Certified finanCial Planner - North Carolina State University

Certified finanCial Planner - North Carolina State University

Certified finanCial Planner - North Carolina State University

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

What Past Participants Have SaidAbout This Program“ As a recent college graduate and a career changer coming from theautomotive field, I credit Mary’s teaching style which incorporatestheory, case studies, and her real-world experiences, along with herphenomenal four-day CFP® exam review course for me passing theCFP® exam (July 2009) on the first attempt where the national averagepassing rate for that exam was 50.4%. I highly recommend theNC <strong>State</strong> CFP® certificate program and exam reviews to anyone in—or planning to enter—the financial planning and, more broadly, thefinancial services industry.”—Caleb Newton, Hurdle Mills, NC“ As a financial advisor, I have worked in the field for 20 years and considermyself experienced and well educated. Mary Cardello showed mehow much more there is to learn; she has an amazing depth of knowledgeand experience to share with the students.”—Carla Liberatore, Vice President,Merrill Lynch, Cary, NC“ Sharing the experience of Mary’s classroom environment with studentsall working toward a common goal brings together a wealth of experience,feedback and support in the journey of financial planning and thechallenge of the CFP exam.”—Freida MacDonald, Registered Paraplanner,Old <strong>North</strong> <strong>State</strong> Wealth Management, LLC, Cary, NC“This course greatly enhancedmy current knowledge baseconcerning financial planningand areas of emphasis in mypractice such as retirement,investment planning, insurance,and estate planning. I feel moreconfident about how to betterapproach client situations. Thematerials and real-life applicationsdiscussed in class weremost valuable because they allowedme to go back to existingclients and provide added valueto situations that I may nothave recognized before.”— Dexter Vincent Perry,President,The Providence Group of N.C., LLC,Cary, NC“ Excellent blend of academic and real-world applications—great forfinancial services professionals and ordinary persons!”—Don McLamb, NC Department of Health and Human Services,Raleigh, NC“ I like how the course challenges me. I have a degree in accounting andI haven’t begun a career in that field yet. I am excited about finishingthe course and becoming one step closer to my goal of becoming aCFP.”—Rachel Lee, Garner, NC“ I feel this course is making me a better advisor for my clients.”—Mark Appleby, Investment Consultant,BB&T Investment Services, Raleigh, NC“ I think this class will be valuable in helping me pass the CFP® certificationexam. I enjoyed the real world examples that we did in class.”—Van James, Business Systems Analyst,SAS Institute, Cary, NC“ It is a lot more effective to come to class than to do self-study for CFP®Certification Program.”—Yun-Lieh Chuu, Cary, NCRegister Today! Online at http://go.ncsu.edu/cfp, orCall 919.515.2261, or Fax your registration form to 919.515.7614.

