ESSENTIAL NEWS for - Georgia Small Business Development Center

ESSENTIAL NEWS for - Georgia Small Business Development Center

ESSENTIAL NEWS for - Georgia Small Business Development Center

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

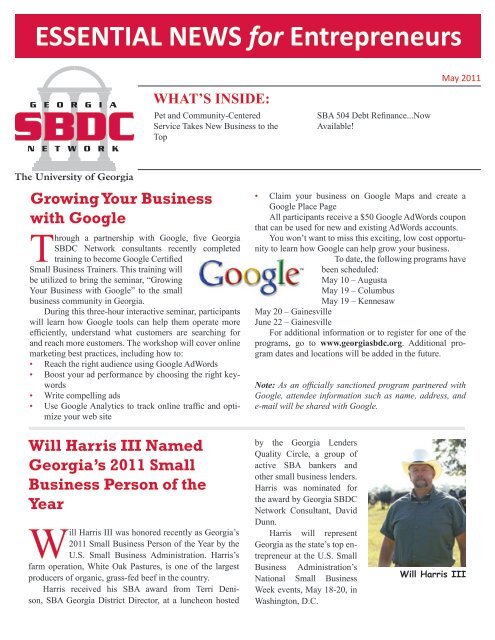

<strong>ESSENTIAL</strong> <strong>NEWS</strong> <strong>for</strong> EntrepreneursWHAT’S INSIDE:Pet and Community-<strong>Center</strong>edService Takes New <strong>Business</strong> to theTopSBA 504 Debt Refinance...NowAvailable!May 2011Growing Your <strong>Business</strong>with GoogleThrough a partnership with Google, five <strong>Georgia</strong>SBDC Network consultants recently completedtraining to become Google Certified<strong>Small</strong> <strong>Business</strong> Trainers. This training willbe utilized to bring the seminar, “GrowingYour <strong>Business</strong> with Google” to the smallbusiness community in <strong>Georgia</strong>.During this three-hour interactive seminar, participantswill learn how Google tools can help them operate moreefficiently, understand what customers are searching <strong>for</strong>and reach more customers. The workshop will cover onlinemarketing best practices, including how to:• Reach the right audience using Google AdWords• Boost your ad per<strong>for</strong>mance by choosing the right keywords• Write compelling ads• Use Google Analytics to track online traffic and optimizeyour web site• Claim your business on Google Maps and create aGoogle Place PageAll participants receive a $50 Google AdWords couponthat can be used <strong>for</strong> new and existing AdWords accounts.You won’t want to miss this exciting, low cost opportunityto learn how Google can help grow your business.To date, the following programs havebeen scheduled:May 10 – AugustaMay 19 – ColumbusMay 19 – KennesawMay 20 – GainesvilleJune 22 – GainesvilleFor additional in<strong>for</strong>mation or to register <strong>for</strong> one of theprograms, go to www.georgiasbdc.org. Additional programdates and locations will be added in the future.Note: As an officially sanctioned program partnered withGoogle, attendee in<strong>for</strong>mation such as name, address, ande-mail will be shared with Google.Will Harris III Named<strong>Georgia</strong>’s 2011 <strong>Small</strong><strong>Business</strong> Person of theYearWill Harris III was honored recently as <strong>Georgia</strong>’s2011 <strong>Small</strong> <strong>Business</strong> Person of the Year by theU.S. <strong>Small</strong> <strong>Business</strong> Administration. Harris’sfarm operation, White Oak Pastures, is one of the largestproducers of organic, grass-fed beef in the country.Harris received his SBA award from Terri Denison,SBA <strong>Georgia</strong> District Director, at a luncheon hostedby the <strong>Georgia</strong> LendersQuality Circle, a group ofactive SBA bankers andother small business lenders.Harris was nominated <strong>for</strong>the award by <strong>Georgia</strong> SBDCNetwork Consultant, DavidDunn.Harris will represent<strong>Georgia</strong> as the state’s top entrepreneurat the U.S. <strong>Small</strong><strong>Business</strong> Administration’sNational <strong>Small</strong> <strong>Business</strong>Week events, May 18-20, inWashington, D.C.Will Harris III

