MIMOS Annual Report 2009

MIMOS Annual Report 2009

MIMOS Annual Report 2009

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

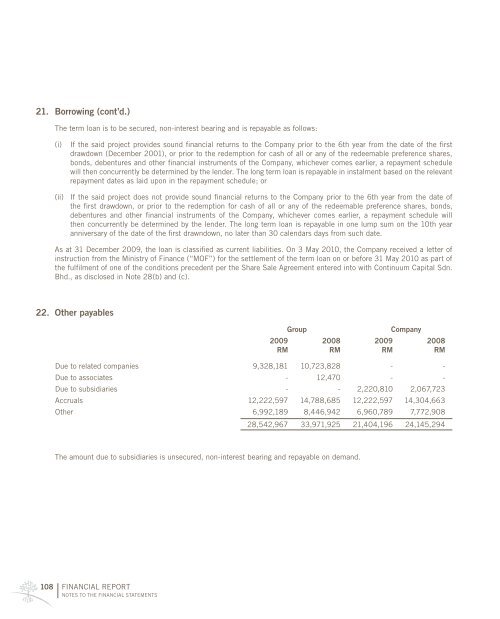

21. Borrowing (cont’d.)The term loan is to be secured, non-interest bearing and is repayable as follows:(i)If the said project provides sound financial returns to the Company prior to the 6th year from the date of the firstdrawdown (December 2001), or prior to the redemption for cash of all or any of the redeemable preference shares,bonds, debentures and other financial instruments of the Company, whichever comes earlier, a repayment schedulewill then concurrently be determined by the lender. The long term loan is repayable in instalment based on the relevantrepayment dates as laid upon in the repayment schedule; or(ii) If the said project does not provide sound financial returns to the Company prior to the 6th year from the date ofthe first drawdown, or prior to the redemption for cash of all or any of the redeemable preference shares, bonds,debentures and other financial instruments of the Company, whichever comes earlier, a repayment schedule willthen concurrently be determined by the lender. The long term loan is repayable in one lump sum on the 10th yearanniversary of the date of the first drawndown, no later than 30 calendars days from such date.As at 31 December <strong>2009</strong>, the loan is classified as current liabilities. On 3 May 2010, the Company received a letter ofinstruction from the Ministry of Finance (“MOF”) for the settlement of the term loan on or before 31 May 2010 as part ofthe fulfilment of one of the conditions precedent per the Share Sale Agreement entered into with Continuum Capital Sdn.Bhd., as disclosed in Note 28(b) and (c).22. Other payablesGroupCompany<strong>2009</strong> 2008 <strong>2009</strong> 2008RM RM RM RMDue to related companies 9,328,181 10,723,828 - -Due to associates - 12,470 - -Due to subsidiaries - - 2,220,810 2,067,723Accruals 12,222,597 14,788,685 12,222,597 14,304,663Other 6,992,189 8,446,942 6,960,789 7,772,90828,542,967 33,971,925 21,404,196 24,145,294The amount due to subsidiaries is unsecured, non-interest bearing and repayable on demand.108FINANCIAL REPORTNotes to the financial statements