Fringe Benefits Reconciliation Worksheet

Fringe Benefits Reconciliation Worksheet

Fringe Benefits Reconciliation Worksheet

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

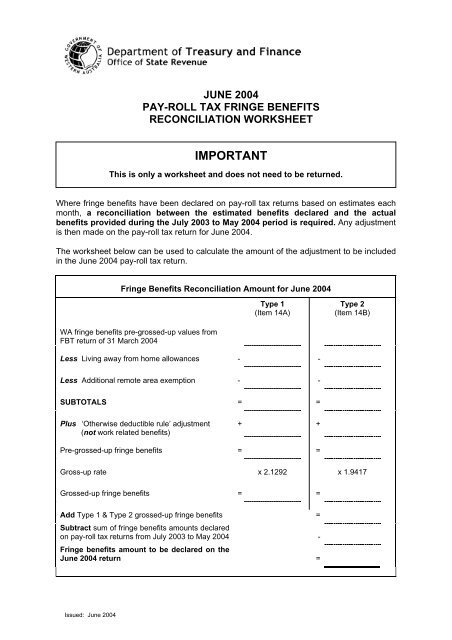

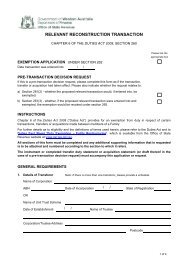

JUNE 2004PAY-ROLL TAX FRINGE BENEFITSRECONCILIATION WORKSHEETIMPORTANTThis is only a worksheet and does not need to be returned.Where fringe benefits have been declared on pay-roll tax returns based on estimates eachmonth, a reconciliation between the estimated benefits declared and the actualbenefits provided during the July 2003 to May 2004 period is required. Any adjustmentis then made on the pay-roll tax return for June 2004.The worksheet below can be used to calculate the amount of the adjustment to be includedin the June 2004 pay-roll tax return.<strong>Fringe</strong> <strong>Benefits</strong> <strong>Reconciliation</strong> Amount for June 2004Type 1(Item 14A)Type 2(Item 14B)WA fringe benefits pre-grossed-up values fromFBT return of 31 March 2004Less Living away from home allowances - -Less Additional remote area exemption - -SUBTOTALS = =Plus ‘Otherwise deductible rule’ adjustment(not work related benefits)+ +Pre-grossed-up fringe benefits = =Gross-up rate x 2.1292 x 1.9417Grossed-up fringe benefits = =Add Type 1 & Type 2 grossed-up fringe benefits =Subtract sum of fringe benefits amounts declaredon pay-roll tax returns from July 2003 to May 2004 -<strong>Fringe</strong> benefits amount to be declared on theJune 2004 return =Issued: June 2004

2004/2005 MONTHLY FRINGE BENEFITS CALCULATIONEmployers who have elected to submit <strong>Fringe</strong> <strong>Benefits</strong> on an estimated basis mayuse this worksheet to calculate the estimated amount of fringe benefits to be declared onmonthly returns in 2004/2005.If an employer has not previously declared fringe benefits on an estimated basis andwishes to do so for 2004/2005, a Pay-roll Tax <strong>Fringe</strong> <strong>Benefits</strong> Election Form should becompleted.This worksheet should not be returned to the Office of State Revenue but retained foryour records.<strong>Fringe</strong> benefits to be declared on pay-roll tax returns for July 2004 to May 2005Type 1(Item 14A)Type 2(Item 14B)WA fringe benefits pre-grossed-up values fromFBT return of 31 March 2004Less Living away from home allowances - -Less Additional remote area exemption - -SUBTOTALS = =Plus ‘Otherwise deductible rule’ adjustment(not work related benefits)+ +Pre-grossed-up fringe benefits = =To gross up each type of fringe benefit x 2.1292 x 1.9417Grossed-up fringe benefits = =Add Type 1 & Type 2 grossed-up fringe benefits =Divide by 12 ÷ 12Amount to be declared on returns each monthfor July 2004 to May 2005 =Telephone: (08) 9262 1300 Facsimile: (08) 9226 0841E-mail: payroll@dtf.wa.gov.au Website: www.osr.wa.gov.au