First Time Homebuyer Program (FTHB) - City of Concord

First Time Homebuyer Program (FTHB) - City of Concord

First Time Homebuyer Program (FTHB) - City of Concord

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

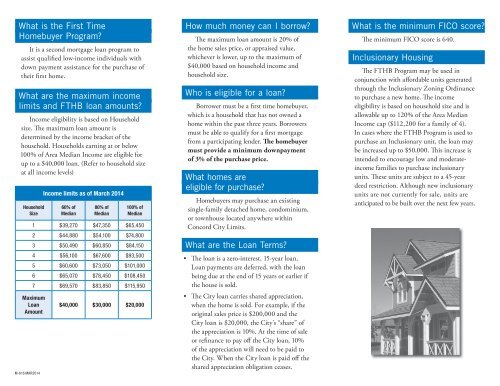

What is the <strong>First</strong> <strong>Time</strong><strong>Homebuyer</strong> <strong>Program</strong>?It is a second mortgage loan program toassist qualified low-income individuals withdown payment assistance for the purchase <strong>of</strong>their first home.What are the maximum incomelimits and <strong>FTHB</strong> loan amounts?Income eligibility is based on Householdsize. The maximum loan amount isdetermined by the income bracket <strong>of</strong> thehousehold. Households earning at or below100% <strong>of</strong> Area Median Income are eligible forup to a $40,000 loan. (Refer to household sizeat all income levels)HouseholdSizeM-616 MAR2014Income limits as <strong>of</strong> March 201460% <strong>of</strong>Median80% <strong>of</strong>Median100% <strong>of</strong>Median1 $39,270 $47,350 $65,4502 $44,880 $54,100 $74,8003 $50,490 $60,850 $84,1504 $56,100 $67,600 $93,5005 $60,600 $73,050 $101,0006 $65,070 $78,450 $108,4507 $69,570 $83,850 $115,950MaximumLoanAmount$40,000 $30,000 $20,000How much money can I borrow?The maximum loan amount is 20% <strong>of</strong>the home sales price, or appraised value,whichever is lower, up to the maximum <strong>of</strong>$40,000 based on household income andhousehold size.Who is eligible for a loan?Borrower must be a first time homebuyer,which is a household that has not owned ahome within the past three years. Borrowersmust be able to qualify for a first mortgagefrom a participating lender. The homebuyermust provide a minimum downpayment<strong>of</strong> 3% <strong>of</strong> the purchase price.What homes areeligible for purchase?<strong>Homebuyer</strong>s may purchase an existingsingle-family detached home, condominium,or townhouse located anywhere within<strong>Concord</strong> <strong>City</strong> Limits.What are the Loan Terms?• The loan is a zero-interest, 15-year loan.Loan payments are deferred, with the loanbeing due at the end <strong>of</strong> 15 years or earlier ifthe house is sold.• The <strong>City</strong> loan carries shared appreciation,when the home is sold. For example, if theoriginal sales price is $200,000 and the<strong>City</strong> loan is $20,000, the <strong>City</strong>’s “share” <strong>of</strong>the appreciation is 10%. At the time <strong>of</strong> saleor refinance to pay <strong>of</strong>f the <strong>City</strong> loan, 10%<strong>of</strong> the appreciation will need to be paid tothe <strong>City</strong>. When the <strong>City</strong> loan is paid <strong>of</strong>f theshared appreciation obligation ceases.What is the minimum FICO score?The minimum FICO score is 640.Inclusionary HousingThe <strong>FTHB</strong> <strong>Program</strong> may be used inconjunction with affordable units generatedthrough the Inclusionary Zoning Ordinanceto purchase a new home. The incomeeligibility is based on household size and isallowable up to 120% <strong>of</strong> the Area MedianIncome cap ($112,200 for a family <strong>of</strong> 4).In cases where the <strong>FTHB</strong> <strong>Program</strong> is used topurchase an Inclusionary unit, the loan maybe increased up to $50,000. This increase isintended to encourage low and moderateincomefamilies to purchase inclusionaryunits. These units are subject to a 45-yeardeed restriction. Although new inclusionaryunits are not currently for sale, units areanticipated to be built over the next few years.

Are there any other requirements?• Borrowers must attend a <strong>City</strong>-approved<strong>FTHB</strong> Counseling Workshop.• A home purchased under the <strong>FTHB</strong>program must be, and remain, theborrower’s principal place <strong>of</strong> residence.The property cannot be leased or rentedduring the term <strong>of</strong> the <strong>City</strong> loan.• Persons with ownership in most real estateassets are not eligible.• Funds are limited. Assistance is providedon a first-come, first-served basis, as longas funds remain available.• A minimum housing cost floor <strong>of</strong> 28%will be eligible for assistance. This includesall housing costs (PITI, HOA and PMI)divided by gross income.• A maximum debt to income ratio <strong>of</strong> 45%will be considered.For <strong>First</strong> <strong>Time</strong> Home Buyer classes please seethe most recent listings on our webpage:www.city<strong>of</strong>concord.org/living/housing/For additional information please contact the<strong>City</strong>’s <strong>FTHB</strong> Administrator:Hello Housing(415) 689-7746Translation services for non-Englishspeaking applicants are available by makingarrangements ahead <strong>of</strong> time with our <strong>of</strong>fice.CONCORD, CALIFORNIA<strong>First</strong> <strong>Time</strong><strong>Homebuyer</strong><strong>Program</strong> (<strong>FTHB</strong>)Servicios de traduccion para solicitantes queno hablan Ingles estan disponibles haciendoareglos anticipado con nuestra <strong>of</strong>icina.www.city<strong>of</strong>concord.org/living/housing/Our mission is to join with our community tomake <strong>Concord</strong> a city <strong>of</strong> the highest quality. We do thisby providing responsive, cost effective and innovativelocal government services.Superior quality <strong>of</strong> life