Allowable and Non-Allowable Business Expenses

Allowable and Non-Allowable Business Expenses

Allowable and Non-Allowable Business Expenses

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

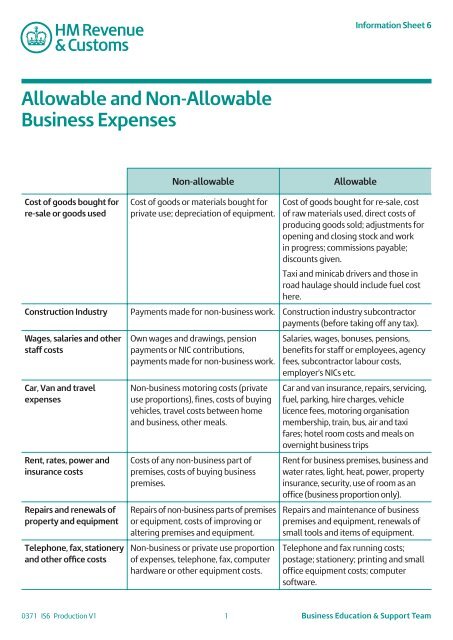

Information Sheet 6<strong>Allowable</strong> <strong>and</strong> <strong>Non</strong>-<strong>Allowable</strong><strong>Business</strong> <strong>Expenses</strong><strong>Non</strong>-allowable<strong>Allowable</strong>Cost of goods bought forre-sale or goods usedCost of goods or materials bought forprivate use; depreciation of equipment.Cost of goods bought for re-sale, costof raw materials used, direct costs ofproducing goods sold; adjustments foropening <strong>and</strong> closing stock <strong>and</strong> workin progress; commissions payable;discounts given.Taxi <strong>and</strong> minicab drivers <strong>and</strong> those inroad haulage should include fuel costhere.Construction Industry Payments made for non-business work. Construction industry subcontractorpayments (before taking off any tax).Wages, salaries <strong>and</strong> otherstaff costsCar, Van <strong>and</strong> travelexpensesRent, rates, power <strong>and</strong>insurance costsRepairs <strong>and</strong> renewals ofproperty <strong>and</strong> equipmentTelephone, fax, stationery<strong>and</strong> other office costsOwn wages <strong>and</strong> drawings, pensionpayments or NIC contributions,payments made for non-business work.<strong>Non</strong>-business motoring costs (privateuse proportions), fines, costs of buyingvehicles, travel costs between home<strong>and</strong> business, other meals.Costs of any non-business part ofpremises, costs of buying businesspremises.Repairs of non-business parts of premisesor equipment, costs of improving oraltering premises <strong>and</strong> equipment.<strong>Non</strong>-business or private use proportionof expenses, telephone, fax, computerhardware or other equipment costs.Salaries, wages, bonuses, pensions,benefits for staff or employees, agencyfees, subcontractor labour costs,employer’s NICs etc.Car <strong>and</strong> van insurance, repairs, servicing,fuel, parking, hire charges, vehiclelicence fees, motoring organisationmembership, train, bus, air <strong>and</strong> taxifares; hotel room costs <strong>and</strong> meals onovernight business tripsRent for business premises, business <strong>and</strong>water rates, light, heat, power, propertyinsurance, security, use of room as anoffice (business proportion only).Repairs <strong>and</strong> maintenance of businesspremises <strong>and</strong> equipment, renewals ofsmall tools <strong>and</strong> items of equipment.Telephone <strong>and</strong> fax running costs;postage; stationery; printing <strong>and</strong> smalloffice equipment costs; computersoftware.0371 IS6 Production V1 1 <strong>Business</strong> Education & Support Team

Information Sheet 6Advertising <strong>and</strong> businessentertainment costsInterest on bank <strong>and</strong>other loansBank, credit card <strong>and</strong>other financial chargesIrrecoverable debtswritten offAccountancy, legal, otherprofessional costsDepreciation <strong>and</strong> loss/profit on sale of assetsOther business expensesEntertaining clients, suppliers,customers, family <strong>and</strong> friends,hospitality at events.Repayment of the loans or overdrafts,or finance arrangements.Repayment of the loans or overdrafts,or finance arrangements.Debts not included in turnover, debtsrelating to fixed assets; general baddebts.Legal costs of buying property <strong>and</strong>large items of equipment; costs ofsettling tax disputes <strong>and</strong> fines forbreaking the law.Depreciation of equipment, cars, etc;losses on sales of assets.Payments to clubs, charities, politicalparties, etc; costs of ordinary clothing.Advertising in newspapers, directories,etc. Mail-shots, free samples, websitecosts.Interest on bank <strong>and</strong> other businessloans, alternative finance payments.Bank, overdraft <strong>and</strong> credit charges,hire purchase interest <strong>and</strong> leasingpayments; alternative financepayments.Amounts included in turnover butunpaid <strong>and</strong> written off because theywill not be recovered.Accountant’s, solicitor’s, surveyor’s,architect’s <strong>and</strong> other professional fees;professional indemnity insurancepremiums.Depreciation <strong>and</strong> loss/profit on sale ofassets are not allowable expenses butclaimed elsewhere.Trade or professional journals <strong>and</strong>subscriptions, protective clothing.VAT<strong>Allowable</strong> expenses costs can include any VAT, which is not recoverable. This will not include any input VATpaid on capital items. However, it should be included in their cost if a claim to capital allowances can be madeon them.If allowable expenses are shown net of recoverable VAT, turnover should be shown on the same basis. As analternative, receipts <strong>and</strong> allowable expenses can be shown gross of VAT <strong>and</strong> the net payment to Customs <strong>and</strong>Excise as an expense. Using this method, a net repayment would be shown as a taxable receipt.For more information visit our website at www.hmrc.gov.ukThis information is for your guidance only; it does not cover all you need to know about this subject. Please refer to HMRC or <strong>Business</strong> Linkfor more help. ©Crown Copyright 20100371 IS6 Production V1 2 <strong>Business</strong> Education & Support Team