015.0016.0016.3017.3017.40LunchPARTIAL DIFFERENTIAL EQUATION (PDE) TECHNIQUES FOR THE PRICING OFDERIVATIVES WITH EXOTIC PATH DEPENDENCIES OR PROCESSES· Handling complex path dependencies such as resetting strikes and sliding windows in anefficient PDE framework.· Demonstrating how PDEs can also be used to advantage when the underlying is described byprocesses such stochastic volatility, jump-diffusion, or pure jump processes.· Handling jump process models with singular distributions.· Examples and practical implementation issues.A GENERAL EIGENFUNCTION APPROACH· Introduction of a new general Eigenfunction approach to solving PDEs.· For each application the approach utilizes a Galerkin type approximation distinguished by anatural choice of basis - the basis is the Eigenfunctions of a closely related spatial operator.· The approach is first demonstrated in the one-dimensional case of a CEV process with drift.· Demonstration of approach in two-dimensional setting for correlated assets and with a termstructure of volatility. Presented in the context of the Quadruple-No-Touch FX barrier option.· Extensions to three and higher dimensions are then treated.· All results constitute fast algorithms and exhibit very high accuracy.(Joint research with Alex Lipton, Deutsche Bank AG)Afternoon breakEXTENDING PRINCIPAL COMPONENT ANALYSIS FOR PORTFOLIO RISKMANAGEMENT· Shortcomings of traditional principal component analysis· Differences between risk dimensionality and risk concentration· Extending principal components to take into account the portfolio· Constructing portfolio-relevant risk factors· Applications of extended principal component analysis to macro hedging and riskconcentration analysisChairman's closing remarksEnd of day fiveCurt Randall, VP-Applications, SciComp IncCurt Randall is a Principal at SciComp Inc, a developer of software synthesis technology for the financeindustry. He has extensive experience in the application of finite difference methods to a variety of disciplines.Prior to joining SciComp, he developed computational methods for advanced simulations at Schlumberger andLawrence Livermore National Laboratory. Curt has a Ph.D. in Applied Physics from the University ofCalifornia-Livermore. He is a co-author of the book: Pricing Financial Instruments: The Finite Difference Method.Thomas Little, Vice President Deutsche Bank AGThomas Little is employed at Deutsche Bank AG where he works in structured equity, FX and ABS products.He received his Ph.D. in Mathematics from The University of Texas at Austin, in the area of nonlinear parabolicequations. He was a Visiting Member at the Courant Institute ('94-'96), and held a joint position at MorganStanley and Columbia University Mathematics Department ('97-'99).Didier Vermeiren, Associate, Octanti AssociatesDidier Vermeiren is an Associate of Octanti Associates, a consulting firm focused on computational issues inpricing, risk management, and software design and development in the financial and insurance industries.Mr. Vermeiren has pioneered new risk control strategies in co-operation with HypoVereinsbank, Munich.Mr. Vermeiren is in the Ph.D. program in Scientific Computing at Stanford University.D A Y F I V E

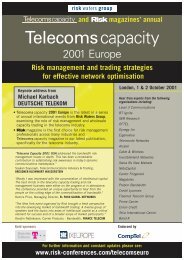

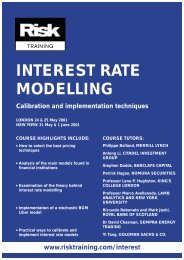

Events CalendarMASTERING AND APPLYINGFINANCIAL ECONOMETRICS*Led by PROFESSOR ROBERT ENGLENew York - 21 & 22 September<strong>London</strong> - 28 & 29 Septemberwww.risktraining.com/econometricsWATERTIGHT DERIVATIVESDOCUMENTATION*<strong>London</strong> - 25 & 26 SeptemberNew York - 28 & 29 Septemberwww.risktraining.com/watertightASSET LIABILITY ANDRISK MANAGEMENT <strong>2000</strong>Paris - 26 & <strong>27</strong> Septembermagazine’s sixth annual conferencewww.risk-conferences.com/alm<strong>2000</strong>euroCREDIT RISK SUMMITNew York - <strong>27</strong> & 28 September<strong>London</strong> - 12 & 13 October‘s 2nd annual credit summitwww.risk-conferences.com/credit<strong>2000</strong>tech <strong>2000</strong> <strong>London</strong><strong>London</strong> - 16 & 17 October‘s annual trading and riskmanagement information technology eventwww.risk-conferences.com/risktech<strong>2000</strong>Latest approaches for effectiveINTEGRATION OF MARKET RISKAND CREDIT RISK*<strong>London</strong> - 06 & 07 <strong>November</strong>New York - 16 & 17 <strong>November</strong>www.risktraining.com/mrcrSTOCHASTIC CALCULUS FORDERIVATIVES*Led by Steven E Shreve, Professor ofMathematics, Carnegic Mellon University<strong>London</strong> 9 & 10 <strong>November</strong> <strong>2000</strong>New York 4 & 5 <strong>December</strong> <strong>2000</strong>www.risktraining.com/stochasticApplying VOLATILITYFORECASTING ANDMODELLING TECHNIQUES*for accurate pricing andhedging of derivativesNew York - 13 & 14 <strong>November</strong><strong>London</strong> - 16 & 17 <strong>November</strong>www.risktraining.com/volatilityAsiaRisk <strong>2000</strong>Hong Kong - 14 & 15 <strong>November</strong>AsiaRisk and magazine’s annualAsia-Pacific risk management congresswww.risk-conferences.com/asiariskOP RISK<strong>London</strong> - 5 & 6 <strong>December</strong>Advanced strategies to mitigateoperational riskLatin Risk <strong>2000</strong>Miami - 28 & 29 <strong>November</strong>‘s 4th annual congress examining the latestdevelopments in risk management andderivatives markets in Latin America.www.risk-conferences.com/latinriskEUROPEAN TRADINGTELECOM CAPACITYCONGRESSAmsterdam - 30 & 31 <strong>November</strong>* signifies a two-day Risk Training CourseFOR FURTHER INFORMATION:www.risk-conferences.com www.risktraining.comMail: Conference Administration, Risk Waters Group, Haymarket House, 28-29 Haymarket, <strong>London</strong> SW1Y 4RX, UKFax: +44 (0) 20 7484 9800, E-mail: conf@riskwaters.com