Pet and Community-<strong>Center</strong>ed ServiceTakes New <strong>Business</strong> to the TopThe magic of TailsSpin beginswith the story of Kai,Riley and Cosmo, threedogs who led their masters fromsuccessful careers in Los Angelesto owning a wildly successful petcenteredretail store in Savannah.Kai tells the story on TailsSpin’sweb site.TailsSpin’s owners JusakBernhard, an actor and producer,and Jeff Manley, an Emmy awardwinningeditor, tell the story a littledifferently. The reasons their saleshave doubled each year since theyopened in 2007 are woven tightlyinto their tale: unconditional loveof animals, commitment to community,and wisdom in seekinghelp when needed.Jusak Bernhard and Jeff ManleyBernhard and Manley hadplanned to open a noodle shop inSavannah, but soon decided thecity wasn’t ready <strong>for</strong> their concept.“At about that time, we werehaving trouble finding a specialallergy-<strong>for</strong>mula dog food thatwe had fed Kai inL.A.,” says Manley.“We had also adoptedCosmo, a straythat had followed usaround <strong>for</strong> days, andwere dealing withour dogs all adjusting.We decided thatwe know a lot aboutdogs, so we neededto open a pet store,”he says.They went toSCORE and sawthere were Tuesday evening businessclasses conducted bythe SBDC in the same building.So they went to hearLynn Vos, area director of theSavannah office of the <strong>Georgia</strong>SBDC Network, talk aboutthe things they would need tostart a business. “Then SBDCConsultant Connie Edwardstook us under her wing, andlater she walked us across thehall to inquire about getting aloan from the <strong>Small</strong> <strong>Business</strong>Assistance Corporation,” saysBernhard.“Jusak and Jeff understoodwhat type of customersthey were targeting andthey both had good businessbackgrounds, but neither hadowned this type of businessbe<strong>for</strong>e,” says Edwards. “Theyneeded help putting togetherfinancial projections and takinga look at potential cash flow. Ihelped them determine how muchmoney it would really take to getthe business open and how muchreserve cash they would need.”“We knew what we wanted todo,” agrees Manley. “We just neededhelp explaining it in a businesssense <strong>for</strong> the banks. Connie played ahuge part in helping us get our loanand walkingus throughthe steps <strong>for</strong>the businessplan.” Shelater referredManley toFastTrac®,which gavehim skillshe sayswould havetaken yearsto achieve.“ C o n n i ehelped tremendously. Without her,I don’t think we could have gottenour store off the ground.”TailsSpin opened in historicSavannah in 2007, relocated toHabersham Village in 2009 andopened a second location in Poolerin May. Its employees will numbera dozen by the end the year.TailsSpin was named the 2009-2010 New and Emerging <strong>Business</strong>of the Year by the <strong>Small</strong> <strong>Business</strong>Chamber of Savannah, and the U.S.Chamber of Commerce named it a“2011 Blue Ribbon <strong>Small</strong> <strong>Business</strong>Award Winner” <strong>for</strong> helping to restorejobs, prosperity and communityin this economy.“Savannah really likes smallbusinesses,” says Manley. “To us,our experience with the SBDC andothers reflect how much <strong>Georgia</strong>and this city like and support theirsmall businesses.”“We knew what wewanted to do. We justneeded help explaining itin a business sense <strong>for</strong> thebanks. ...Connie helpedtremendously. Withouther I don’t think we couldhave gotten our store offthe ground.”