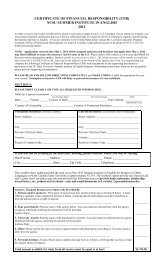

Online...http://go.ncsu.edu/cfpCall...919.515.2261Fax...Your registration to:919.515.7614Mail...Your registration to:Registration CoordinatorNC <strong>State</strong> <strong>University</strong>Office of Professional DevelopmentBox 7401Raleigh, NC 27695-7401For more information...EMailContinuingEducation@ncsu.eduREGISTRATION FORM<strong>Certified</strong> Financial <strong>Planner</strong>Check Class(es)n 1. Financial Planning Process Jan. 14 - Feb. 11, 2013 $1,095/$995 † OPD-MBFINPLN-N-002n 2. Insurance Planning & Risk Management Feb. 25 - March 27, 2013 $1,095/$995 † OPD-MBINSPLN-N-002n 3. Investment Planning April 15 - May 8, 2013 $1,095/$995 † OPD-MBINVPLN-N-002n 4. Income Tax Planning May 29 - July 1, 2013 $1,095/$995 † OPD-MBINCTXPLN-N-003n 5. Retirement Planning and EmployeeBenefits July 22 - August 21, 2013 $1,095/$995 † OPD-MBRETPLN-N-003n 6. Estate Planning Sept. 16 - Oct. 16, 2013 $1,095/$995 † OPD-MBESTATE-N-003n 7. Capstone Course Nov. 6 - Dec. 11, 2013 $1,095/$995 † OPD-MBCAP-N-002†Discount is extended to anyone registering and paying for more than one class simultaneously or to a studentpaying for their seventh and final class.PriorityCodeHow to EnrollS 1 3 0 4 W BIf you are a person with a disability......and desire any assistive devices,services or other accommodations toparticipate in these courses, please call919.515.2261 during business hours(8 a.m. to 5 p.m. Eastern) or emailContinuingEducation@ncsu.edu todiscuss accommodations at least twoweeks in advance.Attend and You’ll Receive• 4.875 contact hours per classroomsession• Instruction by a CFP® professional• Materials that will help you passthe national exam• A Certificate of Attendance foreach course• A Certificate of Completion at theconclusion of the seven courses andsubmission of your capstone projectTo help us serve you better, please enter the code from your mailing label.Enter this code even if label is addressed to someone else. Thank You!Continuing Education CreditsEarn continuing education creditstowards your requirements for the NCInsurance Licenses. Each class qualifiesfor 38 hours of NCDOI C.E., studentsmust have a national producer numberand pay $2 per credit hour.Contact Mary Cardello at 919.619.3176for additional information regardingearning continuing education creditswhile attending this program.All seven courses can be completedwithin one calendar year. Studentsbeginning in January 2013 canplan to take the March 2014 CFP®Certification Examination.Certification Education ProgramMethod of PaymentPayment must accompany registration and bereceived by the first day of the program. Faxedregistrations without a credit card # or a purchaseorder # will not be accepted. The easiest way toguarantee your place is to pay with a credit card.Payor: n Company n SelfPayment Method:n Credit Card n Visa n MasterCardn AmEx n Diners ClubCorporate Card? n Yes n NoCard # _______________________________________________________________________________________________Date of Birth*______________________ /First Name Middle Initial Last Namem m d dTitle_______________________________________________ Badge Name_________________________________Email__________________________________________________________________________________________Company_______________________________________________________________________________________Mailing Address_________________________________________________________________________________City_______________________________________________________ <strong>State</strong>____________ Zip_________________Phone (______)______________________________________ Fax (______)_________________________________Name, Phone Number & Email of Manager Approving Your Training _______________________________________________________________________________________________________________________________________* In lieu of SSN, your date of birth is required as a personal identifier for internal record keeping by this university.Please duplicate this form for multiple registrations. You may want to make a copy foryour records.Expiration Date (mm/yy)_____________________Amount ________________________________________________________________________Cardholder Name (please print)_______________________________________Cardholder Signature (required) (seal)n Check (U.S. banks only) (Do not fax)Make check(s) payable to:<strong>North</strong> <strong>Carolina</strong> <strong>State</strong> <strong>University</strong>Please write the name(s) of participant(s) onthe face of the check(s).n If you wish to pay by purchase order, pleasesubmit your purchase order and this registrationform by mail or fax them to 919.515.7614.n IDT (NC <strong>State</strong> <strong>University</strong> employees only)Project (FAS) #____________________________

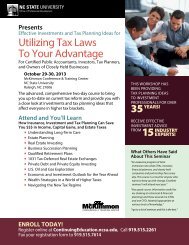

Prepare for the March 2014 CFP ® Certification Examination!1. Financial Planning ProcessJanuary 14 - February 11, 2013ConvenientlyOfferedin theEvenings2. Insurance Planningand Risk ManagementFebruary 25 - March 27, 20133. Investment PlanningApril 15 - May 8, 20134. Income Tax PlanningMay 29 - July 1, 20135. Retirement Planning and Employee BenefitsJuly 22 - August 21, 20136. Estate PlanningSeptember 16 - October 16, 20137. Capstone Course: Developing a Plan toAchieve Your Client’s ObjectivesNovember 6 - December 11, 2013If you receive more than one brochure, pleasepass the extra along to an associate.If addressee is no longer employed, pleaseforward to his/her replacement.Call 919.515.2261 to update your record.Attention: Mailroom personnel or addressee—please re-route if necessary!<strong>Certified</strong> Financial<strong>Planner</strong>Office of Professional DevelopmentBox 7401Raleigh, NC 27695-7401CertificationEducation ProgramA Series of Classes Required to Sit forthe CFP ® Certification ExaminationNon Profit OrganizationU.S. PostagePAID<strong>North</strong> <strong>Carolina</strong> <strong>State</strong> <strong>University</strong>S1304Prepare for the March 2014 CFP ® Certification Examination!JC RaulstonArboretum atNC <strong>State</strong> <strong>University</strong>,Raleigh, NC“ I believe the courses in the <strong>Certified</strong>Financial <strong>Planner</strong> Program haveprovided me with the backgroundneeded to successfully pass theCFP exam.”– Edward Bacon, Apex, NCREGISTER TODAY!Attendance is limited to 35 per class.<strong>Certified</strong> Financial <strong>Planner</strong> Board of Standards, Inc. ownsthe trademarks CFP®, CERTIFIED FINANCIAL PLANNER TMand CFP (with flame logo®) certification marks in the U.S.,which it awards to individuals who successfully complete CFPBoard’s initial and ongoing certification requirements.<strong>Certified</strong> Financial<strong>Planner</strong>CertificationEducation ProgramA Series of Classes Required to Sit forthe CFP ® Certification ExaminationConvenientlyOfferedin theEvenings1. Financial Planning ProcessJanuary 14 - February 11, 20132. Insurance Planning and Risk ManagementFebruary 25 - March 27, 20133. Investment Planning • April 15 - May 8, 20134. Income Tax Planning • May 29 - July 1, 20135. Retirement Planning and Employee BenefitsJuly 22 - August 21, 20136. Estate Planning • September 16 - October 16, 20137. Capstone Course: Developing a Plan to Achieve YourClient’s Objectives • November 6 - December 11, 2013