First Steps as an Employer

First Steps as an Employer

First Steps as an Employer

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong><strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 1

Session contentsWe will look at the following• Becoming <strong>an</strong> employer.• <strong>Employer</strong> responsibilities.• Online filing.• Starters <strong>an</strong>d leavers.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 2

Who counts <strong>as</strong> <strong>an</strong> employee?• Anyone who works for you under a ‘contract of service’ .• Includes full-time, part-time, ti short term workers <strong>an</strong>ddirectors of limited comp<strong>an</strong>ies.• Employment status.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 3

An employer’s first steps• Obtain new employee’s personal records.• Register <strong>as</strong> <strong>an</strong> employer with HMRC.• Set up a payroll system, that is, operate a Pay As YouEarn (PAYE) scheme.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 4

An employer’s first steps - continued• Payments to HMRC.• Making use of the help available.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 5

Help available to employers• Websites <strong>an</strong>d helplines.• P49 ‘Paying i someone for the first time’.’• BEST workshops.• B<strong>as</strong>ic PAYE Tools (BPT).<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 6

<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 7

P11 Calculator• Set up <strong>an</strong> <strong>Employer</strong> Datab<strong>as</strong>e.• Add employee details.• Enter pay details <strong>an</strong>d date of payment.• Back up your data.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 8

National Minimum Wage (NMW)From 1 October 2011• £6.08 per hour for workers aged 21 years <strong>an</strong>d over.• £4.98 for workers aged 18 – 20 inclusive.• £3.68 for workers under 18 who are no longer ofcompulsory school age.• £2.60 for apprentices either under 19 or over 19 <strong>an</strong>d in thefirst year of their apprenticeship.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 9

Other employer responsibilities• Identity checks.• Stakeholder Pensions (Pensions Regulator 0870 606 3636).• Statutory Sick Pay.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 10

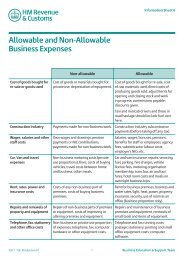

Other employer responsibilities - continued• Other statutory payments.• Expenses <strong>an</strong>d benefits.• <strong>Employer</strong> Annual Return.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 11

<strong>Employer</strong> Annual Return (EAR)• Due by 19 May.• Virtually all employers must file their EAR online.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 12

Online Filing• <strong>Employer</strong> options available.• <strong>Employer</strong> obligations.• Benefits.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 13

<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 14

Penalties• Re<strong>as</strong>on for introduction.• Re<strong>as</strong>onable care.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 15

Starters <strong>an</strong>d Leavers• P45.• P46.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 16

P45Four parts:• Part 1 – leaving details.• Part 1A – employee copy.• Parts 2 & 3 – for the new employer.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 17

P46Information required:• Employee details.• New employer details.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 18

P45• <strong>Employer</strong> completes Part 1 when employee leaves <strong>an</strong>dsubmits online to HMRC.• Parts 1A, 2 & 3 given to leaving employee.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 19

Session contents• Becoming <strong>an</strong> employer.• <strong>Employer</strong> responsibilities.• Online filing.• Starters <strong>an</strong>d leavers.<strong>First</strong> <strong>Steps</strong> <strong>as</strong> <strong>an</strong> <strong>Employer</strong> v2 20