market architecture of selected stock exchanges in ... - Gilles Daniel

market architecture of selected stock exchanges in ... - Gilles Daniel

market architecture of selected stock exchanges in ... - Gilles Daniel

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

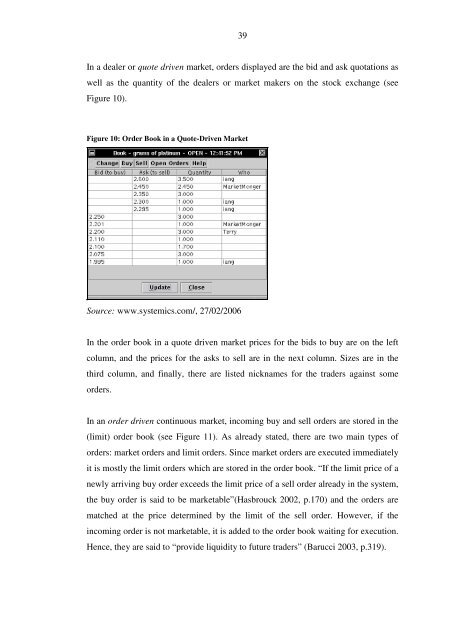

39In a dealer or quote driven <strong>market</strong>, orders displayed are the bid and ask quotations aswell as the quantity <strong>of</strong> the dealers or <strong>market</strong> makers on the <strong>stock</strong> exchange (seeFigure 10).Figure 10: Order Book <strong>in</strong> a Quote-Driven MarketSource: www.systemics.com/, 27/02/2006In the order book <strong>in</strong> a quote driven <strong>market</strong> prices for the bids to buy are on the leftcolumn, and the prices for the asks to sell are <strong>in</strong> the next column. Sizes are <strong>in</strong> thethird column, and f<strong>in</strong>ally, there are listed nicknames for the traders aga<strong>in</strong>st someorders.In an order driven cont<strong>in</strong>uous <strong>market</strong>, <strong>in</strong>com<strong>in</strong>g buy and sell orders are stored <strong>in</strong> the(limit) order book (see Figure 11). As already stated, there are two ma<strong>in</strong> types <strong>of</strong>orders: <strong>market</strong> orders and limit orders. S<strong>in</strong>ce <strong>market</strong> orders are executed immediatelyit is mostly the limit orders which are stored <strong>in</strong> the order book. “If the limit price <strong>of</strong> anewly arriv<strong>in</strong>g buy order exceeds the limit price <strong>of</strong> a sell order already <strong>in</strong> the system,the buy order is said to be <strong>market</strong>able”(Hasbrouck 2002, p.170) and the orders arematched at the price determ<strong>in</strong>ed by the limit <strong>of</strong> the sell order. However, if the<strong>in</strong>com<strong>in</strong>g order is not <strong>market</strong>able, it is added to the order book wait<strong>in</strong>g for execution.Hence, they are said to “provide liquidity to future traders” (Barucci 2003, p.319).