London 27 November - 1 December 2000

London 27 November - 1 December 2000

London 27 November - 1 December 2000

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

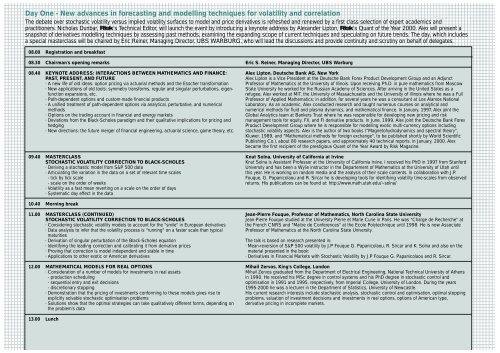

Day One - New advances in forecasting and modelling techniques for volatility and correlationThe debate over stochastic volatility versus implied volatility surfaces to model and price derivatives is refreshed and renewed by a first class selection of expert academics andpractitioners. Nicholas Dunbar, 's Technical Editor, will launch the event by introducing a keynote address by Alexander Lipton, 's Quant of the Year <strong>2000</strong>. Alex will present asnapshot of derivatives modelling techniques by assessing past methods, examining the expanding scope of current techniques and speculating on future trends. The day, which includesa special masterclass will be chaired by Eric Reiner, Managing Director, UBS WARBURG, who will lead the discussions and provide continuity and scrutiny on behalf of delegates.08.0008.3008.4009.4010.4011.0012.0013.00Registration and breakfastChairman's opening remarksKEYNOTE ADDRESS: INTERACTIONS BETWEEN MATHEMATICS AND FINANCE:PAST, PRESENT, AND FUTURE· A new life of old ideas: option pricing via actuarial methods and the Esscher transformation· New applications of old tools: symmetry transforms, regular and singular perturbations, eigenfunctionexpansions, etc.· Path-dependent options and custom-made financial products· A unified treatment of path-dependent options via analytical, perturbative, and numericalmethods· Options on the trading account in financial and energy markets· Deviations from the Black-Scholes paradigm and their qualitative implications for pricing andhedging· New directions: the future merger of financial engineering, actuarial science, game theory, etc.MASTERCLASSSTOCHASTIC VOLATILITY CORRECTION TO BLACK-SCHOLES· Deriving a stochastic model from S&P 500 data· Articulating the variation in the data on a set of relevant time scales- tick by tick scale- scale on the order of weeks· Volatility as a fast mean reverting on a scale on the order of days· Systematic day effect in the dataMorning breakMASTERCLASS (CONTINUED)STOCHASTIC VOLATILITY CORRECTION TO BLACK-SCHOLES· Considering stochastic volatility models to account for the "smile" in European derivatives· Data analysis to infer that the volatility process is "running" on a faster scale than typicalmaturities· Derivation of singular perturbation of the Black-Scholes equation· Identifying the leading correction and calibrating it from derivative prices· Proving that correction is model independent and stable in time· Applications to other exotic or American derivativesMATHEMATICAL MODELS FOR REAL OPTIONS· Consideration of a number of models for investments in real assets- production scheduling- sequential entry and exit decisions- discretionary stopping· Demonstration that the pricing of investments conforming to these models gives rise toexplicitly solvable stochastic optimisation problems· Solutions show that the optimal strategies can take qualitatively different forms, depending onthe problem's dataLunchEric S. Reiner, Managing Director, UBS WarburgAlex Lipton, Deutsche Bank AG, New YorkAlex Lipton is a Vice President at the Deutsche Bank Forex Product Development Group and an AdjunctProfessor of Mathematics at the University of Illinois. Upon receiving Ph.D. in pure mathematics from MoscowState University he worked for the Russian Academy of Sciences. After arriving in the United States as arefugee, Alex worked at MIT, the University of Massachusetts and the University of Illinois where he was a FullProfessor of Applied Mathematics; in addition, for several years he was a consultant at Los Alamos NationalLaboratory. As an academic, Alex conducted research and taught numerous courses on analytical andnumerical methods for fluid and plasma dynamics, and mathematical finance. In January, 1997, Alex joint theGlobal Analytics team at Bankers Trust where he was responsible for developing new pricing and riskmanagement tools for equity, FX, and FI derivative products. In June, 1999, Alex joint the Deutsche Bank ForexProduct Development Group where he is responsible for modelling exotic multi-currency options includingstochastic volatility aspects. Alex is the author of two books ("Magnetohydrodynamics and spectral theory",Kluwer, 1989, and "Mathematical methods for foreign exchange", to be published shortly by World ScientificPublishing Co.), about 80 research papers, and approximately 40 technical reports. In January, <strong>2000</strong>, Alexbecame the first recipient of the prestigious Quant of the Year Award by Risk Magazine.Knut Solna, University of California at IrvineKnut Solna is Assistant Professor at the University of California Irvine. I received his PhD in 1997 from StanfordUniversity and has been a Wylie instructor in the Departement of Mathematics at the University of Utah untilthis year. He is working on random media and the analysis of their scale contents. In collaboration with J.P.Fouque, G. Papanicolaou and R. Sircar he is developing tools for identifying volatility time-scales from observedreturns. His publications can be found at: http://www.math.utah.edu/~solna/Jean-Pierre Fouque, Professor of Mathematics, North Carolina State UniversityJean-Pierre Fouque studied at the University Pierre et Marie Curie in Paris. He was "Charge de Recherche" atthe French CNRS and "Maitre de Conferences" at the Ecole Polytechnique until 1998. He is now AssociateProfessor of Mathematics at the North Carolina State University.The talk is based on research presented in:· Mean-reversion of S&P 500 volatility by J.P Fouque G. Papanicolaou, R. Sircar and K. Solna and also on thematerial presented in the book:· Derivatives in Financial Markets with Stochastic Volatility by J.P Fouque G. Papanicolaou and R. Sircar.Mihail Zervos, King's College, <strong>London</strong>Mihail Zervos graduated from the Department of Electrical Engineering, National Technical University of Athensin 1990. He received his MSc degree in control systems and his PhD degree in stochastic control andoptimisation in 1991 and 1995, respectively, from Imperial College, University of <strong>London</strong>. During the years1995-<strong>2000</strong> he was a lecturer in the Department of Statistics, University of Newcastle.His current research interests include stochastic analysis, stochastic control and optimisation, optimal stoppingproblems, valuation of investment decisions and investments in real options, options of American type,derivative pricing in incomplete markets.