Specialist financial titlesfrom Risk Waters Groupis the world's leading risk managementmagazine, delivering in-depth risk analysis and seminalresearch from the leading minds in the field well beforeother financial publications and academic journals.Annual subscriptionAcademic rate £179/€259/US$299Non-Academic rate £359/€519/US$599The Journal of RiskThis forum for academic and practitionerresearch is designed as a complementarysource of reading to Risk. Each quarterlyissue provides a dedicated medium for thedissemination of research into financialrisk management.Annual subscriptionAcademic rate £99/€142/US$169Non-Academic rate £229/€329/US$389The Journal of Computational FinanceThis quarterly journal is the only publicationdevoted exclusively to computational methodsfor finance. All published work is refereed by adistinguished editorial board that reflects thebroad base of experience and expertise that isessential to this field.Annual subscriptionAcademic rate £99/€142/US$169Non-Academic rate £229/€329/US$389Special discounts for academicsContact the Subscriptions Hotline +44 (0)20 7484 9777for further information and special subscription offers.www.riskwaters.com

CONFERENCESMATHS WEEK <strong>2000</strong> <strong>London</strong> <strong>27</strong> <strong>November</strong> - 1 <strong>December</strong>A B C D E F G H I J K L M N O P Q R S T U V W X Y ZTo Registerwww.risk-conferences.com/mathslondonFax: +44 (0) 20 7484 9800www.risk-conferences.com/mathnewyorkADDRESS DETAILS (if different from above)TITLE FIRST NAME FAMILY NAMEJOB TITLE / POSITIONCOMPANYADDRESSPOST CODECITYCOUNTRYTYPETELEPHONE FAX EMAILPAYMENT DETAILSI enclose a cheque payable to Risk Waters GroupPlease debit my: AMEX VISA MASTERCARD DINERS CARD please supply ‘valid from’ date __________________Further InformationMail: Conference Customer Services, Risk Waters Group,Haymarket House, 28-29 Haymarket, <strong>London</strong> SW1Y 4RX, UKPhone: +44 (0) 20 7484 9898 Email: conf@riskwaters.comVisit the Risk Waters web site for an update on our forthcoming conferences and courses and for information on our magazines andbooks at www.riskwaters.comREGISTRATION DETAILSI would like to attend:One day £799I would like to take advantage of the*SPECIAL MULTI-DAY DISCOUNT PACKAGESTwo days £1,199 - 25% discountThree days £1,499 - 37% discountFour days £1,899 - 41% discountFive days £2,299 - 42% discountThe days I would like to attend are:Day oneDay twoDay three Latest advances in interest rate modellingDay four Advanced credit risk modelling techniquesDay fiveVAT will be added at 17.5%VENUEHilton <strong>London</strong> Kensington179-199 Holland Park Avenue<strong>London</strong> W11 4ULTel. +44 (0)20 7605 7655Fax +44 (0)20 7605 7683For accomodation, call Venue Searchon Tel. +44 (0)20 8541 5656New advances in forecasting and modelling techniques for volatility and correlationKey developments in pricing and hedging exotic derivativesApplication of computational finance techniques to derivative modelling and portfolio risk modelling*The prices quoted for combinations of one to five days of attending Math Week are strictly for one delegate only. We reserve theright to request identification and to refuse admission to any unregistered delegates. We offer extra entries (delegate days) formultiple delegates from the same organisation at a discount of 30%. Please visit www.risk-conferences.com/mathslondon for anonline registration form or contact Natasha Knight on +44 (0) 20 7484 9868.Quote reference: CRXD90CARD NO:EXPIRY DATE:SIGNATURE:DATEPayment is required prior to the event. Risk Waters Group VAT No: GB 681 3190 38 for companies in EU member states onlyWARNING:Risk is a registered trademark, and the title, contents and style of this brochure are the copyright of Risk Waters Group. We will act on any infringement of our rights anywhere in the world. © Risk Waters Group 1998.CANCELLATIONA refund (less 10% administration fee) will be made if notice of cancellation is received in writing three weeks before the event. We regret that no refunds can be given after this period. A substitute delegateis always welcome at no extra charge.DISCLAIMERThe programme may change due to unforeseen circumstances, and Risk Waters Group reserves the right to alter the venue and/or speakers. Risk Waters Group accepts no responsibility for any loss ordamage to property belonging to, nor for any personal injury incurred by, attendees at our conferences, whether within the conference venue or otherwise.INCORRECT MAILING, DATA PROTECTIONIf any of the details on the mailing label are incorrect, please return the brochure to the database administrator at Risk Publications so that we can update our records and ensure future mailings are correct.Please tick this box and return this page if you do not want to receive details of special offers which may be of relevance to you.