Annual Report 2011 - Mandarin Oriental Hotel Group

Annual Report 2011 - Mandarin Oriental Hotel Group

Annual Report 2011 - Mandarin Oriental Hotel Group

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Financial Review<br />

Accounting policies<br />

The Directors continue to review the appropriateness<br />

of the accounting policies adopted by the <strong>Group</strong><br />

having regard to developments in International<br />

Financial <strong>Report</strong>ing Standards (‘IFRS’).<br />

The accounting policies adopted are consistent with<br />

those of the previous year, except that the <strong>Group</strong> has<br />

adopted several new standards, amendments and<br />

interpretations to IFRS effective on 1st January <strong>2011</strong>,<br />

as more fully detailed in the ‘Basis of preparation’ note<br />

in the financial statements. The adoption of these new<br />

standards, amendments and interpretations did not<br />

have a material impact on the <strong>Group</strong>’s financial<br />

statements.<br />

Results<br />

Overall<br />

The <strong>Group</strong> uses earnings before interest, tax,<br />

depreciation and amortization (‘EBITDA’) to analyze<br />

operating performance. Total EBITDA including<br />

the <strong>Group</strong>’s share of EBITDA from associates and<br />

joint ventures is shown below:<br />

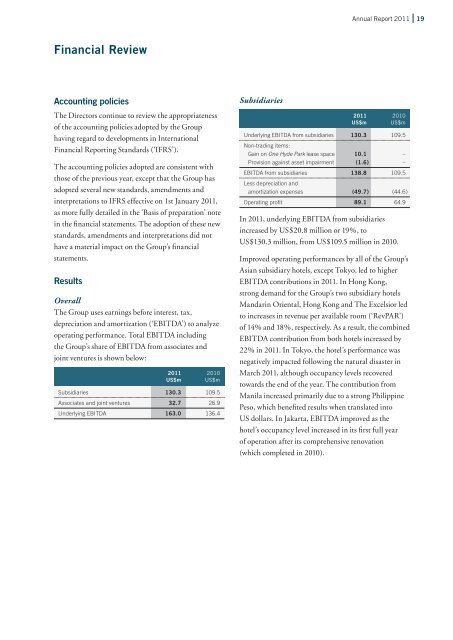

<strong>2011</strong> 2010<br />

US$m US$m<br />

Subsidiaries 130.3 109.5<br />

Associates and joint ventures 32.7 26.9<br />

Underlying EBITDA 163.0 136.4<br />

Subsidiaries<br />

<strong>Annual</strong> <strong>Report</strong> <strong>2011</strong> 19<br />

<strong>2011</strong> 2010<br />

US$m US$m<br />

Underlying EBITDA from subsidiaries<br />

Non-trading items:<br />

130.3 109.5<br />

Gain on One Hyde Park lease space 10.1 –<br />

Provision against asset impairment (1.6 ) –<br />

EBITDA from subsidiaries<br />

Less depreciation and<br />

138.8 109.5<br />

amortization expenses (49.7 ) (44.6 )<br />

Operating profit 89.1 64.9<br />

In <strong>2011</strong>, underlying EBITDA from subsidiaries<br />

increased by US$20.8 million or 19%, to<br />

US$130.3 million, from US$109.5 million in 2010.<br />

Improved operating performances by all of the <strong>Group</strong>’s<br />

Asian subsidiary hotels, except Tokyo, led to higher<br />

EBITDA contributions in <strong>2011</strong>. In Hong Kong,<br />

strong demand for the <strong>Group</strong>’s two subsidiary hotels<br />

<strong>Mandarin</strong> <strong>Oriental</strong>, Hong Kong and The Excelsior led<br />

to increases in revenue per available room (‘RevPAR’)<br />

of 14% and 18%, respectively. As a result, the combined<br />

EBITDA contribution from both hotels increased by<br />

22% in <strong>2011</strong>. In Tokyo, the hotel’s performance was<br />

negatively impacted following the natural disaster in<br />

March <strong>2011</strong>, although occupancy levels recovered<br />

towards the end of the year. The contribution from<br />

Manila increased primarily due to a strong Philippine<br />

Peso, which benefited results when translated into<br />

US dollars. In Jakarta, EBITDA improved as the<br />

hotel’s occupancy level increased in its first full year<br />

of operation after its comprehensive renovation<br />

(which completed in 2010).