A Growing Asset Class sset Class - ALM Events

A Growing Asset Class sset Class - ALM Events

A Growing Asset Class sset Class - ALM Events

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

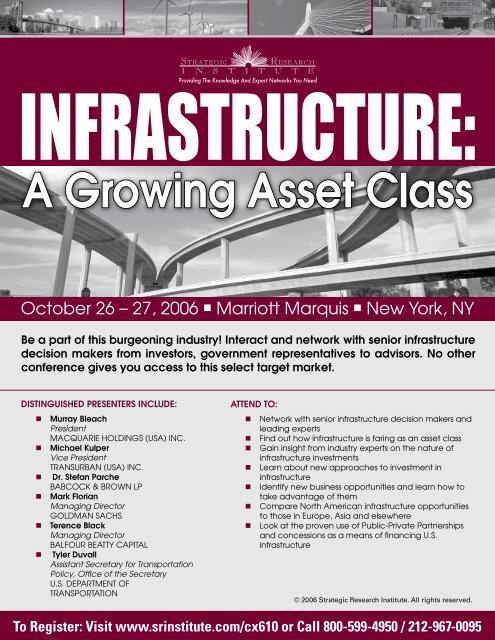

infrastructure:A <strong>Growing</strong> <strong>A<strong>sset</strong></strong> <strong>Class</strong>October 26 – 27, 2006 • Marriott Marquis • New York, NYBe a part of this burgeoning industry! Interact and network with senior infrastructuredecision makers from investors, government representatives to advisors. No otherconference gives you access to this select target market.Distinguished presenters include:• Murray BleachPresidentMacquarie Holdings (USA) Inc.• Michael KulperVice PresidentTransurban (USA) INC.• Dr. Stefan ParcheBABCOCK & BROWN LP• Mark FlorianManaging DirectorGoldman Sachs• Terence BlackManaging DirectorBalfour Beatty CAPITAL• Tyler DuvallAssistant Secretary for TransportationPolicy, Office of the SecretaryU.S. Department ofTransportationAttend to:• Network with senior infrastructure decision makers andleading experts• Find out how infrastructure is faring as an a<strong>sset</strong> class• Gain insight from industry experts on the nature ofinfrastructure investments• Learn about new approaches to investment ininfrastructure• Identify new business opportunities and learn how totake advantage of them• Compare North American infrastructure opportunitiesto those in Europe, Asia and elsewhere• Look at the proven use of Public-Private Partnershipsand concessions as a means of financing U.S.infrastructure© 2006 Strategic Research Institute. All rights reserved.To Register: Visit www.srinstitute.com/cx610 or Call 800-599-4950 / 212-967-0095

A g e n d aTHURSDAY, OCTOBER 26, 20068:00 – 8:30Continental Breakfast & ConferenceRegistration8:30 – 8:45Welcome & Introduction to Conference8:45 – 9:15An Overview of North AmericanInfrastructureTyler Duvall, Assistant Secretary for Transportation PolicyOffice of the Secretary U.S. Department ofTransportation9:15 – 9:45Toll Highways as Investor-Owned Utilities• Why new capacity (toll lanes and toll roads) will be themain growth area in highway privatization;• Lessons learned from private toll projects in Europe andAustralia;• How the private sector is finding innovative ways to addnew highway capacity in congested cities;• Why the private-sector concession model can raise morecapital than traditional public-sector toll agencies.Bob Poole, Director of TransportationReason Foundation9:45 – 10:15:Toll Road P3s – Beyond Acquisition• The growing role of P3s in addressing congestion• Federal and State Government leading the way asenablers• Beyond acquisition – a partnership model for toll road andHOT lane developmentMichael Kulper, Vice-President, North AmericaTransurban (USA) Inc.10:15 – 10:30Morning Break10:30 – 11:30U.S. Toll Road Privatization• Interest in U.S. toll road privatization continues to spread ascompetition heats up• States are facing a real transportation funding crisis• Why are U.S. toll roads such attractive investments• What’s in a Concession Agreement• Ideas for municipal bond investors• A look ahead at U.S. toll road privatizationMurray Bleach, PresidentMacquarie Holdings (USA) Inc.Philip Villaluz, Vice PresidentMerrill Lynch Municipal ResearchCherian George, Managing DirectorFitch RatingsKarl H. Reichelt, Executive Vice President North AmericaSkanska Infrastructure DevelopmentTexas Department of Transportation (INVITED)11:30 – 12:45Luncheon & Networking12:45 – 1:30Investing in Franchise Infrastructure• “Franchise” infrastructure as an a<strong>sset</strong> class• Implications of regulation on infrastructure investment• Who is creating value, who is capturing it?Sonny Lulla, PartnerGuggenheim Franklin Park1:30 – 2:30Financing the Growth of Infrastructure:The Role of Public Private PartnershipsThe use of private financing and operation in publicsector procurement has propelled a new method of buildingand maintaining infrastructure projects. Does the publicprivate partnership framework really offer efficiencies?How do the users of these projects benefit? What arethe key considerations for investors in this class ofinfrastructure project?Terence Black, Managing DirectorBalfour Beatty CapitalDr. Stefan ParcheBabcock & Brown LPRobert Prieto, Senior Vice PresidentFluor CorporationRichard Solway, PartnerErnst & Young LLP2:30 – 3:15Public-Private Partnership Case Study:Virginia Department of Transportation’sPublic-Private Transportation Act Program• Enabling Legislation• Program Objectives• Upcoming ProjectsThomas W. Pelnik III, P.E., Director, Innovative Project Delivery DivisionVirginia Department of Transportation3:15 – 3:30Afternoon Break3:30 – 4:15Alternate Means of Financing InfrastructureMark Florian, Managing DirectorGoldman Sachs4:15 – 5:00Power Utility PanelTimothy S. Carey, President & CEO (Invited)New York Power AuthorityDaniel Aschenbach, Senior Vice PresidentMoody’sPeter Murphy, DirectorStandard & Poor’s5:00 – 6:30Networking ReceptionTo Register: Visit www.srinstitute.com/cx610 or Call 800-599-4950 / 212-967-0095

