ZINC - MCX

ZINC - MCX

ZINC - MCX

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

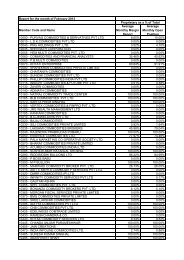

<strong>ZINC</strong>Multi Commodity Exchange of India Ltd (<strong>MCX</strong>) is a state-of-the-art demutualised exchange withpermanent recognition from the government of India. <strong>MCX</strong> offers futures trading in over 40commodities including metals, bullion, energy, etc. The average daily turnover on the <strong>MCX</strong> platform forthe nine months ended December 31, 2011 was `51,419 crore.INTRODUCTIONZinc (chemical symbol - Zn) is a bluish white lustrous metal. It is normally covered with a white coating onexposure to the atmosphere.Zinc is the fourth most common metal in use, behind iron, aluminium and copper in terms of annualproduction.Zinc can be recycled indefinitely, without loss of its physical or chemical properties.It is present in a wide variety of foods, particularly in association with protein foods.APPLICATIONSRoughly 50% of all metallic zinc produced today is used to galvanise other metals such as steel or iron toprevent corrosion. Large quantities of zinc is used to produce die castings, which are used extensively by theautomotive, electrical and hardware industries. Zinc is also used as a chemical compound in rubber, ceramics,paints and agriculture. Zinc coating is widely used to protect finished products ranging from structuralsteelwork for buildings and bridges, to nuts, bolts, strips, sheets, wires and tubes.Zinc Consumption by first use - 2009 Zinc Consumption by end use - 2009<strong>MCX</strong>is a leadingcommodityexchange inIndia, with amarket share of87.3%*(Apr-Dec 2011)*In terms of the value of commodityfutures contracts traded(Source: Data maintained by FMC)13%9%14%8%Source : Brook Hunt4%DEMAND & SUPPLY52%GalvanisingBrass semis & castingsDie-casting alloysThe rise in world zinc mine production in 2010 (8.8% compared with 2009) was primarily influenced byhigher output in Australia, China, India, Mexico and the Russian Federation.Global refined zinc metal production rose by a significant 13.3% in 2010, as much of the capacity suspendedin 2009 was brought back on stream. In addition to a further rise of 18.5% in Chinese output, notableincreases were recorded in Belgium, Brazil, India, Peru, the Russian Federation, the USA and Uzbekistan.Global output of refined zinc metal exceeded usage by 264,000 MT; the fourth successive year that themarket has been in surplus.After a sharp decline in 2009 caused by the economic crisis, world usage of refined zinc metal reboundedby 15.6% in 2010, surpassing 12 million MT for the first time.16%Semi-manufactured productsOxides and chemicalsMiscellaneous7%20%6%51%ConstructionTransportInfrastructureIndustrial machineryConsumer goodsWorld Refined Zinc Production(in thousand MT)World Refined Zinc Consumption(in thousand MT)1400014000www.mcxindia.com1200010000800060004000200002006 2007 2008 2009 2010eOthersAustraliaRep. KoreaKazakhstanJapanChinaUnited StatesMexicoCanadaEurope1200010000800060004000200002006 2007 2008 2009 2010eOthersRep. KoreaJapanChinaUnited StatesEuropeSource : ILZSGe= EstimatedFor private circulation only

INDIAN SCENARIOIndia’s refined zinc production was 646,000 MT in 2009, an increase of around 8%-9% from the previous year.Consumption of refined zinc in India reached 512, 000 MT in 2009, an increase of 20.8% from 2008. India's percapita zinc consumption is at a meager 0.4 kg, among the lowest in the world.The principal use of zinc in the Indian market is in the galvanising sector, which currently accounts for anestimated 70% of the total production.GLOBAL SCENARIOThe rise in refined zinc in 2010 was driven mainly by further growth in Chinese apparent demand of 13.3%and a recovery in European usage of 29.3%. Other contributing factors included increases in Brazil, India,Japan, the Republic of Korea, Taiwan and Thailand.Major refined zinc exporting countries are Canada, Australia and Rep. of Korea, while major refined zincimporting countries are China, USA and Germany .Leading Refined Zinc Exporters - 2009Leading Refined Zinc Importers - 200912.2%CanadaAustralia15.4%ChinaUSA40.0%8.7%8.1%Rep. of KoreaSpainFinlandKazakhstan39.0%13.5%GermanyBelgiumFranceOther Asia4.3%4.7%4.8%6.2%6.0%5.0%NetherlandsMexicoIndiaOthers2.9%3.2%3.5% 4.1%5.8%4.3%8.3%NetherlandsItalyTurkeyOther<strong>MCX</strong> is No.1 insilver and gold,No.2 innatural gas,and No.3 incrude oil**In terms of the commodity futurescontracts traded during CY 2011(Source: Websites of exchangesand FIA)Source : UN Comtarde - Year book 2009FACTORS INFLUENCING THE MARKETZinc prices in India are fixed on the basis of the rates that rule on the international spot market, andRupee and US Dollar exchange rates.Economic events such as national industrial growth, global financial crisis, recession, and inflation affectcommodity-specific events such as the metal prices.Construction of new production facilities or processes, new uses or the discontinuance of historical uses,unexpected mine or plant closures (natural disaster, supply disruption, accident, strike, and so forth), orindustry restructuring, all affect metal prices.Governments set trade policy (implementation or suspension of taxes, penalties, and quotas) that affectsupply by regulating (restricting or encouraging) material flow.Geopolitical events involving governments or economic paradigms and armed conflict can cause majorchanges.There is also a national economic growth factor. Societies, as they develop, demand metals in a way thatdepends on their current economic position.IMPORTANT GLOBAL EXCHANGESExchange Product Lot Size ( in MT) ISTLME Zinc 25 6:30 to 00:30 *Zinc Mini 5 17:10 to 22:40**Shanghai Futures Zinc 5 6.30 to 9:00Exchange (SHFE) 11:30 to 13:30<strong>MCX</strong> Zinc 5#10:00 to 23:30 ( Monday- Friday)Zinc Mini 1 10:00 to 14:00 ( Saturday)www.mcxindia.com* LME select ** LME Ring timing (Start time:- Ring session, End time - Kerb Trading), #: Day light timing 10:00 to 23:55 (Winter)

