Declining Housing Prices and Property Taxes - Institute of ...

Declining Housing Prices and Property Taxes - Institute of ...

Declining Housing Prices and Property Taxes - Institute of ...

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

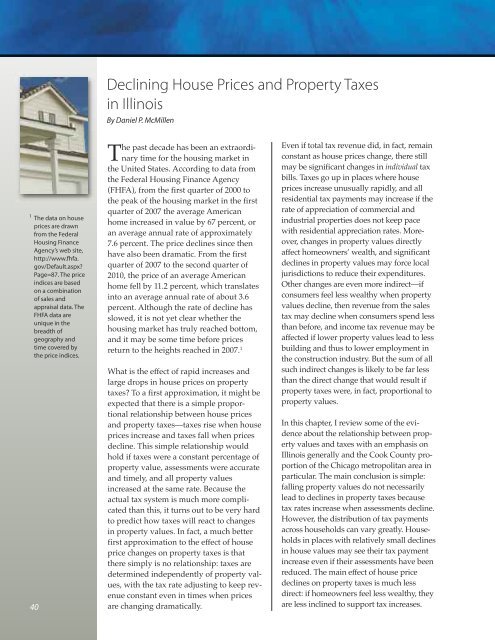

<strong>Declining</strong> House <strong>Prices</strong> <strong>and</strong> <strong>Property</strong> <strong>Taxes</strong>in IllinoisBy Daniel P. McMillen1 The data on houseprices are drawnfrom the Federal<strong>Housing</strong> FinanceAgency’s web site,http://www.fhfa.gov/Default.aspx?Page=87. The priceindices are basedon a combination<strong>of</strong> sales <strong>and</strong>appraisal data. TheFHFA data areunique in thebreadth <strong>of</strong>geography <strong>and</strong>time covered bythe price indices.The past decade has been an extraordinarytime for the housing market inthe United States. According to data fromthe Federal <strong>Housing</strong> Finance Agency(FHFA), from the first quarter <strong>of</strong> 2000 tothe peak <strong>of</strong> the housing market in the firstquarter <strong>of</strong> 2007 the average Americanhome increased in value by 67 percent, oran average annual rate <strong>of</strong> approximately7.6 percent. The price declines since thenhave also been dramatic. From the firstquarter <strong>of</strong> 2007 to the second quarter <strong>of</strong>2010, the price <strong>of</strong> an average Americanhome fell by 11.2 percent, which translatesinto an average annual rate <strong>of</strong> about 3.6percent. Although the rate <strong>of</strong> decline hasslowed, it is not yet clear whether thehousing market has truly reached bottom,<strong>and</strong> it may be some time before pricesreturn to the heights reached in 2007. 1What is the effect <strong>of</strong> rapid increases <strong>and</strong>large drops in house prices on propertytaxes? To a first approximation, it might beexpected that there is a simple proportionalrelationship between house prices<strong>and</strong> property taxes—taxes rise when houseprices increase <strong>and</strong> taxes fall when pricesdecline. This simple relationship wouldhold if taxes were a constant percentage <strong>of</strong>property value, assessments were accurate<strong>and</strong> timely, <strong>and</strong> all property valuesincreased at the same rate. Because theactual tax system is much more complicatedthan this, it turns out to be very hardto predict how taxes will react to changesin property values. In fact, a much betterfirst approximation to the effect <strong>of</strong> houseprice changes on property taxes is thatthere simply is no relationship: taxes aredetermined independently <strong>of</strong> property values,with the tax rate adjusting to keep revenueconstant even in times when pricesare changing dramatically.Even if total tax revenue did, in fact, remainconstant as house prices change, there stillmay be significant changes in individual taxbills. <strong>Taxes</strong> go up in places where houseprices increase unusually rapidly, <strong>and</strong> allresidential tax payments may increase if therate <strong>of</strong> appreciation <strong>of</strong> commercial <strong>and</strong>industrial properties does not keep pacewith residential appreciation rates. Moreover,changes in property values directlyaffect homeowners’ wealth, <strong>and</strong> significantdeclines in property values may force localjurisdictions to reduce their expenditures.Other changes are even more indirect—ifconsumers feel less wealthy when propertyvalues decline, then revenue from the salestax may decline when consumers spend lessthan before, <strong>and</strong> income tax revenue may beaffected if lower property values lead to lessbuilding <strong>and</strong> thus to lower employment inthe construction industry. But the sum <strong>of</strong> allsuch indirect changes is likely to be far lessthan the direct change that would result ifproperty taxes were, in fact, proportional toproperty values.In this chapter, I review some <strong>of</strong> the evidenceabout the relationship between propertyvalues <strong>and</strong> taxes with an emphasis onIllinois generally <strong>and</strong> the Cook County proportion<strong>of</strong> the Chicago metropolitan area inparticular. The main conclusion is simple:falling property values do not necessarilylead to declines in property taxes becausetax rates increase when assessments decline.However, the distribution <strong>of</strong> tax paymentsacross households can vary greatly. Householdsin places with relatively small declinesin house values may see their tax paymentincrease even if their assessments have beenreduced. The main effect <strong>of</strong> house pricedeclines on property taxes is much lessdirect: if homeowners feel less wealthy, theyare less inclined to support tax increases.