FRIDAY, OCTOBER 27, 20068:30 – 9:00Continental Breakfast9:00 – 9:45Allocations to Infrastructure• Risks and opportunities• Choosing the right infrastructure investment for yourorganizationBill Atwood, Executive DirectorIllinois State Board of InvestmentJohn Adler, Director, Private Equity, Capital StewardshipProgramService Employees International UnionEric H. Melis, Vice PresidentBorealis Infrastructure Management Inc.9:45 – 10:30Getting the Infrastructure Owner On-Boardand Up-To-Speed Early• Developing the local strategy• Addressing the technical, legal and financial issues quietlyand early• Gaining local business community and political support• Educating the decision-makers• Preparing the mediaJohn E. Joyner, PresidentInfrastructure Management Group, IncManaging Director, IMG Development LLC10:30 - 11:15Homeland Security and Critical InfrastructureDaniel B. Prieto, Director and Senior Fellow of the HomelandSecurity CenterThe Reform Institute11:15 – 12:30Luncheon & NetworkingPlease visit conference website for agenda updates andspeaker additions.Sponsorship & Exhibit OpportunitiesTabletop Exhibits/Booths – Offer you the perfectopportunity to show your target market what yourproduct or service can do for their business. A limitednumber of exhibit tables/booths are availableand are strategically positioned to guarantee optimumexposure. Exhibit Tables/Booths are assigned ona first-come, first-serve basis. Please register early forbest location.Sponsorships – Sponsoring a cocktail reception,luncheon, breakfast or special event will maximize yourcompany’s recognition and provide you the opportunityto network with targeted senior level executives. If youare interested in showcasing your company to this targetmarket, please call Deborah Blake at (949) 706-7074 orby e-mail: dblake@srinstitute.com for more details.To Register: Visit www.srinstitute.com/cx610 or Call 800-599-4950 / 212-967-0095

Who Should AttendFrom the Investment Community:• Infrastructure Investment Funds• Private Equity funds• Pension funds• Hedge funds• Project financiersFrom the Government:• County, State and Federal governmentrepresentatives• County, State and Federal government planersand strategists• Policy-makers & decision-takers• Regulatory bodiesAdvisors and Service Providers:• Infrastructure owners• Insurance companies• Investment banks• <strong>A<strong>sset</strong></strong> & fund management companies• Project management companies• Consulting firms• Accounting firms• Legal professionals• Project managers• Deal facilitatorsAlumni ClubComplimentary Attendance for “InstitutionalInvestor Alumni Club” Members:The Strategic Research Institute Institutional InvestorClub Members (senior investment officers of qualifiedPension Plans, Endowments & Foundations who havepreviously attended one of our events) enjoy a waiverof all registration fees for our programs. As a first timeattendee to a Strategic Research Institute event,senior investment officers of qualified pension plans,endowments and foundations pay an initial registrationfee of $495 which includes membership in the Club.Thereafter, as a member, all future relevant events arecomplimentary. Please note: advisors, a<strong>sset</strong> managersand fund of funds do no qualify for membership. Pleasecontact Kerry Cunniffe at: kcunniffe@srinstitute.comto inquire about membership qualifications. Pleaserefer to: www.srinstitute.com for a full list of InstitutionalInvestor Club Members.5PHONE 800-599-49501-212-967-00958:30 - 5:30, Eastern TimeMonday - FridayFAX1-212-967-8021EMAILinfo@srinstitute.comPayments: Financial Professionals, Consultants, Legal Community& Advisors – $1,395 if you register by August 18, 2006; 1,595 if youregister by October 13, 2006. Government Employees – $800 ifyou register by August 18, 2006; $900 if you register by October 13,2006. Qualified Plan Sponsor Rate – $495 (subject to approval) Paythis one-time fee in order to join the Strategic Research Institute“Institutional Investor Alumni Club” and become eligible forcomplimentary registration to other relevant Strategic ResearchInstitute events. (Note: only pension plan sponsors and endowmentsand foundations will be considered for membership.) See insidebrochure for details.Payments may be made by company check, American Express,Visa, MasterCard or Diner’s Club. Please make checks payable to:Strategic Research Institute LP and be sure to write the registrant’sname(s) on the face of the check along with the conference codeCX610. Payments by check must be received no later than DATE.If registering AFTER DATE, a credit card payment will be required.*Note: Please register by October 13 th . A late registration fee of $200will be added after that date.Cancellations: All cancellations will be subject to a $227administration fee. In order to receive a prompt refund, your noticeof cancellation must be received in writing by DATE. We regretrefunds will not be issued after this date. The registration may betransferred to you or another member of your organization for anyStrategic Research Institute conference during the next twelvemonths. If you plan to send a substitute in your place, pleasenotify us as soon as possible so that materials and preparationscan be made. In the event of a conference cancellation,Strategic Research Institute assumes no liability for non-refundabletransportation costs, hotel accommodations or additional costsincurred by registrants.Hotel Accommodations: We have reserved a limited block ofrooms with the hotel at a special discounted rate for our attendees.To secure your accommodations, please contact the hotel at1-800-980-6429 least four weeks in advance and be sure to mentionthat your are a Strategic Research Institute delegate. Space islimited, so please make your hotel reservation early by calling thehotel directly at and mention the Strategic Research Institute.Venue:Easy Ways to RegisterMarriott Marquis1535 BroadwayNew York, NY 10036Tel: 212-398-1900Fax: 212-704-8930Web: www.marriotthotels.comMAILReturn Registration Form to:Strategic Research Institute333 Seventh Ave, 9th FloorNew York, NY 10001WEBwww.srinstitute.com/cx610To Register: Visit www.srinstitute.com/cx610 or Call 800-599-4950 / 212-967-0095