Zinc <strong>MCX</strong> Near Month & LME Cash Correlation 99.74%300015025001252000100$ / MT150075` / kg1000505002500Apr-08Jun-08Aug-08Oct-08Dec-08Feb-09Apr-09Jun-09Aug-09Oct-09Dec-09Feb-10Apr-10Jun-10Aug-10Oct-10Dec-10Feb-11Apr-11Jun-11Aug-11Oct-11Dec-11LME<strong>MCX</strong>Source: Bloomberg<strong>MCX</strong> Zinc Volume & Open Interest<strong>MCX</strong>reaches out to1572 cities andtowns in Indiathrough 2,96,000trading terminals(including CTCL)Price in ` / kg200180160140120100806040Apr-08Jun-08Source: <strong>MCX</strong> R&D1000000Aug-08Oct-08Dec-08Feb-09Apr-09Jun-09Aug-09Oct-09Dec-09Feb-10Apr-10Jun-10Aug-10Oct-10Dec-10LME Zinc 3 Month Price Vs LME StockFeb-11Apr-11Jun-11Aug-11Oct-11Dec-113000300000250000200000150000100000500000OI & Vol in MT(as of Dec. 31, 2011)90000080000025007000002000Stocks in MT6000005000004000001500Price in $ / MT300000100020000050010000000LME StockLME PriceApr-08Jun-08Aug-08Oct-08Dec-08Feb-09Apr-09Jun-09Aug-09Oct-09Dec-09Feb-10Apr-10Jun-10Aug-10Oct-10Dec-10Feb-11Apr-11Jun-11Aug-11Oct-11Dec-11www.mcxindia.comSource: Bloomberg

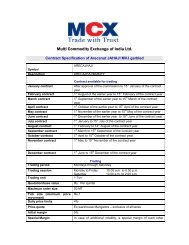

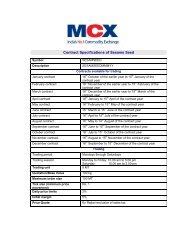

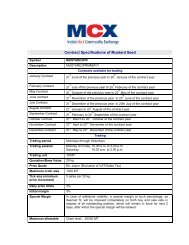

IMPORTANT WEB SITESwww.ilzsg.org | www.ilzro.org | www.iza.com | www.metalbulletin.com | www.basemetals.com |www.futuresource.com | www.metalsmarket.net | www.metalsplace.com | www.metalprices.com |www.gfms-metalsconsulting.com | www.brookhunt.com | www.world-bureau.com | http:\\minerals.usgs.govCONTRACT SPECIFICATION OF <strong>ZINC</strong> & <strong>ZINC</strong> MINISymbolDescriptionTrading period<strong>ZINC</strong><strong>ZINC</strong>MMMYYMonday through SaturdayTrading session Monday to Friday: 10:00 am to 11:30 pmSaturday:10:00 am to 2:00 pm#<strong>ZINC</strong>MINI<strong>ZINC</strong>MINIMMYY<strong>MCX</strong>COMDEXis India’s firstreal timecompositecommodityfutures priceindexContract monthsExpiry dateTrading unitQuotation/base valueTick sizeMaximum order sizeMonthly contractsLast day of the contract5 MT` / kgDaily price limit 4%Initial marginSpecial marginMaximum allowableopen positionDelivery logicDelivery centerDelivery unitDue date rate (DDR) calculation5 paise / kg100 MTMinimum 5% or based on SPAN, whichever is higherIn case of additional volatility, an additional margin (on both buy-side& sell-side) and/or special margin (on either buy-side or sell-side) atsuch percentage, as deemed fit; will be imposed in respect of alloutstanding positions.For individual clients: 3,600 MTFor a member collectively for all clients: 18,000 MT or not more than15% of the market-wide open position, whichever is higher.Both optionsWithin 20 km outside mumbai octroi limits10 MT with tolerance limit of +/– 1% (100 kg)1MTDue date rate is calculated on the last day of the contract expiry, bytaking international spot price of Zinc and it would be multiplied byRupee-US$ rate as notified by the Reserve Bank of India.#: Day light timing 10:00 am to 11:55 pm (Winter)Note: Please refer to the exchange circulars for the latest contract specifications and delivery and settlementprocedures.www.mcxindia.comFor Customer Support : +91-22-6649 4040To get the latest futures prices on mobilevisit http://m.mcxindia.com or sms “<strong>MCX</strong> ” to 58888Exchange Square, Suren Road, Andheri (East), Mumbai 400 093, India.Tel. No. 91-22-6731 8888 • info@mcxindia.com • www.mcxindia.com230212