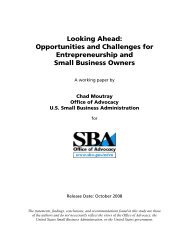

SBA 504 Debt Refinance....Now Available!Brent Swanson, <strong>Georgia</strong> <strong>Small</strong> <strong>Business</strong> CapitalStarting February 28, 2011,the SBA began acceptingSBA 504 loan applications<strong>for</strong> refinancing of existing qualifiedreal estate debt <strong>for</strong> small businessowners.SBA Administrator Mills pointedout, “The economic downturnof recent years and the decliningvalue of real estate have had a significant,negative impact on manysmall businesses with mortgagesmaturing within the next few years.This temporary program is anothertool SBA can provide tohelp these small businessesremain viable and protectjobs.”Certified <strong>Development</strong>Companies (CDCs) havebeen anticipating a surgein demand knowing thereare many small businessesin their communities thathave been waiting <strong>for</strong> thisrefinancing option as a wayto take advantage of lowerinterest rates and extenddebt. The ability to use agovernment-guaranteed504 loan to refinance anexisting commercial realestate debt was authorizedunder the <strong>Small</strong> <strong>Business</strong>Jobs Act, but it is a temporary programthat will expire on September27, 2012.SBA 504 refinancing loans willbe structured like a traditional 504loan. A bank or third party lenderprovides at least 50 percent of theloan, the SBA – through a CDC –provides up to 40 percent of theloan and the small business borrowermust provide equity of atleast 10 percent. This equity maybe drawn from the existing assetvaluation, rather than new cashinjection.Borrowers will be able to refinanceup to 90 percent of thecurrent appraised property valueor 100 percent of the outstandingmortgage, whichever is lower,plus eligible refinancing costs.Loan proceeds may not be used <strong>for</strong>other business expenses, and existing504 projects and governmentguaranteedloans are not eligibleSBA/CDCOwnerEquity40%10%SBA 504 LoanStructureBank or ThirdParty Lender50%to be refinanced. SBA is expectedto issue further regulations to fullyimplement the legislative directiveto enable borrowers to use excessreal estate equity <strong>for</strong> working capitalin their businesses.The CDC industry welcomesthis new provision and sees it as avery important way to assist businessowners across the country,save thousands of jobs and helpthe economy expand. This newrefinance program is only <strong>for</strong> businessesthat can demonstrate thattheir loans are current and that theyhave successfully made all requiredpayments over the last 12 months.There will also be a new, independentappraisal required <strong>for</strong> all projects.These are the four key questionsto ask in order to determineeligibility <strong>for</strong> a SBA 504 RefinanceLoan:1) Has the debt been outstanding<strong>for</strong> at least two years?2) Has the subject businessbeen in operation <strong>for</strong>at least two years?3) Has the borrower beencurrent (no payment deferralsor past dues of morethan 30 days) on the note<strong>for</strong> the past 12 months?4) Was the debt to be refinancedsubstantially (85%or more) used <strong>for</strong> eligible504 purposes originally?Qualifying purposes:Owner-occupied commercialreal estate; heavy machinery;equipment; andclosing costs associatedwith the project.If you have any questionsabout the SBA 504 loan program,please call or e-mail Brent Swansonat 404-275-5250 or bswanson504@aol.com.

1180 East Broad StreetAthens, GA 30602-5412RETURN SERVICE REQUESTEDNon-Profit Org.U.S. POSTAGEPAIDATHENS, GASoutheastern Colorwww.georgiasbdc.orgThe University of <strong>Georgia</strong>Clayton State University<strong>Georgia</strong> Southern University<strong>Georgia</strong> State UniversityKennesaw State UniversityUniversity of West <strong>Georgia</strong>Valdosta State University“Funded in part through a cooperative agreementwith the U.S. <strong>Small</strong> <strong>Business</strong> Administration.”Ron Simmons Named <strong>Georgia</strong>SBDC Network Consultant ofthe YearRon Simmons, area director of the Gainesville officeof the <strong>Georgia</strong> SBDC Network, recently receivedthe SBDC’s “2010 Consultant of the Year” award. Theannual award, which was presented in Duluth on April26, is based on a consultant’s accomplishments duringthe year which includes his/her work with the businesscommunity, program development, publications, presentations,and professional development.Since his employment with the SBDC, Simmonshas been promoted three times and holds the facultyrank of Senior Public Service Associate.When presenting the award, Allan Adams, statedirector, spoke of Ron as always being a team player.“Ron is always ready to say ‘yes’ when asked <strong>for</strong> helpby colleagues or clients. He is always thinking aboutthe good of the organization and its mission to help thesmall business community in <strong>Georgia</strong>,” said Adams.The 2010 Best Continuing Education Programaward was presented to Monica Page of the ValdostaState University SBDC and Ricky Lanard of the stateoffice of the <strong>Georgia</strong> SBDC Network <strong>for</strong> their work onthe Salesmanship 101 program.Allan Adams and Ron Simmons