W e l c o m eDear Investor,Inadequate infrastructure is a major challenge facing the U.S. From roads to rails, the U.S. requires an estimated$1.6 trillion in infrastructure spending over the next five years, according to the American Society of CivilEngineers. Decades of underinvestment plus rapid economic growth have resulted in an urgent and realdemand for new infrastructure. As the public sector becomes unwilling and unable to fund the demandin infrastructure investments, private-sector project financing is stepping in to fill the gap, attracting investorinterest at record levels. The demand by institutional investors for long-term, government backed, inflationlinkeda<strong>sset</strong>s has created phenomenal opportunities.Strategic Research Institute’s 2006 Infrastructure: A <strong>Growing</strong> <strong>A<strong>sset</strong></strong> <strong>Class</strong> Conference is where major institutionalinvestors, private finance, construction companies, Wall Street and others will meet and discuss these veryopportunities. The most pertinent topics of the industry will be addressed to include:• Comparisons of North American infrastructure opportunities to those in Europe, Asia and elsewhere• Infrastructure as an a<strong>sset</strong> class• Alternate means of financing infrastructure• Toll road privatization• The proven use of Public-Private Partnerships and concessions as a means of financing U.S. infrastructureI invite you to join us for two days of discussion, exploration and networking where you will have the opportunityto learn from the experiences and insights of our distinguished guest presenters.This conference promises valuable content, discussions and networking for your organization. To reserveyour place, you may register by visiting the website at: www.srinstitute.com/cx610, faxing or mailing inyour completed registration form on the back of this brochure or by calling Strategic Research Institute at800.599.4950.I look forward to seeing you in New York this October!Best Regards,Catherine B. RosenbaumConference Producerlogo and write-ups to comeThank You To Our Media PartnersTo Register: Visit www.srinstitute.com/cx610 or Call 800-599-4950 / 212-967-0095

infrastructure:A <strong>Growing</strong> <strong>A<strong>sset</strong></strong> <strong>Class</strong>October 26 – 27, 2006 • Marriott Marquis • New York, NYINFRASTRUCTURE: A <strong>Growing</strong> <strong>A<strong>sset</strong></strong> <strong>Class</strong>www.srinstitute.com/cx610REGISTRATION FORM333 Seventh Avenue, 9th Floor, New York, NY 10001Tel 212-967-0095 or 800-599-4950 • Fax 212-967-8021o Financial Professionals, Consultants, Legal Community& Advisors – $1,395 if you register by August 18, 2006;$1,595 if you register by October 13, 2006.o Government Employees – $800 if you register byAugust 18, 2006; $900 if you register by October 13,2006.o Qualified Plan Sponsor Rate – $495 (subject toapproval)*Note: Please register by October 13th. A late registration fee of $200will be added after that date.o Payment enclosed o Bill my companyCharge my: o American Express o Visao MasterCard o Diners Club o DiscoverCard# ___________________________________Expiration Date: Month_________ Year __________________________________________________Name (as shown on card)_____________________________________________________Name (please print)_____________________________________________________Title_____________________________________________________Company_____________________________________________________Address_____________________________________________________City/State/Zip Code_____________________________________________________E-Mail_____________________________________________________PhoneFax333 Seventh Avenue, 9th floorNew York, NY 10001cX610